|

|

Post by zuolun on Jan 20, 2015 13:48:19 GMT 7

|

|

|

|

Post by zuolun on Jan 20, 2015 19:42:21 GMT 7

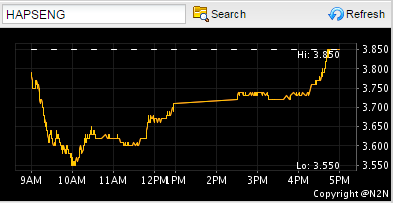

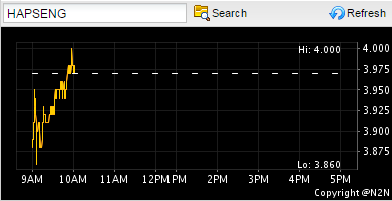

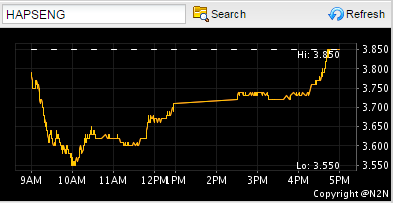

Hap Seng intraday hit low of RM3.55 and EOD closed @ day's high @ RM3.85 on 20 Jan 2015.  Hap Seng — Bullish Gartley Pattern formation Hap Seng — Bullish Gartley Pattern formationHap Seng closed with a hammer @ RM 3.85 (+0.08, +2.1%) with 4.66m shares done on 20 Jan 2015. Immediate support RM3.55, immediate resistance @ RM 3.93.   |

|

|

|

Post by zuolun on Jan 21, 2015 9:44:41 GMT 7

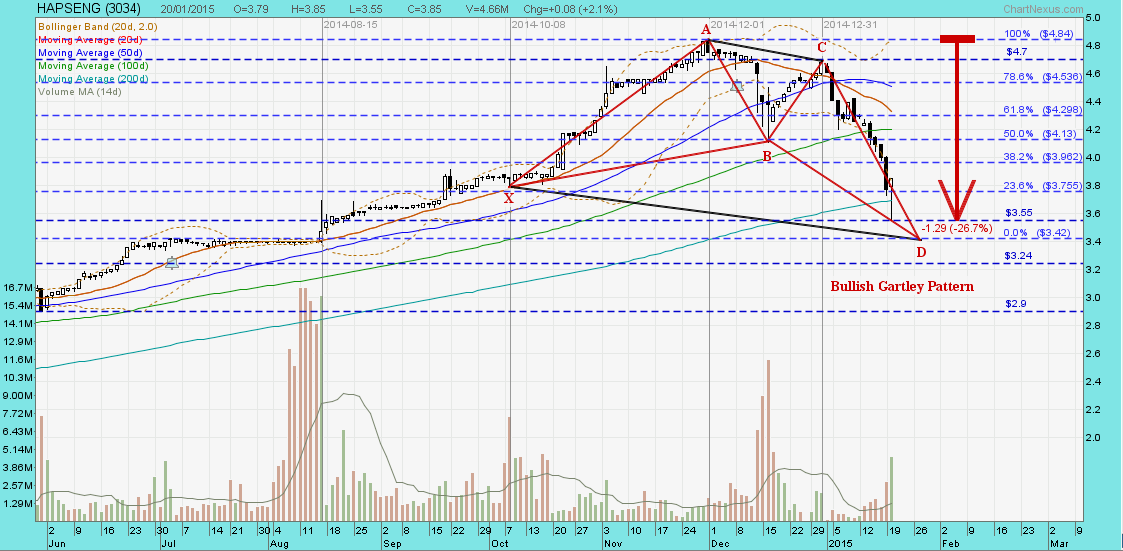

For intraday trading the focus is on 1 to 2 bids profit. But for trend trading, the focus is on "how to calculate the percentage increase" and a profit-take strategy. Hap Seng: Market Dept on 21 Jan 2015 at 11.15am  Hap Seng gapped up from low of RM3.86 to high of RM4.00 with 1.254m shares done on 21 Jan 2015 at 10am   Hap Seng intraday hit low of RM3.55 and EOD closed @ day's high @ RM3.85 on 20 Jan 2015.  |

