|

|

Post by zuolun on Dec 16, 2013 0:39:03 GMT 7

KepCorp — Double top breakoutImmediate resistance S$11.03, immediate support S$10.71, crucial support S$10.65, the 20w SMA..  KepCorp (weekly) — Trading in an upward sloping channel KepCorp (weekly) — Trading in an upward sloping channel

|

|

|

|

Post by zuolun on Dec 18, 2013 21:45:25 GMT 7

odie, KepCorp is consolidating in a long rectangle; properties stocks, especially CDL & Capitaland are trading lower low. The STI is now left with Singtel & the 3 banks as the last line of defense. If crucial supports of these stocks are broken convincingly with extremely high volume, they're prime targets for SHORT, not LONG. ( Note: Singtel's crucial support is @ S$3.65, the 6.8c dividends XD date is on 19 Dec 2013.)

KepCorp — Double top breakout; crucial support @ S$9.96KepCorp broke the 200d EMA convincingly with extremely high volume done at 5.74m shares. The stock closed at day's low with a long black marubozu @ S$10.56 (-0.25, -2.3%) on 18 Dec 2013.  |

|

|

|

Post by zuolun on Jan 17, 2014 9:02:27 GMT 7

KepCorp — Trading in an upward sloping channel; consolidating in a long rectangleImmediate resistance @ S$11.20, crucial support @ S$10.65, the 200d SMA, next support @ S$10. KepCorp traded @ S$10.83 (-0.11, -1%) on 17 Jan 2014 at 10.15am.

