|

|

Post by me200 on Feb 24, 2014 9:09:38 GMT 7

|

|

|

|

Post by candy188 on Feb 24, 2014 11:19:04 GMT 7

It is a fact that we are stuck with the HDB flat, especially for my case, need to wait till Jan 2016 to fulfill the 5-years minimum occupation period before I am allowed to dispose the property to upgrade to private property.   Extract from the news Extract from the news: Zink said Singapore’s housing market is unique because the majority of citizens live in government-built homes, where many families have already paid off their mortgages. About 82 percent of Singaporeans live in these so-called Housing & Development Board apartments, according to the housing authority’s website.

“So if it goes up and down a little bit, for an asset they can’t sell, does it really affect them much? I don’t think so, “So if it goes up and down a little bit, for an asset they can’t sell, does it really affect them much? I don’t think so,” said Singapore-based Zink, 55, who’s lived in Asian cities including Jakarta and Guangzhou for 17 years. www.bloomberg.com/news/2014-02-23/citigroup-downplays-property-bubble-in-singapore-southeast-asia.html www.hdb.gov.sg/fi10/fi10321p.nsf/w/BuyResaleFlatResaleIndex?OpenDocument#Detail www.hdb.gov.sg/fi10/fi10321p.nsf/w/BuyResaleFlatResaleIndex?OpenDocument#Detail |

|

|

|

Post by candy188 on Feb 28, 2014 11:14:12 GMT 7

Look like the property agents are hit hard by numerous rounds of cooling measures.  Was greeted by a property agent (with the title of Associate Branch Director stated on the name card) who was a leading a team of 5 property agents to share about "market outlook of latest property measures".   First thing that she asked me, "Are you aware of the latest property transacted price in your area?" One unit of 5-room with floor area of 117 sqm (21 to 25 storey, 37 years old) at our vicinity was recently transacted at $818k. Developers & agents: Review property cooling measures Developers & agents: Review property cooling measuresSpeaking at a lunch organised by the Real Estate Developers’ Association of Singapore (Redas) at the W Singapore, Sentosa Cove yesterday (7 Feb), City Developments (CDL) executive chairman Kwek Leng Beng asked the government to review some of its property market cooling measures as home sales and prices fall.

“As the property market starts to cool… this may be the right time to tweak the control measures in the light of concern over the global economy,” said Mr Kwek Leng Beng. “It does take time for the medicine to work. Both the private and public sectors want a soft landing.” Property consultants and agents echoed Mr Kwek’s views urging the government to modify some property curbs. “We need a tweak because the market is reaching a psychological fear level where crowd behaviour believes that the market is going to crash,” said Savills research head Alan Cheong. “The Government could keep on top of this situation by turning that perception around, so that it doesn’t become self-fulfilling.”  Budget 2014: Singapore says 'too early' to relax property cooling measures Budget 2014: Singapore says 'too early' to relax property cooling measuresThe remarks by Finance Minister Tharman Shanmugaratnam in parliament came amid concerns by analysts about property prices soaring to unsustainable levels in emerging markets, including those in Asia. "Our cooling measures have been aimed at moderating the market so as to prevent property prices from getting too far out of line with incomes," Shanmugaratman said as he unveiled the 2014 national budget. "We are not engineering a hard landing, but neither are we able to eliminate cycles in the property market, with upswing in prices in some years followed by corrections," he said. "Given the run-up in prices in recent years, it is too early to start relaxing our measures. The government will continue to monitor the property market and adjust the measures when necessary."

|

|

|

|

Post by zuolun on Mar 10, 2014 13:47:46 GMT 7

|

|

|

|

Post by zuolun on Mar 18, 2014 17:31:53 GMT 7

|

|

|

|

Post by zuolun on Mar 20, 2014 17:42:16 GMT 7

|

|

|

|

Post by me200 on Apr 1, 2014 8:46:55 GMT 7

|

|

|

|

Post by oldman on Apr 2, 2014 5:50:47 GMT 7

Heard in the industry that the top end property market in Singapore is really under pressure. Sales have slowed significantly and transaction prices are falling quickly. However, the mid and lower end properties are still holding on relatively well though these are expected to fall more in the months ahead. The mid and lower tier property prices may be cushioning the property index, at least for the time being.

Singapore Home Prices Slide for Second Straight Quarter - 1 April 2014 |

|

|

|

Post by me200 on Apr 2, 2014 7:50:36 GMT 7

|

|

|

|

Post by oldman on Apr 2, 2014 9:32:44 GMT 7

|

|

|

|

Post by oldman on Apr 2, 2014 9:47:18 GMT 7

Worth seeing and hearing from Minister Shanmugam .... from the 18 min onwards....

|

|

|

|

Post by me200 on Apr 3, 2014 8:50:34 GMT 7

"Guru" view on 2014 property outlook. Seems like these "guru" is still very bullish despite strong head wind.

