|

|

Post by candy188 on Oct 23, 2013 14:46:11 GMT 7

Favourable analyst reports from JP Morgan & TA Securities.

Plantation Sector

A Milder Stocks Build up

Overweight

TA Securities, 11 Sep 2013

An Orderly Stocks Build Up The drastic increase in stocks in the Sept/Nov period last year will likely to be absent this year. All in, we estimate stocks could increase to 1.78mn – 1.80mn tonnes at the end of Sept this year (Sept 2012: 2.48mn tonnes), barring any export shock. This factor is supportive of our 4QCY13 average CPO price estimate of RM2,500/tonne. As for stocks pick, we like Sime Darby and Boustead.

Wilmar too appears attractive underpinned by sustained recovery in the

Oilseeds & Grains segment and earnings accretion from the aggressive expansion in sugar and flour in the past two years.

IFAR’s share price has declined as much as 21% in the past three months, which we think is related to the devaluation of Rupiah. The stock is now trading at 8.7x forward PER, close to the historical low of 8.3x.

ASEAN Agri-Commodities

August palm oil inventory continued to stay low -ALERT

JP Morgan, 10 Sep 2013

Malaysia August palm oil inventory stayed low at 1.67 million MT: MPOB just released August palm oil inventory at 1.67 million MT (flat M/M), against Street estimate of 1.71 million MT and an earlier survey figure of 1.73 million MT reported by Reuters last week.

Stock-to-export ratio fell to a low of 1.1x (historical mean: 1.3x), a level last seen in June 2012 before inventory started to rise significantly that caused the CPO price correction in 4Q2012. This is despite having entered the seasonally higher production period in the year where production rose further in August.

We believe this inventory print will continue to be positive in supporting CPO price, with added strength from the roll-out of B10 biodiesel in Indonesia adding to demand.

Production picked up in line with seasonality but further normalization underway: Production rose a further 3.6% M/M (+4.3% Y/Y) to 1.74 million MT, in line with seasonality trends. This followed from an 18% M/M increase in July. YTD production growth continued to see a gradual normalization trend at +5.7% Y/Y. That inventory continued to maintain in a low, comfortable level was a strong reflection of the underlying demand as evident from both the exports and domestic consumption trend.

Exports rose 7.4%, domestic consumption also strong: Exports rose 7.4% M/M and 5.7% Y/Y, continuing the strength in July. YTD, exports were up 7.4%. Domestic consumption also stayed strong, up 25% Y/Y.

Macro datapoints also supportive of CPO price recovery: Soybean price saw a strong c.10% rally from its mid-Aug trough, triggered by dryness affecting major soybean producing regions in US Midwest.

Early signs of dryness in South America that could potentially impede soybean planting in Brazil this month have also raised some supply concerns further out. The recent B10 biodiesel push in Indonesia is also expected to drive near term CPO demand with current crude oil price making blending profitable even without subsidies. YTD CPO price is tracking our forecast and we maintain our 3Q/4Q13E forecast of M$2,350/M$2,400 and M$2,500 for 2014E.

JPM view – CPO price recovery underway, OW GGR, FR, BWPT, GENP, SIME:

Our thesis regarding a gradual recovery in CPO price in 2H2013 remains intact with potential upside risks if weather events were to disrupt the upcoming US or next year's South America's soybean crop.

Further strength in crude oil price may also encourage faster adoption of the B10 biodiesel programs in Indonesia and Malaysia. The sector is well positioned for a recovery, in our view. We therefore expect stocks that have underperformed but continued to deliver strong production growth or are expected to see meaningful earnings recovery in 2H13 to play catch-up. The near term biasness could therefore be tilted towards the Malaysian-listed names which have been the bigger underperformers across the region over the past 1 month.

|

|

|

|

Post by candy188 on Oct 23, 2013 15:04:40 GMT 7

3 Things You Should Know About Wilmar International

By Alison Hunt - August 16, 2013 PalmTrees Founded in 1991, Wilmar International (SGX: F34) is Asia’s leading agribusiness group.

Wilmar’s business covers everything from crop production to merchandising – what’s more it’s the world’s largest processor and merchandiser of palm and lauric oils, with sizeable plantations in Indonesia, Malaysia and parts of Africa.

Wilmar is amongst the top 10 raw sugar producers in the world, and owns CSR and Chelsea, leading sugar and sweetener brands in Australia and New Zealand. Wilmar is amongst the top 10 raw sugar producers in the world, and owns CSR and Chelsea, leading sugar and sweetener brands in Australia and New Zealand.

