|

|

Post by oldman on Oct 30, 2013 15:51:05 GMT 7

Catalist index is now down 2.3% to 991. All the top volume counters made up of mostly penny stocks are mostly red.  |

|

|

|

Post by puregold on Oct 30, 2013 16:21:40 GMT 7

More value will surface? I am open to Catalist counters now.

|

|

|

|

Post by zuolun on Nov 11, 2013 10:26:02 GMT 7

As at 31 Oct 2013, MSCI SINGAPORE INDEX As at 8 Nov 2013, MSCI SMALL CAP INDICE CHANGE Additions ASIAN PAY TELEVISION GSH CORP INTERNATIONAL HEALTHWAY KRISENERGY MAPLETREE GREATER CHINA OUE HOSPITALITY TRUST REX INTERNATIONAL HLDG ROWSLEY SINGHAIYI GROUP SOILBUILD BUSINESS REIT SPH REIT UNITED ENVIROTECH YHM GROUP Deletion AMTEK ENGINEERING ASIASONS CAPITAL INNOPAC HOLDINGS LIONGOLD CORP |

|

|

|

Post by oldman on Jan 2, 2014 8:25:45 GMT 7

My goodness. All the top active stocks on the first day of trading in 2014 are all catalist stocks and most of these are below 10cts.  The BAL (Blumont, Asiasons, LionGold) saga is certainly behind us.... |

|

|

|

Post by oldman on Nov 1, 2014 6:16:51 GMT 7

Over the past few weeks, I have increased my collection of the smaller cap stocks. The Catalist index has fallen by over 25% since the start of the year as compared to the STI which has gone up a little since the beginning of the year. Guess the BAL issue played a major part in the collapse of the Catalist index as there is now increased fear for these smaller stocks. However, I feel that if the STI remains strong, it is likely that the Catalist stocks will recover significantly in the weeks and months ahead. After all, the market is all about fear and greed and soon, the fear of Catalist stocks will give way to the greed for such stocks again. I don't think the bull run is over just yet. This is why I continue buying into the weakness of Catalist stocks. Only time will tell if I am right.  |

|

|

|

Post by victor on Nov 1, 2014 12:42:34 GMT 7

Would you be kind enough to share with us what stock are you looking at? Thanks. It is alright , if you think it is confidential.

|

|

|

|

Post by oldman on Nov 1, 2014 19:12:20 GMT 7

Would you be kind enough to share with us what stock are you looking at? Thanks. It is alright , if you think it is confidential. Victor, I do share some of the stocks that I collect in this forum. But, I cannot share all the shares that I am collecting. Thanks for your understanding. Just click on my nickname Oldman and you will find a link there for all the latest postings that I have made. Some of these are on the stocks that I have an interest in. |

|

|

|

Post by oldman on Feb 27, 2015 6:46:19 GMT 7

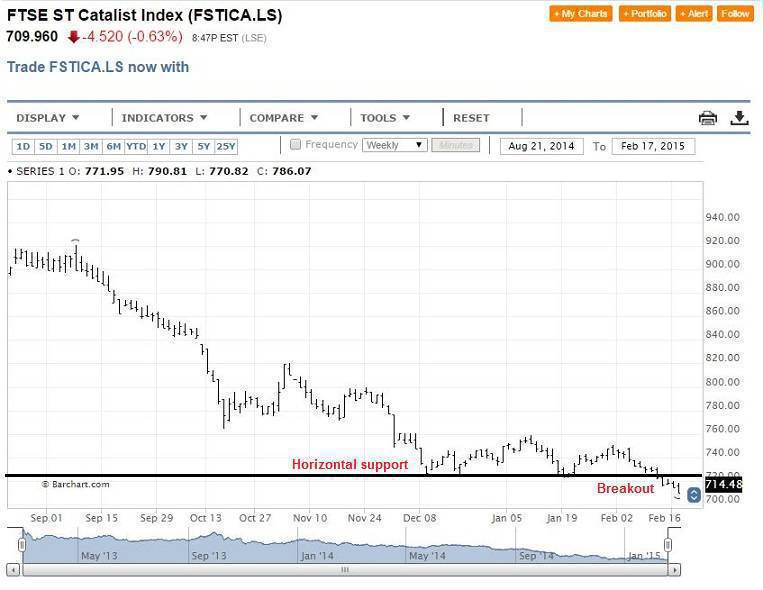

I am still hopeful that the Catalist stocks will come back into play. Many of these stocks have been beaten up quite badly..... more badly than what the historical chart shows below. Only time will tell...... As for the BAL and related stocks, I have avoided them completely given the restructuring that has happened to some of the related stocks.  |

