|

|

Post by zuolun on Dec 17, 2013 15:38:33 GMT 7

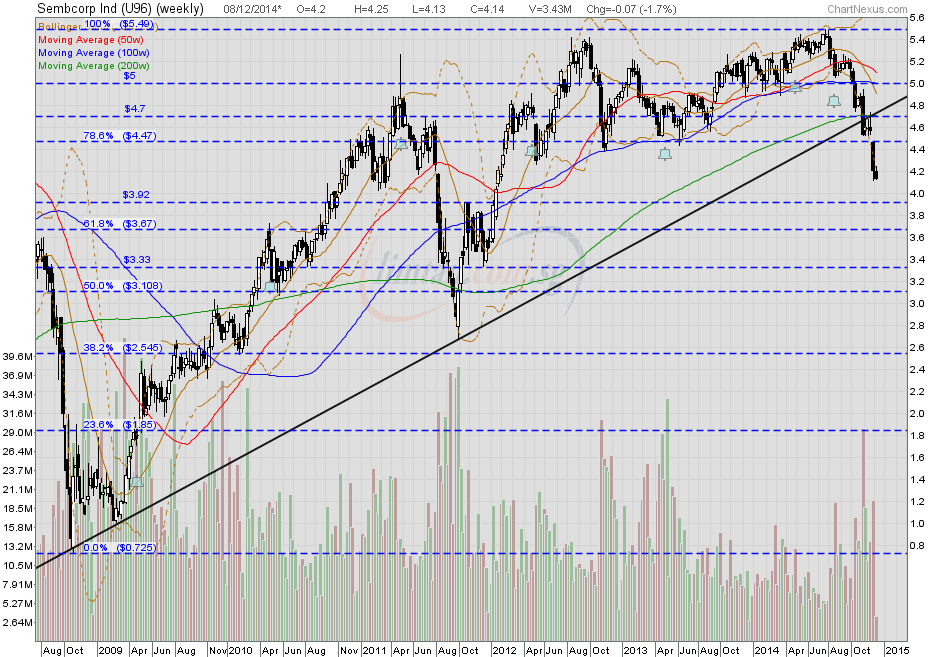

SembCorp — Trading in a rectangle; BUY at support and SELL at resistance SembCorp (weekly) — Trading in an upward sloping channel SembCorp (weekly) — Trading in an upward sloping channel

