|

|

Post by odie on Apr 13, 2014 16:54:17 GMT 7

US

Economic statistics remain mixed while the severe winter storms have continued to affect some indicators released during February including

the ISM Manufacturing index which declined to an 8 month low in January. Similarly, industrial production declined by 0.3% in January

and retail sales fell by 0.4%, a slow- down from the final months of 2013. In her first congressional testimony, the Fed’s Chairman Janet

Yellen mentioned the weather related impacts on economic activity.

More importantly, her testimony confirmed that the Fed will likely stick to its current policy and “reduce the pace of asset purchases in further

measured steps”. Unemployment continued its slow decline and fell to 6.6% in January coming very close to the Fed’s threshold of 6.5%

although it is expected that the Fed will revise its forward guidance broadening out the number of targets

The S&P 500 increased by 4.6% in total return terms over the month with the NASDAQ index beating this with a return of 5.0% reflecting outperformance in IT and biotechnology stocks. Food and drug retailers were the best performing sector of the S&P 500 followed by cyclical sectors such as Chemicals, Construction and Autos. US government bonds reported modest returns with the 10 year US Treasury producing a total return of 0.5%

|

|

|

|

Post by zuolun on Apr 14, 2014 12:20:22 GMT 7

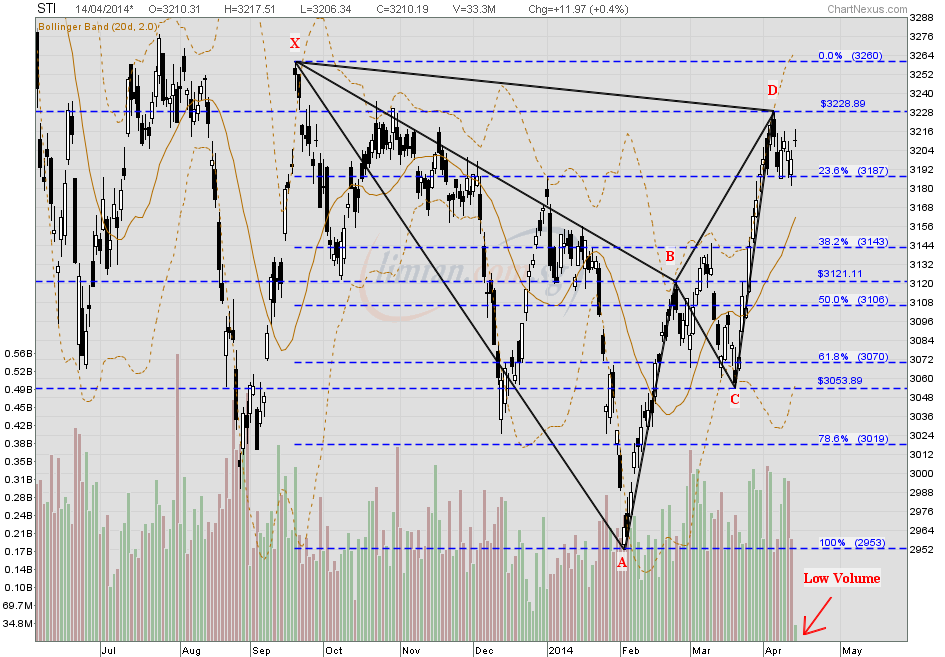

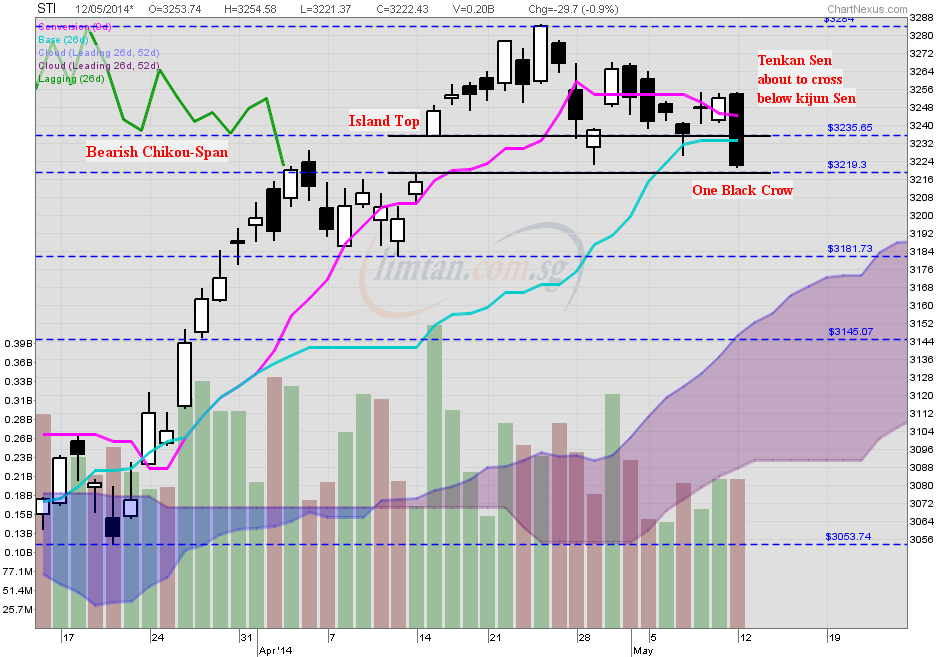

STI — Bearish Gartley patternSTI gapped up > 15 points with low volume within 15 mins. in the morning and had a doji @ 3210.9 (+11.97, +0.4%) on 14 Apr 2014 at 1.10pm.