|

|

|

Post by zuolun on Jan 22, 2015 20:42:15 GMT 7

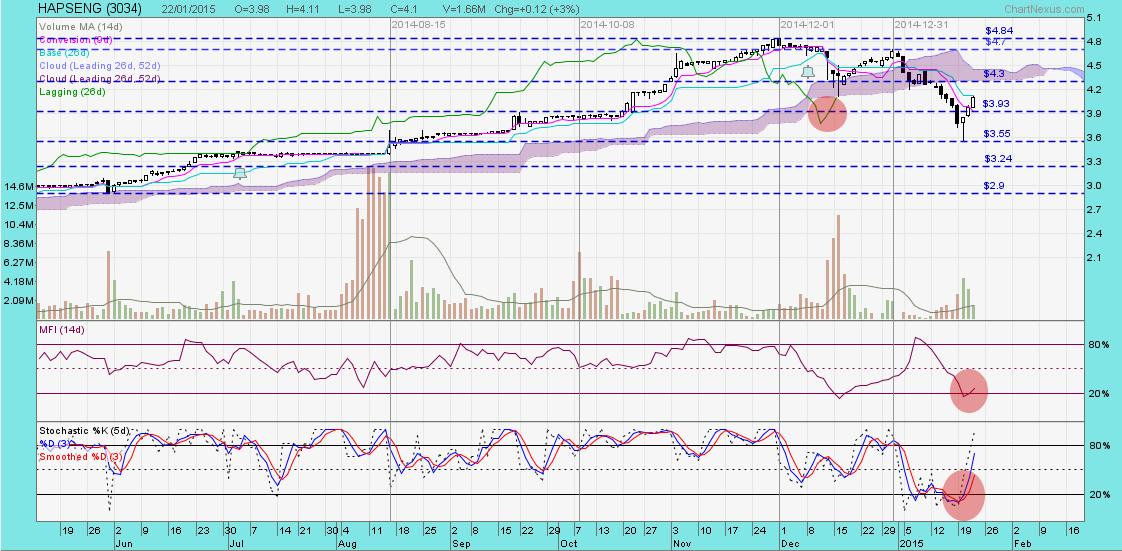

For intraday trading the focus is on 1 to 2 bids profit. But for trend trading, the focus is on "how to calculate the percentage increase" and a profit-take strategy. Hap Seng — Bullish Butterfly Gartley BreakoutHap Seng closed with a white marubozu @ RM 4.10 (+0.12, +3%) with 1.66m shares done on 22 Jan 2015. Immediate support RM 3.85, immediate resistance @ RM 4.30.   |

|

|

|

Post by zuolun on Jan 23, 2015 9:46:15 GMT 7

"Throughout all my years of investing I’ve found that the big money was never made in the buying or the selling. The big money was made in the waiting.” ~~ Jesse LivermoreHap Seng: Low of RM4.13 to high of RM4.20 with 677 lots done on 23 Jan 2015 at 10.40am

