|

|

Post by zuolun on Aug 17, 2015 15:00:23 GMT 7

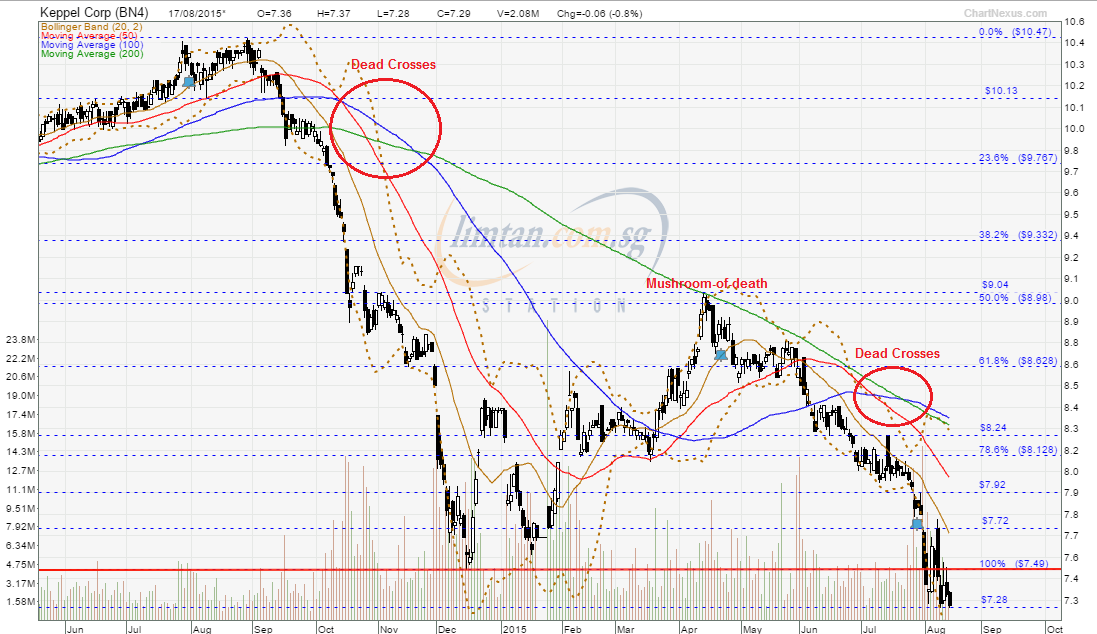

KepCorp ~ Classic MOD chart pattern, interim TP S$6.29KepCorp had a black marubozu and traded @ S$7.29 (-0.06, -0.8%) with 2.08m shares done on 17 Aug 2015 at 1550 hrs. Immediate support @ S$7.00, immediate resistance @ S$7.49.

