Bloomberg explains how Draghi can “free up” $900 billion ~ 7 Mar 2016

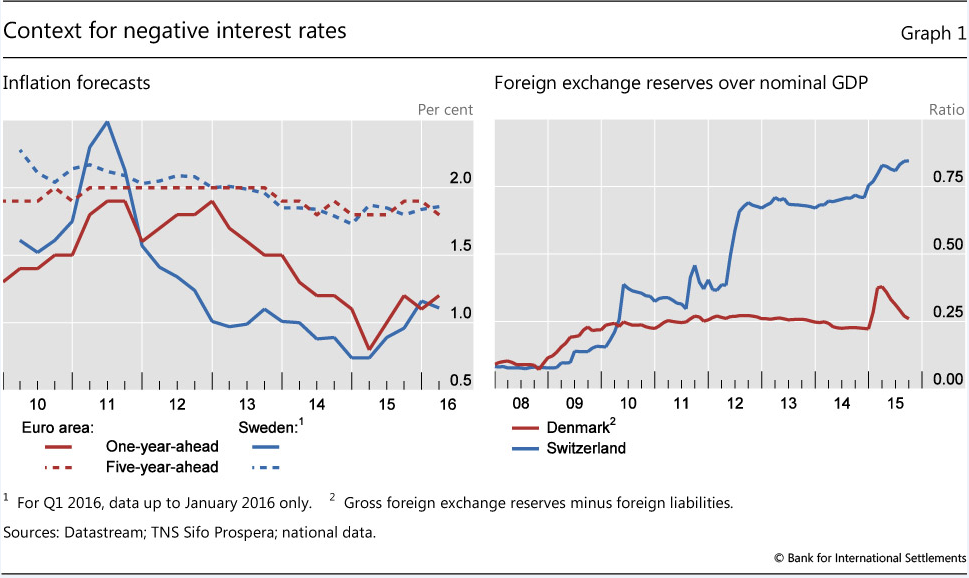

Faith in 'healing' central banks has faded: BIS

Faith in 'healing' central banks has faded: BIS ~ 6 Mar 2016

ECB to announce new stimulus measures on 10 March 2016 ~ 6 Mar 2016

BIS warns central banks on consequences of negative interest rates ~ 6 Mar 2016

How have central banks implemented negative policy rates? ~ 6 Mar 2016

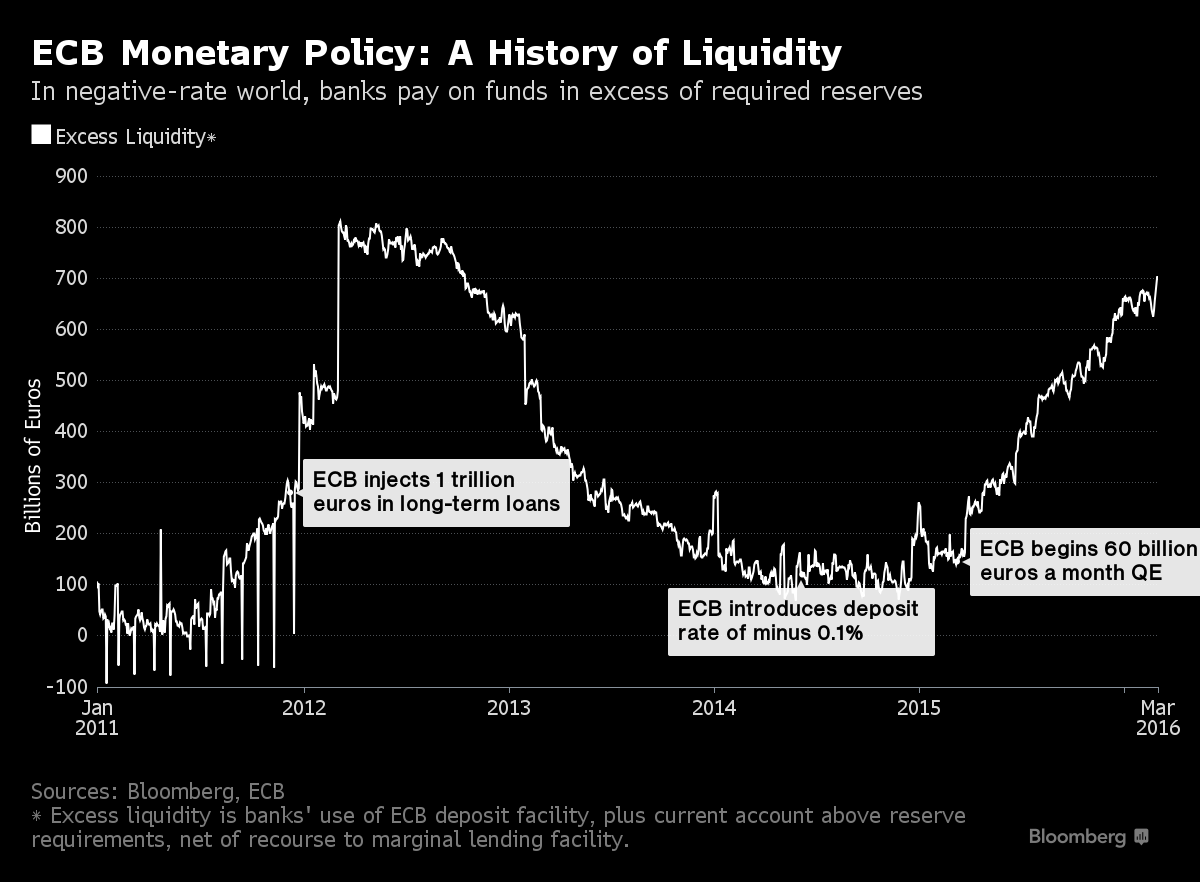

Draghi's liquidity shows negative-rate pressure on banks: Chart

Draghi's liquidity shows negative-rate pressure on banks: Chart ~ 3 Mar 2016

Making depressions great again

Making depressions great again ~ 29 Feb 2016

Why buying gold now could be a lot like buying stocks in 2009

Why buying gold now could be a lot like buying stocks in 2009 ~ 29 Feb 2016

Sterling would fall to parity vs euro after Brexit vote - UBS ~ 29 Feb 2016

Euro zone economy hits wall of worry, deflation concern ~ 29 Feb 2016

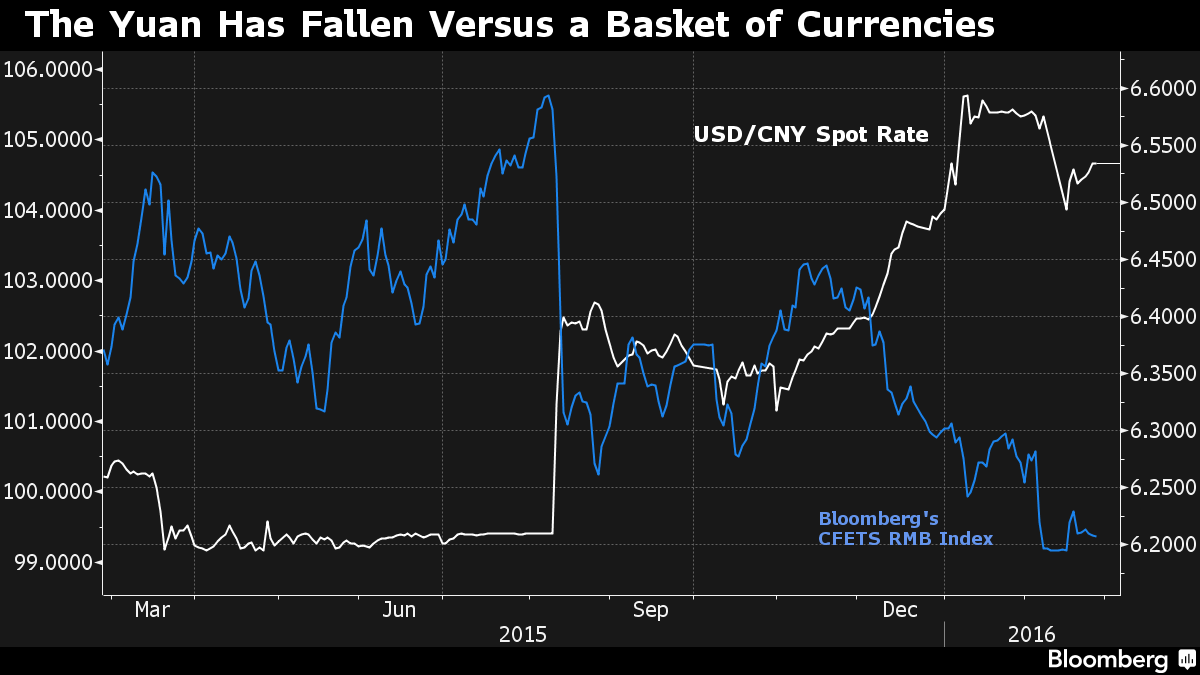

China stocks drop sharply as yuan dips to 3-week low ~ 29 Feb 2016

Is the PBOC already backtracking on the G20 summit? ~ 29 Feb 2016

China eases banks’ reserve ratios to boost liquidity ~ 29 Feb 2016

China fixes yuan at four-week low despite pledge ~ 29 Feb 2016

Stocks soft on Fed angst, G20 fails to help ~ 29 Feb 2016

The G-20 puts spotlight on central banks ~ 29 Feb 2016

Yuan fixings enigma returns as PBOC reverts to currency basket ~ 29 Feb 2016

G20 finance minsters and central bankers move to ease fears about currency volatility and market turmoilMeeting was a ‘good opportunity for building consensus’ but lacked substantial action plans, observers say

G20 finance minsters and central bankers move to ease fears about currency volatility and market turmoilMeeting was a ‘good opportunity for building consensus’ but lacked substantial action plans, observers sayBy Daniel Ren in Shanghai

