|

|

Post by zuolun on Jan 26, 2015 13:16:16 GMT 7

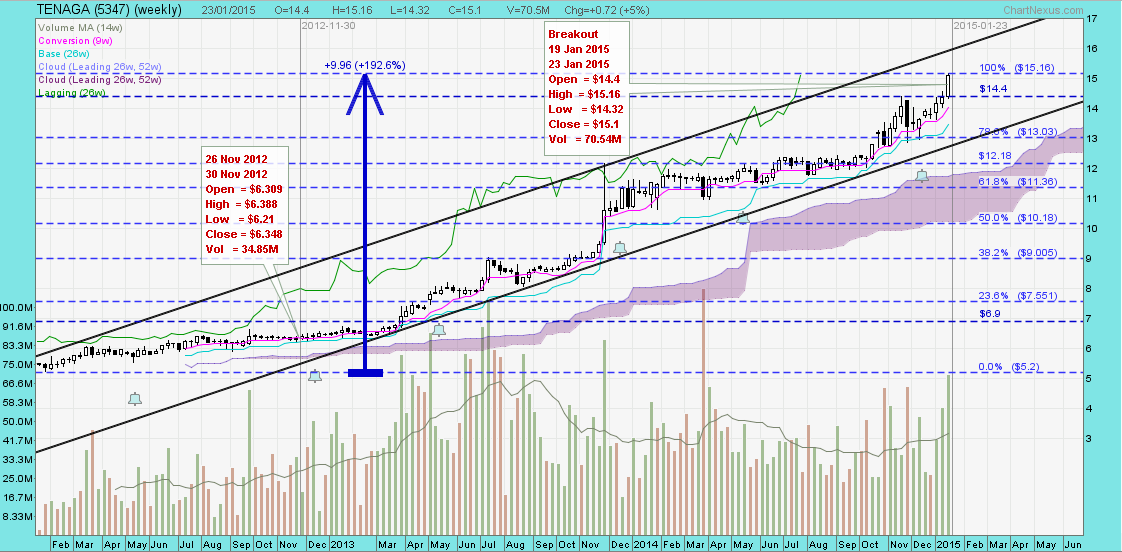

TENAGA — Bullish Ascending Triangle Breakout, Interim TP RM 17.50TENAGA closed with a long white marubozu @ RM15.10 (+0.58, +4%) with high volume done at 24.3m shares on 23 Jan 2015. Immediate support @ RM14.64 immediate resistance @ RM15.85   TENAGA (Weekly) — Trading in an upward sloping channel TENAGA (Weekly) — Trading in an upward sloping channel TENAGA — 31 Dec 2007 to 26 Jan 2015 TENAGA — 31 Dec 2007 to 26 Jan 2015 国能输掉1.13亿诉讼案 国能输掉1.13亿诉讼案 — 22 Sep 2012 TENAGA — Jan 1995 to Sep 2012