|

|

|

|

KepCorp

Sept 29, 2015 13:55:38 GMT 7

Post by zuolun on Sept 29, 2015 13:55:38 GMT 7

|

|

|

|

Post by zuolun on Oct 28, 2015 7:04:14 GMT 7

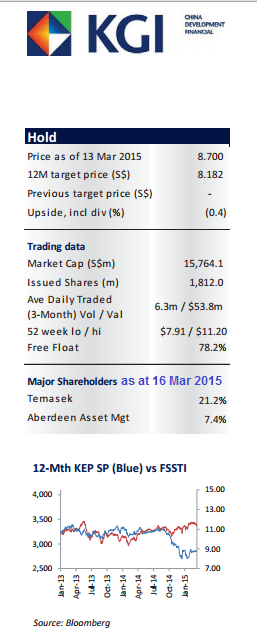

How a lone oil rig embodies the Brazil boom that never was ~ 29 Oct 2015 Eni strikes Saipem deals, selling shares and recovering debt ~ 28 Oct 2015 Nigeria: How oil revenues got diverted to private pockets ~ 28 Oct 2015 Oilpatch to lose $2.1B this year, improve in 2016 ~ 28 Oct 2015 BP’s oil price optimism may prove to be misplaced ~ 28 Oct 2015 BP sees oil prices rising to US$60 a barrel in 2017... ~ 27 Oct 2015 U.S. oil contango widest in five months as stockpiles weigh ~ 27 Oct 2015 Keppel and SembMar's 3Q results indicate sustained weakness: UOB ~ 27 Oct 2015 No end in sight for baffled O&M firms grappling with Sete Brasil conundrum ~ 27 Oct 2015 Corruption currents: Rabobank faces border-money laundering probe ~ 26 Oct 2015 Land ahoy: Can land operations save the day for sinking Keppel? ~ 26 Oct 2015 Next few weeks will reveal full extent of oil industry suffering ~ 26 Oct 2015 Transocean, Shell and DSME to delay two drillship deliveries ~ 26 Oct 2015 Ample crude supplies until mid-2016: IEA chief ~ 26 Oct 2015 Petrobras has another problem to deal with...Oil ~ 25 Oct 2015 More fund managers sue scandal-hit Petrobras ~ 25 Oct 2015 KepCorp:: 3Q15 mixed as O&M weakness offset by property strength ~ 23 Oct 2015 KepCorp’s property earnings rose 51% y-o-y for first nine months of 2015 ~ 23 Oct 2015 Keppel to extend full cooperation to Brazilian authorities in graft probe ~ 23 Oct 2015 SBM Offshore exposed in the Petrobras “bribes-for-contracts” scheme ~ 23 Oct 2015 Brazil deepens probe into alleged corruption at Petrobras ~ 23 Oct 2015 Singapore's Keppel says may face Brazil corruption probe ~ 23 Oct 2015 KepCorp's latest earnings: Long winter ahead? ~ 23 Oct 2015 Three outcomes for Brazil's political crisis ~ 22 Oct 2015 KepCorp's Q3 profit declines 12% ~ 22 Oct 2015 Former Sevan Marine employees involved in bribery case in Brazil? ~ 16 Oct 2015 Petrobras to cut 9-10 offshore rigs loose early ~ 13 Oct 2015 Petrobras and majors sit out worst Brazil oil round in decade ~ 7 Oct 2015 Here’s why Keppel has the upper hand against rival SembMar ~ 30 Sep 2015 Transocean linked to bribery scandal in Brazil ~ 28 Sep 2015 $90B dollar-denominated debt likely spells doom for Petrobras ~ 24 Sep 2015 Petrobras: Don’t buy PBR stock, not even at $5 ~ 22 Oct 2015 In technical analysis, a stock that has made a new low is one that must be treated with caution and to be avoided buying for longterm investment.Petróleo Brasileiro S.A. - Petrobras (PBR) closed @ $4.70 (-0.22, -4.47%) on 27 Oct 2015.  Oil rigs left idling turn caribbean into expensive parking lot Oil rigs left idling turn caribbean into expensive parking lot ~ 24 July 2015  A sign of the times? Drilling rigs idle off Malaysia A sign of the times? Drilling rigs idle off Malaysia ~ 22 July 2015  Oil drilling rigs are idle worldwide, some see opportunity Oil drilling rigs are idle worldwide, some see opportunity ~ 1 July 2015  KepCorp's major shareholders as per KGI's review (Hold) on 16 Mar 2015 KepCorp's major shareholders as per KGI's review (Hold) on 16 Mar 2015- Temasek 21.2%