|

|

|

|

Post by zuolun on Sept 14, 2014 15:10:53 GMT 7

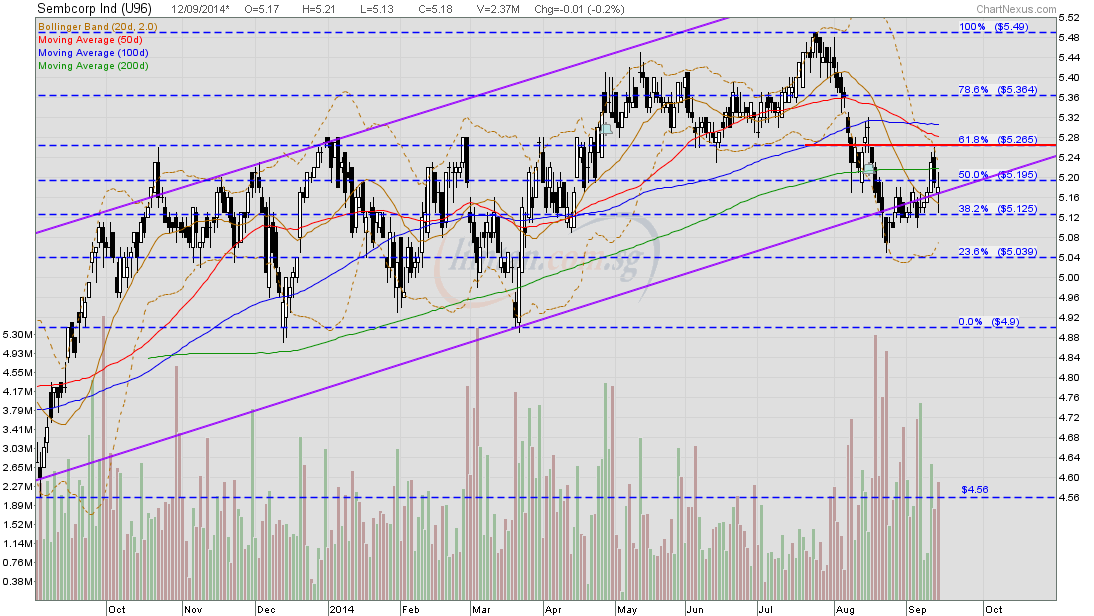

CIMB: Sembcorp Industries - India plug-in, Add TP S$6.14 — 11 Sep 2014 SembCorp Ind — Trading in an upward sloping channelSembCorp Ind closed with a spinning top @ S$5.18 (-0.01, -0.2%) with 2.37m shares done on 12 Sep 2014. Immediate support @ S$5.13, immediate resistance @ S$5.265.