It produces fertiliser and biodiesel, has 450 manufacturing plants throughout Asia and is one of the largest listed companies by market capitalisation on the Singapore Stock Exchange. But did you know… Cheap and durable palm oil, which is produced from the fruits of the oil palm, is the world’s most-used edible vegetable oil. ==> Its uses are diverse

– not only could you find it in your margarine and ice cream,

- it may also be lurking in your shampoo, washing powder,

- plus it’s commonly used for bio-fuels. Growing demand has made it a lucrative farming option. In 1884, palm and olive oils were used by Lever Brothers to make Sunlight – the world’s first, packaged laundry soap. Wilmar International was ranked 223rd in size in the 2012 FORTUNE Global 500 largest corporations in the world, and took first place in the 2012 FORTUNE magazine’s World’s Most Admired Companies in the Food Production Industry.

Joint ventures Wilmar’s subsidiary, Newbloom Pte Ltd has recently announced it will buy a 53.7% stake in Noble Plantations Pte Ltd, which is owned by natural resource management company Noble Group (SGX: N21) to produce and sell palm oil and its by-products in the Papua region of Indonesia. Wilmar has also gone into partnership with another agribusiness giant, Archer Daniels Midland (NYSE: ADM) to sell and market vegetable oils and fat in Europe. Palm oil controversy

Of course, palm oil production is not without its problems and producers are facing criticism for often not taking environmental and social best practices into account. Palm oil cultivation can devastate rainforests, destroy habitats of endangered species, such as the Sumatran orang-utan and forest conversion can contribute hugely to climate change. Haze

Closer to home, the record levels of thick smoke or ‘haze’ that recently polluted Singapore and Malaysia are largely attributed to errant companies using the ‘slash and burn’ technique (cutting and burning forests or woodlands) to clear land in nearby Sumatra to plant, amongst other things, oil palm. While the technique allows fast land clearance, the fires can quickly rage out of control, particularly when carbon-rich peat catches hold. ROSP While Wilmar says it abides by its commitment to the Roundtable on Sustainable Palm Oil (RSPO) and bans burning on its own plantations, it admits, like many producers it relies on third parties for the crude palm oil for its refineries, and has said it plans to cut ties with any Indonesian suppliers that clear land with illegal fires. Palm oil production is certainly always going to be a sensitive subject and it’s up to the big producers like Wilmar International to lead the way and show zero tolerance to those flouting the ROSP guidelines.

ROSP Certified Sustainable Palm Oil

But interestingly, even shareholders can have their say. Starbucks (Nasdaq: SBUX) and Dunkin’ Donuts have both committed to source only 100% RSPO certified palm oil in direct response to shareholder pressure.www.fool.sg/2013/08/16/3-things-you-should-know-about-wilmar-international-2/

|

|

jays

Junior Member

Posts: 6

|

Post by jays on Nov 1, 2013 9:27:59 GMT 7

It is good that you highlight the Haze. It is like chicken comes 1st or egg comes 1st issue. Wilmar may not have burn the forests but their demand causes it. It is the same with sharkfins......if you stop eating fins, there are no need to kill sharks. Now Asians have caused huge environment damage ......burning forest for cooking oil, killing sharks for fins, killing elephants for tusks, exterminate tigers for bones and rhino for horns.

Everytime the haze reached Singapore, my breathing becomes uncomfortable. My lung specialist said I should stop smoking but she forgot I that everytime I breath I get more toxins than the cigarette.

Greenpeace recently found Wilmar has been buying palm from companies that practise burn techniques. Well done Wilmar.