|

|

|

|

Post by zuolun on Feb 4, 2014 12:07:15 GMT 7

|

|

|

|

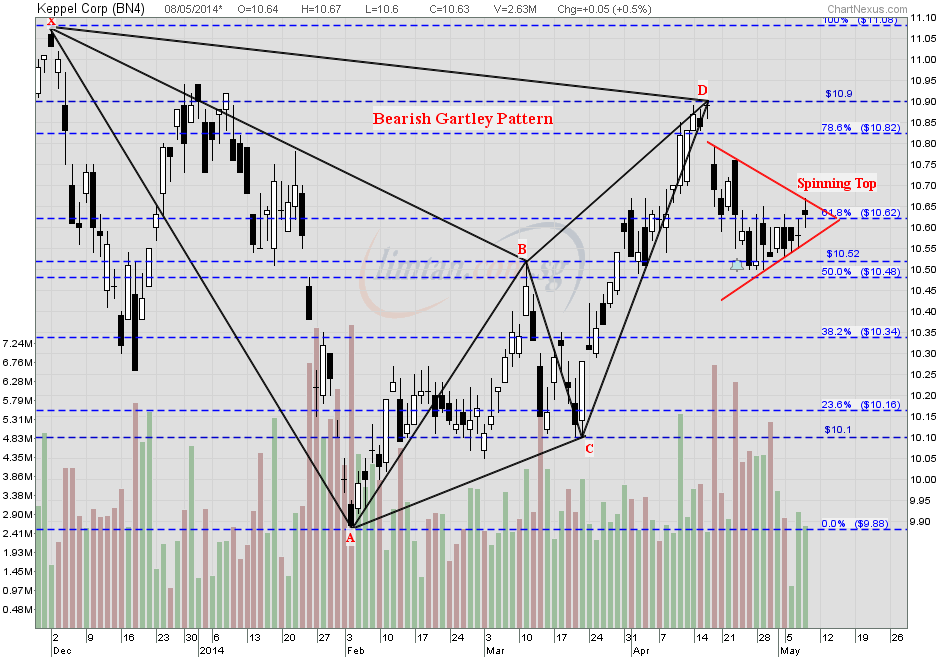

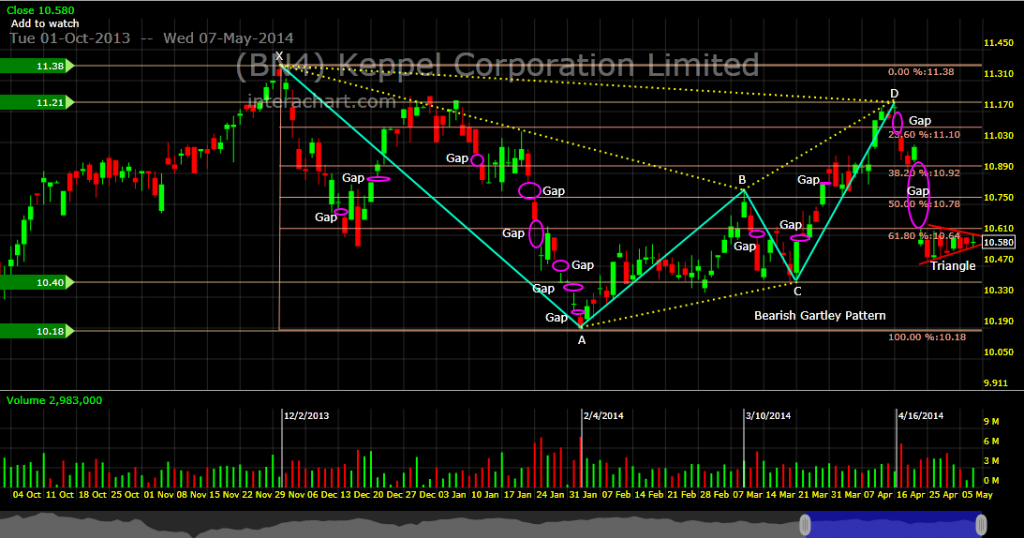

Post by zuolun on May 8, 2014 15:55:54 GMT 7

Interesting Bearish Gartley Pattern; chart pattern suggests more downside than upside, after adjusted for dividends payment. KepCorp — Bearish Gartley BreakoutKepCorp had a spinning top @ S$10.63 (+0.05, +0.5%) on 8 May 2014 at 4.58pm.   |