|

|

|

|

Post by zuolun on Feb 12, 2015 15:52:38 GMT 7

|

|

|

|

Post by zuolun on Mar 22, 2015 13:52:54 GMT 7

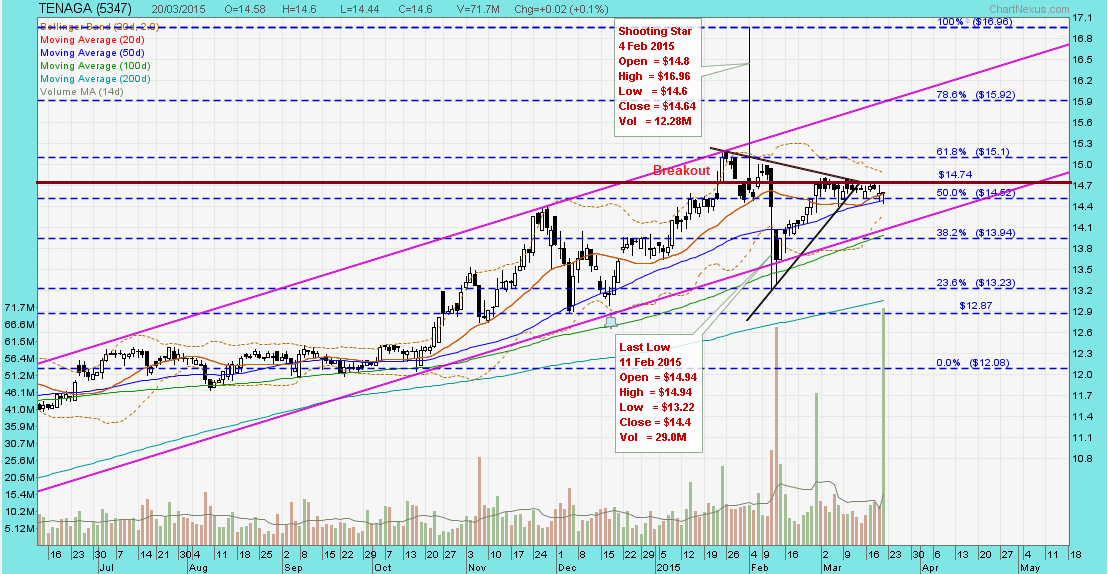

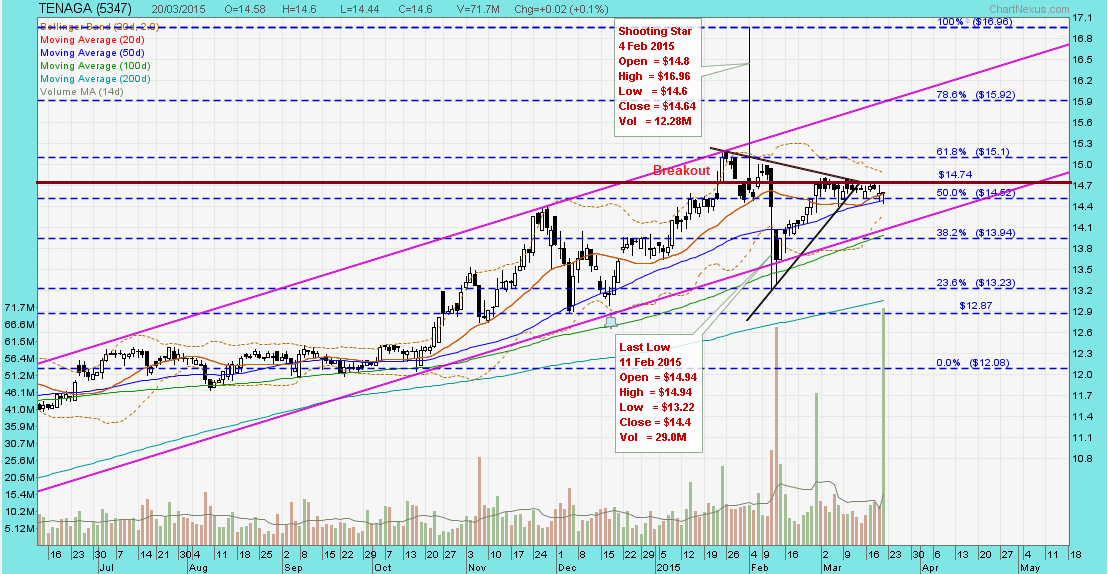

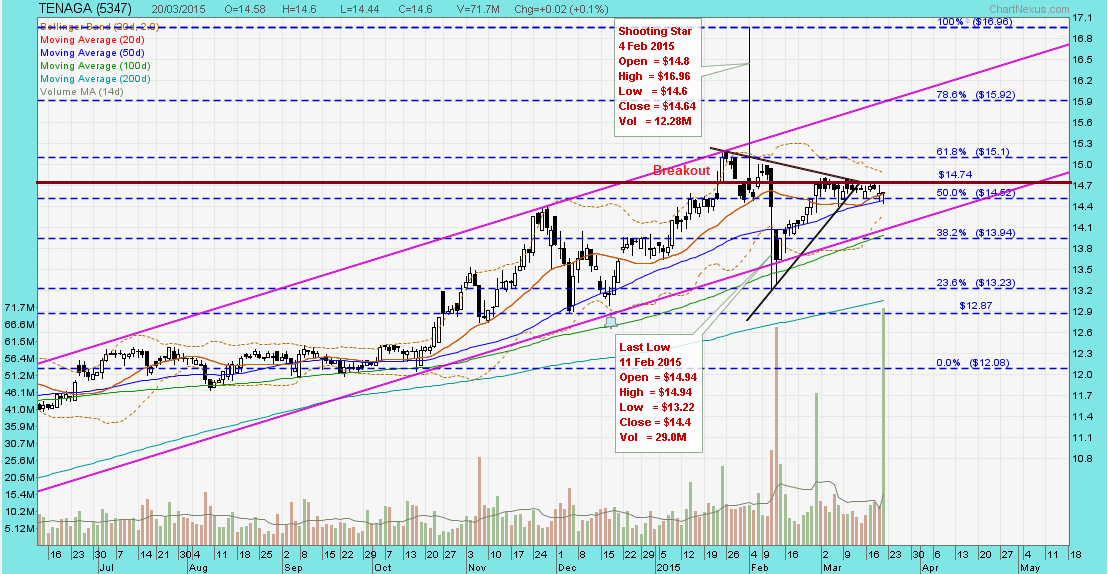

TENAGA ~ Symmetrical Triangle formation, biased to the downsideTENAGA closed with a hanging man @ RM14.60 (+0.02, +0.1%) with extremely high volume done at 71.7m shares on 20 Mar 2015. Immediate support @ RM14.52 immediate resistance @ RM14.74. How to use divergences as leading indicators  TENAGA — Bullish Ascending Triangle Breakout, Interim TP RM 17.50TENAGA closed with a long white marubozu @ RM15.10 (+0.58, +4%) with high volume done at 24.3m shares on 23 Jan 2015. Immediate support @ RM14.64 immediate resistance @ RM15.85

|

|

|

|

Post by sptl123 on Mar 22, 2015 14:49:31 GMT 7

TENAGA ~ Symmetrical Triangle formation, biased to the downsideTENAGA closed with a hanging man @ RM14.60 (+0.02, +0.1%) with extremely high volume done at 71.7m shares on 20 Mar 2015. Immediate support @ RM14.52 immediate resistance @ RM14.74. How to use divergences as leading indicators  TENAGA — Bullish Ascending Triangle Breakout, Interim TP RM 17.50TENAGA closed with a long white marubozu @ RM15.10 (+0.58, +4%) with high volume done at 24.3m shares on 23 Jan 2015. Immediate support @ RM14.64 immediate resistance @ RM15.85  Thank you very much Bro Zuolun. It is an eye-opening for me ; using divergences as a leading indicators. In the example of TENAGA and DJ Index, a series of Diverged-Falling MFI indicates a price correction to the down side is insight. Can we apply the reverse; if a Diverged-Raising MFI is developing, one can predict that the price will soon moving upward? I just spotted the following from CAB chart and it confirmed a diverged-falling MFI leads to a price fall for 5 trading sessions.  Bro Zuolun, there is plenty to learn from your posts each day....  |

