|

|

OLAM

Mar 19, 2014 16:29:37 GMT 7

oldman likes this

Post by zuolun on Mar 19, 2014 16:29:37 GMT 7

Agreed. What I was trying to point out is that smart money will take care of themselves. Smart money is not there to take care of you. If in the process, you happen to benefit from smart money coming in, pat yourself in the shoulder.  oldman, Temasek has been making high stakes bet on commodities past few years, it bought Chesapeake at the peak (bad market timing), OLAM may not be the last purchase. One year after Temasek bought Olam in 2009 to shift focus to commodities; — June 1, 2009 The Singapore investment company, Temasek bought Chesapeake in 2010 — May 12, 2010 Chesapeake’s future is Bright — May 24, 2010 Chesapeake’s Outlook Dims Amid Board Reversal on CEO Loans — Apr 27, 2012 UBS's review on Olam — Nov 16, 2012 Citi Has A Monumental Call Declaring The End Of The Commodities Boom — Nov 19, 2012 Short Seller's Bet Sends Olam Shares Plunging — Nov 20, 2012 Why Buffett Disciple's Mohnish Pabrai is buying big into Chesapeake? — Nov 24, 2012 An End to the Commodity Boom — Dec 27, 2012 Temasek Boosts Olam Stake to 19%, Says Attractive Long Term — Dec 28, 2012 Downtrend prevails in food grains market — Dec 31, 2012 World Food Prices Fell Third Month in December on Grain Plunge — Jan 10, 2013 Olam trades above pre-Muddy Waters level — Mar 20, 2013 Wheat prices rebound, helped by EU, US crop fears — April 04, 2013 |

|

|

|

OLAM

Mar 19, 2014 16:42:26 GMT 7

Post by oldman on Mar 19, 2014 16:42:26 GMT 7

Zuolun, I use the term smart money to refer to the fund managers and not the fund itself. The fund itself is OPM (other people's money).  |

|

|

|

OLAM

Mar 19, 2014 16:49:56 GMT 7

oldman likes this

Post by zuolun on Mar 19, 2014 16:49:56 GMT 7

Zuolun, I use the term smart money to refer to the fund managers and not the fund itself. The fund itself is OPM (other people's money).  oldman, I'm aware that's why I say we're in different channel, earlier.  If there was insider trading in GIC... it's not difficult to figure out there may be something else in Temasek's OLAM offer. Someone in fb posted that the only reason why Nomura has objection over OLAM's offer price is likely due to the fund managers' overall holding cost per share on OLAM being much higher...  Nomura advises Olam shareholders to reject Temasek unit's offer Nomura advises Olam shareholders to reject Temasek unit's offer — 19 Mar 2014 oldman, Most of the time you could read what I actually mean in many of my postings except this time on OLAM but it doesn't matter... |

|

|

|

Post by me200 on Mar 20, 2014 20:03:46 GMT 7

Temasek to takes Olam to private? Why, because it got something to hide?

|

|

|

|

Post by me200 on Mar 25, 2014 9:36:53 GMT 7

Olam, Temasek and a huge pile of debt andyxianwong.wordpress.com/2014/03/23/olam-temasek-a-huge-pile-of-debt/

Temasek’s offer to buy out Olam in a S$2.53 billion deal comes as the commodity trader continues to pile on debt. While Olam’s politically well-connected management and shareholders may appreciate the sovereign wealth fund’s backing, this is a deal which ticks all the wrong boxes for Singapore.

Olam’s management have been fending off critics of their financials and accounting for years. While Carson Block’s very public decision to short the stock in 2012 was widely reported, less well-known is the fact that top Asian equity house CLSA incurred the commodity trader’s wrath the year before over a research note that raised some of the same concerns. And while the public response from Olam has always been defiant, privately management have admitted defeat – tearing up a flagship six-year plan to generate US$1 billion in profits by 2016 and slashing the debt fuelled growth that Block saw as unsustainable.

