|

|

Post by zuolun on Jan 8, 2014 9:05:43 GMT 7

VARD Vs CITYDEV Vs AusGroup

|

|

|

|

Post by zuolun on Jan 8, 2014 10:23:36 GMT 7

thanks zuolun bro for update this is a high beta stock i daren't trade this one odie, 1. Stocks that are trading in long term downtrends or below the 200d SMA are in a bear-market territory, i.e. the major resistance is at the 200d SMA. 2. Chartwise, VARD, CITYDEV and Ausgroup are extremely strong downtrend stocks. 3. These 3 stocks have similar chart pattern; both VARD and CITYDEV are resisted at the 100d SMA, while Ausgroup at the 50d SMA. 4. Using the price and the volume as a trend indicator, it is easier to trade with the (primary) trend than against it = short not long = 顺势而行。5. When in a bear-market territory, these downtrend stocks have a distinctive characteristic — the price movement follows the oscillators closely, especially the stochastic. (Setting at 14,3,3.) 6. Do not trade against the major (primary) trend, the market will punish those who never obey the rules. Examples: OCBC and STI show similarity in the stochastic  |

|

|

|

Post by odie on Jan 9, 2014 20:30:02 GMT 7

thanks zuolun bro, i will take a look this weekend  currently waiting for extreme greed on vix |

|

|

|

Post by zuolun on Jan 11, 2014 17:21:52 GMT 7

Del Monte Vs Jardine C&CBoth stocks had peaked and collapsed exactly at 41.9%.