|

|

|

Post by zuolun on Mar 22, 2015 16:44:22 GMT 7

Thank you very much Bro Zuolun. It is an eye-opening for me ; using divergences as a leading indicators. In the example of TENAGA and DJ Index, a series of Diverged-Falling MFI indicates a price correction to the down side is insight. Can we apply the reverse; if a Diverged-Raising MFI is developing, one can predict that the price will soon moving upward? I just spotted the following from CAB chart and it confirmed a diverged-falling MFI leads to a price fall for 5 trading sessions. Bro Zuolun, there is plenty to learn from your posts each day....  , Yes, a +ve Diverged-Raising MFI is one of the key indicators indicating that the price will move upward but you should also use the OBV and the CMF to see the strength of the buying pressure. Your CAB chart is an excellent example of a negative divergence.  |

|

|

|

Post by sptl123 on Mar 23, 2015 15:12:07 GMT 7

Bro Zuolun, You are correct once again ! Tenaga drop 2% as at 1600HR on 23rd March 2015. That also proved the working of a -ve diverged-falling MFI on your chart. It is yet another jaw-dropping on me  TENAGA ~ Symmetrical Triangle formation, biased to the downsideTENAGA closed with a hanging man @ RM14.60 (+0.02, +0.1%) with extremely high volume done at 71.7m shares on 20 Mar 2015. Immediate support @ RM14.52 immediate resistance @ RM14.74. How to use divergences as leading indicators  |

|

|

|

Post by zuolun on Mar 23, 2015 15:59:32 GMT 7

sptl123, TENAGA's share price down 2.6% today is mainly due to -ve news.  英特格斯大股東出招‧國能全購價恐需調高 英特格斯大股東出招‧國能全購價恐需調高 ~ 20 Mar 2015 国能收购添变数 3造股价齐跌 ~ 19 Mar 2015 Bro Zuolun, You are correct once again ! Tenaga drop 2% as at 1600HR on 23rd March 2015. That also proved the working of a -ve diverged-falling MFI on your chart. It is yet another jaw-dropping on me

