|

|

Post by zuolun on Aug 5, 2015 14:41:47 GMT 7

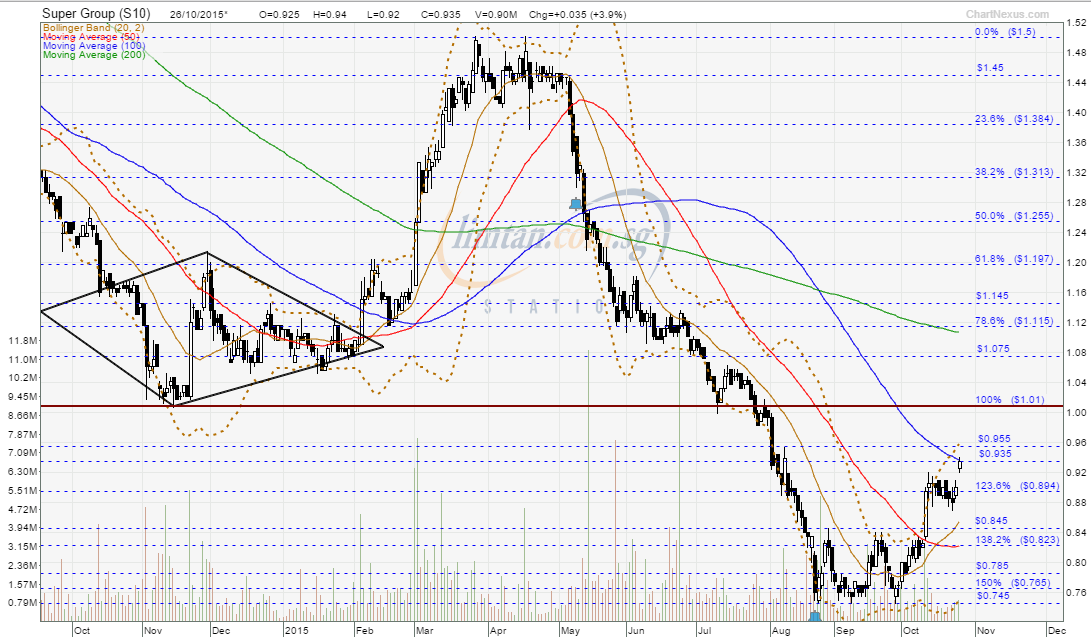

Note:When companies could not boost their share price thru healthy sustainable earnings/economic growth and innovations...instead boost their share price thru share buybacks, bonus issues, rights issue, stock consolidations/splits, warrants issue, etc...these are creative deals which do not have fundamental value or basis = strong signal that the share price may be due for a steep decline. MTQ and SuperGroup have similar characteristics; a break below the one dollar mark will be a penny stock in the making... ~ 21 July 2015 SuperGroup ~ Classic Mushroom-Of-Death chart pattern, interim TP S$0.80, next TP S$0.68SuperGroup had a black marubozu and traded @ S$0.93 (-0.015, -1.6%) with thin volume done at 760,000 shares on 5 Aug 2015 at 1530 hrs. Immediate support @ S$0.89, immediate resistance @ S$0.955.  |

