Post by zuolun on Aug 18, 2015 22:54:54 GMT 7

SIA hedged 65.3% of its fuel needs in the 6 months to Mar 2015 @ US$116 a barrel ~ 1 Feb 2015

AirAsia’s fuel expenses are around 47%; both AirAsia and its AAX are unhedged for 2016 ~ 30 Jan 2015

Asian Aviation Sector to benefit from fuel-price plunge ~ 27 Jan 2015

Air Asia sees RM160 million savings from lower fuel prices ~ 18 Aug 2015

Chinese airlines promising year may turn into a nightmare due to yuan devaluation

Sijia Jiang

13 August 2015

Mainland airline stocks slid a further 5.47 per cent on average with the yuan yesterday after being the worst hit sector on Tuesday by the nearly 2 per cent devaluation of the Chinese currency by the People's bank of China, the central bank.

On Tuesday, China Southern Airlines and China Eastern Airlines suffered their largest single-day share price drops since the September 11 attack in 2001.

Daiwa analyst Kelvin Lau, who downgraded both stocks to sell and cut their target prices by 42.5 per cent and 21 per cent respectively on the news, said: "We expect to see a derating trend for the [mainland] airline sector in general."

China Southern, boasting Asia's largest fleet with more than 600 planes, also has the largest amount of dollar debt in a sector most vulnerable to yuan fluctuation given its renminbi-based revenue and dollar-based debt for aircraft purchases.

It had 105 billion yuan (HK$128.6 billion) worth of dollar-denominated debt at the end of 2014, with every 1 per cent change in the yuan exchange rate translating to 767 million yuan in its bottom line, according to the company's annual report.

Before the dramatic yuan devaluation on Tuesday, mainland airlines were on track to achieve what could have been their highest profit figures to date after their forecast first-half profits had outstripped full-year earnings last year, thanks to low fuel prices and a Chinese travel boom.

A 3.39 per cent drop in the yuan in the first four months of 2014 was blamed for exchange losses suffered by mainland airlines last year, with China Southern ending the first half with net losses of one billion yuan.

The company has forecast net profit for the first half this year would soar to 3.6 billion yuan, while China Eastern said its earnings would jump to 3.7 billion yuan and Air China up to four billion yuan.

"A 3.4 per cent decline of the yuan could mean about half of mainland airlines' first-half earnings might be cancelled out," Bocom analyst Geoffrey Cheng said.

"But the busy season of the second half should be more than enough to compensate for that, especially the third quarter that always accounts for the bulk of mainland airlines' full-year profits. Overall full-year earnings would still be much better than 2014," he said.

"Outbound travel to the US may be dealt a blow because of the weakened yuan, but Southeast Asia and other Asian destinations should not be too affected as those currencies also depreciated," Cheng said, adding he is not too worried because of signals from Beijing that it does not intend to wage a currency war.

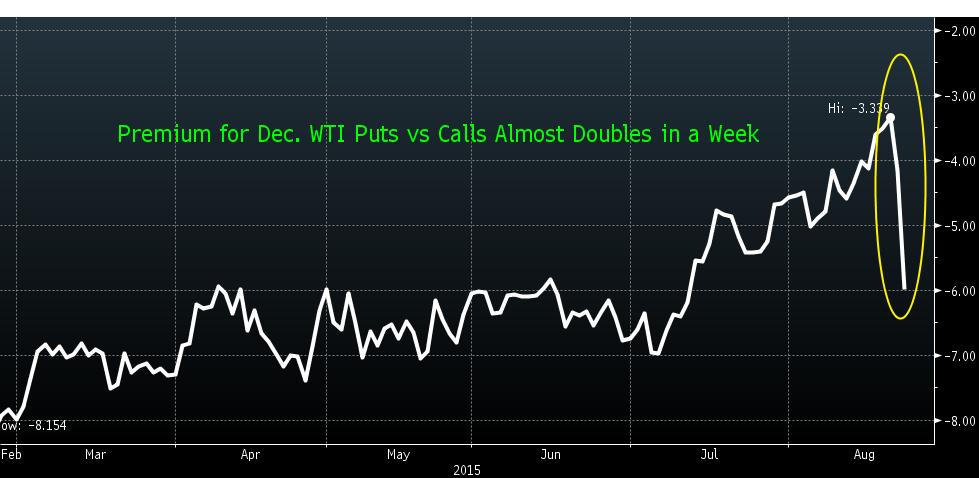

Lau said there were market concerns the yuan could depreciate further in the coming 12 months. The combination of a downward trend for the Chinese currency and a 12-month low for jet fuel prices at US$58 per barrel with "no more downside surprises" means the trend has turned unfavourable for mainland airline stocks and especially China Southern, for which the current valuation was "too high", he said.

Less bearish were Citi analysts Vivian Tao and Michael Beer, who said fundamental growth drivers were still healthy and could even be strengthened by possible rate cuts and other stimulus to come.

"We expect the weak currency to negatively impact investor sentiment on [the] Chinese airline sector, despite the other positive factors," they wrote in a report. A 5 per cent depreciation of the yuan this year would shrink forecast earnings for the Big Three airlines for the year by 19 per cent to 25 per cent, they said.