China, Singapore agree on new initiatives to boost internationalization of RMB ~ 14 Oct 2015

China to extend onshore FX trading to overlap with London ~ 14 Oct 2-15

Visa and MasterCard are caught in China's new spending curbs ~ 10 Oct 2015

China's economic slowdown played into Fed inaction on interest rates ~ 9 Oct 2015

Asian demand for plastic to defy China economic slowdown ~ 9 Oct 2015

Why emerging economies are slowing down ~ 9 Oct 2015

Deutsche bank's 3Q loss of €6.2b and the massive writedowns ~ 8 Oct 2015

Deutsche bank may swell $14b selloff in China bank stakes ~ 8 Oct 2015

Deutsche bank’s kitchen sink augurs new plumbing ~ 8 Oct 2015

IMF warns of 'stronger growth slowdown' in China ~ 7 Oct 2015

China, Brazil dump US debt ~ 7 Oct 2015

Bill Gross: Capitalism 'can't survive' at 0% rates ~ 6 Oct 2015

Lower food costs rein in China consumer inflation 14 Oct 2015

A slowdown in food prices pulled China's consumer price index back from a 13-month high, while producer prices continued to deflate at their quickest rate since 2009.

China's consumer price index fell from 2 per cent in August to 1.6 per cent in September. Food inflation pulled back 0.1 per cent month-to-month. On a year-to-year basis food prices were up 2.7 per cent, shaving an entire percentage point off the rate in August.

In August, pork prices were an outlier to the disinflationary trend, rising nearly one-fifth over the year. That pushed CPI to 2 per cent, a 13-month high. The risk of runaway pork prices likely diminished last month, but full details aren't out yet to confirm this.

Low inflation should allow Beijing, whose target for inflation is "around 3 per cent" this year, to enact stimulus should it seek to support the economy.

"The inflation environment in China is on the soft side, but higher food prices have boosted consumer prices lately," said Moody's Analytics before the release. "The reduced pork supply will keep food inflation elevated, but this masks the underlying disinflation dynamics. Overcapacity remains a problem and firms are pushing prices lower to drive demand."

Meanwhile, producer prices deflated for a 43rd consecutive month, reflecting excess supply of housing materials and raw materials, and overcapacity in heavy industry. Producer prices remained 5.9 per cent below year-ago levels, its deepest since 2009.

"Imported commodity costs and overcapacity among domestic producers are leading to lower prices of energy, iron ore and other inputs," Moody's Analytics said. "Recent stock market volatility also appears to have caused a downtick in investment and production, which could lead to further deflation pressures. The recent yuan devaluation likely did not affect import costs to a great extent."

Asian stocks drop with metals as China data sow deflation fears

Asian stocks drop with metals as China data sow deflation fears ~ 14 Oct 2015

China’s growth outlook plays out on big screenGrowth in services like movies and travel give a truer picture of the changing nature of China’s economy.

China’s growth outlook plays out on big screenGrowth in services like movies and travel give a truer picture of the changing nature of China’s economy.By Wayne Arnold

14 October 2015

China released its latest trade data yesterday and it appears its biggest export may now be deflation.

Exports dropped almost 6% on year in the third quarter, to roughly $598 billion, according to CEIC. Imports fell even faster, falling 14.4% to $145 billion and thereby pulling China’s trade surplus with the rest of the world up 28%, to $164 billion.

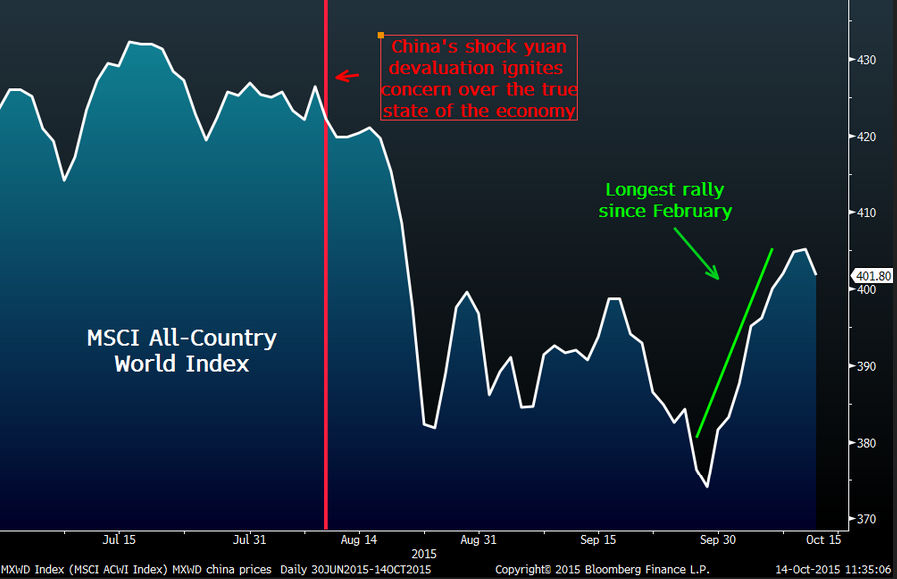

What’s troubling is that even though exports dropped when calculated in dollars, the volume of China’s exports jumped by 23%. The data also show what a little devaluation can do: thanks to the People’s Bank of China’s move to devalue the yuan in August, the trade surplus grew 28% in dollars, but swelled 31% in yuan. Had the yuan stayed at its pre-Aug. 11 rate, the surplus would have grown by about 29%. Not a big difference, but every little bit helps when like China you’re struggling to reflate economic growth.