|

|

|

|

Post by zuolun on Jan 26, 2015 10:07:57 GMT 7

|

|

|

|

Post by zuolun on Mar 12, 2015 9:56:43 GMT 7

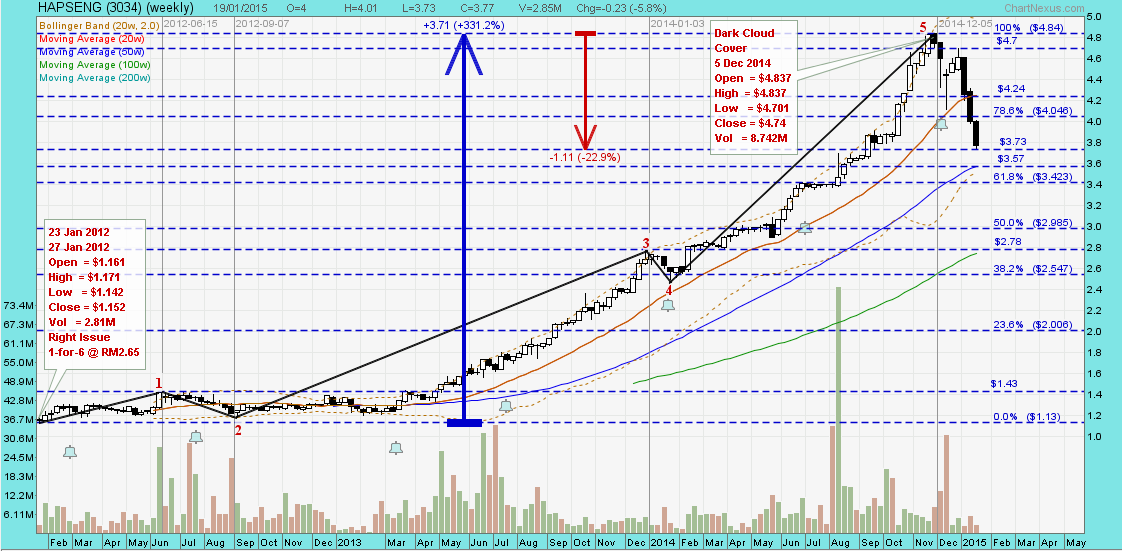

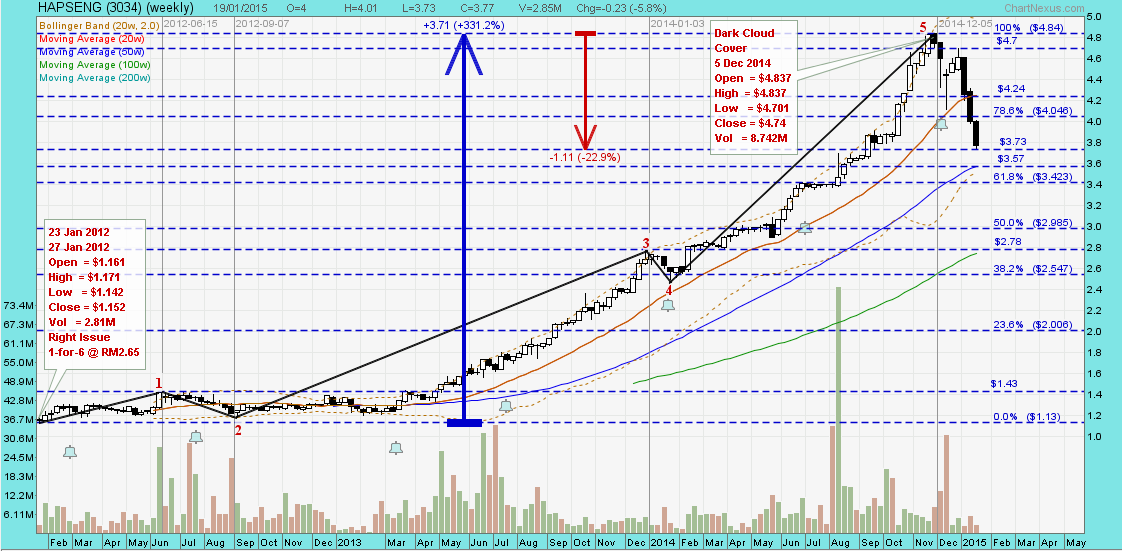

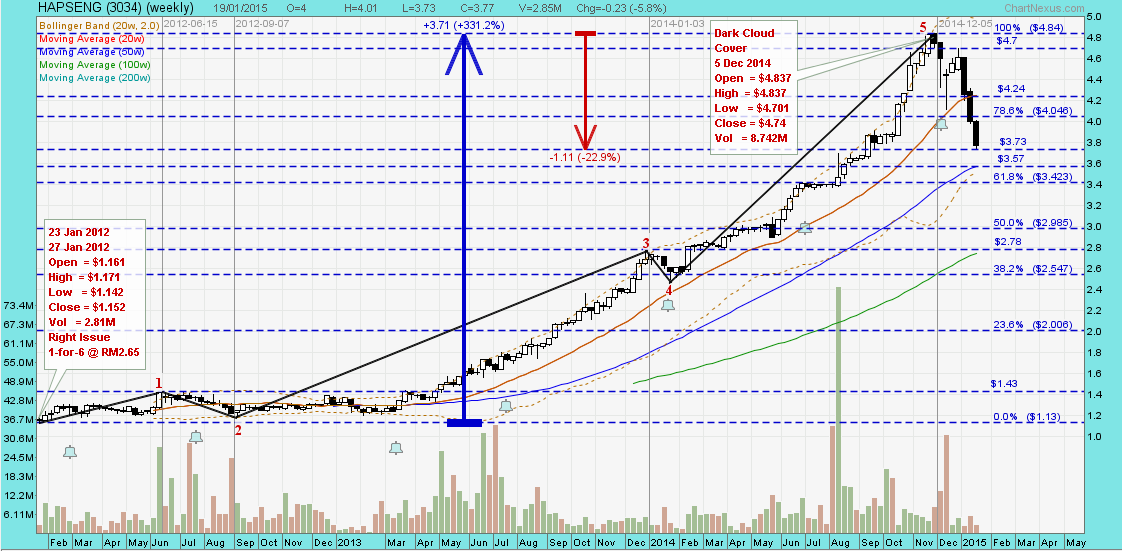

Hap Seng ~ Bullish Gartley pattern / short-term trend reversalHap Seng closed with a spinning top @ RM 3.79 (-0.01, -0.3%) with thin volume done at 480,000 shares on 11 Mar 2015. Immediate support @ RM3.68, immediate resistance @ RM3.83.  Hap Seng ~ The Elliott Wave pattern Hap Seng ~ The Elliott Wave pattern Hap Seng (weekly) — The Elliott Wave Pattern Hap Seng (weekly) — The Elliott Wave Pattern

|

|

|

|

Post by zuolun on Apr 9, 2015 12:40:05 GMT 7

Hup Seng Industries proposes 1.5 sen dividend

8 Apr, 2015

Hup Seng Industries Bhd has proposed a final dividend of 1.5 sen per share for the financial year ended Dec 31, 2014.

This is subject to the shareholders' approval at a forthcoming annual general meeting.

"The entitlement and payment dates of the dividend will be announced at a later date," said Hup Seng Industries in a filing with Bursa Malaysia today.