28 Feb 2016

Monetary tools, fiscal policies and structural reforms should be mobilised to support the world economy, G20 central bankers and finance ministers said after their meeting in Shanghai yesterday.

The two-day gathering of the world’s top economies ended with few concrete outcomes as the Group of 20 leading economies agreed to use all policy tools to drive the global growth while pledging greater cooperation to dispel fears about currency volatility and market turmoil.

Without mention of explicit concerns about China’s policymaking and reform agenda, the communique published after the meeting said the magnitude of recent market volatility had not reflected the underlying fundamentals of the global economy.

The rhetoric came after China’s central bank governor Zhou Xiaochuan said before the meeting that Beijing would embark on a proactive monetary policy to improve the fundamentals of the world’s second-largest economy while promising to keep a stable yuan without engaging in competitive devaluations to bolster exports.

A stock market rout on the mainland and a surprising one-off devaluation of the yuan last year resulted in turbulence on the global markets with jittery investors complaining about Beijing’s opaque policymaking.

There had been mounting worries about a currency war as nations rushed to devalue their own currencies to make exports cheaper.

Beijing reiterated it would not join competitive devaluations, with the central bank governor saying its policies aimed to ensure a smooth transition to growth driven by consumption rather than exports and investments.

“The language on the exchange rates is very important,” US Treasury Secretary Jacob Lew told reporters after the communique was released. “We will keep each other informed and avoid surprising each other.”