|

|

|

|

Post by zuolun on Oct 13, 2014 18:03:55 GMT 7

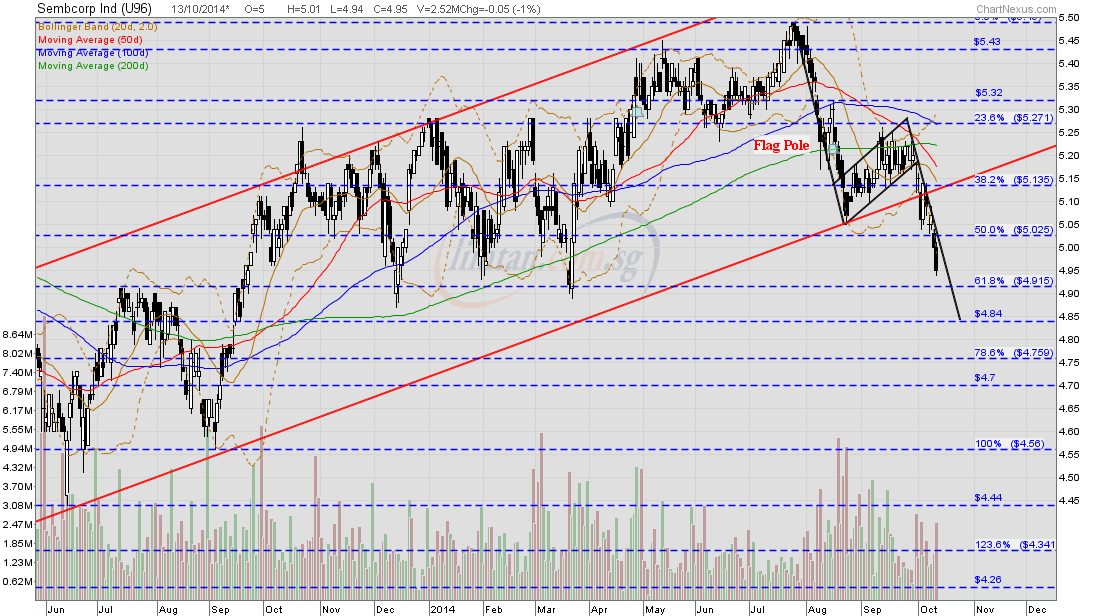

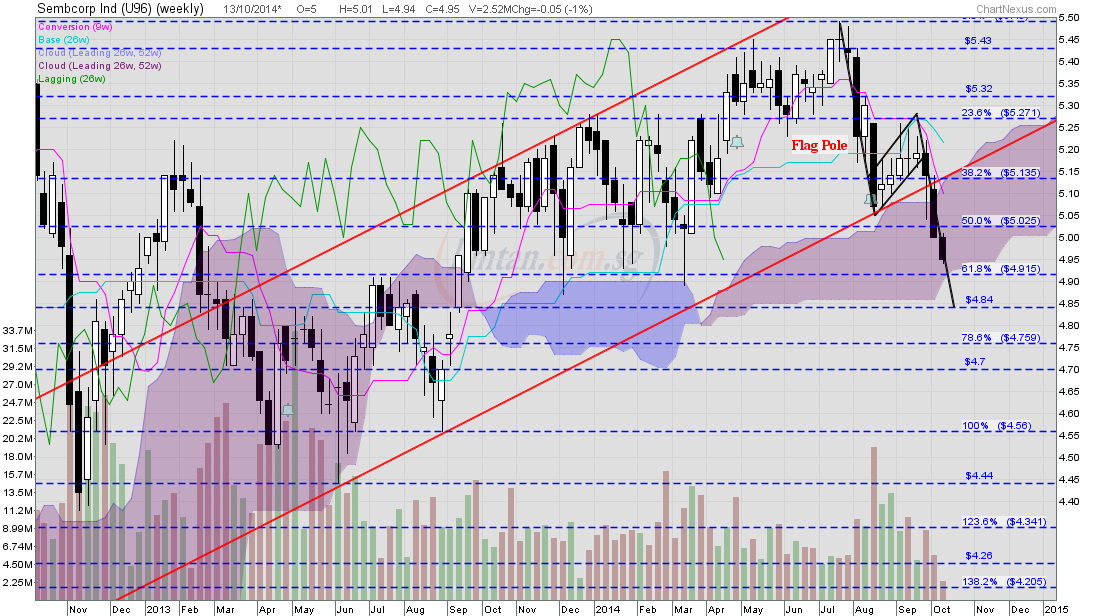

SembCorp Ind — Bear Flag Breakout, Interim TP S$4.84, Next TP S$4.56SembCorp Ind closed with a long black marubozu @ S$4.95 (-0.05, -1%) with 2.52m shares done on 13 Oct 2014. Immediate support @ S$4.92, immediate resistance @ S$5.03.  SembCorp Ind (weekly) — Uptrend is broken, critical support @ S$4.70 SembCorp Ind (weekly) — Uptrend is broken, critical support @ S$4.70

