|

|

Post by zuolun on Jan 3, 2014 17:44:17 GMT 7

|

|

|

|

Post by oldman on Jan 3, 2014 18:22:16 GMT 7

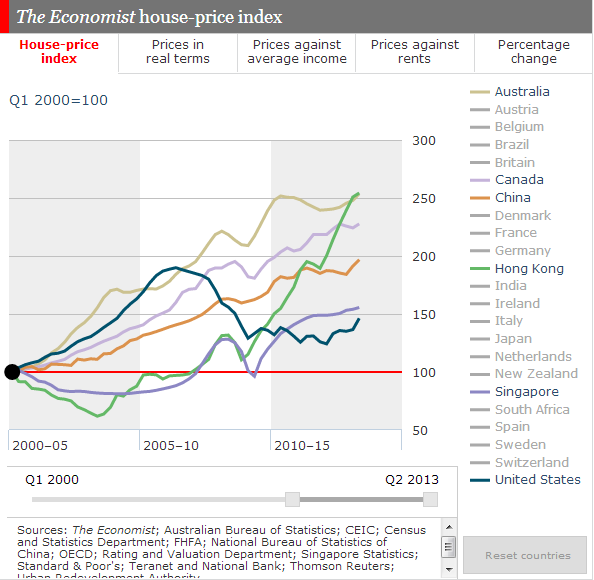

Zuolun, used your link and added in Singapore and HK. Horizontal axis has to change as they don't have earlier China data.... Japanese properties look interesting.  |

|

|

|

Post by zuolun on Jan 3, 2014 18:31:36 GMT 7

oldman, WOW...your chart shows a much better/clearer picture of the current global housing market trend.  Thanks!  Zuolun, used your link and added in Singapore and HK. Horizontal axis has to change as they don't have earlier China data.... Japanese properties look interesting.  |

|

|

|

Post by oldman on Jan 4, 2014 6:18:00 GMT 7

The charts do suggest that the Singapore property market is not as toppish as we think it is..... compared to the other regional property markets like Australia, China, Britain and Hong Kong.

|

|

|

|

Post by zuolun on Jan 4, 2014 7:10:54 GMT 7

The charts do suggest that the Singapore property market is not as toppish as we think it is..... compared to the other regional property markets like Australia, China, Britain and Hong Kong. oldman, S'pore and HK property markets were seriously affected by SARS in 2003 plus the -ve aftershock impact from 2004 to 2007. The Economist house-price index chart showed the slow recovery of both markets started in 2008 (from -ve to +ve), pulled back in 2009 and continued the uptrend thereafter. If investors were to measure in US$ (S$ appreciated while HK$ depreciated), both the S'pore and HK property markets would have moved in tandem with the global property markets.  |

|

|

|

Post by zuolun on Jan 4, 2014 7:30:58 GMT 7

|

|

|

|

Post by zuolun on Jan 4, 2014 9:27:10 GMT 7

|

|

|

|

Post by zuolun on Jan 4, 2014 12:14:37 GMT 7

oldman, S'pore and HK property markets were seriously affected by SARS in 2003 plus the -ve aftershock impact from 2004 to 2007. The Economist house-price index chart showed the slow recovery of both markets started in 2008 (from -ve to +ve), pulled back in 2009 and continued the uptrend thereafter. If investors were to measure in US$ (S$ appreciated while HK$ depreciated), both the S'pore and HK property markets would have moved in tandem with the global property markets. oldman, There is a reason why I always emphasize that longterm investing in S'pore equities and properties when measure in US dollar, the exchange rate plays a vital factor in total return. One of my close relatives had purchased a 3-room HDB flat in Queenstown direct from HDB at S$7,900 with full cash payment in the early 70's. His flat was initially registered solely under his name with his mother and only younger sister as a family nuclear (his father passed away since he was a kid). It was later transferred to his mother and younger sister's names after he got his Australian citizenship. He used to come back to S'pore for holidays with his wife and 2 kids and stayed in the flat at least once a year. This arrangement was fine for 4 decades even after his younger sister got married later as he put his mother's name as the sole owner of the flat and his younger sister as tenant only (under the single scheme, his mother was qualified to own and keep the flat). However, when his younger sister informed him urgently that his elderly mother at age 92 was very sick in the hospital and according to HDB rules, he had to sell the flat prior to her death, he made an unexpected fortune from the sales reluctantly when the sales proceeds was converted from S$ to A$. I remembered the exchange rate was A$1 = S$2.1 on my last visit to Australia, Sydney in 1982. As at 4 Jan 2014, the exchange rate for A$1 = S$1.1329.  oldman, I had a bad experience thirty-one (31) years ago when I went to Australia, Sydney for a one-month long holiday, in 1982. Before I had a chance to join the queue for immigration clearance for tourists at the Sydney International airport, I was told to join another queue specially designated for tourists from Southeast Asian countries. I was shocked that all Chinese tourists were segregated from the rest and were treated like prisoners in that special and extremely long queue. Those who queued right in front were greeted by 2 huge police dogs, each and every one had to stand at a designated spot to be smelt thoroughly from toe to armpit, left to right by the 2 dogs. After the "smell check" on the body, next check was on the luggage. When it was my turn to be checked, I passed the "smell check" but failed the luggage check. The custom officer ransacked my luggage and ordered me to go inside one room for interrogation. I never forget that I wasted a total of 3 hours at the Sydney International airport for immigration clearance after disembarkation.  |