Beijing admitted its policies had a spillover effect that could lead to currency volatility and cross-border capital flows.

But Zhou, despite saying China welcomed communication and coordination, insisted Beijing would take a firm stance on its reforms, which would likely introduce new policy incentives including interest rate cuts.

“The key policymakers appeared to have agreed to continue to ease monetary policies to buoy global growth on the G20 meeting,” said Luo Wenbo, an economist at Zhongtai Securities. “The meeting served as a good opportunity for building consensus though it still lacked substantial action plans.”

The G20 nations said renewed efforts would be made to achieve the goal of 2 per cent additional growth by 2018.

The communiqué added Britain’s prossible exit from the European Union, and the escalating refugee crisis in Syria to its long list of concerns, even as it argued recent market volatility didn’t reflect global growth momentum.

China’s finance minister Lou Jiwei said a proactive monetary policy was needed now for the world’s second-largest economy to implement the structural reforms but Beijing would also strike a balance between the short-term effect and long-term benefits in policymaking.

Inflation may force ECB to take action ~ 28 Feb 2016

Central banks near policy limits but back in focus after G20 ~ 28 Feb 2016

G20 stalemate on getting sluggish global economy working again ~ 28 Feb 2016

New EU dynamics will unsettle the world ~ 27 Feb 2016

Why is the Dutch central bank suddenly moving its gold? ~ 27 Feb 2016

Dutch central bank looking at moving gold in Amsterdam vault ~ 26 Feb 2016

Can binge drinking really cure alcoholism? Can central banks cure… ~ 26 Feb 2016

Contraction of credit… central bankers greatest fear!