|

|

|

|

Post by zuolun on Nov 8, 2014 12:12:42 GMT 7

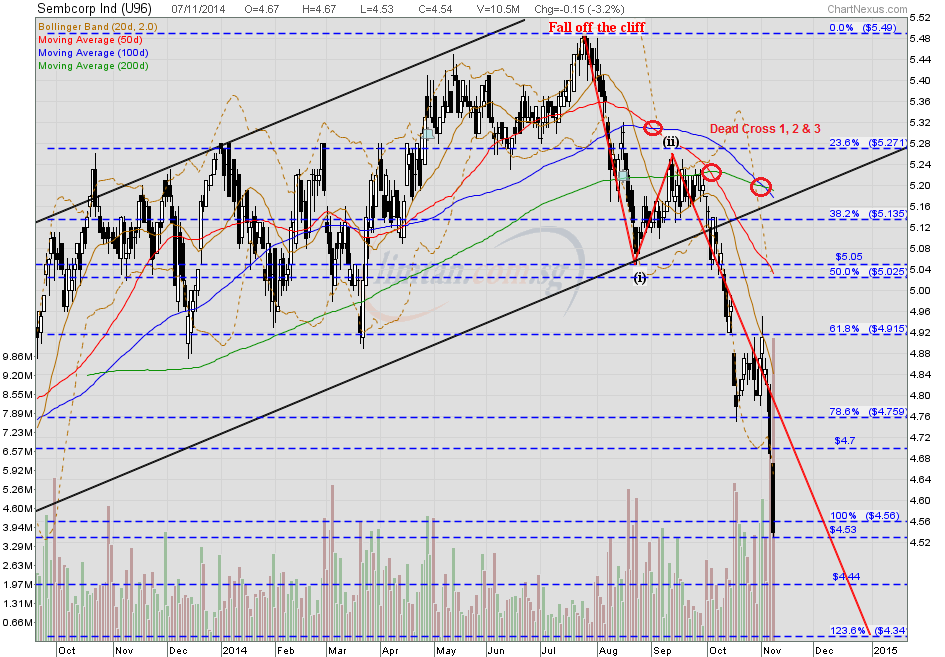

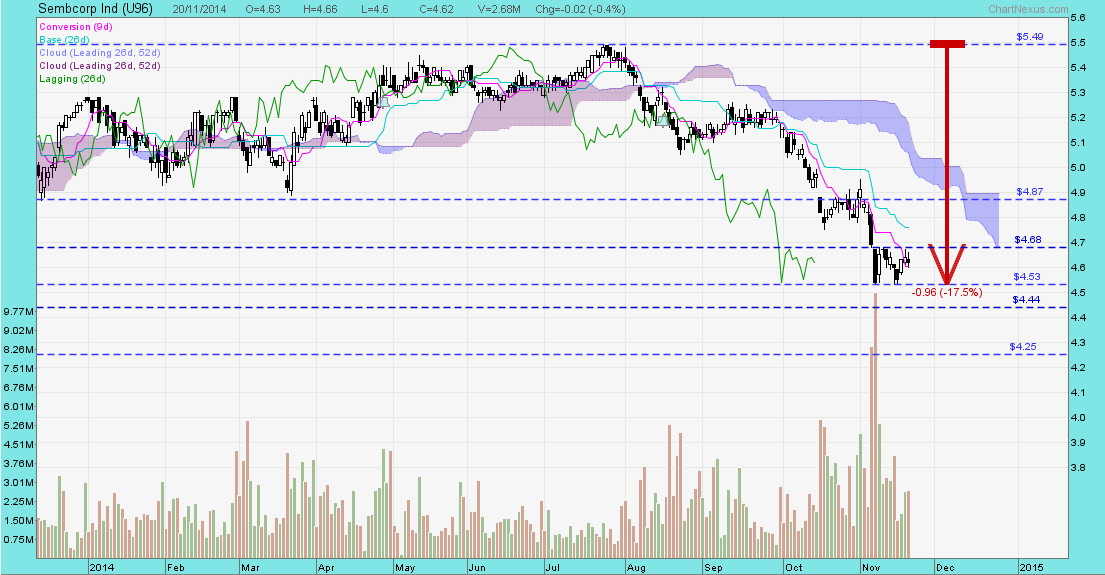

SembCorp Ind’s 9M falls 6% to $560.5m — 6 Nov 2014 SembCorp Ind — A "Waterfall Decline" chart pattern with 5 waves down, Interim TP S$4.34SembCorp Ind closed with a long black marubozu @ S$4.54 (-0.15, -3.2%) with extremely high volume done at 10.5m shares on 7 Nov 2014. Immediate support @ S$4.44, immediate resistance @ S$4.70.