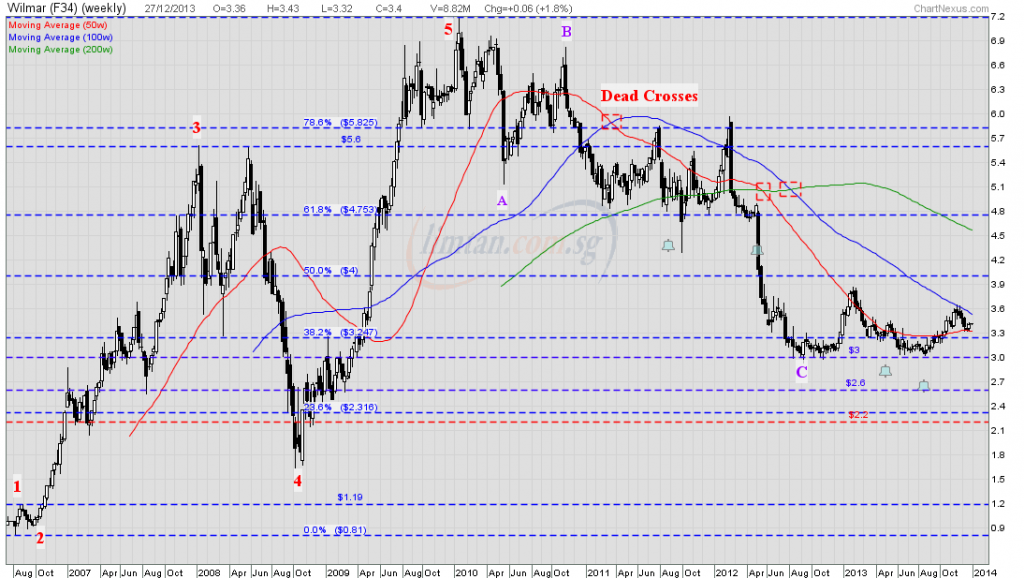

BTW, I love buying this stock for capital gains esp around the $3 level and selling at $4. Making money from Wilmar gives me a sense of justice...the stock price helps pay for my medical bills. You should buy some too.

Pse don't lecture on ethics of investing. Invest in 'green' companies etc. This style of investing is all BS. There are no ethical companies on earth. They all tell investors good stories and only want your capital to 'play'. Trading Wilmar shares don't give the company one dime of your capital as you are buying from other shareholders. However, if Wilmar was to propose a rights issue, then it is a different story......it will be wanting $ from shareholders and I won't want to give a single cent to a company that contribute greatly to global warming.

|

|

|

|

Post by oldman on Nov 1, 2013 9:40:04 GMT 7

Jays, welcome to our forums.

You may find it strange to hear this from me but in principle, I agree with you. Companies are in the business of making money and in the process of making money, they or their business partners are bound to make decisions that may impact negatively the environment or people, in one way or another. I don't think small investors like us should worry too much about such things. Saying that, of course, I will stay far away from such companies like tobacco companies.

|

|

|

|

Post by candy188 on Nov 1, 2013 10:09:53 GMT 7

Jays, welcome to our forums. You may find it strange to hear this from me but in principle, I agree with you. Companies are in the business of making money and in the process of making money, they or their business partners are bound to make decisions that may impact negatively the environment or people, in one way or another. I don't think small investors like us should worry too much about such things. Saying that, of course, I will stay far away from such companies like tobacco companies.Hi oldman, Share your view to abstain from investment in tobacco or even gambling companies.  A friend stated that "being a shareholder of a casino company, I'm actually helping to promote gambling indirectly and this is something that I do NOT want to do."  |

|

jays

Junior Member

Posts: 6

|

Post by jays on Nov 2, 2013 11:26:33 GMT 7

Thank you for your welcome, Oldman. I find it strange to type oldman when your pic showed you are quite young.

Thank you for agreeing with me. We are small investors trying to make $ in a sea of corporate powers that have never in history been so powerful. They can influence a US president to go to war so they (defence contractor) can make tons of $ from subcontracting and over-charging the military, whose budget comes from taxpayers. The media does not ask too many questions cause they are big businesses too.

I am a trader/investor just out to make $. Therefore, I cannot let idealogy get in the way. Look at the odds we have to overcome against the big guys. They have huge capital, political power and inside knowledge. Even Obama makes tons of $ from his stockpicks given his knowledge of defence contractors.

From years of studying the companies in the stockmarkets, I found the more 'badass' the company is the more profitable and thus higher stock prices. If you do not believe go google "HSBC and money laundering", or, "Why I left Goldman", or, "The good, bad, ugly of capitalism". Companies like Walmart and Apple were reported to use exploited workers in third world countries. Exxon guilty of polluting the sea. Look up youtube on Alberta's oil sands and how they brought cancer to the North Americans native people.

The more 'badass' the more these companies grew bigger and bigger. You may wonder why? It is simply because these big companies contribute to political parties and 'set' the political agendas. If they want less regulations to expand their empire, they have people like Alan Greenspan to do it. He let the deposit-taking banks expand into trading and investment banking and this let to the 2008 recession cause he refused to regulate the derivative business which grew like wild fire on the back on CDO explosion. Nobody in banking in USA went to jail over this. And today, Wall Street is still highly influential in the white house.