|

|

|

|

Post by zuolun on Jan 18, 2014 2:17:38 GMT 7

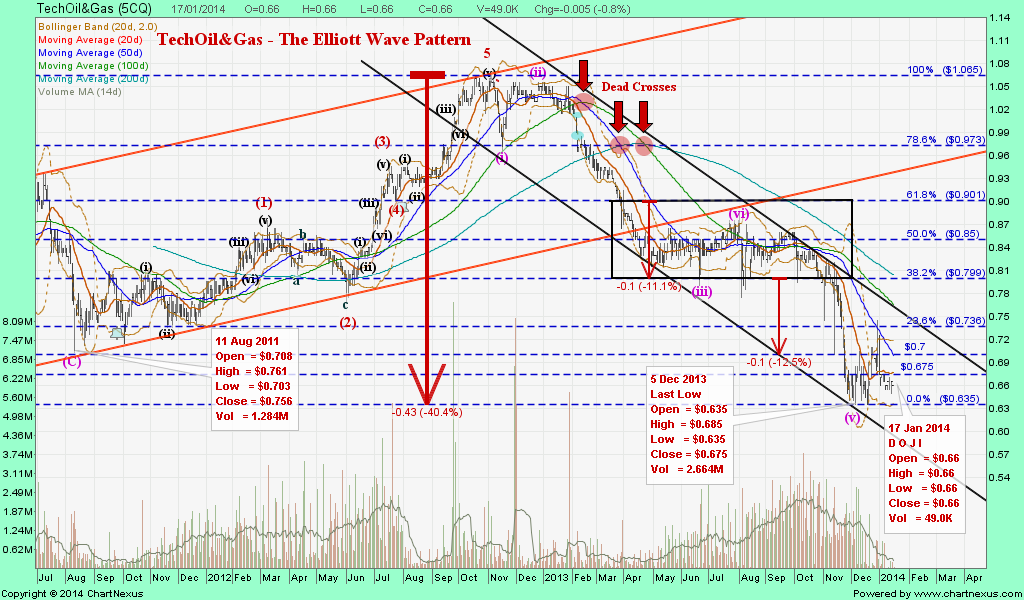

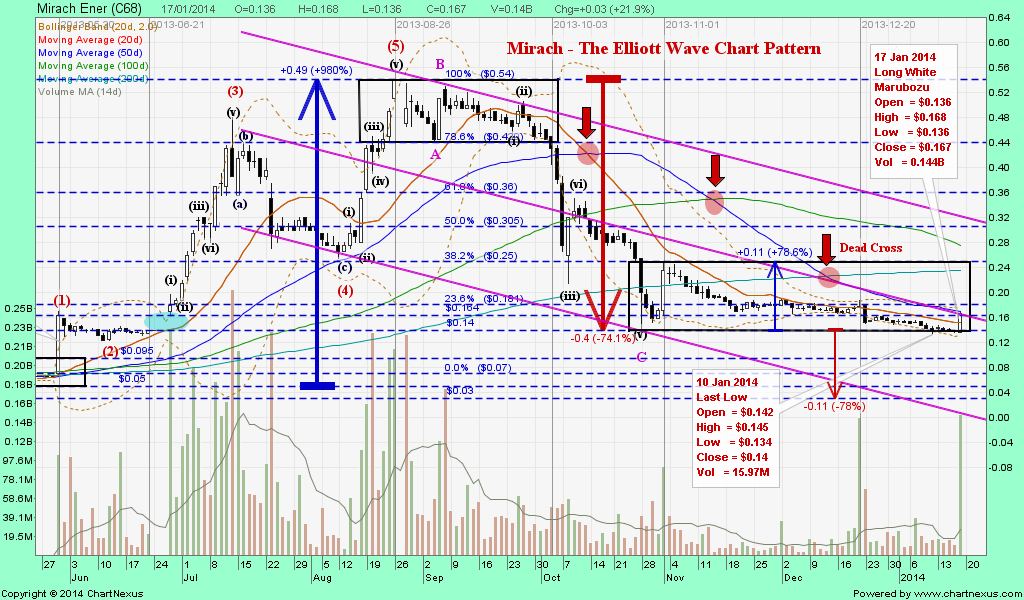

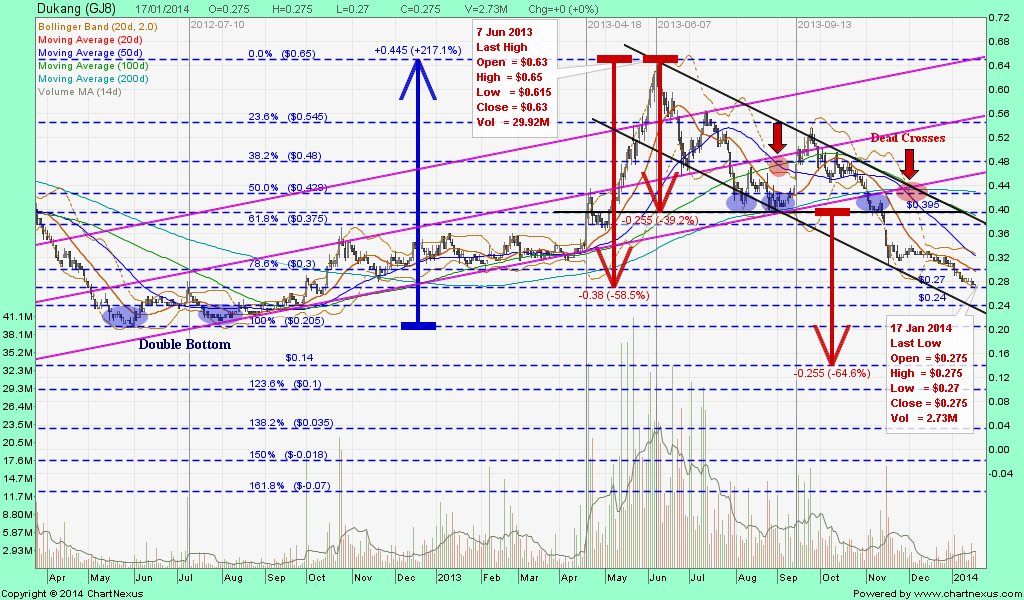

TechOil&Gas, Mirach Ener, EMS Ener, SMRT and Dukang

|

|

|

|

Post by zuolun on Jan 21, 2014 9:09:54 GMT 7

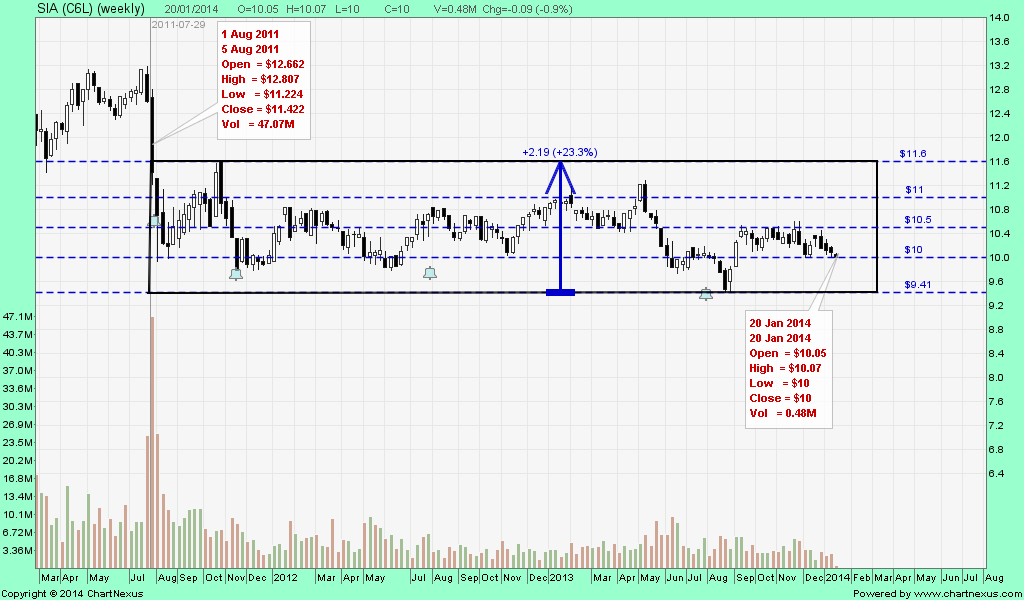