- Aberdeen 7.4%

- Free Float 78.2%

Macquarie: Keppel Corp is diversified but delays still hurt Macquarie: Keppel Corp is diversified but delays still hurt27 Oct 15 Following a 1.7% decline in the oil price last Friday, Keppel Corp (KEP) traded 0.7% lower after coming back from the weekend. Despite the dip yesterday, KEP’s finishing price of $7.20 is still 2.9% higher than its 50-day moving average, which may suggest short term strength in its share price. Macquarie Equities Research (MER) issued a report on Keppel Corp (KEP) last Thursday (22 Oct) after the conglomerate reported their third quarter’s earnings. Here are some excerpts from the report. KEP reported 3Q15 net profit of S$363m which included one-offs amounting to S$70m, which included gains from the sale of assets and write backs on impairments. Clean net profit was S$293m, down 27% Year-on-Year (YoY) vs the third quarter of 2014 (3Q14). Impact‘Offshore & Marine’ accounts for the big decline: Earnings fell 34% YoY to S$166m as delays caused a fall in revenue recognition. Keppel has acceded to delivery postponement requests of three jack-ups (two from Grupo R and one from Parden Hldgs) from 2015 to early 2016. ‘Property’ provides some resilience with higher contribution: Earnings grew 56% YoY to S$143m. The large increment was due to the increased shareholding of Keppel Land, without which earnings would have been down 18% YoY to S$75m, in MER’s view. A subdued property market in Singapore leading to fewer homes sold relative to China was the main reason for this, in MER’s view. ‘Infrastructure’ a small but stable segment: Earnings declined 11% YoY to S$34m at the net profit level due to Keppel Merlimau Cogen’s noncontribution post the asset sale vs last year. Looking forward:O&M margins decline: The O&M EBIT margins fell to 12.3% in 3Q15 vs 15.0% in 3Q14 (12.3% in 2Q15 as well). MER expects further contract deferments and a changing revenue mix away from jack-ups to continue exerting pressure on margins. Net order book of S$10bn but at risk: Keppel has a net order book of S$10bn, but continual pressures from the low oil price environment presents the key risks of contract cancellations and deferments. Increase reliance on ‘property’: ‘Property’ contributed 40% of earnings in 3Q15 vs 22% in 3Q14, whilst O&M contributed 46% in 3Q15 vs 61% in 3Q14.As headwinds continue to weather against the O&M segment, MER expects the ‘property’ segment to grow in importance to the Group. Earnings and target price revision- MER’s estimates are currently under review.