|

|

|

|

Post by scg8866t on Nov 21, 2014 6:32:57 GMT 7

|

|

|

|

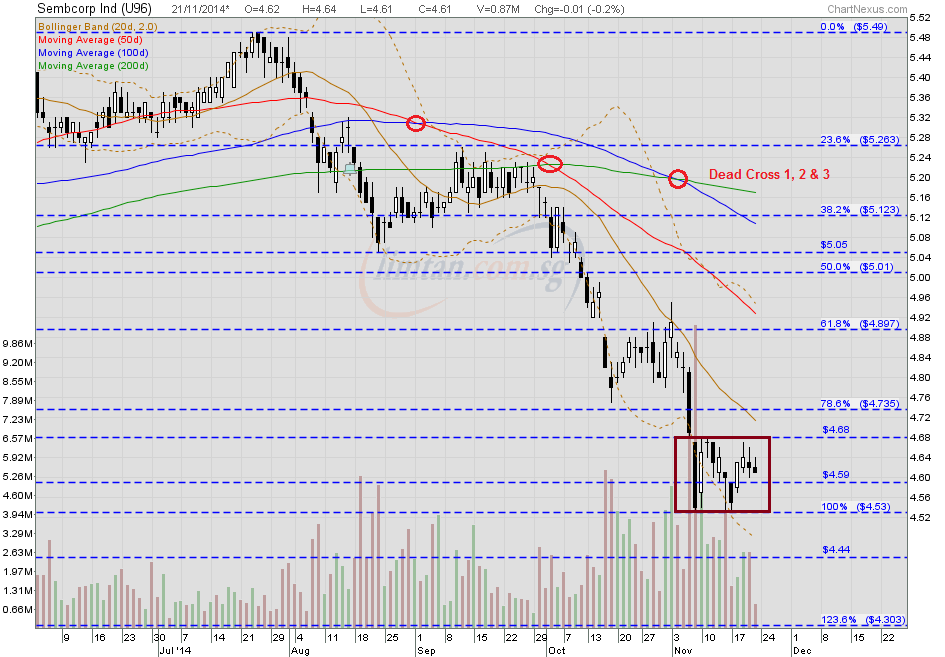

Post by zuolun on Nov 21, 2014 9:12:31 GMT 7

SembCorp Ind — A "Waterfall Decline", Interim TP S$4.25SembCorp Ind had an inverted hammer @ S$4.61 (-0.01, -0.2%) with 870 lots done on 21 Nov 2014 at 9.55am. Immediate support @ S$4.59, immediate resistance @ S$4.68.