In today's hyper competitive world, the 'badass' companies that colludes with politicians, within their monopolistic club, who gets licenses (casino) etc are the winners. Go google 'Aurther Anderson', 'Enron', 'Ernst and Young and fraud accounting', 'role of credit rating agency in CDO', 'rescue of AIG'........see how badass they are. Most of these are still around and thriving....go read Moody's role in financial crisis. What they did was worst than any badass person can do with a weapon. Billion of taxpayers monies have to be use to rescue AIG.

As an investor, I urge Candy to never say never. Your friend's thinking is old fashion and naive. If you are such a good hearted person, you should never invest in stocks. Buy mutual fund instead. Go watch the documentary film, Inside Job. I did and I grew up as an investor. I will invest in any stocks as long as they have a competitive edge that is so secure like a moat (Buffett's idea). They can be casino, tobacco, walmart, telecoms, oil, banks etc.

|

|

|

|

Post by candy188 on Nov 2, 2013 12:25:53 GMT 7

I prefer to AGree to disagree.  Respect the fact that everyone has different belief system.  Will only invest in businesses that support my belief system. "Love what you DO, Do What you LOVE", shared by a friend.   |

|

|

|

Post by oldman on Nov 2, 2013 16:12:14 GMT 7

Jays, I used the nick Oldman when I started ShareInvestor in 1999. I was then 38 years old and had plenty of grey hair. I started having grey hair when I was in my early teens. My wife always called me oldman and hence, this became my nick ever since.  Sadly, I agree with most of what you have said. The link to Inside Job is here.My difference is that I feel that there are lots of things that I can invest in. So, I can pick and choose. I will avoid investing in certain industries like gambling as these affect my conscience. Many years back, I was asked to join a group of entrepreneurs to create an education company targeted at educating the young on entrepreneurship. The problem is that I don't think entrepreneurship can be taught that way and even though the money was good as the government was funding most of the education, I declined. I like to earn money and keep my conscience clear as one day, I know that I too will have to die and when that day comes, I will die happy knowing that I have not done anything against my conscience.  You can view my thoughts on education and entrepreneurship here: pertama.freeforums.net/thread/133/education-lust-life |

|

|

|

Post by zuolun on Dec 16, 2013 12:15:17 GMT 7

|

|

|

|

Post by candy188 on Dec 27, 2013 21:54:05 GMT 7

|

|

|

|

Post by candy188 on Dec 27, 2013 22:13:33 GMT 7

Great news for Wilmar investors with only slight increase in CPO production next year. RI expects slight increase in CPO production in 2014 RI expects slight increase in CPO production in 2014The Jakarta Post, Medan | Business | Thu, December 26 2013, 3:14 PM Indonesia’s crude palm oil (CPO) production is expected to reach 29.5 million tons in 2014, up slightly from the previous year. “This year, national palm oil production is estimated to reach only 26.2 million tons, lower from the initial target of between 28 million and 28.5 million tons,” said chairman of the Indonesian Palm Oil Board (DMSI) Derom Bangun on Thursday, as quoted by Antara news agency.  He said this year’s farming activities had been hampered by problems, such as weather-disrupted harvests.

More restricted regulations and limited areas for expansion of oil palm plantations in the country would aggravate the problems next year, he went on.  “With only 2.1 million tons of CPO left in 2013, Indonesia will have only 31.6 million tons of CPO stock in 2014 “With only 2.1 million tons of CPO left in 2013, Indonesia will have only 31.6 million tons of CPO stock in 2014,” said Derom. He further said that only around 18 million of total 29.5 million tons of CPO production next year would be for export markets. The remainder would be used for domestic consumption, starting from food, industry, biofuel and the national reserves. “There is a trend in declining imports in 2014 compared to this year, which is expected to reach 19 million tons,” said Derom. www.thejakartapost.com/news/2013/12/26/ri-expects-slight-increase-cpo-production-2014.html

|

|

|

|

Post by zuolun on Dec 28, 2013 10:49:25 GMT 7

|

|

|

|

Post by zuolun on Dec 28, 2013 18:39:10 GMT 7

|

|

|

|

Post by zuolun on Dec 29, 2013 0:09:00 GMT 7

Chinese version from Greenpeace International

护林喜讯:全球最大棕榈油贸易商丰益国际承诺“零毁林”