|

|

|

Post by zuolun on Feb 27, 2015 7:50:53 GMT 7

I am still hopeful that the Catalist stocks will come back into play. Many of these stocks have been beaten up quite badly..... more badly than what the historical chart shows below. Only time will tell...... As for the BAL and related stocks, I have avoided them completely given the restructuring that has happened to some of the related stocks. , Based on your latest Catalist Index chart dated 17 Feb 2015, it broke down and hit a new low of 714.48 points. In technical analysis, a stock that has made a new low is a decisive signal to short, not long. It means the Catalist Index is likely to go further down to a target projection at 680 points.   |

|

|

|

Post by oldman on Mar 27, 2015 15:48:30 GMT 7

it is wonderful to see Catalist stocks occupying the top 30 stocks by volume. Hopefully, this Catalist stock rally will continue and folks start making money again. When easy money is being made, more people may join in the market again and make it more vibrant. Hopefully, SGX will keep the customary queries to a minimum.  |

|

|

|

Post by zuolun on Apr 2, 2015 11:16:59 GMT 7

Singapore market largely directionless; small caps active2 Apr 2015 Singapore shares traded mostly sideways as investors were hesitant to take positions ahead of tomorrow's Good Friday holiday. Most of the action centred on small caps. At 10:33am (0233 GMT), the Straits Times Index was little changed at 3,448.15. Market breadth was slightly positive. IPO Corp rose 7.6% to 18.5 cents in active trade, past the takeover price of 17 cents a share offered by Oei Hong Leong, in a sign that shareholders were expecting the business tycoon to improve his bid. it is wonderful to see Catalist stocks occupying the top 30 stocks by volume. Hopefully, this Catalist stock rally will continue and folks start making money again. When easy money is being made, more people may join in the market again and make it more vibrant. Hopefully, SGX will keep the customary queries to a minimum.

|

|

|

|

Post by zuolun on Apr 7, 2015 8:00:05 GMT 7

Volume swells as small caps in play; STI ends flat

By Frankie Ho

6 Apr 2015

Singapore shares ended mostly higher although interest in blue chips was subdued as investors preferred to wait for the March-quarter earnings season to begin before putting more money to work.

Gainers outnumbered decliners 284 to 161.

Investors were largely unfazed by last Friday's dismal US March jobs report, which showed US employers added only 126,000 jobs last month, compared to 264,000 in February and 201,000 in January.

The data fuelled expectations that the Federal Reserve will raise interest rates later rather than sooner.

"The odds for the first Fed rate hike should probably be tilted to a later date, perhaps for liftoff to occur at the September 2015 meeting (instead of July)," Thomas Lam, an economist at RHB Securities Singapore, wrote in a note.

Some 1.95 billion shares changed hands, substantially more than last Thursday's 1.39 billion, although the total value of stocks traded was 24% lower at $704.3 million. This was mainly because the active counters today were penny stocks.

The Straits Times Index ended little changed at 3,452.91.

Ellipsiz was the most active stock in the market, up 2.8% at 14.5 cents, with 181.6 million shares traded.

Other sought-after small caps included Polaris, up 20% at 2.4 cents; Mirach Energy, up 13.1% at 6.9 cents; Vallianz Holdings, up 13.2% at six cents; and Charisma Energy Services; up 9.1% at 2.4 cents.

Charisma Energy rose after the company said it has acquired full control of Aus Am, a company that owns and leases onshore oil and gas assets in Australia. The latter has a leasing contract worth about A$24 million ($24.7 million) and valid for up to 10 years.

AusGroup put on 2.3% to 22 cents after the company said it has secured a five-year contract to provide brown-field maintenance and support services to Chevron Australia. The value of the contract was not disclosed.