|

|

|

|

Post by zuolun on Dec 8, 2014 22:17:16 GMT 7

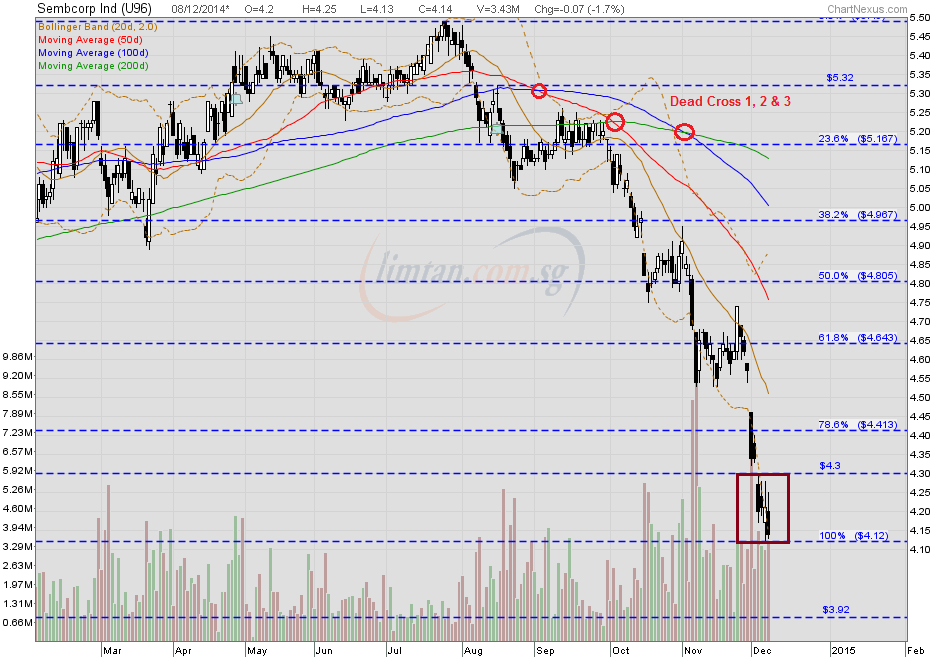

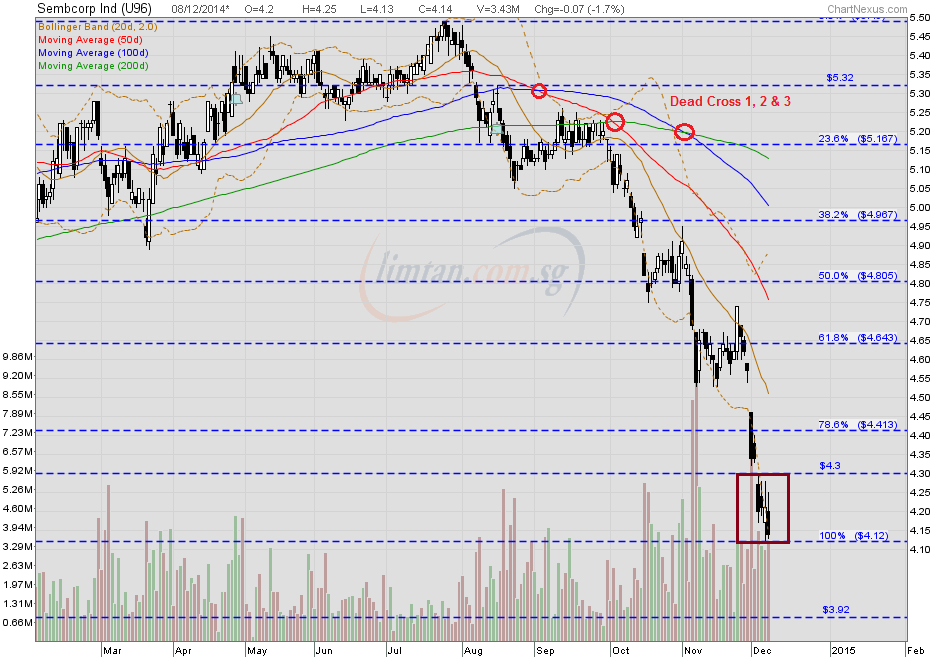

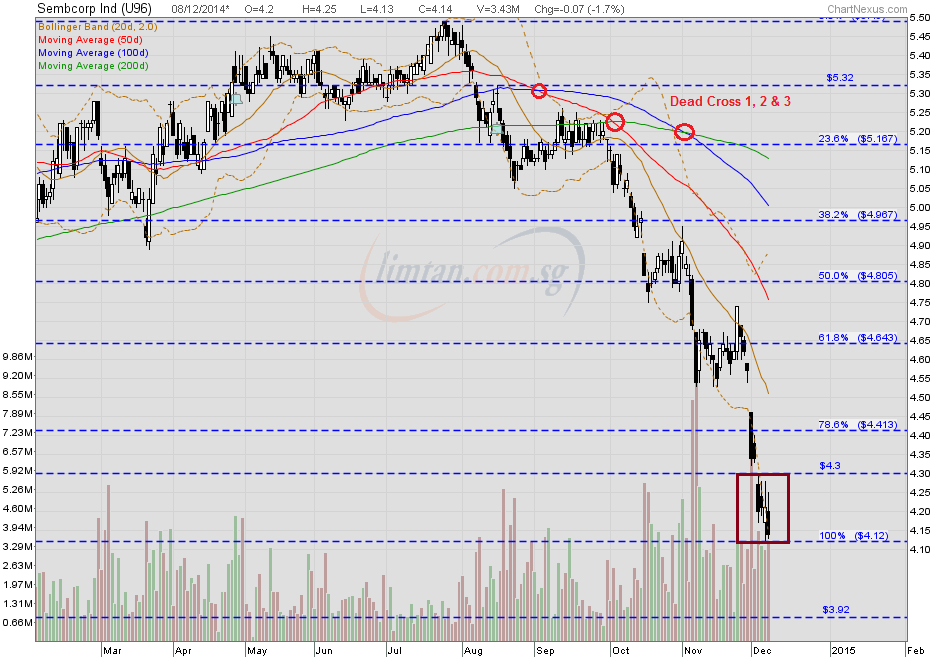

"A stock is never too high to buy and never too low to short." — Jesse LivermoreSembCorp Ind — A "Waterfall Decline", Interim TP S$3.65SembCorp Ind closed with a black marubozu @ S$4.14 (-0.07, -1.7%) with 3.43m shares done on 8 Dec 2014. Immediate support @ S$3.92, immediate resistance @ S$4.30.  SembCorp Ind (weekly) — Uptrend is broken, biased to the downside, TP S$3.33 SembCorp Ind (weekly) — Uptrend is broken, biased to the downside, TP S$3.33