|

|

|

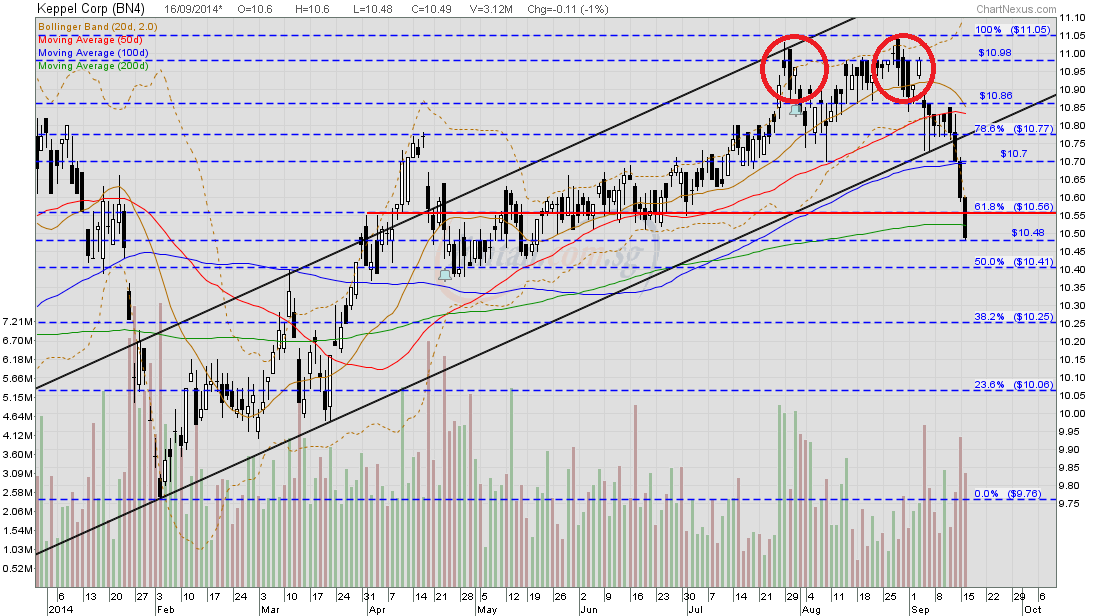

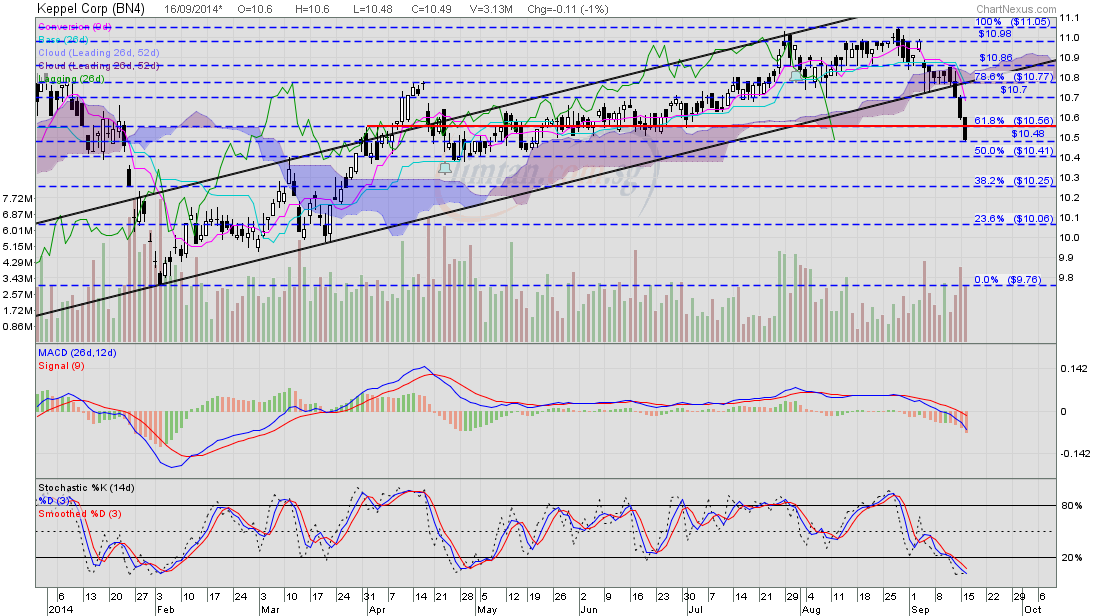

Post by zuolun on Sept 16, 2014 10:46:06 GMT 7

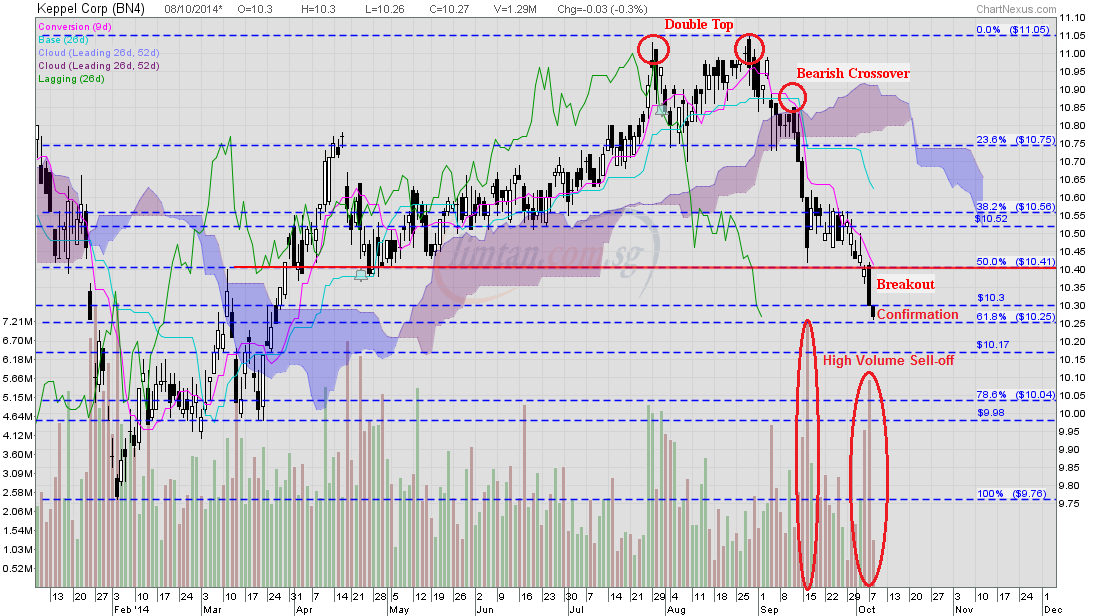

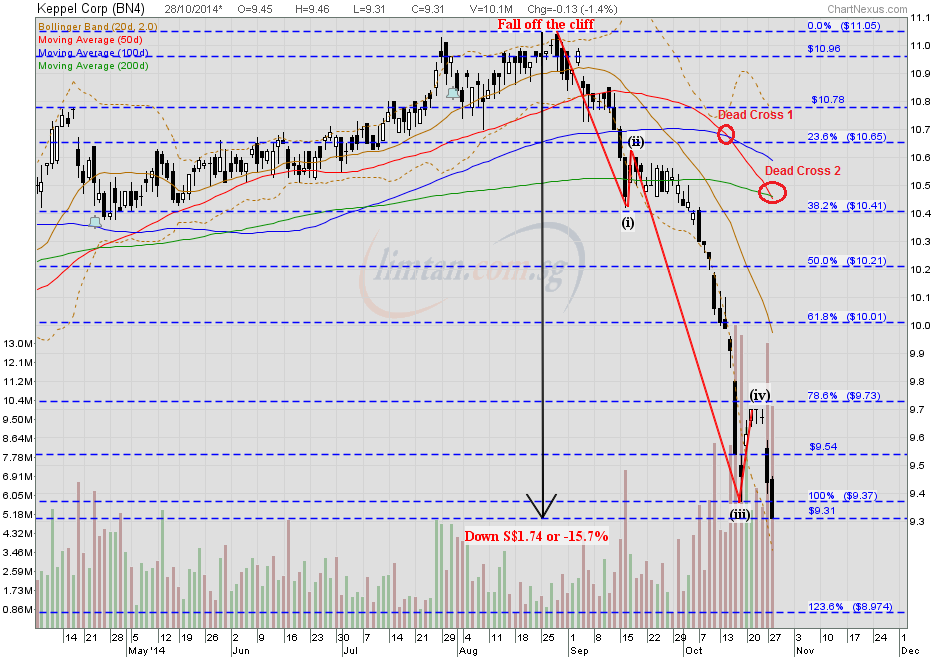

KepCorp — Double top breakout, biased to the downside interim TP S$10.35, next TP S$10.07KepCorp had a long black marubozu @ S$10.49 (-0.11, -1%) with high volume done at 3.12m shares on 16 Sep 2014 at 11.55am. Immediate support @ S$10.41, immediate resistance S$10.56. Chart Pattern Observations:- KepCorp peaked @ S$11.05 on 28 Aug 2014.

- The stock is extremely oversold, stochastic (14,3,3) has already hit below 20.

- Expect a dead cat bounce @ S$10.41, the 50% Fibo level, b4 its downside continuation.

|

|

|

|

Post by zuolun on Oct 7, 2014 15:47:06 GMT 7

KepCorp — Double top breakout, major bearish trend reversal with 5-Wave down, interim TP S$9.98, next TP S$9.76KepCorp had a long black marubozu @ S$10.30 (-0.10, -1%) with high volume done at 4.43m shares on 7 Oct 2014 at 4.40pm. Immediate support @ S$10.25, immediate resistance S$10.41.

|

|

|

|

Post by zuolun on Oct 8, 2014 11:51:38 GMT 7

Never catch a falling knife — oldman A falling knife in the stock market refers to a stock that experiences a sharp decline and it may collapse > 50% from its breakout/pivotal point, b4 bottoming out. If you use ichimoku, you must always ensure that, A) the price trades above the purple cloud; not inside or below it. B) Should the price trade inside or below the purple cloud with the Tenkan-Sen crosses below the Kijun-Sen and the Chikou-Span crosses below the share prices, run road and get out fast. KepCorp — Double top breakout, major bearish trend reversal with 5-Wave down, interim TP S$9.98, next TP S$9.76KepCorp had a hammer @ S$10.27 (-0.03, -0.3%) with 1.29m shares done on 8 Oct 2014 at 12.45pm. Immediate support @ S$10.25, immediate resistance S$10.41.