2013-12-11 11:50 - 全球最大棕榈油贸易商丰益国际 (Wilmar International) 终于宣布了“零毁林”政策,承诺不再破坏森林。这是全球数以万计消费者携手推动“守护天堂雨林”行动的成果。新的政策如果能真正付诸行动,不但有助于拯救危在旦夕的印度尼西亚热带雨林,更能让苏门答腊虎、红猩猩等濒危雨林动物免受灭绝的威胁。

全球棕榈油需求量的快速增长,让不可持续的油棕种植扩张成为导致印度尼西亚森林消逝的罪魁祸首。棕榈油产业的魔爪更逐步伸向非洲以及其他全球仅存的原始森林。丰益国际掌控了全球超过1/3的棕榈油贸易,是最有能力推动全球棕榈油供应链可持续发展的企业,“零毁林”政策的意义在于,丰益国际将禁止其子公司和第三方供应商破坏森林及泥炭地,为改变业界现行不可持续的运营模式迈出了重要的一步。

今年10月,绿色和平发起了“守护天堂雨林”的行动,发布了一份名为《丰益国际印度尼西亚毁林实录》的调查报告,揭露棕榈油商业化扩张破坏印度尼西亚雨林的恶行,指出丰益国际纵容其子公司和第三方棕榈油供货商,非法砍伐森林、焚烧泥炭地和大规模破坏老虎栖息地。过去的7年中,绿色和平已曾多次揭露丰益国际涉及破坏印度尼西亚天堂雨林的行为。

我们后续的调查结果更发现,知名日化企业:立白、纳爱斯、上海家化和宝洁等,都向丰益国际及其中国子公司益海嘉里购买棕榈油及其衍生品,但至今仍没制定任何可持续采购政策去有效地确保所采购的棕榈油不涉及森林的破坏。

消费者的力量,拯救印度尼西亚天堂雨林

绿色和平呼吁消费者们共同签署“护林宣言”,一起告诉这些家喻户晓的日化企业及品牌:我们拒绝使用破坏森林、摧毁濒危动物栖息地及加剧全球气候变化得来的棕榈油产品。因此,请这些企业立即制定“零毁林”采购政策。

全球消费者的力量成功地推动了丰益国际制定护林新政策,承诺将要求所有供应商在2015年底前全面遵循“零毁林”政策,不再破坏任何储藏着大量二氧化碳的森林、高保护价值的地区及泥碳地。新政策同时还会设立100%可追溯棕榈油来源的机制,便于追踪和监督。此外,政策还会尊重当地原住民、社区以及工人的权益,以公开透明的方式处理有关投诉。

下一步,我们需要确保丰益国际尽快兑现承诺。根据绿色和平调查所得,丰益国际的个别棕榈油供货商仍然在持续破坏森林,加剧社会冲突——丰益国际做出政策承诺之后的首个考验,就在于它如何立即要求并确保供货商做到“零毁林”。

护林下一步:推动棕榈油消费企业共同兑现“零毁林”承诺

绿色和平将继续监督丰益国际能否实践承诺,同时推动更多棕榈油生产和贸易商承诺同类“零毁林”政策。但是要真正杜绝棕榈油破坏雨林,我们也需要更多大型棕榈油消费企业加入护林,制定“零毁林”的采购政策。

众多知名棕榈油消费企业已采取措施保护印度尼西亚森林。联合利华(Unilever)、雀巢(Nestle)、费列罗(Ferrero)和亿滋国际 (Mondelēz International,前身为卡夫Kraft)都已经承诺制定“零毁林”采购政策及运行时间表。

遗憾的是,作为丰益国际及其中国子公司益海嘉里主要客户的立白、纳爱斯、上海家化和宝洁等棕榈油消费企业,既没有“零毁林”的承诺,也没有相应的政策和措施去确保他们采购的棕榈油不涉及对森林的破坏。

要改变整个棕榈油行业生态,彻底实行“零毁林”,绝不可能一蹴而就。丰益国际的最新承诺已经为棕榈油产业及消费品牌树立了典范,请继续支持绿色和平,一起推动立白、纳爱斯、上海家化和宝洁承诺护林,让消费者能购买到善待森林和老虎得来的棕榈油产品。谢谢!