|

|

|

|

Post by zuolun on Dec 10, 2014 16:33:47 GMT 7

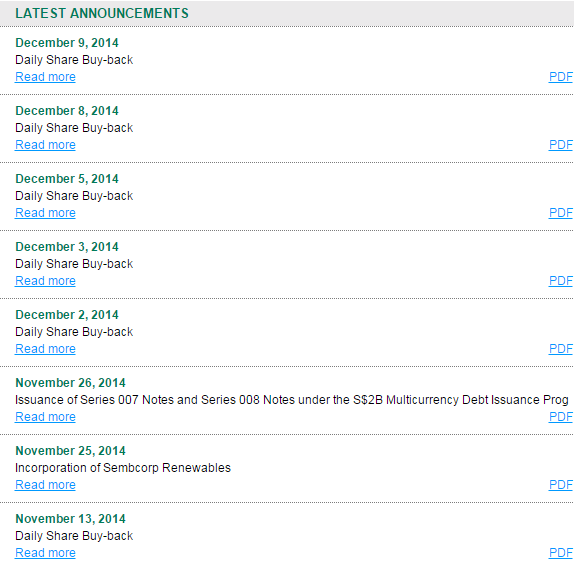

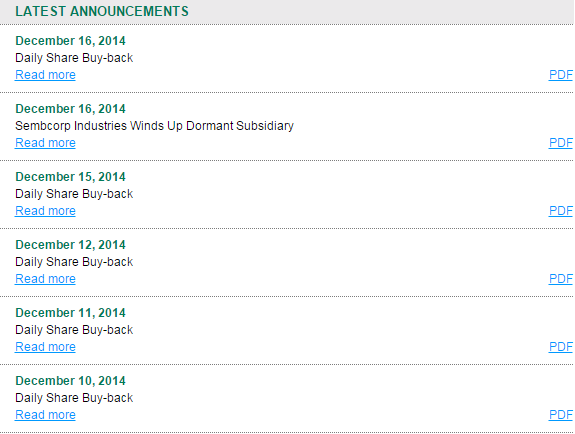

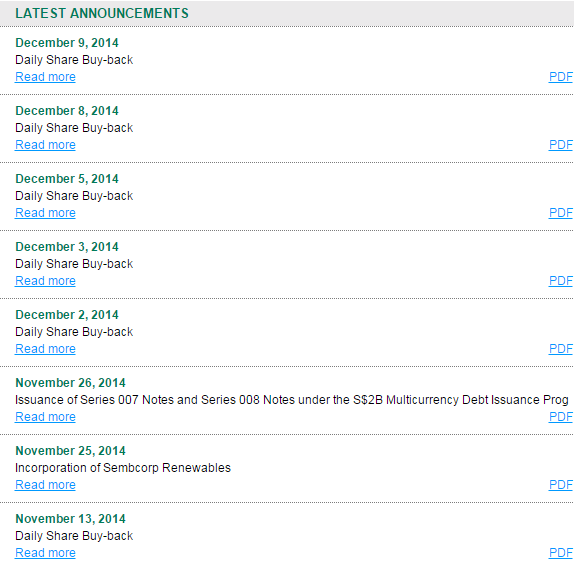

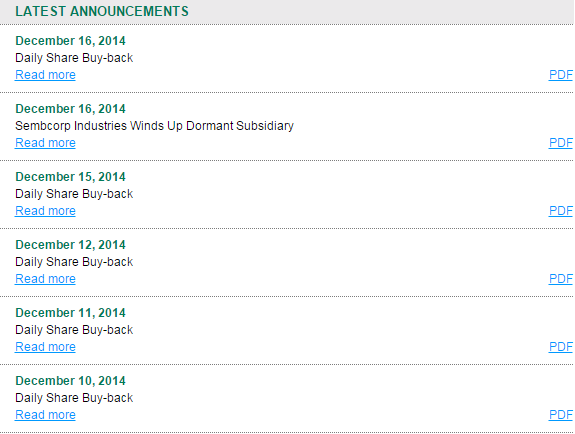

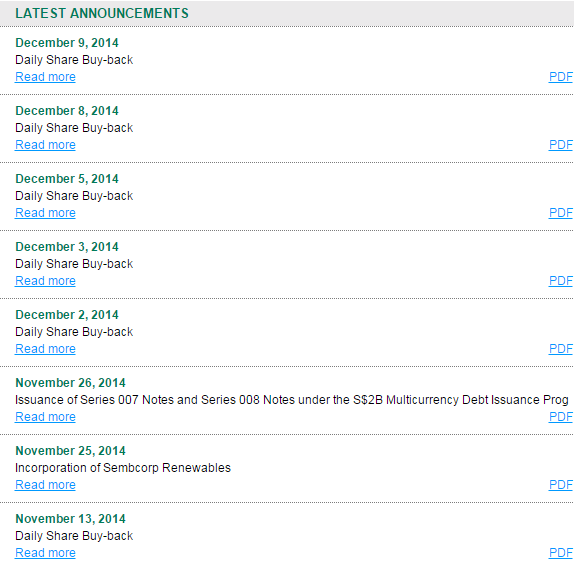

Hi Bro Zuolun, Recently, I took a small position in Sembcorp though I know the weakness of oil related counters. I have worked in one of the subsidiary of Sembcorp before and thus I like their business concept especially the utilities division. In the best of odds, will it be similar to what you portray for the 3 stocks? Win peanuts, lose coconut was my favourite phrase when in Shareinvestors. It is applicable nowsaday...for many stocks to the detriments of many people. