|

|

Post by zuolun on Nov 16, 2013 13:11:20 GMT 7

|

|

|

|

Post by zuolun on Dec 23, 2013 12:26:00 GMT 7

|

|

|

|

Post by zuolun on Jan 11, 2014 16:28:38 GMT 7

葡萄美酒夜光杯,

欲饮琵琶马上催。

醉卧沙场君莫笑,

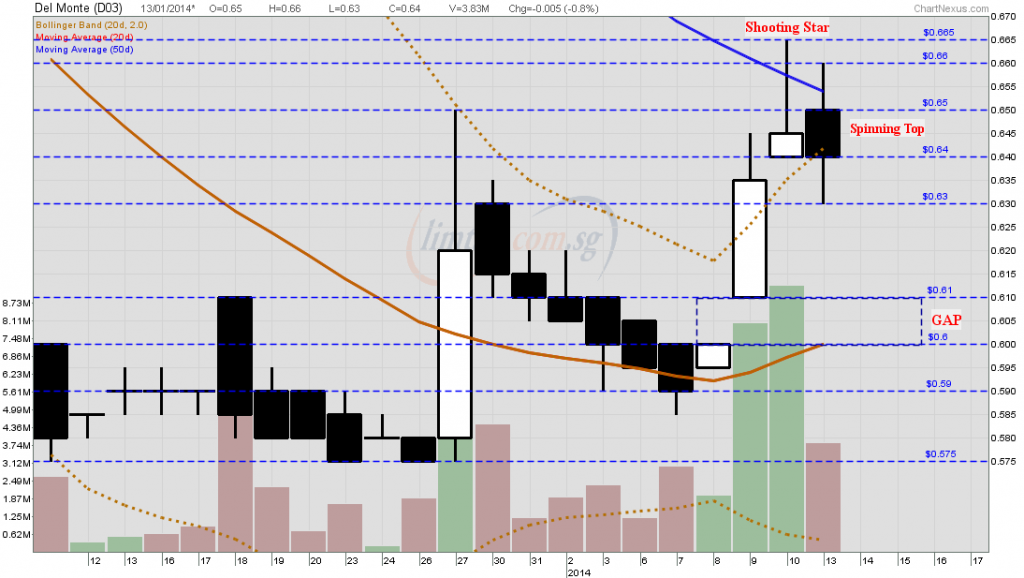

古来征战几人回。This poem is best to describe that the stock market is a bloody battlefield. While chances of winning do exist but it's not meant for everyone. Investors fight hard to win but how many return home safe and sound, as winners. Del Monte — Bull TrapDel Monte closed with a bearish shooting star @ S$0.645 (+0.01, +1.6%) with extremely high volume done at 9.35m shares on 10 Jan 2014. Strong resistance @ S$0.675, immediate support @ S$0.575.

|

|

|

|

Post by zuolun on Jan 13, 2014 13:23:16 GMT 7

Del Monte — Bull TrapDel Monte has a spinning top and traded @ S$0.64 (-0.005, -0.8%) on 13 Jan 2014 at 2.20pm.  Stop Over Trading - Trading Discipline Stop Over Trading - Trading Discipline