Among blue chips, notable movers included Jardine Strategic Holdings, which rose 1.6% to US$35.51, and Ascendas REIT, which fell 1.5% to $2.56.

|

|

|

|

Post by oldman on Apr 8, 2015 6:59:30 GMT 7

|

|

|

|

Post by zuolun on Apr 8, 2015 15:56:53 GMT 7

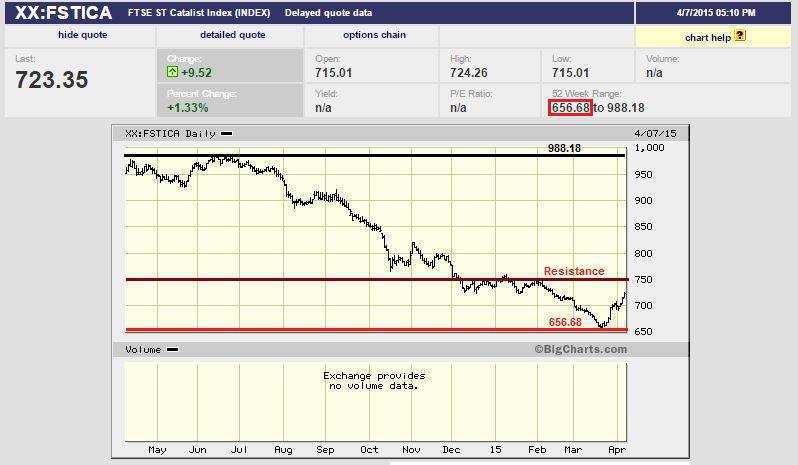

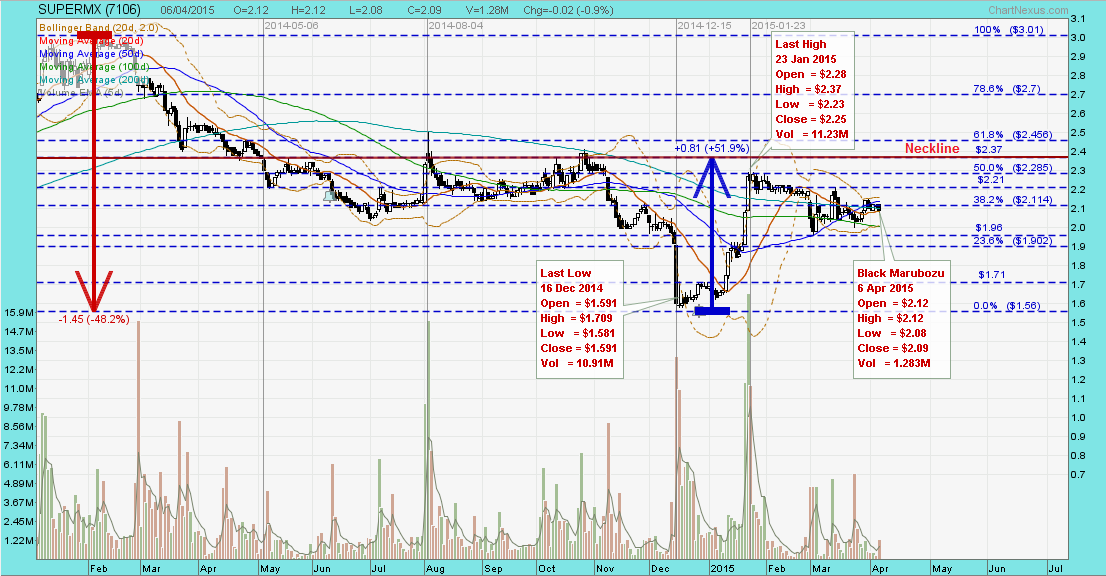

I am still hopeful that the Catalist stocks will come back into play. Many of these stocks have been beaten up quite badly..... more badly than what the historical chart shows below. Only time will tell...... As for the BAL and related stocks, I have avoided them completely given the restructuring that has happened to some of the related stocks. , Based on your latest Catalist Index chart dated 17 Feb 2015, it broke down and hit a new low of 714.48 points. In technical analysis, a stock that has made a new low is a decisive signal to short, not long. It means the Catalist Index is likely to go further down to a target projection at 680 points. Always happy to see the Catalist chart moving upwards after such a long period of decline. , Your Catalist chart dated 7 Apr 2015 is similar to SUPERMX ~ Tough game: Strong resistance @ 750 points.  |

|

|

|

Post by oldman on Apr 9, 2015 12:29:35 GMT 7

Great. It really feels like it is back to the old days when penny stocks can jump 100% a day with no reason or rhythm. 750 soon?  |

|