|

|

|

Post by oldman on Jan 4, 2014 13:05:34 GMT 7

Thanks. Never knew that the Aussie dollar was so strong before. Yes, I agree and this is why most of my assets are in Singapore. As a nation without much manufacturing, it makes sense for Singapore to maintain a strong currency. I am sure the well heeled foreigners also like the Singapore dollar for the same reason even though a strong dollar may reduce the lure of tourism. However, I think the rich around the world will not mind travelling and living here because this must be one of the safest countries in the world.

However, at the back of my mind, I know that all good things have to come to an end one day. Million dollar question is whether the Singapore dollar will remain strong and attractive. I think it will. But one still has to look around given the small size of Singapore and the tensions around our neighbourhood.

|

|

|

|

Post by zuolun on Jan 9, 2014 15:25:26 GMT 7

|

|

|

|

Post by zuolun on Jan 9, 2014 17:28:58 GMT 7

|

|

|

|

Post by zuolun on Jan 14, 2014 9:09:58 GMT 7

oldman, There is a reason why I always emphasize that longterm investing in S'pore equities and properties when measure in US dollar, the exchange rate plays a vital factor in total return. One of my close relatives had purchased a 3-room HDB flat in Queenstown direct from HDB at S$7,900 with full cash payment in the early 70's. His flat was initially registered solely under his name with his mother and only younger sister as a family nuclear (his father passed away since he was a kid). It was later transferred to his mother and younger sister's names after he got his Australian citizenship. He used to come back to S'pore for holidays with his wife and 2 kids and stayed in the flat at least once a year. This arrangement was fine for 4 decades even after his younger sister got married later as he put his mother's name as the sole owner of the flat and his younger sister as tenant only (under the single scheme, his mother was qualified to own and keep the flat). However, when his younger sister informed him urgently that his elderly mother at age 92 was very sick in the hospital and according to HDB rules, he had to sell the flat prior to her death, he made an unexpected fortune from the sales reluctantly when the sales proceeds was converted from S$ to A$. I remembered the exchange rate was A$1 = S$2.1 on my last visit to Australia, Sydney in 1982. As at 4 Jan 2014, the exchange rate for A$1 = S$1.1329. Thanks. Never knew that the Aussie dollar was so strong before. Yes, I agree and this is why most of my assets are in Singapore. As a nation without much manufacturing, it makes sense for Singapore to maintain a strong currency. I am sure the well heeled foreigners also like the Singapore dollar for the same reason even though a strong dollar may reduce the lure of tourism. However, I think the rich around the world will not mind travelling and living here because this must be one of the safest countries in the world. However, at the back of my mind, I know that all good things have to come to an end one day. Million dollar question is whether the Singapore dollar will remain strong and attractive. I think it will. But one still has to look around given the small size of Singapore and the tensions around our neighbourhood. oldman, A lengthy article written by Jesse Colombo, an economic analyst explained why all good things have to come to an end one day. |

|

|

|

Post by zuolun on Jan 15, 2014 19:59:40 GMT 7

|

|

|

|

Post by zuolun on Jan 16, 2014 15:15:33 GMT 7

|

|

|

|

Post by zuolun on Jan 19, 2014 10:28:31 GMT 7

|

|