Dyna-Mac Vs SIA

|

|

|

|

Post by zuolun on Jan 28, 2014 10:43:17 GMT 7

|

|

|

|

Post by zuolun on Feb 3, 2014 14:35:38 GMT 7

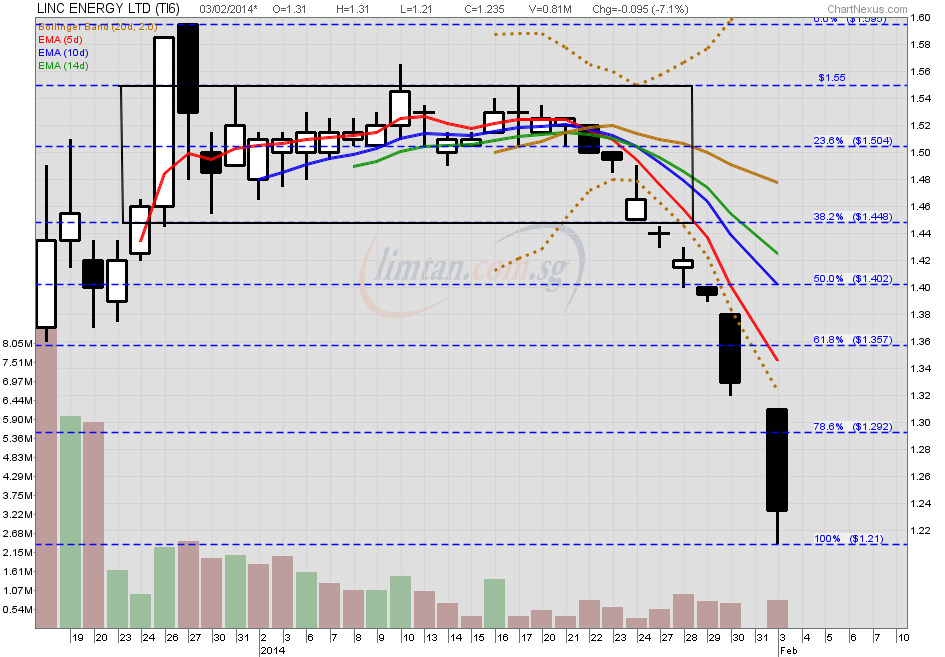

Linc Ener Vs Kris Ener

|

|

|

|

Post by zuolun on Feb 5, 2014 15:47:45 GMT 7

SGX Vs SingTel

|

|

|

|

Post by zuolun on Feb 7, 2014 9:35:19 GMT 7

|