Price catalyst- 12-month price target: S$10.85 based on a Sum of Parts methodology.

- Catalyst: Contract wins, oil price increments.

Action and recommendationOffshore & Marine under pressure with order book at risks; Property offers some resilience: Keppel continues to face risks of order delays and cancellations, which continues to put pressure on revenues, margins and its balance sheet. Yet KEP’s increased contribution from ‘property’ offers it more resilience vs other pure O&M plays.

|

|

|

|

Post by zuolun on Nov 2, 2015 12:14:07 GMT 7

KepCorp ~ Bearish Gartley formationKepCorp had a black marubozu and traded @ S$6.93 (-0.15, -2.1%) with 2.4m shares done on 2 Nov 2015 at 1305 hrs. Immediate support @ S$6.90, immediate resistance @ S$7.11.

|

|

|

|

Post by zuolun on Dec 13, 2015 11:47:52 GMT 7

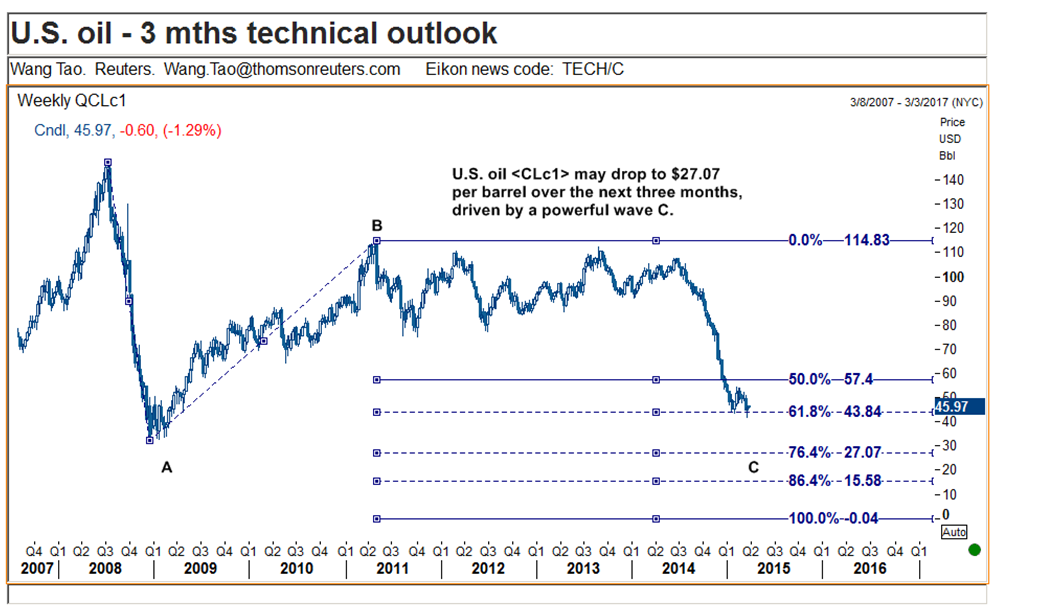

Singapore oil stocks could be heading for more trouble ~ CMC Markets says investors should re-examine Singapore oil stocks following a plunge in oil prices last Friday. The brokerage says Keppel Corp (BN4.SG) is vulnerable. "Not only have they rebounded the most [among Singapore oil stocks], fresh news over a huge turnout at a political protest in Brazil could also lead to a reassessment of Keppel Corp's close association to their key clients in Brazil, who are themselves embroiled in a corruption scandal," Nicholas Teo a market analyst at CMC Markets said in a note on Monday. According to CMC Markets, SembCorp Marine (S51.SG) might also see selling pressure, as it has exposure to similar clients as Keppel Corp. The brokerage add that Keppel has not booked any significant orders year-to-date. "Furthermore, the current orders they have on hand may also prove vulnerable to cancellations due to the bleak outlook for oil," Teo says. Shares of the other two oil firms, Ezion (5ME.SG) and Ezra (5DN.SG) have lost back almost their entire January rally and are languishing near their December lows, CMC adds. ~ 16 Mar 2015 Why is no one paying attention to Singapore oil stocks anymore? ~ 12 Mar 2015 Never catch a falling knife: "At the end of the day, the stock market is about supply and demand and if lots more investors want to sell, it is likely that the prices will drift southwards. Investors may have to sell these non related stocks to cover for their losses in the related sectors. There may also be forced selling for those who have bought shares with margin and are currently under margin calls. " ~ oldman ~ 10 Dec 2015 Are there any reasons for investors to be optimistic over KepCorp? ~ 7 Dec 2015 Outlook for oil rig builders remains cloudy: Analysts ~ 7 Dec 2015 Petrobras reveals 32 companies have been barred while corruption probes continue ~ 4 Dec 2015 It’s all downhill from here for Singapore’s largest rig builders ~ 2 Dec 2015 KepCorp: Completion of Issuance of S$200M 3.725% Notes Due 2023 ~ 30 Nov 2015 Brazilian senator and banker are arrested as Petrobras scandal widens ~ 25 Nov 2015 Prosecutor in Petrobras scandal warns foreign companies ~ 8 Nov 2015 Singapore's Keppel says may face Brazil corruption probe ~ 22 Oct 2015 Major offshore drilling company accused of involvement in Petrobras scandal ~ 27 Sep 2015 Singapore firms with Brazil exposure hit after S&P downgrade ~ 11 Sep 2015 Singapore yards alleged to be part of Brazil bribe scandal ~ 23 Jun 2015 Buying KepCorp using PE ratio and dividend yield ~ 3 Jan 2015 |

|

|

|

Post by zuolun on Dec 15, 2015 13:45:50 GMT 7

|

|

|

|

Post by odie on Jan 9, 2016 13:28:05 GMT 7

|

|

|

|

Post by roberto on Jan 9, 2016 18:18:00 GMT 7

From the article: "...if all revenue recognition from Sete Brasil is stripped out, the resulting reduction in cashflows could raise Sembcorp Marine’s net gearing, while Keppel’s leverage ratio will remain steady thanks to its diversified income stream..." In such a situation, KC is really impressive and makes it an obvious better buy compared to SembMar. |

|

|

|

Post by odie on Jan 9, 2016 20:38:32 GMT 7

From the article: "...if all revenue recognition from Sete Brasil is stripped out, the resulting reduction in cashflows could raise Sembcorp Marine’s net gearing, while Keppel’s leverage ratio will remain steady thanks to its diversified income stream..." In such a situation, KC is really impressive and makes it an obvious better buy compared to SembMar. “Up till now, the widely-held view was that Sete Brasil would scale down its 29-rig program to 15, of which 13 will be from Keppel and SMM, with deliveries over 2015-2020. Talks have been ongoing for Sete Brasil to restructure and secure financing. The prospects of Keppel and SMM receiving payments now look increasingly bleak,” said Maybank Kim Eng. there is also a chance of equity raising thru rights issue. Dividends will be cut. No more 8% yield based on Kep's last traded price. |