|

|

|

|

Post by zuolun on Feb 14, 2014 14:01:59 GMT 7

|

|

|

|

Post by zuolun on Feb 27, 2014 11:34:50 GMT 7

|

|

|

|

Post by zuolun on Mar 13, 2014 13:13:12 GMT 7

|

|

|

|

Post by zuolun on May 17, 2014 16:15:15 GMT 7

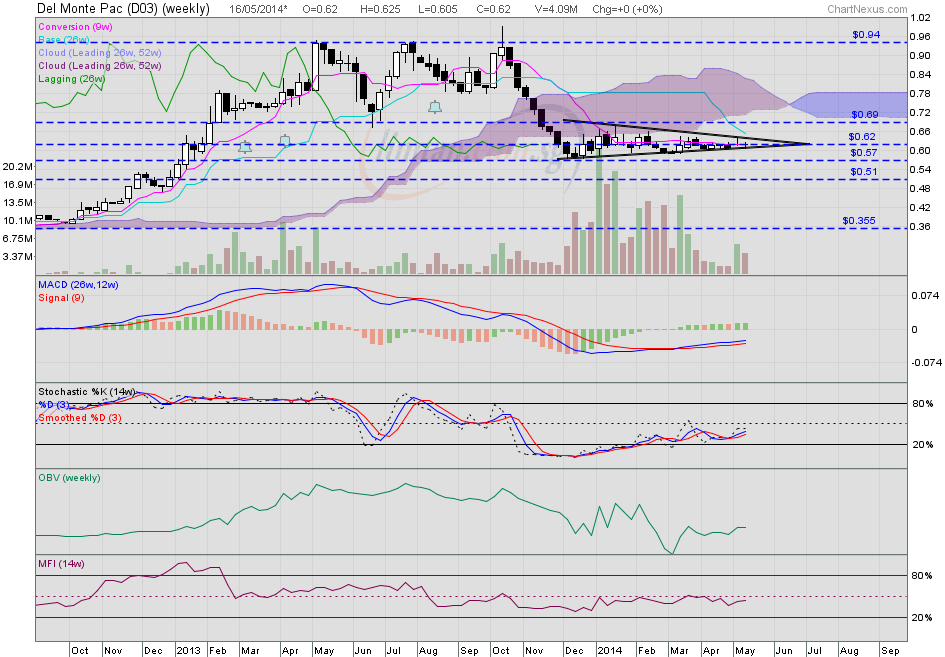

Del Monte: To report a net Loss on or before 14 Jun 2014 for the transition qtr ended 30 Apr 2014 — 16 May 2014 Kim Eng's review: Patience is bitter, but its fruit is sweet, BUY TP S$0.85 — 3 Mar 2014 Del Monte — 13 Jan 2014Edgardo M Cruz, Del Monte Pacific’s executive director, has been raising his direct stake in the company. From Dec 16 to Jan 6, he acquired 782,800 shares at prices ranging between 59.5 cents and 65 cents on the open market, raising his direct stake in the company to 0.18%. Del Monte Pacific is a producer, processor and retailer of food and beverage products. It produces and markets processed and fresh pineapples, pineapple concentrate, tropical mixed fruit, ketchup, sauces and pasta. The company also owns the rights to the Del Monte brand for processed products for the Philippines, the Indian subcontinent and Myanmar, as well as the S&W brand for both processed and fresh products for Asia, Europe, the Middle East and Africa. On Oct 11, Del Monte Pacific announced the acquisition of Del Monte Foods’ consumer food business in the US for US$1.68 billion ($2.13 billion). Rolando Gapud, Del Monte Pacific’s chairman, says this landmark transaction offers the company greater access to a well-established, attractive and profitable branded consumer food business in the world’s biggest market. For 9MFY2013 ended September, Del Monte Pacific recorded a turnover of US$335 million, an 11.7% increase from the US$300 million recorded in the corresponding period last year. However, its earnings declined by 5% to US$17.8 million as a result of non-recurring expenses of US$1.7 million related transaction fees for the proposed US acquisition and US$1.2 million in fees related to the dual listing on the Philippine Stock Exchange last June. Del Monte — Symmetrical Triangle formationDel Monte closed unchanged with a doji @ S$0.62 with 1.06m shares done on 16 May 2014. Strong resistance @ S$0.675, immediate support @ S$0.575. Should the symmetrical triangle breakdown @ S$0.62, interim TP S$0.51. Alternatively, based on Del Monte's weekly chart, if the symmetrical triangle break up @ S$0.62, the uptrend will resume.  Del Monte (weekly) — Crucial support @ S$0.57 Del Monte (weekly) — Crucial support @ S$0.57

|

|

|

|

Post by zuolun on Jul 6, 2014 13:19:25 GMT 7

Del Monte — Bearish Symmetrical Triangle Breakout, Interim TP S$0.485Del Monte closed with a bullish harami @ S$0.53 (0.005, +1%) with thin volume done at 185 lots on 4 July 2014. Immediate resistance @ S$0.54, crucial support @ S$0.0.515, the last low scored on 27 Jun 2014.   Del Monte — Triple Top formation; crucial support @ S$0.725