|

|

|

Post by zuolun on Feb 7, 2014 12:23:14 GMT 7

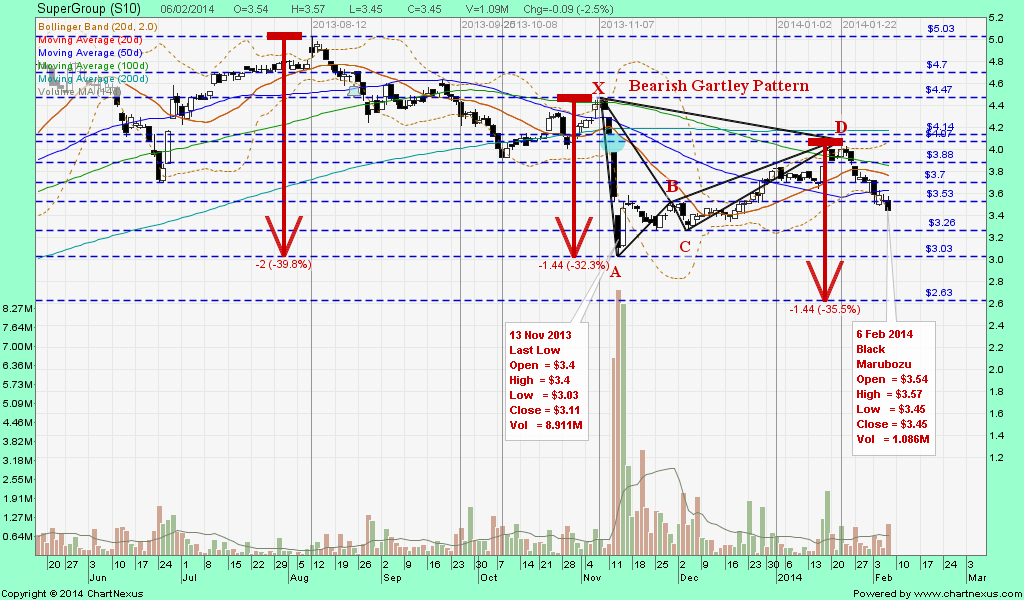

Ascendasreit, SuperGroup and Innopac

|

|

|

|

Post by zuolun on Feb 11, 2014 12:31:15 GMT 7

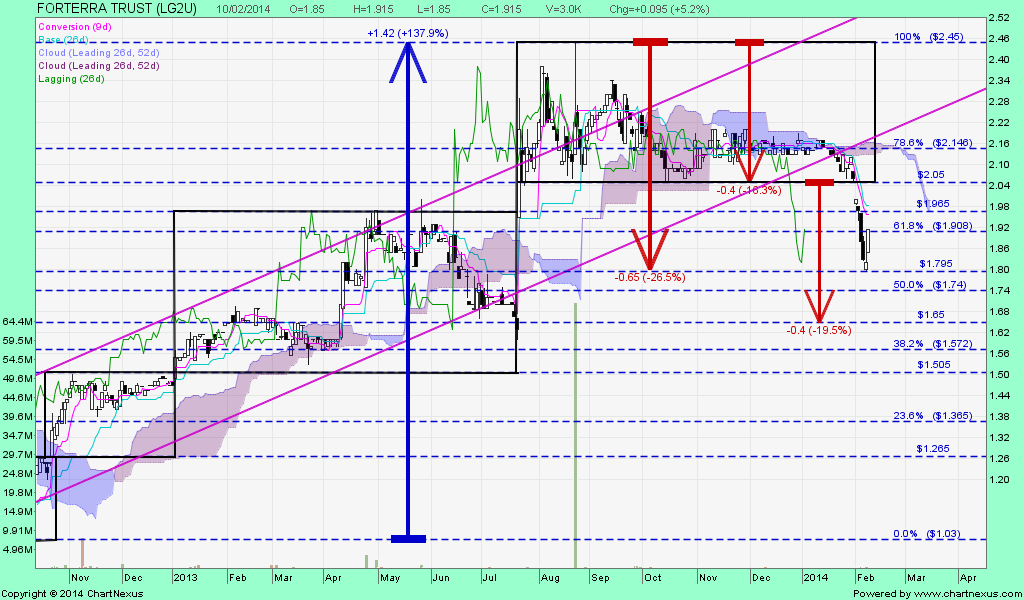

Ichimoku chart shows Forterra and SGX have no purple cloud, i.e. without a bra. Forterra Vs SGX  |