China’s weak trade data helped drive stocks down on Wall Street. Investors are increasingly confident the U.S. Federal Reserve has been cowed into submission by the International Monetary Fund and Beijing and won’t raise interest rates until March at the earliest. But all that cheap global money will count for naught if China drags the global economy into recession.

After years of blithely ignoring China’s growing problems, investors are now paranoid about them. Bank of America Merrill Lynch’s global economist Ethan Harris advises investors to bear two things in mind: “First, China’s slowdown is damaging to China’s closest trading partners and to commodity producers, but the shock fades markedly for the rest of the world. Second, China has been slowing for some time and hence a lot of the damage to trading partners has already happened.”

Indeed, among analysts closer to China – and whose livelihoods depend on continued interest in Asia’s markets – it is increasingly fashionable to recommend focusing not on the dying state-dominated manufacturing sector, but rather the new, vibrant domestic service-oriented sector sprouting up in its shadow.

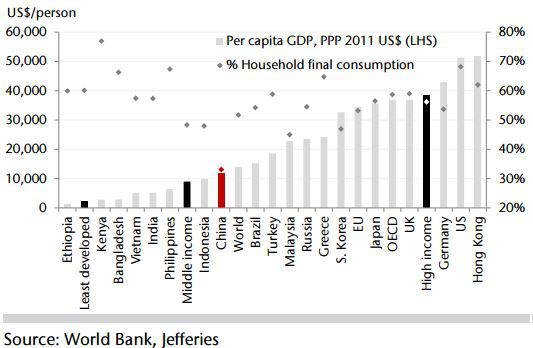

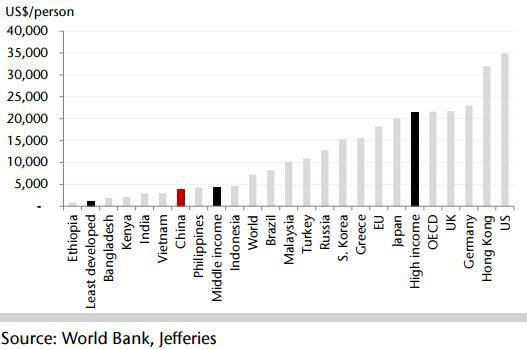

Perhaps the most novel take on this so far comes from the analysts at Jefferies in Hong Kong. In a report last week, they argued that investors should stop focusing on data that only reflects old China’s gloomy demise. This data is encapsulated in what’s known as the Li Keqiang index – named because it’s the data Premier Li Keqiang once reputedly admitted that he focuses on after conceding that China’s suspiciously perky GDP data is “man-made.” What’s in it? Electricity demand, rail cargo volumes and bank loans – all things that tend to measure industrial output, Jefferies argues, rather than consumption of services.

THE LI KEQIANG INDEX, JEFFERIES ASSERTS, IS “DEFUNCT.” So Jefferies concocted an alternative set of indicators that includes, among other things, demand for gasoline, box office receipts, logistics sales, and air travel. As you’d expect, it reveals a much more encouraging snapshot: Air travel in China grew 13% on year in August, while box office receipts more than doubled in September.

As alluring as these kind of bright-spot analyses may be, however, investors should take them with a grain of salt. While parts of any economy can remain robust as the whole suffers, they can’t obscure the larger picture of slowing overall growth. Nor can the services sector absorb the kind of investment that has gone into manufacturing and industry.

Worse, the services sector is vulnerable to knock-on effects of the wider slowdown and not just because consumers will cut back if big companies start going bust. The enthusiasm for China’s services sector recalls a similar fad for small, service-oriented companies in Japan during the first of its two “lost” decades of deflation. Time and time again, analysts in the 1990s heralded “green shoots” of growth in Japan. And time and time again, Japan’s petrified giants smothered those green shoots, sucking up available credit and depriving new entrants of market share. For its own forest to rejuvenate, China’s old growth conifers need to rot and feed the fungi and ferns of the services sector. Otherwise they will suffocate the saplings struggling for sunlight below.

Jefferies is confident, however, that even as China’s old economy withers, its services economy will -- like kudzu -- gradually take over and revive growth. Jefferies says services already account for 52.5% of China’s GDP, up from 44.3% in 2011.

Even as China’s population ages and overall growth slows, Jefferies argues this consumer economy will flourish, driven by rising incomes and the continued shift of people from rural areas into cities. Government plans to provide more comprehensive healthcare and pensions, moreover, will free consumers to save less and spend more. Chinese will devote less of their cash to worrying about the future and more to enjoying life – a trend analysts have to hope means less fear and more fun for them as well.

How China's official bank card is used to smuggle money

How China's official bank card is used to smuggle money ~ 11 Mar 2014

十一黄金周旅游市场 西安:“变味”的一日游 ~ 10 Oct 2015

The commodity currency reversal ~ 9 Oct 2015

After the fear, the hope ~ 8 Oct 2015

When political risk costs money ~ 8 Oct 2015

China dumps dollars to buy gold ~ 1 Oct 2015

What is causing China's economic slowdown? ~ 24 Aug 2015