|

|

|

|

Post by zuolun on Sept 14, 2014 15:50:54 GMT 7

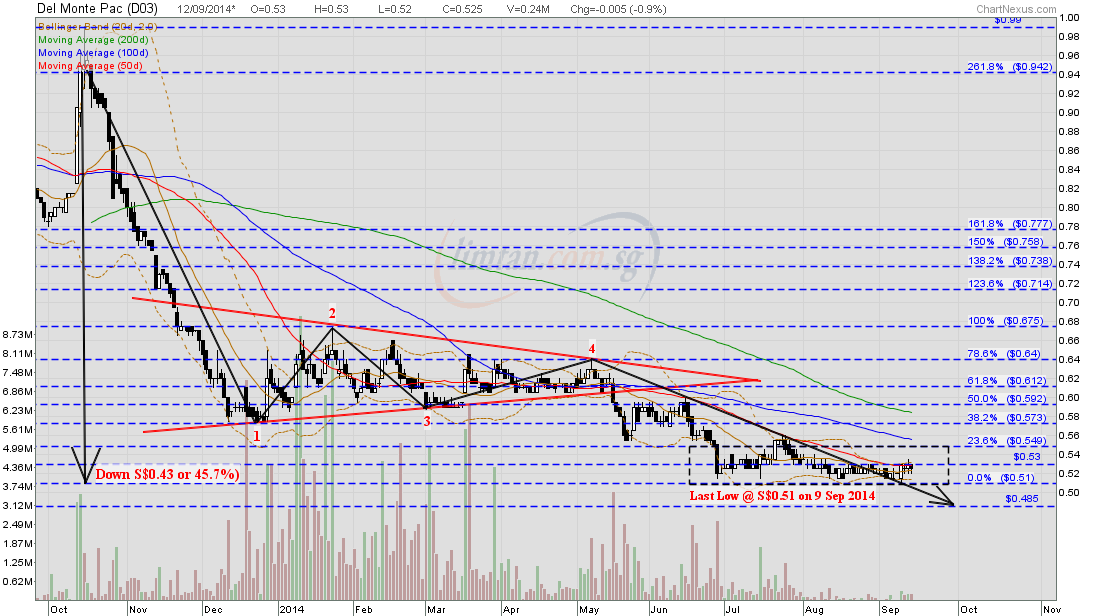

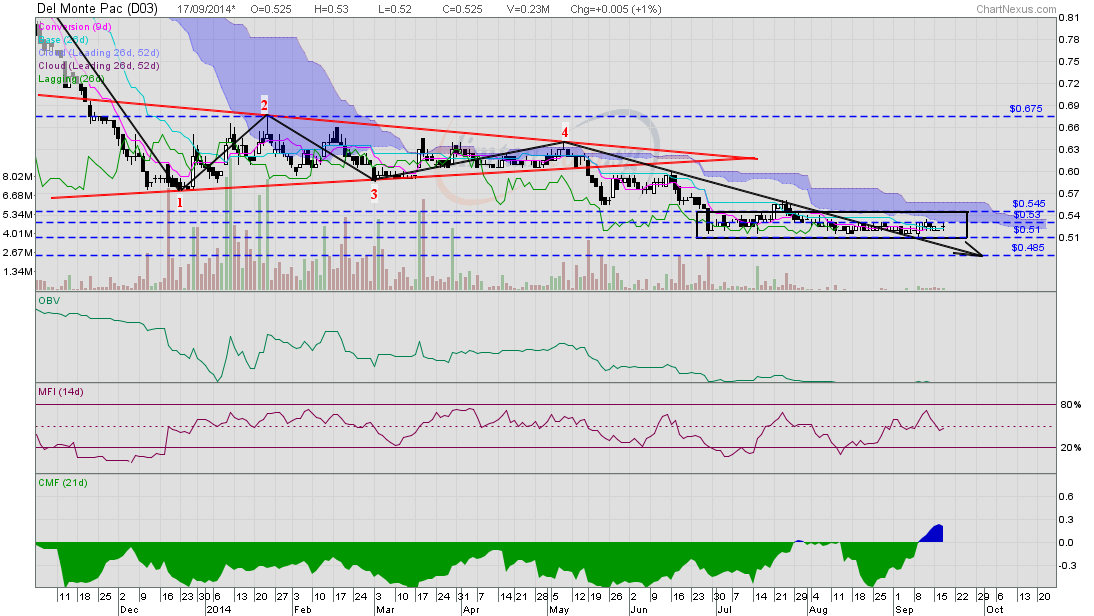

Bearish Triple Top Breakout @ S$0.725 — Extremely powerful on Del MonteTP S$0.51 (-S$0.43 or -45.7%) already hit within a timeframe of approx. 9 months or 3qtrs (from S$0.94 end-Oct 2013 to S$0.51 mid-Sep 2014). Del Monte — Trading in a rectangle, biased to the downside TP S$0.485Del Monte closed with a hammer @ S$0.525 (-0.005, -0.9%) with 244 lots done on 12 Sep 2014. Crucial support @ S$0.51, strong resistance at the 20d SMA @ S$0.53.