|

|

|

|

Post by zuolun on Oct 10, 2014 7:28:27 GMT 7

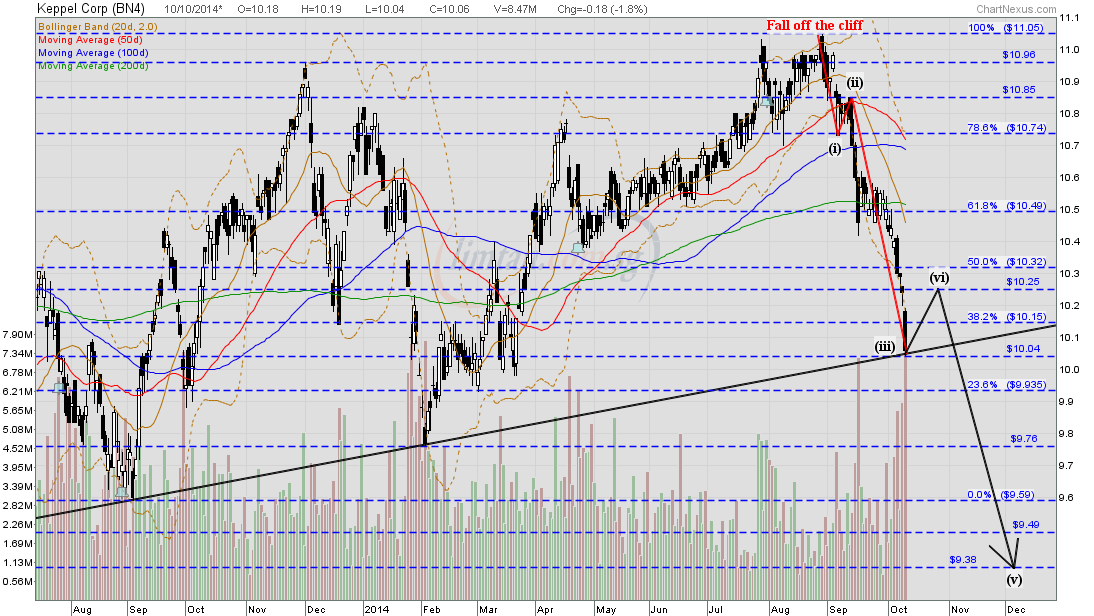

KepCorp's selling pressure is extremely strong; no sign of dead cat bounce with 2 hammers!  KepCorp — Double top breakout, major bearish trend reversal with 5-Wave down, interim TP S$9.98, next TP S$9.76 KepCorp — Double top breakout, major bearish trend reversal with 5-Wave down, interim TP S$9.98, next TP S$9.76KepCorp closed with a hammer @ S$10.24 (-0.05, -0.5%) with high volume done at 5.89m shares on 9 Oct 2014. Immediate support @ S$10.04, immediate resistance S$10.25.  |