Expensive failure

It is quite spectacular how badly Olam has failed to deliver on its financial goals. It was in 2010 that Olam launched their strategic plan – on the face of it a relatively simple one – to borrow money, grow the business, grow profits and then pay back the money. Yet while the money was borrowed, the profits never materialised. The plan set out a specific goal to reach US$1 billion in annual profits by 2016, but Olam has come nowhere near achieving that number. Olam’s investor presentations translated the goal to a $1.25 billion Singapore dollar equivalent – yet after reaching a high of S$373 million in FY2011, profits fell to S$356 million and S$349 million in the following years. So while profits are now about a quarter of what the plan projected, debt levels have increased dramatically – 35% in just the last two years, reaching a total of S$8.85 billion in 2013. An obvious question now looms for Olam – if the revenues needed to generate a billion dollars of profit never materialise, and it seems obvious that they will not, how is the debt going to be repaid?

This is where Temasek entered the picture last week, with that S$2.53 billion dollar offer to take full ownership of the company.

Good for Olam, bad for Singapore

Despite Temasek’s bullish support, all those years of borrowing have left Olam’s financials in bad shape. Reuter’s last week described the commodity trader’s balance sheet as “weak“. Michael Dee, a former senior manager at Temasek said the deal “makes no sense” – citing Olam’s negative cash flow and likely further increases in debt. So while it may be a positive for Olam’s embattled management, the deal is a negative for Temasek, and by extension Singapore. Moody’s – a rating agency – explicitly called the deal a “credit negative” for Temasek, due to the impact on portfolio liquidity and dividend yield. And since Temasek’s investment returns are widely believed to be used to pay off the CPF board’s government bonds, a negative for Temasek’s credit rating also means a negative for CPF holding Singaporeans, making the deal all the more troubling.

Now, Olam is small compared to Temasek’s total assests, so there should be no fear that this deal itself will have a material impact on the government’s ability to pay back the CPF board, but there is a question here around how and why Temasek is allowed to absorb the huge debts of a company in which it originally only took a 13.8% stake. We know that the Singapore government cites financial prudence in refusing to borrow money for spending, but borrowing billions to fund spending is exactly what Olam has been doing for years. Does allowing Temasek to take on this debt make sense? How many Olams could Temasek buy, how many billions of dollars of debt could Temasek take on, before the government would struggle to repay the CPF board? With the government’s opaque approach to financial reporting, is it even possible to know?

Well connected

So why not just cut Olam loose? Temasek bought only 13.8% of Olam in 2009 for S$438 million – money down the drain perhaps – but you can’t win on all your deals, Ho Ching certainly knows that. Why throw further billions at a company and a management team that has so obviously failed to deliver? The problem might be that Olam’s management team are politically too well-connected to crash and burn without the government of Singapore being left with some awkward explaining to do.

You see, if Olam fails due to management’s inability to deliver on strategic plans, the Ministry of Trade and Industry’s decision to appoint Olam CEO Sunny G. Verghese as head of IE Singapore for over five years (he just stepped down on 31 December 2013) may look unwise. That is the same IE Singapore that embarrassingly had to restate NODX for September and October last year due to an error in counting exports – an error that seems particularly hard to explain given the oversight of a man who has made his career in imports and exports. And what of Michael Lim – Olam’s lead independent director since 2010 and Chairman of the Singapore Accountancy Commission? Carson Block slammed Olam for supposed accounting irregularities, and with Lim responsible for audit, compliance and governance at the boardroom level in Olam – whether or not any irregularities actually existed – an Olam failure in the midst of such accusations could be awkward for DPM Tharman who presumably appointed Lim to lead the newly instituted SAC.

I’ve written before on the “closed circle” of power in Singapore. Without independent oversight and a transparent framework to guide Temasek’s investments, it is hard to tell whether the purchase of Olam is a purely economic investment decision or a politically motivated face-saving exercise. If Temasek followed the vastly superior Norwegian sovereign fund model such questions could never occur since a full takeover of a failing company would not be possible. But without such transparency, we are just left wondering as to the true reasoning.