|

|

|

Post by zuolun on Sept 30, 2015 8:35:42 GMT 7

|

|

|

|

Post by zuolun on Oct 2, 2015 11:43:48 GMT 7

|

|

|

|

Post by zuolun on Oct 26, 2015 14:40:48 GMT 7

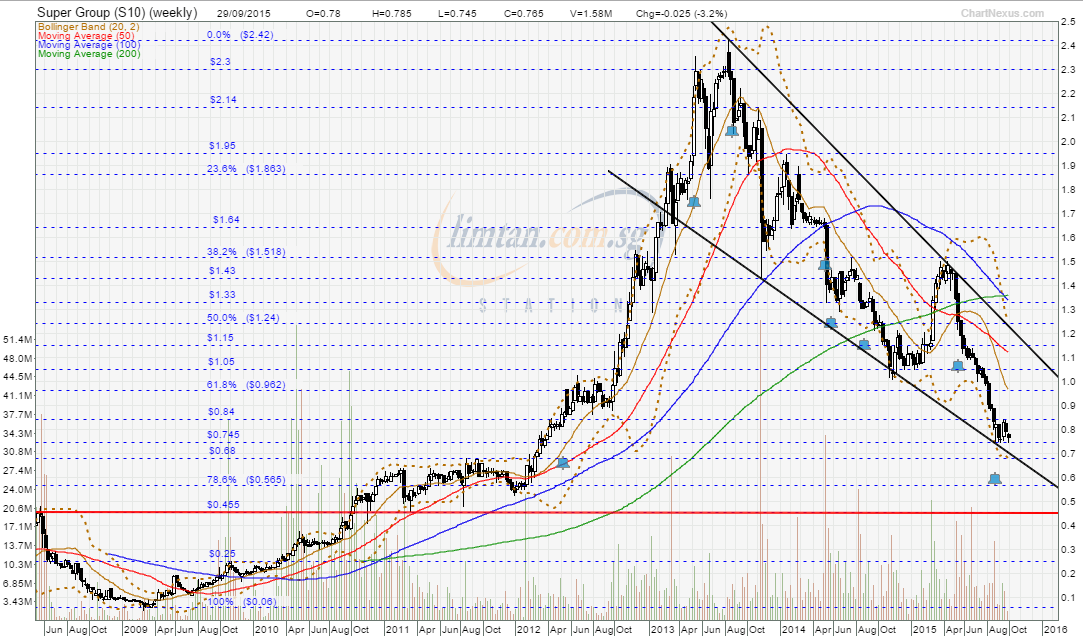

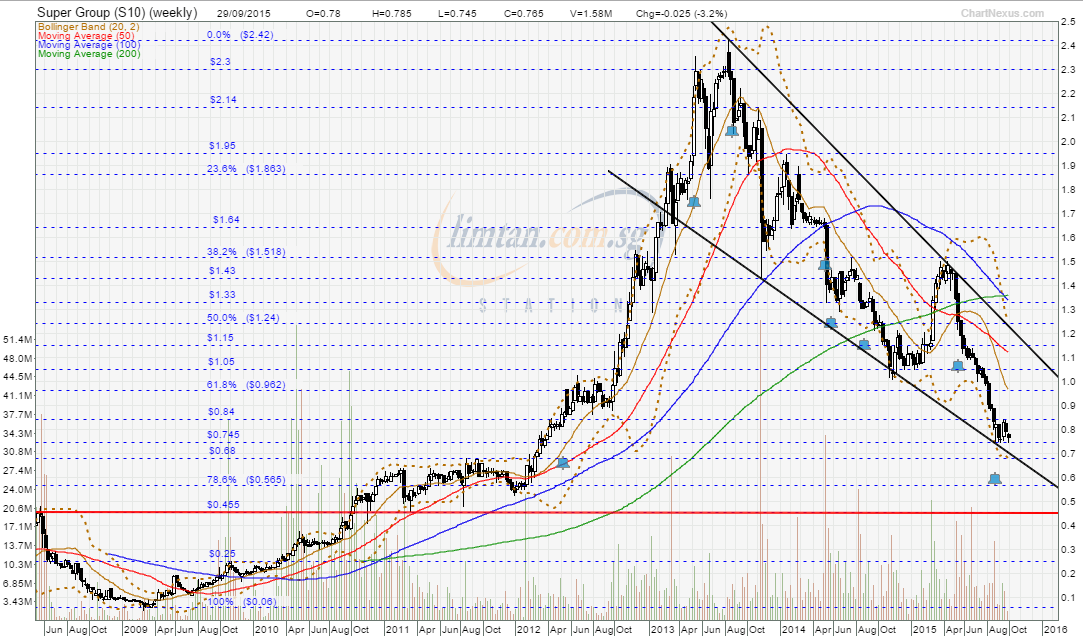

John Murphy's 10 laws of technical tradingSpot the trend and go with it ~ Determine the trend and follow it. Market trends come in many sizes – long-term, intermediate-term and short-term. First, determine which one you're going to trade and use the appropriate chart. Make sure you trade in the direction of that trend. Buy dips if the trend is up. Sell rallies if the trend is down. If you're trading the intermediate trend, use daily and weekly charts. If you're day trading, use daily and intra-day charts. But in each case, let the longer range chart determine the trend, and then use the shorter term chart for timing. Stocks that exhibit certain chart patterns (Cup and Handle, Double Bottom and Flat Base) can lead to strong price appreciation when they breakout on strong volume.  SuperGroup to announce Q3 earnings results on 12 Nov 2015 after trading hours SuperGroup to announce Q3 earnings results on 12 Nov 2015 after trading hours ~ 22 Oct 2015 Daiwa Capital: Unattractive given its modest earnings-growth profile ~ 9 Oct 2015 Company share buyback: 100,000 shares @ S$0.75 per share ~ 29 Sep 2015 SSH, Matthews Int'l sold 122,200 shares @ S$0.77 per share ~ 28 Sep 2015 (Pared down from 67,029,100 to 66,906,900 shares or 6.0105% to 5.9996%). SSH, Matthew Int'l pared down its stake to 4.999% or 55,744,500m shares ~ 25 Sep 2015 HSBC Global: Will not re-rate SuperGroup anytime soon ~ 25 Sep 2015 SuperGroup: A mixed cuppa results ~ 12 Aug 2015 SuperGroup ~ Rounding Bottom potential short-term bullish trend reversal, TP S$1.075SuperGroup gapped up with a spinning top and traded @ S$0.935 (+0.035, +3.9%) with 900,000 shares done on 26 Oct 2015 at 1525 hrs. Immediate support @ S$0.895, immediate resistance @ S$0.955. "Gap-Trading" Strategies     SuperGroup (weekly dated 20 Sep 2015) ~ Falling wedge formation SuperGroup (weekly dated 20 Sep 2015) ~ Falling wedge formation SuperGroup (weekly dated 10 Sep 2015) ~ Completed the impulsive 5-wave up, riding on the corrective ABC-wave down SuperGroup (weekly dated 10 Sep 2015) ~ Completed the impulsive 5-wave up, riding on the corrective ABC-wave down

|

|

|

|

Post by zuolun on Jan 15, 2016 9:03:40 GMT 7

|

|

|

|

Post by zuolun on Feb 7, 2016 8:15:39 GMT 7

|

|

|

|

Post by zuolun on Feb 22, 2016 15:26:14 GMT 7

|

|

|

|

Post by zuolun on Mar 7, 2016 12:36:25 GMT 7

SuperGroup ~ Bullish Falling Wedge BreakoutSuperGroup had a long-legged doji and traded @ S$0.975 (-0.02, -2%) with 1.31m shares done on 7 Mar 2016 at 1325 hrs. Immediate support @ S$0.96, immediate resistance @ S$0.99.   SuperGroup (weekly dated 20 Sep 2015) ~ Falling wedge formation SuperGroup (weekly dated 20 Sep 2015) ~ Falling wedge formation

|

|