|

|

Post by zuolun on Oct 18, 2014 13:41:45 GMT 7

|

|

|

|

HSI

Jan 2, 2015 6:13:27 GMT 7

oldman likes this

Post by zuolun on Jan 2, 2015 6:13:27 GMT 7

|

|

|

|

HSI

Apr 8, 2015 16:18:37 GMT 7

oldman likes this

Post by zuolun on Apr 8, 2015 16:18:37 GMT 7

|

|

|

|

HSI

Apr 12, 2015 20:38:54 GMT 7

oldman likes this

Post by zuolun on Apr 12, 2015 20:38:54 GMT 7

|

|

|

|

HSI

Apr 12, 2015 20:51:32 GMT 7

sptl123 likes this

Post by om on Apr 12, 2015 20:51:32 GMT 7

|

|

|

|

HSI

Apr 14, 2015 22:49:44 GMT 7

Post by om on Apr 14, 2015 22:49:44 GMT 7

|

|

|

|

HSI

Apr 23, 2015 5:50:06 GMT 7

Post by zuolun on Apr 23, 2015 5:50:06 GMT 7

|

|

|

|

Post by zuolun on Jun 9, 2015 14:51:21 GMT 7

|

|

|

|

HSI

Jun 25, 2015 7:01:39 GMT 7

Post by zuolun on Jun 25, 2015 7:01:39 GMT 7

|

|

|

|

HSI

Sept 29, 2015 11:43:47 GMT 7

Post by zuolun on Sept 29, 2015 11:43:47 GMT 7

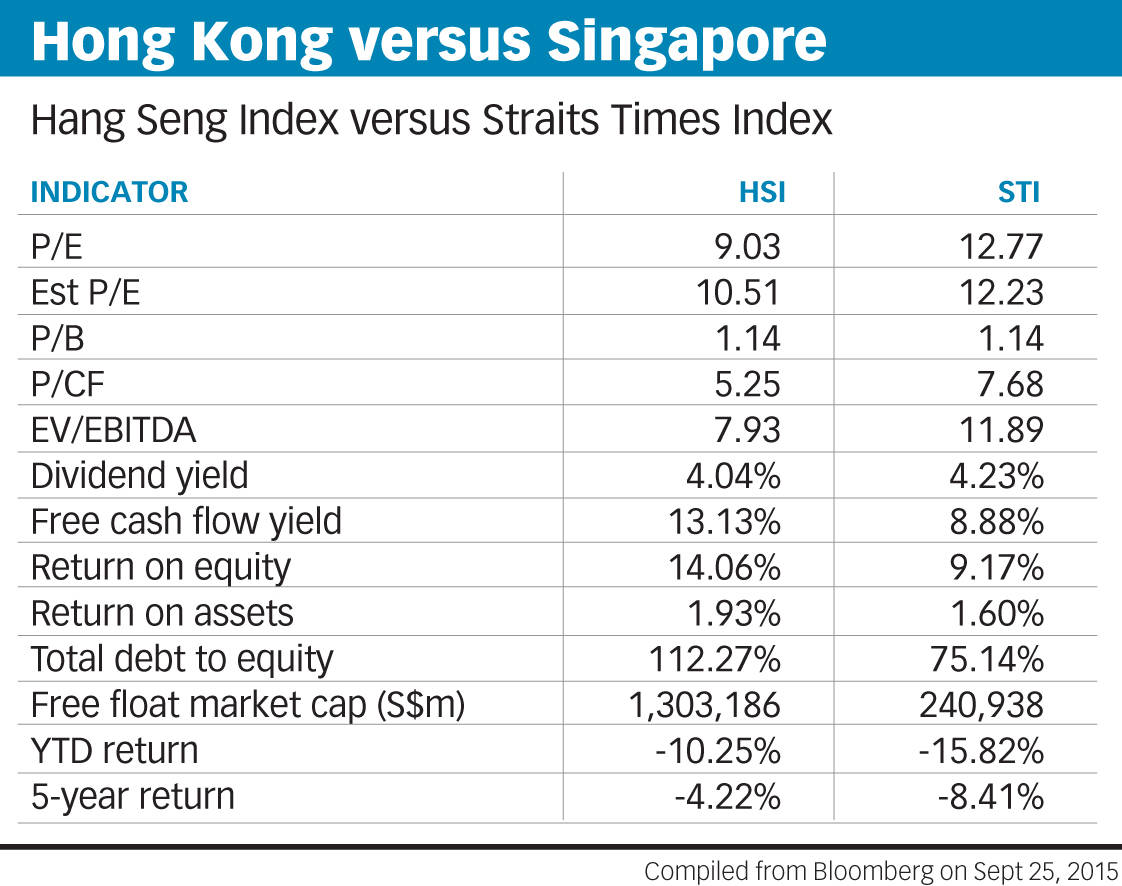

A tale of two cities29 Sep 2015 The two cities see each other as rivals. Singapore markets itself as the gateway to Asia, notably Southeast Asia, while Hong Kong has benefited from its status as the gateway to China. A comparison can be made of their two indices as well. The investable Hong Kong market, as represented by its index, is about five-and- a-half times as big as the Singapore market. Both have declined significantly since the beginning of the year, and even when compared to five years ago. Sector-wise, the Hang Seng Index (HSI) is skewed towards financials, with almost half the index made up of banks and insurance companies. Singapore's Straits Times Index (STI), meanwhile, is about one-third banks. A full tenth of the HSI is also dominated by a single Internet company - Tencent - while telco Singtel also takes up almost 12 per cent of the STI. In terms of valuation, the HSI trades at a lower price-to-earnings multiple than the STI in absolute terms. The HSI at nine times earnings is at the lower range of where it has traded in the last few years, of between nine and 11 times. The STI, at 13 times earnings, is down from a peak of 16 times earlier this year, and trading roughly at where it has been for the last few years. In terms of price-to-book ratios, however, both indices are trading at multi-year lows. HSI companies seem to be valued more cheaply than STI companies when their cash flows are taken into account. However, they also have significantly more debt relative to their net assets. To sum up, Hong Kong looks like a cheaper market than Singapore, with higher profitability to boot. However, the market could be pricing in higher risks, especially from higher debt levels.

|

|

|

|

HSI

Oct 3, 2015 22:45:30 GMT 7

Post by zuolun on Oct 3, 2015 22:45:30 GMT 7

|

|

|

|

HSI

Nov 6, 2015 9:46:14 GMT 7

Post by zuolun on Nov 6, 2015 9:46:14 GMT 7

|

|

|

|

HSI

Jan 25, 2016 11:50:57 GMT 7

Post by zuolun on Jan 25, 2016 11:50:57 GMT 7

|

|

|

|

HSI

Feb 10, 2016 13:00:51 GMT 7

Post by zuolun on Feb 10, 2016 13:00:51 GMT 7

|

|

|

|

HSI

Feb 11, 2016 9:08:16 GMT 7

Post by zuolun on Feb 11, 2016 9:08:16 GMT 7

|

|