Finally, it has been widely commented that news of the buy-out was leaked, and there is a strong suspicion that people close to or on the deal team appear to have traded very profitably on material non-public information, bidding the price of Olam shares up to surprising levels in recent weeks while the SGX looked on. Such a state of affairs just reinforces the perception that institutional governance is weak, and that Singapore lacks proper independent bodies to hold the powerful to account. Without good governance, secret agreements and the right connections rather than pure economics and meritocracy become the easiest way for a well-connected minority to make money in Singapore, often at the expense of everyone else, who suffer a “credit negative” instead. Is this the crony capitalism of Singapore Inc in microcosm?

|

|

|

|

Post by zuolun on Oct 23, 2014 17:45:58 GMT 7

|

|

|

|

OLAM

Feb 17, 2015 14:28:27 GMT 7

Post by zuolun on Feb 17, 2015 14:28:27 GMT 7

|

|

|

|

OLAM

Aug 26, 2015 12:54:20 GMT 7

oldman likes this

Post by zuolun on Aug 26, 2015 12:54:20 GMT 7

|

|

|

|

OLAM

Mar 10, 2016 12:17:07 GMT 7

Post by zuolun on Mar 10, 2016 12:17:07 GMT 7

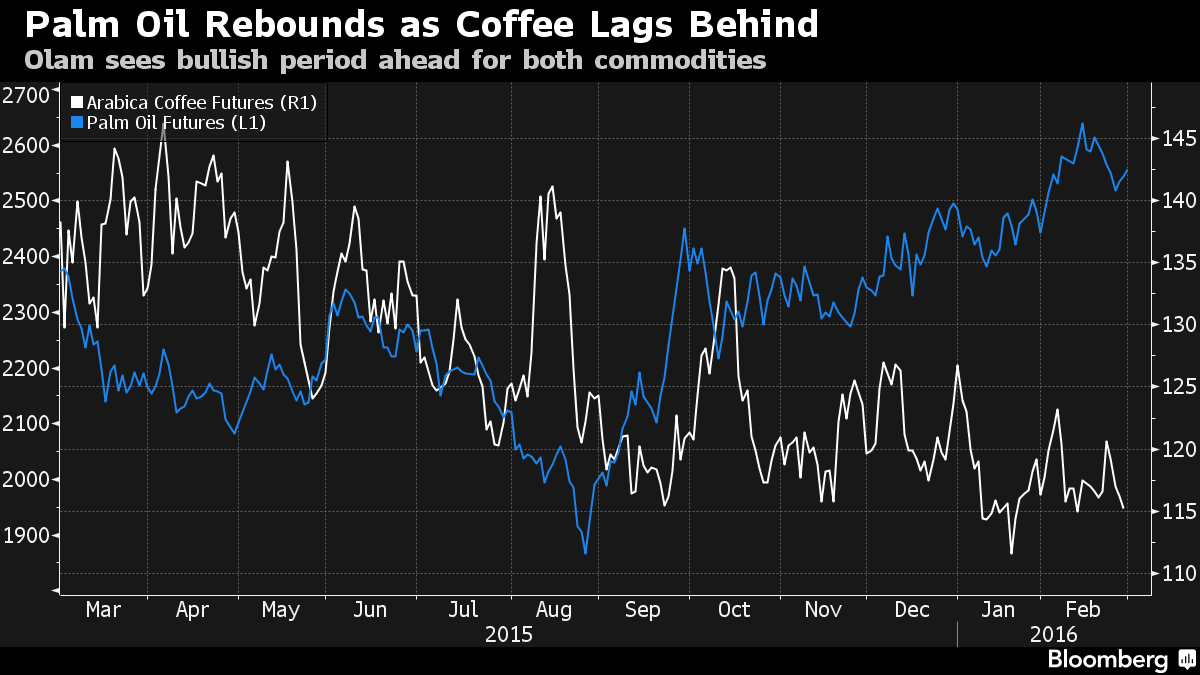

Olam said to start edible-oils desk with hires from Glencore ~ 3 Mar 2016 Palm oil and coffee prices set to rise ~ 1 Mar 2016 Olam's no Amazon ~ 29 Feb 2016 Olam posts losses but food business still robust: CEO ~ 29 Feb 2016 Here’s how the dreaded drought will affect agribusiness players in Singapore this year ~ 29 Feb 2016 Olam flags gains for palm oil, coffee as El Nino trims reserves ~ 29 Feb 2016  Why Mitsubishi is buying 20% of grain trader Olam (video) Why Mitsubishi is buying 20% of grain trader Olam (video) ~ Mitsubishi, betting on growing demand for food in Asia, agreed to buy a 20% stake in Olam International, the commodity trader controlled by Singapore’s state investment company, in two deals worth S$1.53 billion ($1.09 billion). ~ 28 Aug 2015 Palm oil recovery could ease sting of red inkBy Tomomi Kikuchi 29 Feb 2016 Singapore-based commodity producer and supplier Olam International posted a net loss of 64.3 million Singapore dollars ($45.7 million) for the year ending in December 2015, down from a net profit of S$591 million for the same period a year earlier. The purchase of Archer Daniel Midland's cocoa business and stock valuation losses weighed on the bottom line. Olam's revenue for 2015 fell 3.6% to S$19.05 billion. The company attributed the slide to the closure of lower-margin businesses. Operating profit after taxes and minority interests increased 20.1% to S$346.2 million, though the fourth quarter figure declined 16.2% on the year. The company posted a net loss of S$397 million on "exceptional" factors, including