|

|

|

|

Post by zuolun on Sept 17, 2014 22:16:49 GMT 7

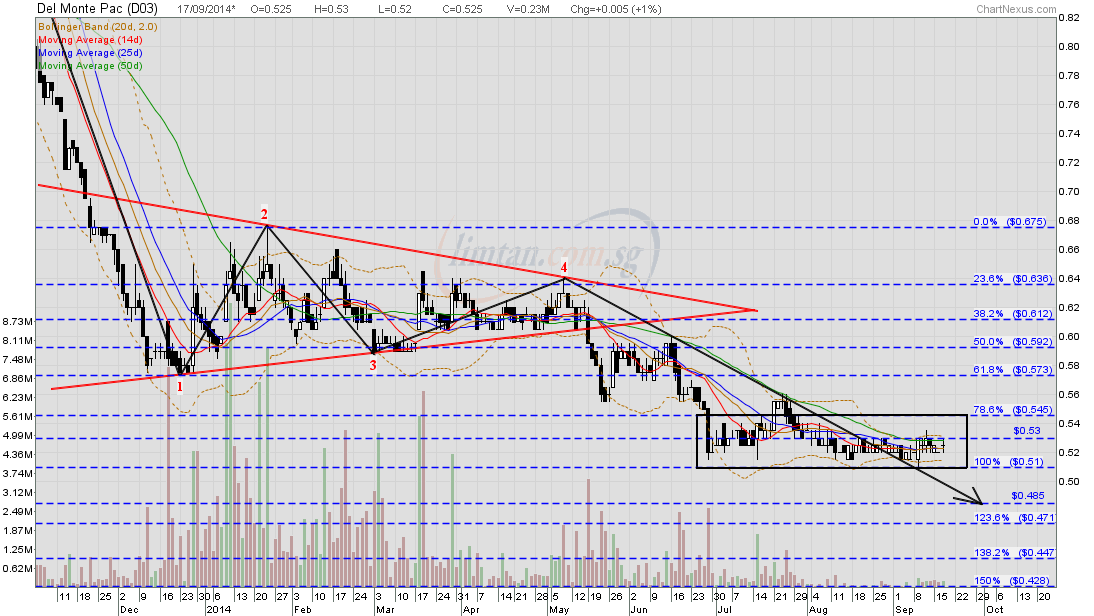

Del Monte Pacific incurs $21.9m loss in fiscal Q1 2015 on US acquisition expenses — 12 Sep 2014 Del Monte — Trading in a rectangle, biased to the downside TP S$0.485Del Monte closed with a doji @ S$0.525 (+0.005, +1%) with 232 lots done on 17 Sep 2014. Crucial support @ S$0.51, strong resistance @ S$0.53. Observation: Technical indicators showed that Del Monte has been under extremely strong selling pressure since last Dec 2013, expect more downside.