Contraction of credit… central bankers greatest fear! ~ 26 Feb 2016

Gold moves revive memories of 1990s currency crisis

Gold moves revive memories of 1990s currency crisis ~ 25 Feb 2016

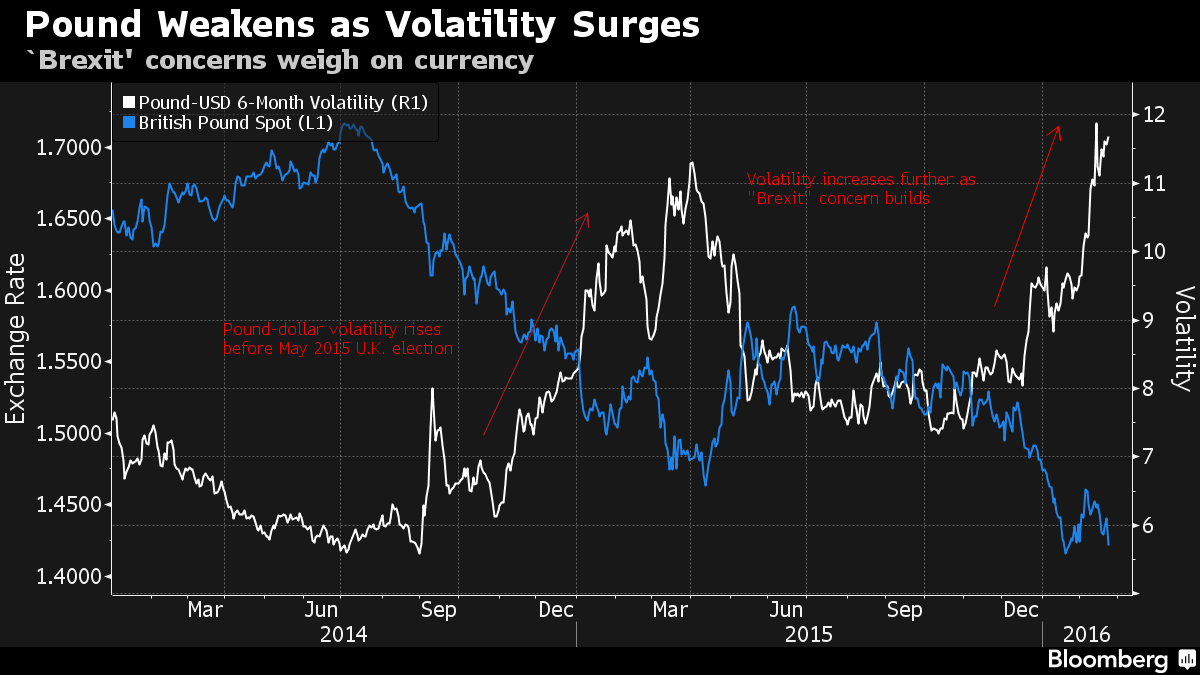

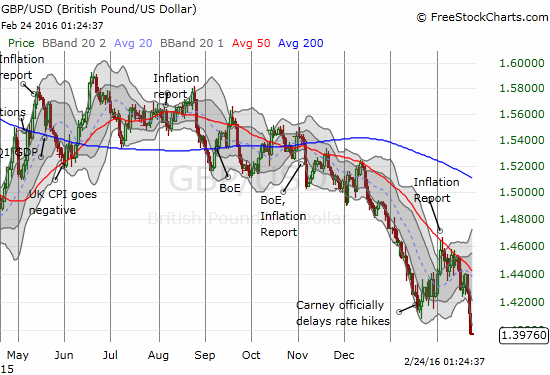

Forget the yuan — the devaluation of the British pound is breathtaking ~ 24 Feb 2016

Use of yuan for trade deals seen growing despite volatility, interventions

Use of yuan for trade deals seen growing despite volatility, interventions ~ 23 Feb 2016

Mexico's central bank sold $2 bln in direct dollar sales ~ 23 Feb 2016

The Eurozone has been infected by the US slowdown ~ 22 Feb 2016

Pound in worst day since banking crisis as `Brexit' fears bite

Pound in worst day since banking crisis as `Brexit' fears bite ~ 22 Feb 2016