a S$192.6 million write-down the company's holdings in Malaysian sweetener producer PureCircle. The commodities sector has been grappling with falling prices of palm oil and other products. For the current year, Olam expects palm oil prices to move higher due to lower crop yields in Indonesia and Malaysia. Affecting output is the El Nino weather phenomenon, which is "a little bit more severe than what we had anticipated," said Sunny Verghese, co-founder and CEO of Olam. Combined with additional demand stemming from the Indonesian government's mandate to use palm oil as a biofuel, "We feel the palm oil price will likely trend higher," Verghese said. Verghese said El Nino will dampen production of rice and cocoa, as well. In contrast, it will likely boost Olam's almond production in California by bringing more rainfall to the region, the CEO said. In 2015, Olam's almond business performed well, with the operations in Australia benefiting from the depreciation of Australian dollar. The cocoa business delivered a stronger performance thanks to the added processing capacity from the ADM acquisition. Meanwhile, the food staples and packaged food business struggled as the contribution from sugar and palm trading decreased. The cost of restructuring the company's struggling dairy business in Uruguay last year resulted in a net exceptional loss of S$76.9 million. The company closed a number of dairy farms in Uruguay and cut its herd size in Uruguay by around 36%. Dairy products are in oversupply and milk prices have slumped in the wake of a European Union ban on imports of Russian dairy products. Lower demand from China stemming from its economic slowdown is also hurting the segment. Olam expects the Uruguay dairy business to turn profitable from 2017. Verghese said the current downtrend in the commodities sector "offers a lot of opportunities" for acquisitions. With the financial back-up of stakeholders, Singaporean state investor Temasek Holdings and Japanese trading house Mitsubishi Corp., Olam will focus on making fewer but bigger acquisitions. Or as the CEO put it, the company will target deals "that will really move the needle for us." Olam's shares closed at S$1.59 Monday, down 0.93% from Friday's close. The Straits Times index gained 0.65%. DBS Group Research maintained its "hold" call for Olam shares in a report issued on Monday, but lowered the target price from S$2.01 to S$1.58. Analyst Mervin Song said in the report that the investors will likely "remain on the sidelines" until Olam "successfully integrates its recent $1.2 billion acquisition of ADM cocoa." Song remains optimistic on the company for the medium term, as there are unrealized synergies from ADM acquisition and its new partner and major shareholder Mitsubishi Corp.

|

|