|

|

|

|

Post by zuolun on Dec 30, 2013 12:13:26 GMT 7

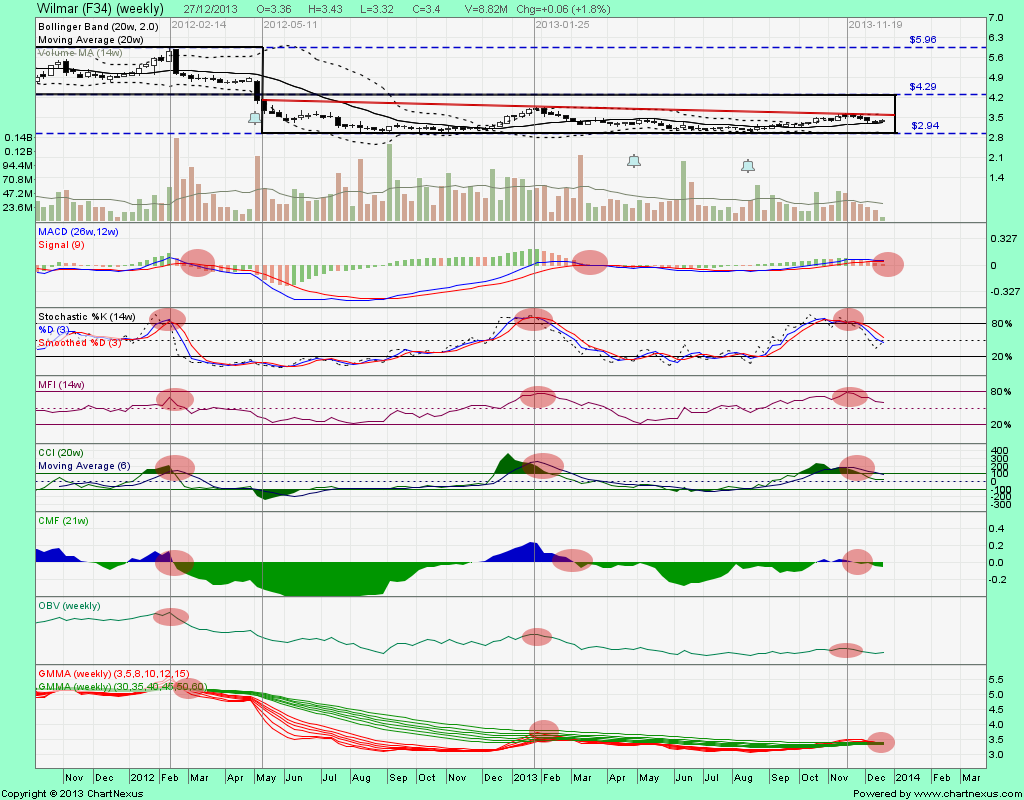

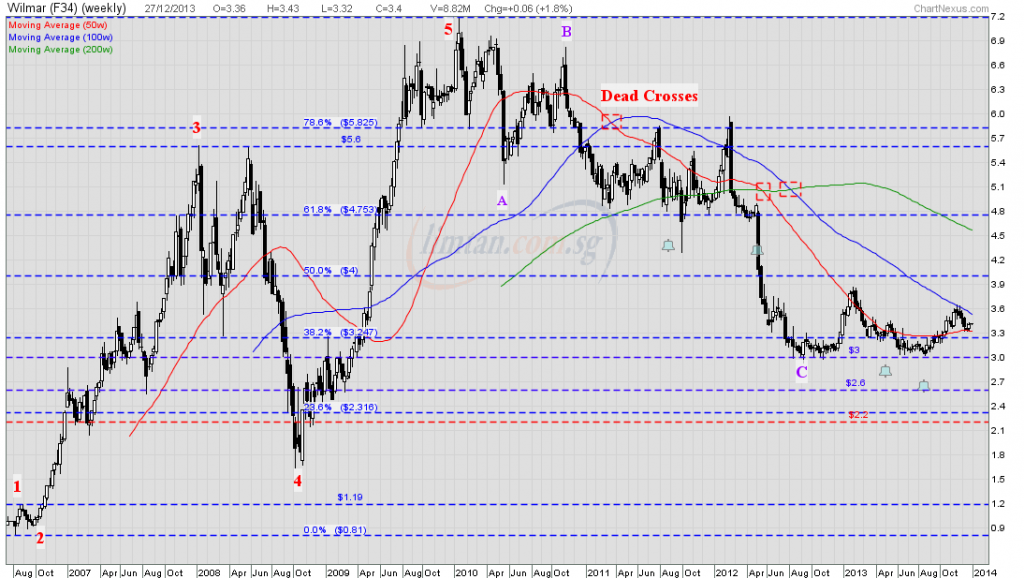

Wilmar — The Elliott Wave Chart Pattern Wilmar — The Elliott Wave Chart Pattern |

|