|

|

|

|

Post by sptl123 on Mar 23, 2015 16:54:52 GMT 7

Bro Zuolun, Am I right to say that the news is the cause, the effect of which is falling price and -ve divergence was the early symptom? Is it possible that long before the news, some interested parties or insiders already have information not publicly available and their actions were captured by MFI? sptl123, TENAGA's share price down 2.6% today is mainly due to -ve news.  英特格斯大股東出招‧國能全購價恐需調高 英特格斯大股東出招‧國能全購價恐需調高 ~ 20 Mar 2015 国能收购添变数 3造股价齐跌 ~ 19 Mar 2015 Bro Zuolun, You are correct once again ! Tenaga drop 2% as at 1600HR on 23rd March 2015. That also proved the working of a -ve diverged-falling MFI on your chart. It is yet another jaw-dropping on me  |

|

|

|

Post by zuolun on Mar 24, 2015 6:59:07 GMT 7

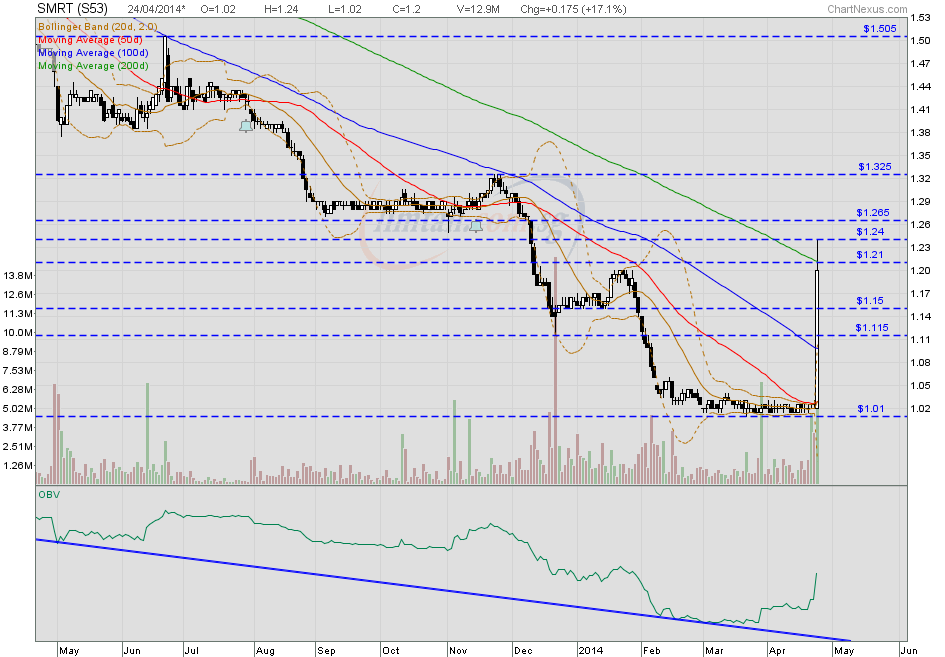

Bro Zuolun, Am I right to say that the news is the cause, the effect of which is falling price and -ve divergence was the early symptom? Is it possible that long before the news, some interested parties or insiders already have information not publicly available and their actions were captured by MFI? , Yes, you got it right! Stock prices are always news-driven. TENAGA's current -ve news is exactly the same as SMRT's +ve news then. Based on chart pattern, price action and volume, it's obvious that certain privileged BBs had capitalized on the newsflow (not known to retail investors / general public) to make huge profit.  TENAGA ~ Bearish Symmetrical Triangle Breakout, biased to the downside TENAGA ~ Bearish Symmetrical Triangle Breakout, biased to the downsideTENAGA closed with a long black marubozu @ RM14.24 (-0.36, -2.5%) with 13m shares done on 23 Mar 2015. Immediate support @ RM13.94, immediate resistance @ RM14.52.   |

|

|

|

Post by zuolun on Jun 19, 2015 20:45:40 GMT 7

|

|

|

|

Post by zuolun on Aug 10, 2015 11:58:17 GMT 7

|

|