|

|

|

|

Post by sptl123 on Apr 14, 2015 15:09:24 GMT 7

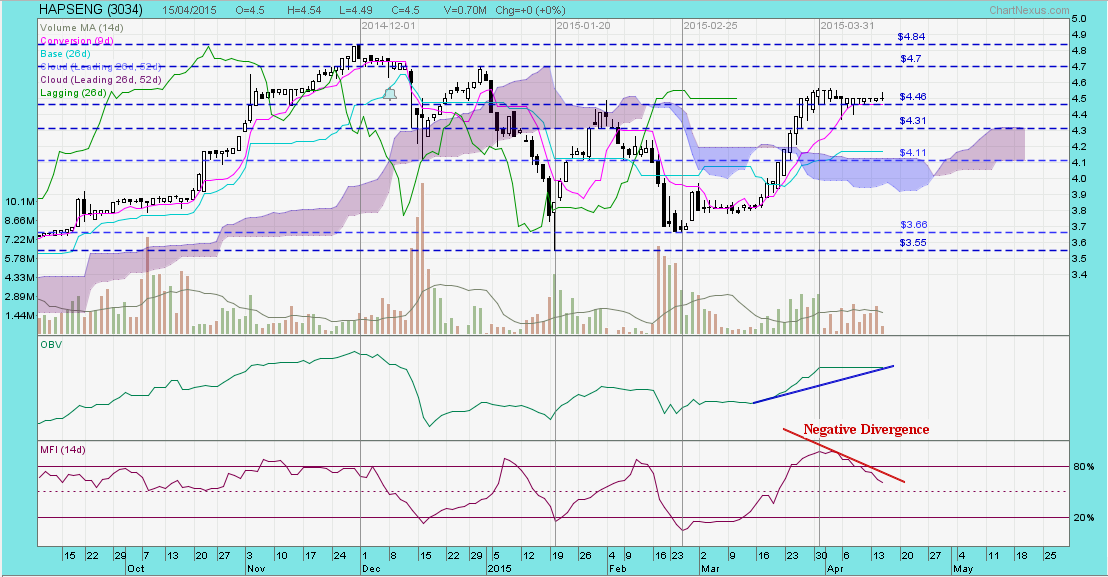

Bro Zuolun, After studied your post of Hap Seng last month, I vested and made money but sold it 40 bids too early. I think I could do better in the future in similar situation with the help of TA. I like Hap Seng, it is above 200dMA and 20dMA raising. On hindsight , there were golden opportunities; the snap-back-effect of 20dMA in middle of Jan 2015 and at the end of Feb 2015. The price volume action is consolidating now , I see some opportunity coming, however most indicators are -ve. at the moment. Commander, if one were to attack Hap Seng in the near future, what strategies would you advise ?  |