|

|

|

|

Post by zuolun on Apr 3, 2014 18:30:40 GMT 7

|

|

|

|

Post by zuolun on Apr 7, 2014 14:21:01 GMT 7

Property bluesBy Joan Ng 4 Apr 2014 On April 1 the Urban Redevelopment Authority released its flash estimate of the price index for private residential property in 1Q2014. The index is estimated to have fallen 2.7 points q-o-q, from 214.3 points in 4Q2013 to 211.6 points in 1Q2014. This represents a 1.3% decline, accelerating from the 0.9% decline reported in 4Q2013. Real estate-related stocks, on the other hand, have been surprisingly buoyant. The FTSE ST Real Estate Index ended the month of March up 1%, according to FTSE’s monthly report. This was below the 2.5% gain in the Straits Times Index (STI) and the 1.3% gain in the FTSE ST All-Share Index. Nevertheless, it suggested that investors still see value in select property counters. The top five gainers within the FTSE ST Real Estate Index in March were Fragrance Group, up 15.9%; Centurion Corp, up 14.5%; China New Town Development Co, up 8.3%; Ascendas India Trust, up 7.7%; and City Developments (CDL), up 7.6%. At the other end of the spectrum, the weakest five were Global Logistic Properties (GLP), down 6.4%; Ying Li International Real Estate, down 4.8%; OUE Hospitality Trust and Yanlord Land Group, both down 4.5%; and Keppel REIT, down 3%. The 10 largest constituents of the FTSE ST Real Estate Index are Hongkong Land Holdings, GLP, CapitaLand, CDL, CapitaMall Trust, Ascendas REIT, Suntec REIT, CapitaCommercial Trust, UOL Group and CapitaMalls Asia (CMA). Somewhat more surprisingly, the FTSE ST Real Estate Index managed to outperform the STI this week, ending April 4 at 717.5 points, up 1.7%. The STI, in comparison, ended the week at 3,212.7 points, up 1.3%. Should investors prepare for a sell-off? Which counters can they count on? In its latest note to clients, Deutsche Bank says it is expecting a decline in residential property prices of 5% to 10% this year. “Our preference remains for the integrated developers with limited domestic exposure such as CapitaLand and Keppel Land,” the bank says. “Our top sector pick is CapitaLand.” CIMB Research has a similar recommendation. It is expecting a steeper fall in property prices of 10% to 15% this year and next. “This is fuelled by the decline in investment and foreign demand, higher price sensitivity within the upgraders segment and significant supply in the pipeline,” it says. “Our recent ground checks suggest that it is still a buyers’ market, particularly in the secondary market. Prices are just beginning to come off. We believe the catalyst to drive down physical prices will be supply, with 17,540 and 21,299 units expected to complete in 2014 and 2015, respectively – more than two times the 20-year historical average supply of 8,034 units p.a..” At the same time, CIMB thinks there is no need to be particularly bearish. “The mitigating factors are a healthy household balance sheet and lower speculative demand through the current cycle, which may prevent forced selling during the downturn,” it says. “We take comfort in the fact that buyers are generally not over-leveraging to buy residential properties, at a five to six times home price-to-income ratio and 23% to 29% mortgage-to-income ratio. Moreover, developers have diversified into investment properties and overseas, with the Singapore residential segment making up less than 30% of gross asset value for most developers. The brokerage currently favours developers with lower residential exposure. Its top picks are GLP, CMA, UOL and Frasers Centrepoint. UOB Kay Hian, on the other hand, is sounding a much more positive note. While it does expect a 5% to 10% correction in property prices this year, it is calling this a “healthy correction.” The brokerage also has an “overweight” call on property-related equities. “We believe the market has over-discounted the negative prospects, pricing in a 40% to 50% fall in property prices,” UOB says in an April 2 report. It has a preference for deep value and diversified developers and lists Keppel Land, Ho Bee Land and Wing Tai Holdings as its preferred picks.

|

|

|

|

Post by zuolun on Apr 7, 2014 19:56:38 GMT 7

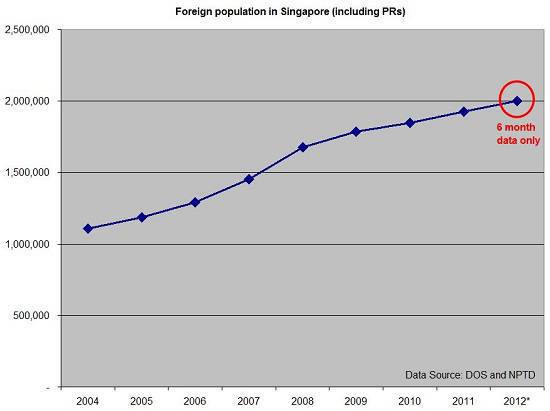

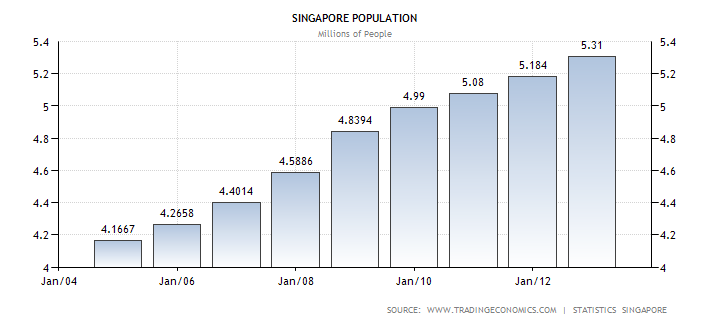

Gist of the 8 rounds of cooling measures — 7 Apr 2014 Look ahead to 10 million people by 2100? — 28 Apr 2013 Singapore can, if it wants, accommodate eight million people — 8 Oct 2012 Housing is all about demand and supply:- There is a two segment market in Singapore, both heavily driven by government policy.

- Land supply is tightly controlled by the Singapore Land Authority. HDB supply of apartments is tightly controlled as well (future supply).

- The Singapore population growth rate (future demand) is also determined by government policy.

The Laws of demand and supply: When the Singapore population growth rate (future demand) far exceeds the rate of supply of homes (future supply), prices of homes in all categories will continue to rise accordingly; the reverse will only happen when demand falls below supply. Hard Truths- If Singapore's population increases to 7m people (5.3m + 1.7m) in 17 years (2030 - 2013).

- Then 1.7m divided by 17 years = additional 100,000 people per year.

- The total Singapore Population was last recorded at 5,312.4 million people as at 28 Sep 2012.

|

|