|

|

|

|

Post by zuolun on Dec 16, 2014 7:57:26 GMT 7

|

|

|

|

Post by zuolun on Feb 13, 2015 14:43:03 GMT 7

Del Monte ~ An example of a Leveraged Buyout (LBO)Del Monte to raise $208.6m via rights issue of 641.9m shares for $0.325 each ~ 13 Feb 2015 DMPL Renounceable Underwritten Rights Issue ex-date on 5 Feb 2015Del Monte shelves rights issue in view of weak market conditions ~ 22 Jan 2015 Del Monte Pacific to delever after jumbo LBO ~ 18 Dec 2014 Del Monte Q2 profit plunged 97.9% to US$200,000, down from $8.9m ~ 15 Dec 2014 Long PH process forces Del Monte to list in Singapore ~ 14 Dec 2014 Philippines company to buy Del Monte Foods business ~ 24 Oct 2013 Del Monte Foods sells consumer products division for US$1.68b to focus on pet foods ~ 11 Oct 2013 KKR-led group to buy Del Monte for $4 billion ~ 25 Nov 2010 Gambling with Other People’s MoneyImagine a superb poker player who asks you for a loan to finance his nightly poker playing. For every $100 he gambles, he’s willing to put up $3 of his own money. He wants you to lend him the rest. You will not get a stake in his winning. Instead, he’ll give you a fixed rate of interest on your $97 loan. The poker player likes this situation for two reasons. First, it minimizes his downside risk. He can only lose $3. Second, borrowing has a great effect on his investment — it gets leveraged. If his $100 bet ends up yielding $103, he has made a lot more than 3 percent — in fact, he has doubled his money. His $3 investment is now worth $6. But why would you, the lender, play this game? It’s a pretty risky game for you. Suppose your friend starts out with a stake of $10,000 for the night, putting up $300 himself and borrowing $9,700 from you. If he loses anything more than 3 percent on the night, he can’t make good on your loan. Not to worry — your friend is an extremely skilled and prudent poker player who knows when to hold ,em and when to fold ,em. He may lose a hand or two because poker is a game of chance, but by the end of the night, he’s always ahead. He always makes good on his debts to you. He has never had a losing evening. As a creditor of the poker player, this is all you care about. As long as he can make good on his debt, you’re fine. You care only about one thing — that he stays solvent so that he can repay his loan and you get your money back. But the gambler cares about two things. Sure, he too wants to stay solvent. Insolvency wipes out his investment, which is always unpleasant — it’s bad for his reputation and hurts his chances of being able to use leverage in the future. But the gambler doesn’t just care about avoiding the downside. He also cares about the upside. As the lender, you don’t share in the upside; no matter how much money the gambler makes on his bets, you just get your promised amount of interest. If there is a chance to win a lot of money, the gambler is willing to take a big risk. After all, his downside is small. He only has $3 at stake. To gain a really large pot of money, the gambler will take a chance on an inside straight. As the lender of the bulk of his funds, you wouldn't want the gambler to take that chance. You know that when the leverage ratio — the ratio of borrowed funds to personal assets — is 32–1 ($9700 divided by $300), the gambler will take a lot more risk than you’d like. So you keep an eye on the gambler to make sure that he continues to be successful in his play. But suppose the gambler becomes increasingly reckless. He begins to draw to an inside straight from time to time and pursue other high-risk strategies that require making very large bets that threaten his ability to make good on his promises to you. After all, it’s worth it to him. He’s not playing with very much of his own money. He is playing mostly with your money. How will you respond? You might stop lending altogether, concerned that you will lose both your interest and your principal. Or you might look for ways to protect yourself. You might demand a higher rate of interest. You might ask the player to put up his own assets as collateral in case he is wiped out. You might impose a covenant that legally restricts the gambler’s behavior, barring him from drawing to an inside straight, for example.

|

|

|

|

Post by sptl123 on Feb 13, 2015 16:16:52 GMT 7

Bro Zunlun, Can this gambler be short still. Read that a stock make new low is an idea candidate for short  It exceed your sell TP last year; good reward if you or someone long the short since . Kim Eng fella buy TP was wrong again, he now can buy Del Monte for less than half the price  KKR seem to be wrong very often; they bought Kodak USA few years ago and loss big big too. |

|

|

|

Post by zuolun on Feb 13, 2015 16:56:49 GMT 7

Bro Zunlun, Can this gambler be short still. Read that a stock make new low is an idea candidate for short  It exceed your sell TP last year; good reward if you or someone long the short since . Kim Eng fella buy TP was wrong again, he now can buy Del Monte for less than half the price  KKR seem to be wrong very often; they bought Kodak USA few years ago and loss big big too. , "A stock is never too high to buy and never too low to short." — Jesse Livermore Del Monte closed @ S$0.355 (-0.025, -6.6%) on 13 Feb 2015. It is likely to hit $0.325, the rights issue price and go further down to classic baseline support @ S$0.30.  |

|