|

|

|

Post by zuolun on Apr 16, 2015 9:34:14 GMT 7

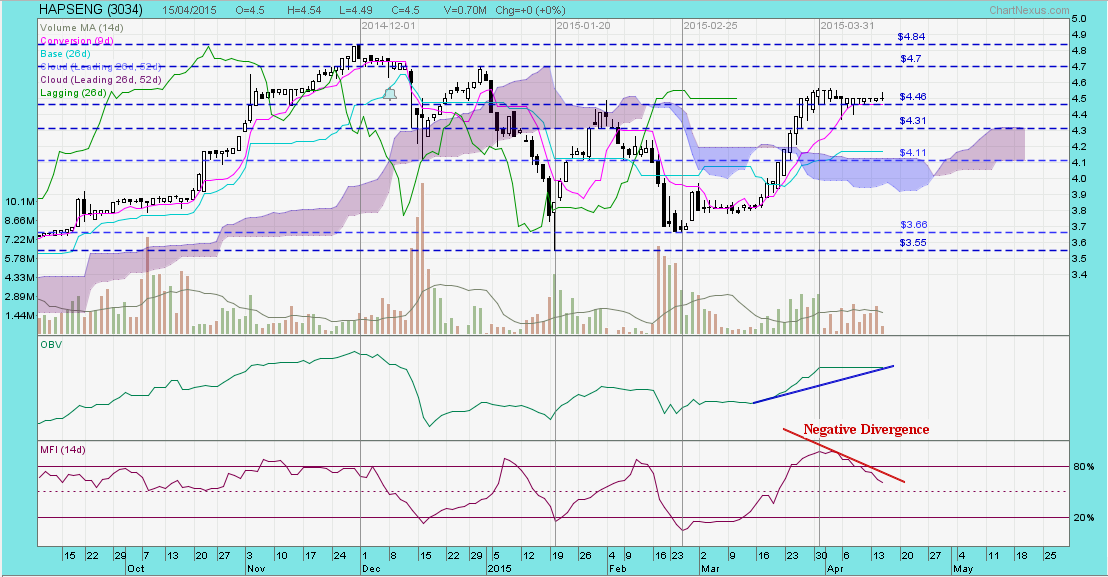

Bro Zuolun, After studied your post of Hap Seng last month, I vested and made money but sold it 40 bids too early. I think I could do better in the future in similar situation with the help of TA. I like Hap Seng, it is above 200dMA and 20dMA raising. On hindsight , there were golden opportunities; the snap-back-effect of 20dMA in middle of Jan 2015 and at the end of Feb 2015. The price volume action is consolidating now , I see some opportunity coming, however most indicators are -ve. at the moment. Commander, if one were to attack Hap Seng in the near future, what strategies would you advise ? , A technical rebound or dead cat bounce is a short-term intermediate trend reversal. In Chinese, it is known as 回光返照。Unless Hap Seng could hit RM4.70 and spike higher to retest the last high @ RM4.84 (dividend adjusted) scored on 1 Dec 2014, else the dead cat bounce is done. Hap Seng ~ Bearish Gartley AB = CD Pattern formationHap Seng closed with a doji unchanged @ RM4.50 with 700,000 shares done on 15 Apr 2015. Immediate support @ RM4.46, immediate resistance @ RM4.70.   Hap Seng — Bullish Gartley Pattern formationHap Seng closed with a long black marubozu @ RM 3.77 (-0.23, -5.8%) with 2.85m shares done on 19 Jan 2015. Immediate support RM3.57, immediate resistance @ RM 3.93.  Hap Seng (weekly) — The Elliott Wave Pattern Hap Seng (weekly) — The Elliott Wave Pattern  |

|

|

|

Post by sptl123 on Apr 16, 2015 16:09:58 GMT 7

I salute you bro Zuolun. For the same thing, you could read and analyze it with good depth and wide perspective. Bro Zuolun, After studied your post of Hap Seng last month, I vested and made money but sold it 40 bids too early. I think I could do better in the future in similar situation with the help of TA. I like Hap Seng, it is above 200dMA and 20dMA raising. On hindsight , there were golden opportunities; the snap-back-effect of 20dMA in middle of Jan 2015 and at the end of Feb 2015. The price volume action is consolidating now , I see some opportunity coming, however most indicators are -ve. at the moment. Commander, if one were to attack Hap Seng in the near future, what strategies would you advise ? , A technical rebound or dead cat bounce is a short-term intermediate trend reversal. In Chinese, it is known as 回光返照。Unless Hap Seng could hit RM4.70 and spike higher to retest the last high @ RM4.84 (dividend adjusted) scored on 1 Dec 2014, else the dead cat bounce is done. Hap Seng ~ Bearish Gartley AB = CD Pattern formationHap Seng closed with a doji unchanged @ RM4.50 with 700,000 shares done on 15 Apr 2015. Immediate support @ RM4.46, immediate resistance @ RM4.70.   Hap Seng — Bullish Gartley Pattern formationHap Seng closed with a long black marubozu @ RM 3.77 (-0.23, -5.8%) with 2.85m shares done on 19 Jan 2015. Immediate support RM3.57, immediate resistance @ RM 3.93.  Hap Seng (weekly) — The Elliott Wave Pattern Hap Seng (weekly) — The Elliott Wave Pattern  |

|

|

|

Post by zuolun on Aug 6, 2015 12:46:12 GMT 7

Hap Seng — Trading in an upward sloping channel, biased to the upsideHap Seng closed with a hammer @ RM 5.45 (+0.04, +0.7%) with 710,000 shares done on 5 Aug 2015. Immediate support RM 5.39, immediate resistance @ RM 5.58.  For intraday trading the focus is on 1 to 2 bids profit. But for trend trading, the focus is on "how to calculate the percentage increase" and a profit-take strategy. Hap Seng — Bullish Butterfly Gartley BreakoutHap Seng closed with a white marubozu @ RM 4.10 (+0.12, +3%) with 1.66m shares done on 22 Jan 2015. Immediate support RM 3.85, immediate resistance @ RM 4.30.

|

|