|

|

|

Post by zuolun on Feb 11, 2014 13:08:42 GMT 7

|

|

|

|

Post by zuolun on Feb 21, 2014 23:54:59 GMT 7

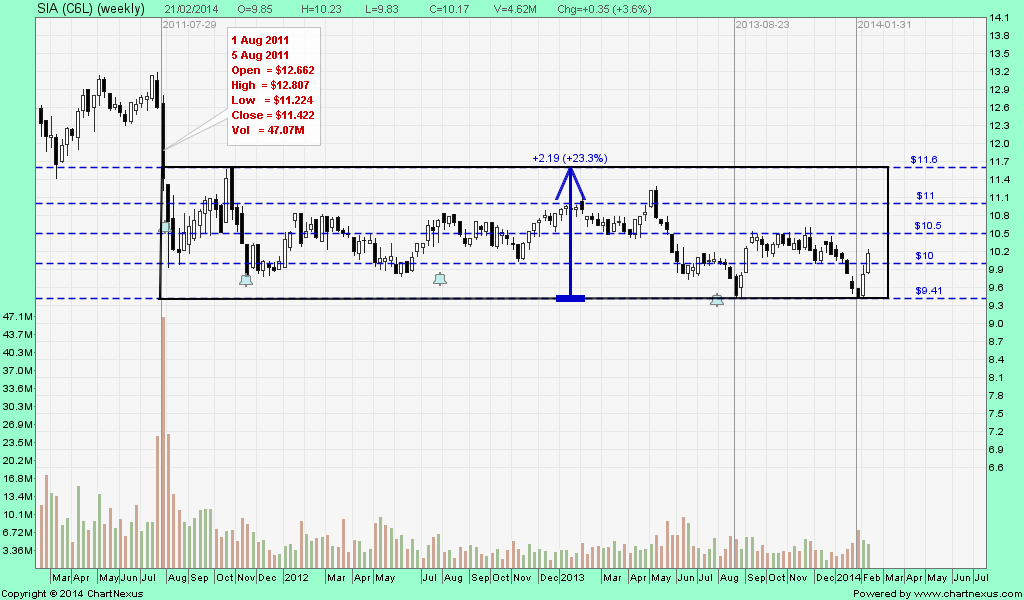

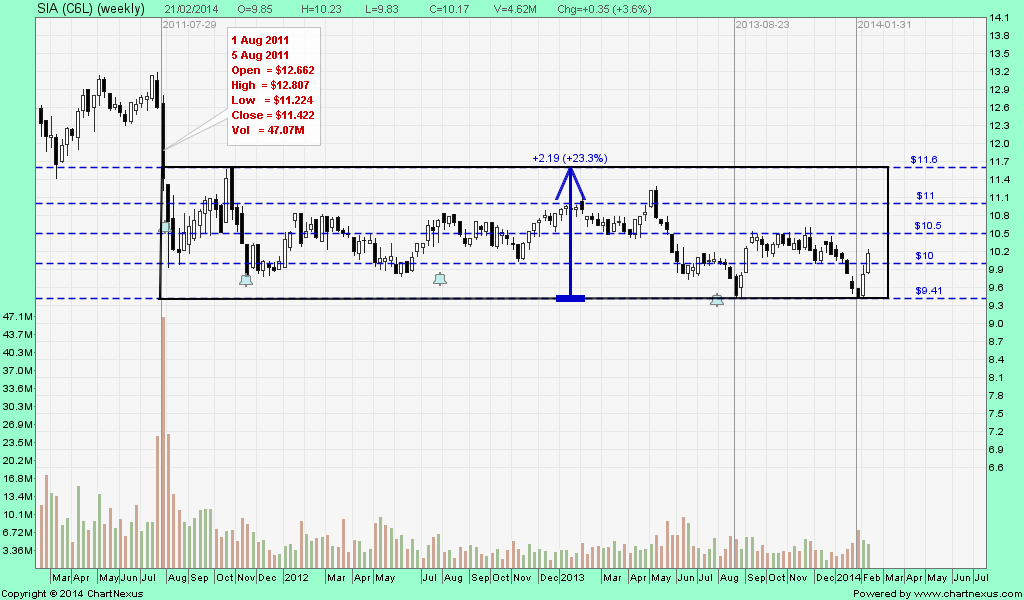

Noble Vs SIA

|

|

|

|

Post by zuolun on Feb 22, 2014 14:04:11 GMT 7

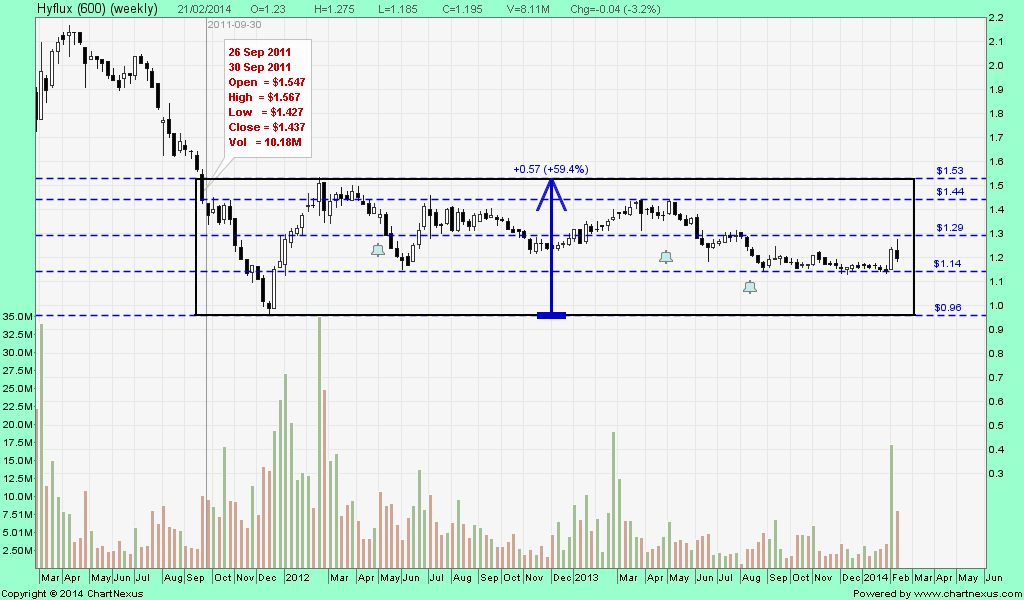