|

|

|

|

Post by zuolun on Apr 15, 2014 23:48:29 GMT 7

odie,

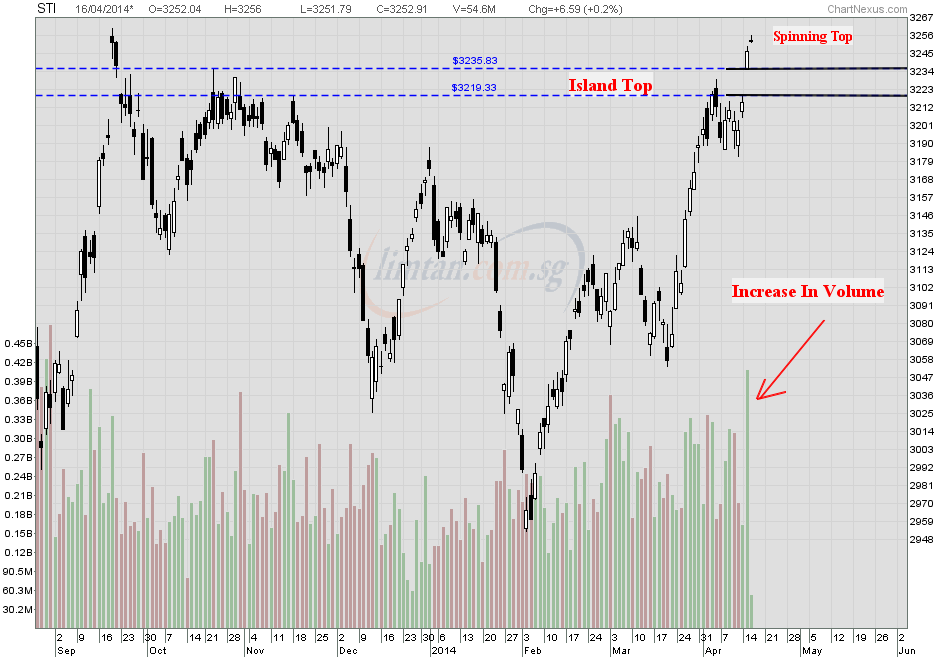

The STI has a bearish island top chart pattern today.

|

|

|

|

Post by zuolun on Apr 16, 2014 8:59:14 GMT 7

Money drives our stock market. If you have lots of money, you have the ability to encourage prices to move the direction you want. After all, the market is about supply and demand and if you have the money to suck up the available supply, the share price is more likely to rise. Strong hands are people with money. The STI closed with a bearish island top chart pattern @ 3,246.32 (+31.49, + 0.98%) with extremely high volume done at 415.2m shares on Tuesday, 15 April 2014. Total of 2.6 billion shares done valued at S$1.77 billion, gainers beat losers 250 to 205. The STI has a spinning top @ 3252.91 (+6.59, + 0.2%) with volume done at 54.8m shares on 16 Apr 2014 at 10.30am. Expect a formation of a bearish evening star pattern on the STI.    |