|

|

|

Post by scg8866t on Oct 11, 2014 1:25:24 GMT 7

|

|

|

|

Post by zuolun on Oct 11, 2014 9:36:10 GMT 7

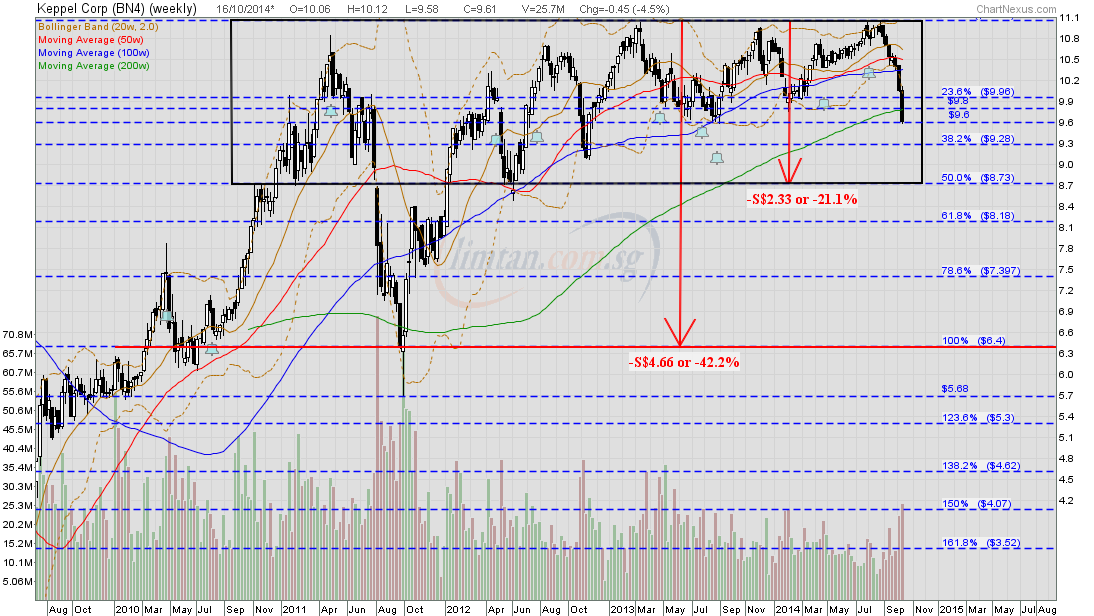

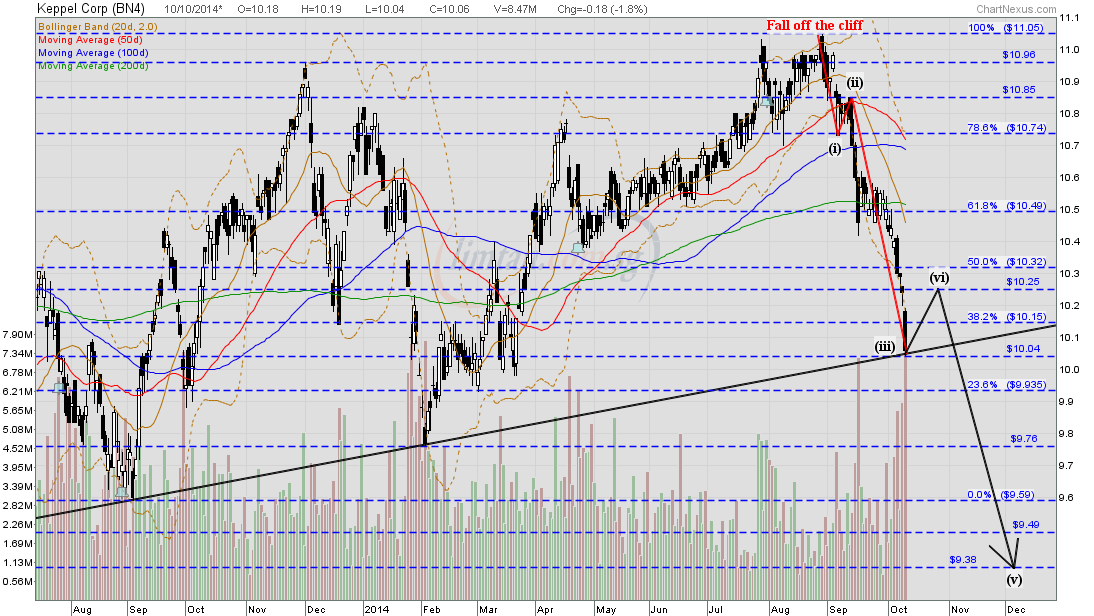

KepCorp's selling pressure is identical to the one in 2011, i.e. extremely strong and powerful with heavy volume. KepCorp — Double top breakout, major bearish trend reversal with 5-Wave down, Interim TP S$9.76, Next TP S$9.38KepCorp closed with a long black marubozu @ S$10.06 (-0.18, -1.8%) with high volume done at 8.47m shares on 10 Oct 2014. Immediate support @ S$9.90, immediate resistance S$10.25.   |

|

|

|

Post by zuolun on Oct 16, 2014 13:41:27 GMT 7

Whack a kitty with One Good Trade   技术分析: 技术分析:

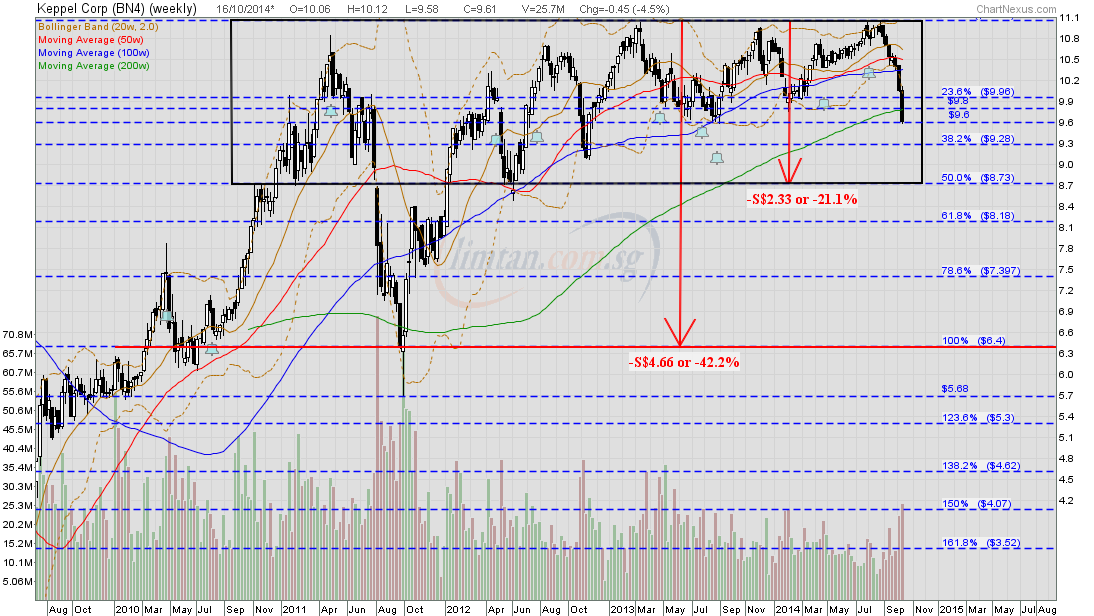

一代过去,一代又来。地却永远长存。日头出来,日头落下,急归所出之地。风往南刮,又向北转,不住地旋转,而且返回转行原道。江河都往海里流,海却不满。江河从何处流,仍归何处……。已有的事,后必再有。已行的事,后必再行。日光之下并无新事。Technical Analysis:History repeats itself. The future is but a repetition of the past..."The thing that hath been, it is that which shall be; and that which is done is that which shall be done: and there is no new thing under the sun." The dead cat bounce on KepCorp didn't materialize @ S$10.04, expect the corrective ABC-Wave to be extremely strong and powerful. KepCorp's 2011 chart showed that the plunge was down S$5.12 or -42.2% (from high of S$12.14 to low of S$7.02), so using it to extrapolate a freefall of the same magnitude with the same timeframe is not impossible. KepCorp (weekly) — Trading in a rectangle, Interim TP S$8.73, Next TP S$6.40    [/font]

|

|

|

|

Post by zuolun on Oct 17, 2014 14:51:17 GMT 7

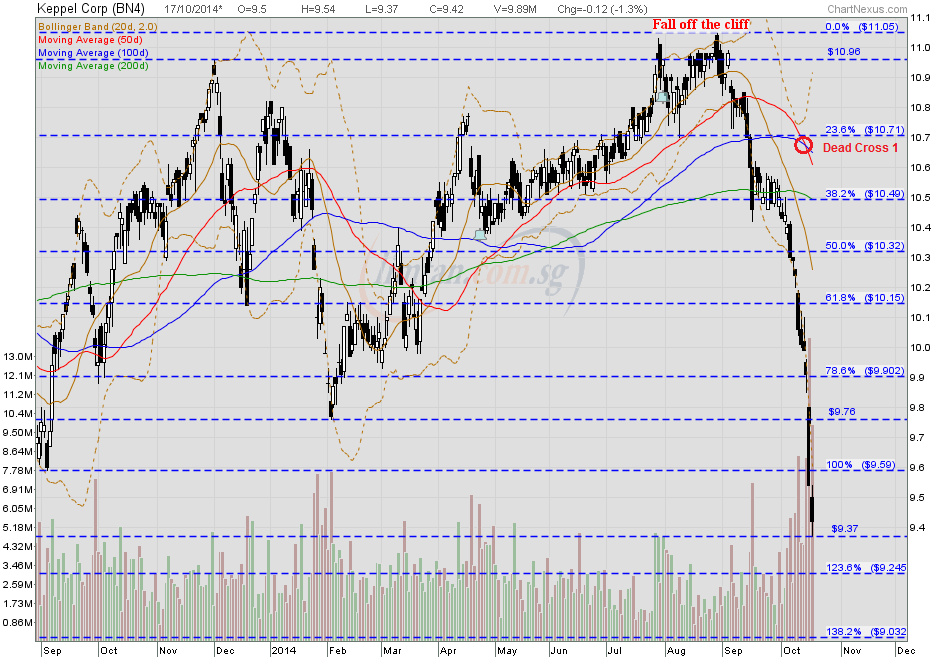

KepCorp — Major bearish trend reversal, Interim TP S$8.73, Next TP S$6.40KepCorp had a spinning top @ SS$9.42 (-0.12, -1,3%) with extremely high volume done at 9.89m shares on 17 Oct 2014 at 3.45pm.  KepCorp (weekly) — Trading in a rectangle, Interim TP S$8.73, Next TP S$6.40 KepCorp (weekly) — Trading in a rectangle, Interim TP S$8.73, Next TP S$6.40

|

|

|

|

Post by zuolun on Oct 24, 2014 13:56:16 GMT 7

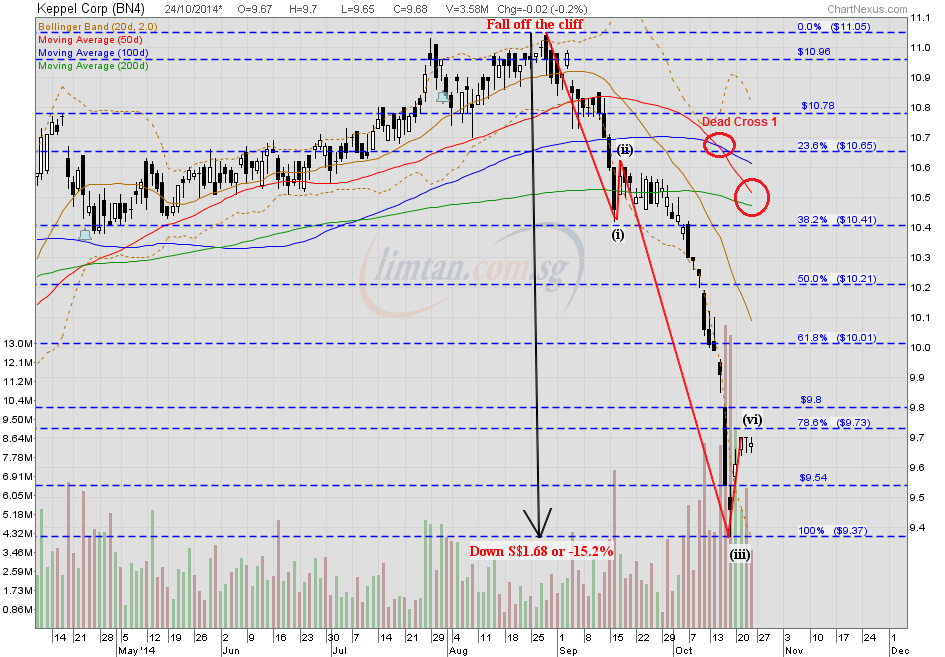

KepCorp — A "Waterfall Decline" with 5-Wave down, Interim TP S$8.73 KepCorp had a spinning top @ S$9.68 (-0.02, -0.2%) with 3.58m shares done on 24 Oct 2014 at 3pm. Immediate support @ S$9.54, immediate resistance S$9.73.

|

|

|

|

Post by zuolun on Oct 28, 2014 15:27:44 GMT 7

Whack a kitty with One Good Trade   KepCorp — A "Waterfall Decline" with 5-Wave down, Interim TP S$8.73, Next TP S$6.40 KepCorp — A "Waterfall Decline" with 5-Wave down, Interim TP S$8.73, Next TP S$6.40KepCorp had a long black marubozu @ S$9.31 (-0.13, -1.4%) with extremely high volume done at 10.1m shares on 28 Oct 2014 at 4.45pm. Immediate support @ S$8.97, immediate resistance S$9.54.

|

|