|

|

Post by zuolun on Apr 7, 2015 16:37:56 GMT 7

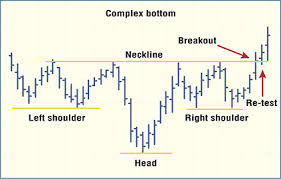

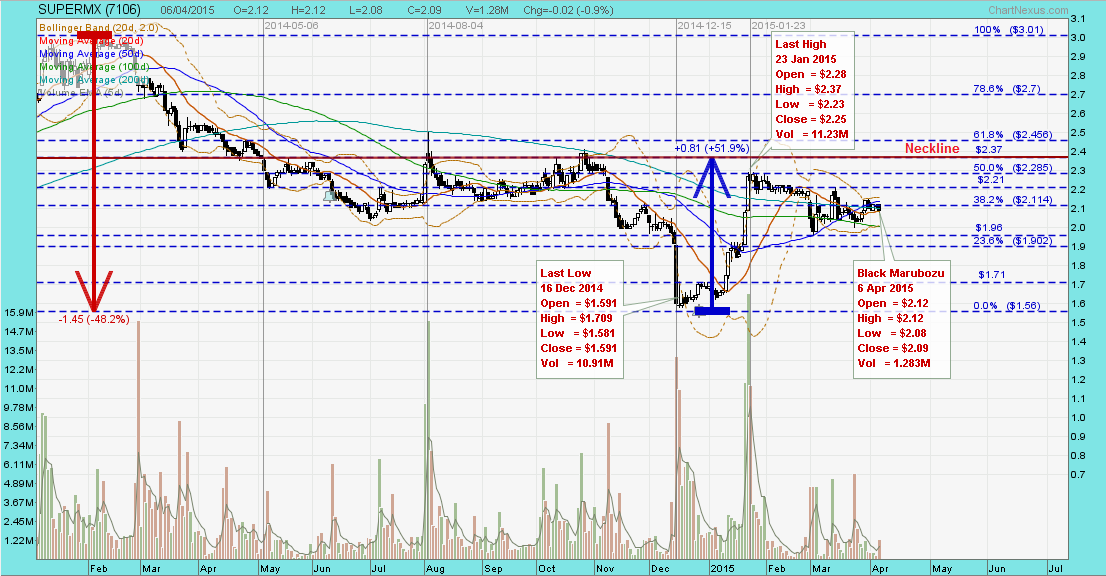

SUPERMX SUPERMX ~ Complex Bottom FormationSUPERMX closed with a small black marubozu @ RM2.09 (-0.02, -0.9%) with 1.28m shares done on 6 Apr 2015. Immediatr support @ RM1.96, immediate resistance @ RM2.21.   SUPERMX (weekly) ~ Trading in a downward sloping channel SUPERMX (weekly) ~ Trading in a downward sloping channel |

|

|

|

Post by zuolun on May 4, 2015 17:39:33 GMT 7

|

|

|

|

Post by sptl123 on May 4, 2015 23:43:40 GMT 7

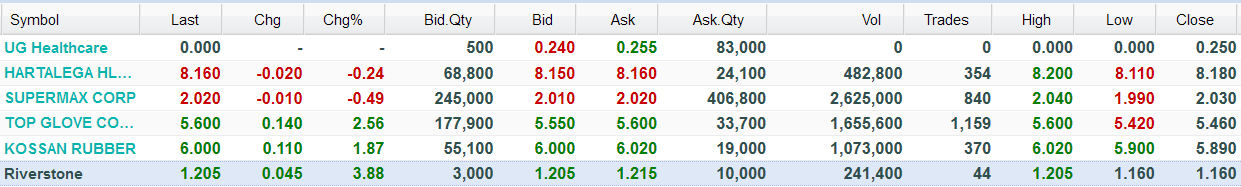

Bro Zuolun, Most Glove makers made substantial gain in the last few sessions. Supermax is a lagger. However it last closed with a long spinning tail suggested strong buying pressure. Closing price of glove makers as as 4/5/2015:  I am looking for reasons to long SUPERMAX: 1) Bullish CCI(26) oversold and reversing. 2) Medium term bullish MA crossover; 25dMA crossed above 50dMA. 3) Williams %R(14): Bullish Williams %R at -84 (Over bought and reversing). 4) 5d Stochastic hooking up. 5) ADX and ADXR well below 16 sugguest no trend. Does Fibonacci Retracement works for the trend which SUPERMAX is in now? I am thinking of "buy the Dip and Sell the Rally" using it with the 20dMA as a guide. Trading plan is to buy above RM 2.02(support turn resistance) and cut lost at RM 1.97. Bro Zuolun, you think go or no-go?   |

|

|

|

Post by zuolun on May 6, 2015 7:57:51 GMT 7

|

|