|

|

Post by zuolun on Nov 8, 2013 6:01:33 GMT 7

Straits Times Index (STI)Wild price movement on the top 6 STI stocks could swing the SiMSCI and vice versa.

1. 12.21% for Singtel 2. 11.62% for DBS3. 10.84% for OCBC4. 10.73% for UOB5. 6.35% for KepCorp6. 3.73% for GLP

|

|

|

|

Post by zuolun on Nov 9, 2013 16:31:49 GMT 7

STI — Symmetrical Triangle; immediate support 3134

|

|

|

|

Post by zuolun on Nov 14, 2013 8:54:51 GMT 7

|

|

|

|

Post by zuolun on Nov 14, 2013 12:23:42 GMT 7

|

|

|

|

Post by zuolun on Nov 15, 2013 10:19:45 GMT 7

|

|

|

|

Post by zuolun on Nov 15, 2013 21:58:07 GMT 7

|

|

|

|

Post by zuolun on Nov 18, 2013 17:15:35 GMT 7

|

|

|

|

Post by zuolun on Nov 21, 2013 13:47:51 GMT 7

Chart is similar to a compass if one knows how to use it correctly

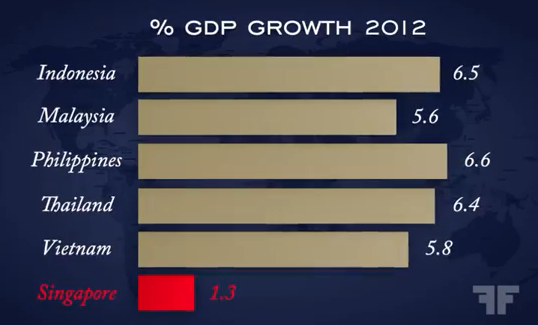

When the stock markets of other Asian markets plunged big time in end-May to end-Jun 2013, they reflected the mass capitulation by Foreign Funds. As the S$/US$ has appreciated by 15% since 2009 and S'pore had underperformed other ASEAN countries in term of % GDP growth 2012, Foreign Funds were mostly absent at end-Dec 2012. So the impact of capitulation by Foreign Funds on the STI was not great as compared to other Asian markets. Thus, the tight trading range bet. 3167 - 3328 points in the 1H2013 suggested that the STI has been supported mainly by local Fund managers since the beginning of 2013. These local Fund managers only support the 2 major pillars of the S'pore economy; the properties and bank stocks. But properties and bank stocks are sensitive to sharp interest rates spikes which will negatively affect their qtrly earnings — that's a fundamental and inverse change. So if you're the local Fund managers with portfolios heavy on S'pore properties and bank stocks, would you consider increasing or paring down the 2 main categories of stocks at current prices which had corrected at the most 10%? Southeast Asia Bears Brunt of Market Chaos — 20 Jun 2013 STI (2H2013) — Range bound trading bet. 3167 - 3250  STI (1H2013) — Range bound trading bet. 3167 - 3328 as at 21 Aug 2013 STI (1H2013) — Range bound trading bet. 3167 - 3328 as at 21 Aug 2013  |

|

|

|

Post by zuolun on Nov 22, 2013 11:46:15 GMT 7

|

|

|

|

Post by zuolun on Nov 23, 2013 11:46:07 GMT 7

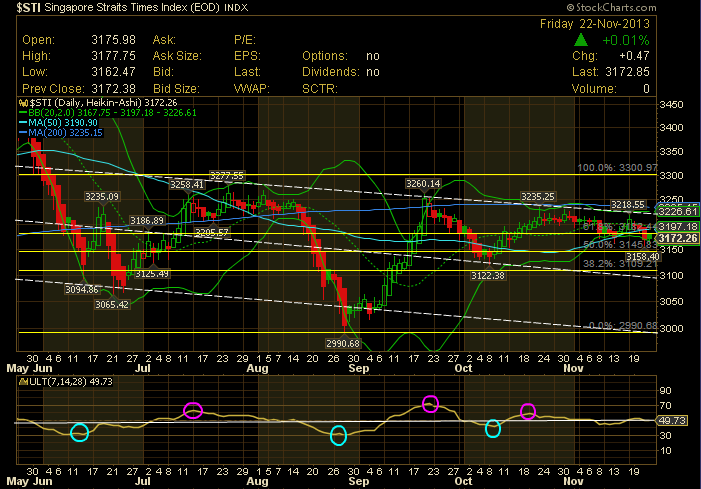

STI @ 3172.85 (+0.47, +0.01%) — 22 Nov 2013  |

|

|

|

Post by zuolun on Nov 28, 2013 9:11:22 GMT 7

Window DressingSTI @ 3197.21 (+25.15, +0.8%) with extremely low volume for Nov month-end window dressing on 28 Nov 2013 at 10am. [/b]

|

|

|

|

Post by zuolun on Nov 29, 2013 8:21:41 GMT 7

|

|

|

|

Post by elvinliang on Nov 30, 2013 1:38:38 GMT 7

|

|

|

|

Post by zuolun on Nov 30, 2013 9:06:50 GMT 7

Chart is similar to a compass if one knows how to use it correctly

When the stock markets of other Asian markets plunged big time in end-May to end-Jun 2013, they reflected the mass capitulation by Foreign Funds. As the S$/US$ has appreciated by 15% since 2009 and S'pore had underperformed other ASEAN countries in term of % GDP growth 2012, Foreign Funds were mostly absent at end-Dec 2012. So the impact of capitulation by Foreign Funds on the STI was not great as compared to other Asian markets. Thus, the tight trading range bet. 3167 - 3328 points in the 1H2013 suggested that the STI has been supported mainly by local Fund managers since the beginning of 2013. These local Fund managers only support the 2 major pillars of the S'pore economy; the properties and bank stocks. But properties and bank stocks are sensitive to sharp interest rates spikes which will negatively affect their qtrly earnings — that's a fundamental and inverse change. So if you're the local Fund managers with portfolios heavy on S'pore properties and bank stocks, would you consider increasing or paring down the 2 main categories of stocks at current prices which had corrected at the most 10%? The S$/US$ has appreciated by 19.55% (S$1.2469 currently Vs S$1.55, the peak in 2009); the STI would be at record high now if measured in US$. This suggests why the STI has been tightly range bound trading bet. 3167 - 3328 points since the beginning of 2013, despite changes to the composition.

5-year Chart: 1 Jan 2009 to 24 Nov 2013 STI — Range bound trading bet. 3167 - 3328 STI — Range bound trading bet. 3167 - 3328

|

|

|

|

Post by zuolun on Nov 30, 2013 18:22:52 GMT 7

|

|