|

|

|

Post by zuolun on Jan 11, 2016 8:12:34 GMT 7

“Up till now, the widely-held view was that Sete Brasil would scale down its 29-rig program to 15, of which 13 will be from Keppel and SMM, with deliveries over 2015-2020. Talks have been ongoing for Sete Brasil to restructure and secure financing. The prospects of Keppel and SMM receiving payments now look increasingly bleak,” said Maybank Kim Eng. there is also a chance of equity raising thru rights issue. Dividends will be cut. No more 8% yield based on Kep's last traded price. If KepCorp proposes a 1-for-1 rights issue, the TP would be S$4.07 divided by 2 (ref KepCorp's weekly chart dated 8 Jan 2016). Never catch a falling knife ~ oldman A falling knife in the stock market refers to a stock that experiences a sharp decline and it may collapse > 50% from its breakout/pivotal point, b4 bottoming out. Brazil's mounting woes threaten to wipe out bond rebound in 2016 ~ 11 Jan 2016 Can rig builders stay afloat if Sete Brasil goes bust? ~ 11 Jan 2016 Rig-building woes hitting KepCorp, SembMar hard ~ 8 Jan 2016 Can KepCorp hold up in a recession? ~ 7 Jan 2016 5 reasons why I love KepCorp as an investment as oil prices turn around ~ 4 May 2015 How much is a stock really worth? ~ 10 Feb 2015 KepCorp: A value buy or a value trap? ~ 17 Dec 2014 KepCorp ~ Major bearish trend reversal with 5-wave down, interim TP S$4.96, next TP S$4.45KepCorp closed with a 'counterattack' @ S$5.80 (-0.02, -0.34%) with high volume done at 13.1m shares on 8 Jan 2016. Immediate support @ S$5.48, immediate resistance @ S$5.90.  KepCorp (weekly) ~ Riding on the corrective ABC-wave down, TP S$4.07 KepCorp (weekly) ~ Riding on the corrective ABC-wave down, TP S$4.07 KepCorp (weekly) as at 15 Oct 2014 KepCorp (weekly) as at 15 Oct 2014 Oil may drop more than 20% in three months Oil may drop more than 20% in three months ~ 8 Dec 2015  KepCorp's major shareholders as at 16 Mar 2015 KepCorp's major shareholders as at 16 Mar 2015- Temasek 21.2%

- Aberdeen 7.4%

- Free Float 78.2%

Aberdeen pared down 4,055,000 KepCorp shares to 5.7861% on 19 Nov 2015Sete Brasil’s crisis to weigh on Singapore’s shipbuilders8 Jan 2016 Singapore’s Keppel Corporation and Sembcorp Marine (Sembmarine) are likely to lose several rig orders placed by cash-strapped Sete Brasil. Sete Brasil’s financial health has taken a nosedive in the aftermath of the corruption scandal involving Brazilian oil company Petrobras, according to OCBC Investment Research and UOB Kay Hian Securities. Grupo BTG Pactual and other investors in Sete Brasil will meet this month to decide whether the drilling rig supplier will file for bankruptcy protection after oil prices collapsed amid the scandal, in which Petrobras executives were alleged to have paid kickbacks to Brazilian politicians to win orders. The funds were reportedly taken from Petrobras’s earnings. In addition, Petrobras, which was to have chartered the rigs from Sete Brasil, may reduce the total order from 15 to six rigs. As oil prices exceeded USD100 per barrel in the early 2010s, Sete Brazil ordered six rigs from Keppel and seven rigs at SGD800 million (USD630 million) each from Sembmarine as it had ambitions of owning the world’s biggest deepwater drilling rigs. OCBC believes that the rigs have been incurring negative cashflow for Keppel and Sembmarine since the third quarter of last year. The shipbuilders have collected 28% and 40%, respectively, of the total contract value. “We obtained [from Sete Brasil’s financial statements] the exact amount of cumulative payments by Sete to both Keppel and Sembmarine for each rig as of December 2014,” it said. “Considering Sete has not paid since November last year, we think the numbers should still hold as of now. Do note that Keppel has collected the 10% down payment for the last three rigs [percentage completion: 11%, 4%, and 0%], and this has also contributed to the cash flow situation.” Given the situation, OCBC thinks Keppel and Sembmarine will each build three of the rigs ordered by Sete Brasil. Over at Keppel, two of the rigs are in the advanced stages of construction, while three of the rigs Sembmarine is building are in an advanced stage of build. “To do this, Keppel would need USD1.3 billion in working capital, which would push its net gearing from 0.5x currently to 0.65x, should the group rely solely on debt financing,” OCBC continued. “While this is relatively high, it is still very much below Keppel’s comfortable level of 1.0x [investment grade]. Asset sales would also help to manage gearing.” In the worst-case scenario, should Sete Brasil cancel all the orders, OCBC would need to revise down its earlier 2016 earnings forecast of SGD750 million for Keppel, as there could also be impairments for the rigs. “It is most likely difficult for Keppel and Sembmarine to find another buyer for the rigs at the earlier contracted price of USD800 million per rig,” OCBC said. UOB Kay Hian said an optimistic forecast for Sembmarine’s 2016 profit could be around SGD281.4 million, and at worst it could incur a SGD229.8 million loss. “The negative impact on Keppel would be more muted,” UOB Kay Hian said. “Moreover, Keppel has the benefit of sizeable earnings from its property business.” |