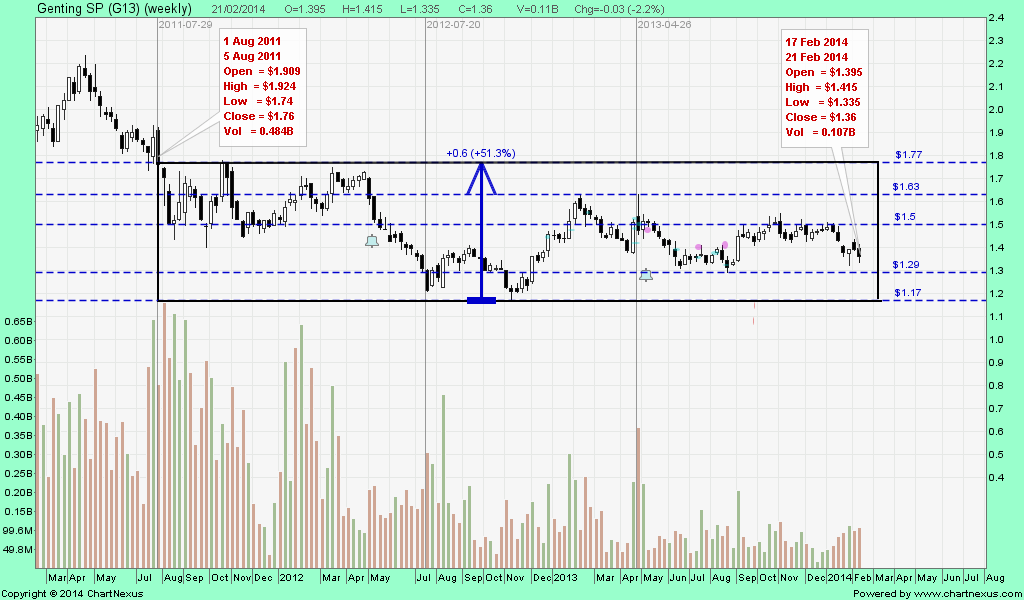

Strong downtrend moving sideway = Cruise to Nowhere = 牛皮市1. Noble 2. SIA 3. Hyflux 4. Wilmar 5. Genting SP      Read one stock quite similar to SIA's chart pattern, it has been trading in a rectangle for 10-year since 2003 (see below).

|

|