|

|

|

Post by zuolun on Apr 22, 2014 17:17:38 GMT 7

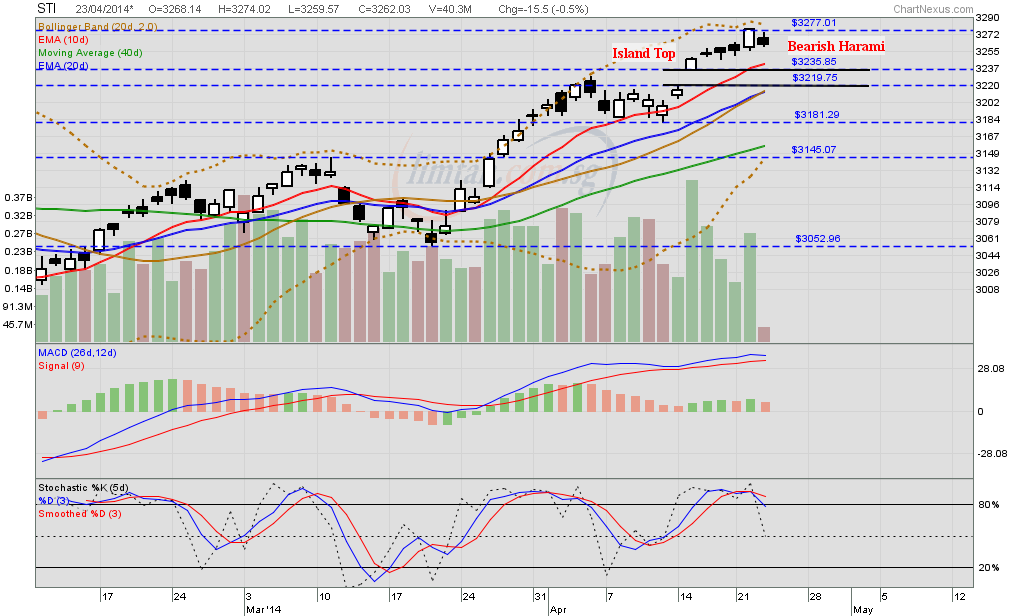

STI — The MFI shows a bearish divergence, expect a pullback

|

|

|

|

Post by zuolun on Apr 23, 2014 9:58:16 GMT 7

STI — The MFI shows a bearish divergence, expect a pullback The expected long-overdue pullback materialized, expect the gap bet. 3219 to 3235 to be covered by thin trading volume. STI — STI — Bearish Island Top reversalSTI had a bearish harami @ 3262.03 (-15.5, -0.5%) with thin volume done at 40.3m shares on 23 Apr 2014 at 10.50am. Immediate resistance @ 3277, immediate support @ 3235, strong support @ 3181.   |

|

|

|

Post by zuolun on Apr 25, 2014 9:11:48 GMT 7

|

|

|

|

Post by zuolun on Apr 28, 2014 7:50:00 GMT 7

odie, STI's dead butterfly didn't disappear; it's still there and it had flown higher!  I believe in the 'gap' theory and use it quite often to track the BB's footprint.  STI — Bearish Gartley Pattern STI — Bearish Gartley Pattern  |

|

|

|

Post by zuolun on Apr 29, 2014 12:48:14 GMT 7

|

|

|

|

Post by zuolun on May 7, 2014 12:43:43 GMT 7

|

|

|

|

Post by zuolun on May 12, 2014 18:35:06 GMT 7

STI — One Black Crow on 12 May 2014 STI — One Black Crow on 12 May 2014Expect the gap bet. 3219 to 3235 to be covered by thin trading volume.  |

|

|

|

Post by odie on May 12, 2014 19:26:59 GMT 7

thanks for update, bro zuolun  |

|

|

|

Post by zuolun on May 21, 2014 10:16:37 GMT 7

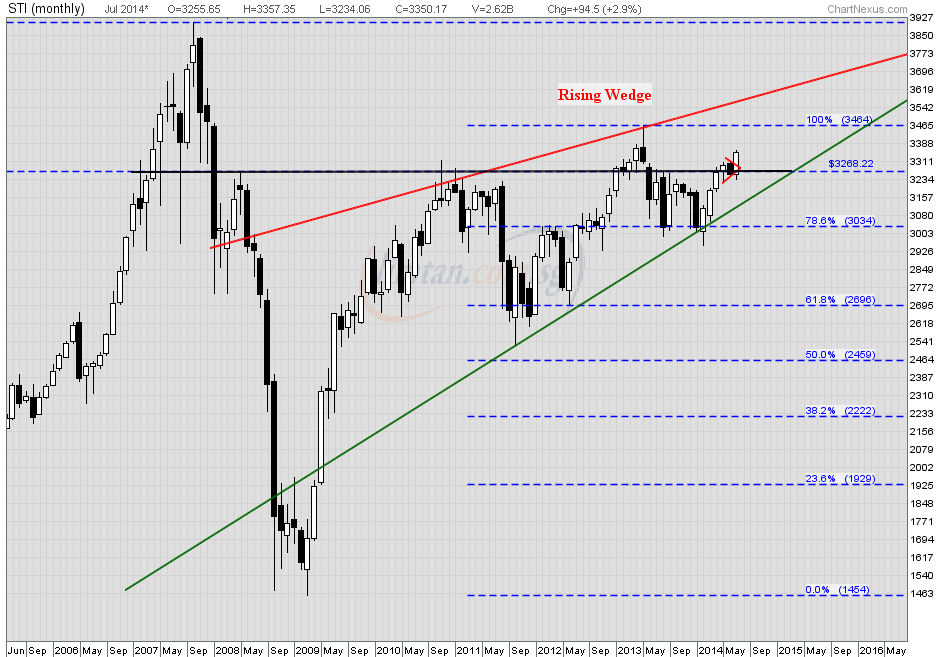

STI may have a chance to turn the tables should the resistance @ 3,278 is taken out and hit higher high @ 3,322. STI (weekly) — Symmetrical Triangle formation STI (Feb 2008 to Aug 2013) — The Elliott Wave pattern as at 28 Aug 2013 STI (Feb 2008 to Aug 2013) — The Elliott Wave pattern as at 28 Aug 2013 |

|

|

|

Post by odie on May 22, 2014 6:23:17 GMT 7

Zuolun bro,

One last push before the World Cup lull

LOL

|

|

|

|

Post by zuolun on Aug 4, 2014 4:17:34 GMT 7

STI — H&S Formation, potential downside TP 3056

|

|