|

|

|

KepCorp

Jan 19, 2016 15:44:07 GMT 7

Post by zuolun on Jan 19, 2016 15:44:07 GMT 7

|

|

|

|

Post by zuolun on Jan 22, 2016 5:48:17 GMT 7

Keppel uncertainty prolongs as Brazil client delays decision ~ 22 Jan 2016 Iran's oil goal: Selling 1 million more barrels a day ~ 22 Jan 2016 Oil rallies hard, but this is not the bottom ~ 21 Jan 2016 US oil settles up $1.18, or 4.2%, at $29.53 a US oil settles up ~ 21 Jan 2016 Sell into an oversold bounce ~ 20 Jan 2016 KepCorp’s Q4 profit slumps 44% on Brazil woes, oil plunge ~ 21 Jan 2016 KepCorp: Unaudited results for the fourth quarter and Full-Year ended 31 December 2015- 4Q 2015 Net Profit down 44% to S$405 million, compared to 4Q 2014's S$726 million.

- FY 2015 Net Profit down 19% to S$1,525 million, compared to FY 2014's S$1,885 million.

- Earnings per Share was 84 cents, down 19% from FY 2014's 103.8 cents.

- Annualised Return on Equity of 14.2%.

- FY 2015 Economic Value Added decreased to S$648 million from S$1,778 million YoY.

- Cash outflow of S$694 million.

- Net gearing was 0.53x.

- Total cash dividends of 34.0 cents per share for FY 2015.

KepCorp ~ Major bearish trend reversal with 5-wave down, interim TP S$4.45, next TP S$4.07KepCorp closed with a black marubozu @ S$4.80 (-0.03, -0.6%) with high volume done at 12.9m shares on 21 Jan 2016. Immediate support @ S$4.64, immediate resistance @ S$4.96.

|

|

|

|

KepCorp

Jan 23, 2016 11:56:39 GMT 7

Post by odie on Jan 23, 2016 11:56:39 GMT 7

|

|

|

|

KepCorp

Jan 25, 2016 10:53:25 GMT 7

Post by zuolun on Jan 25, 2016 10:53:25 GMT 7

Keppel to consolidate and grow its asset management business ~ 25 Jan 2016 Keppel axes over 6,000 O&M workers as contracts dry upSingapore Business Review – Fri, Jan 22, 2016 5:18 PM SGT It needs to rightsize to stay afloat. Keppel Corporation’s shrinking staff numbers paint a disheartening picture of its battered offshore and marine segment. In its latest earnings presentation, Keppel reported that it has let go of about 6,000 direct staff in its local and overseas yards since January 2015, in a bid to slash costs and optimise its current operations. Meanwhile, the size of its Singapore subcontract workforce has dropped by about 7,900 workers, representing a fourth of Keppel O&M’s subcontract employees. Keppel suffered a wave of contract deferrals in the past year. It started the 2015 with the expected deliveries of 15 drilling jackup rigs, but eight of these have since been pushed into 2016. “Bracing ourselves for a possibly long winter, we need to ensure that our overheads are well under control and that we are ready if the market conditions get tougher. We are preparing ourselves to meet the near term challenges by rightsizing our operations and resources,” said Keppel CEO Loh Chin Hua at the group’s earnings presentation. Although Keppel is focussed on reducing costs, Loh stressed that it is still investing prudently in R&D as well as improving its productivity and core competencies. “The storm hitting the offshore and marine business is not one which we are unfamiliar. Keppel had braved through many cycles, emerging stronger and more resilient each time,” Loh said.

|

|

|

|

KepCorp

Jan 26, 2016 18:12:49 GMT 7

Post by odie on Jan 26, 2016 18:12:49 GMT 7

|

|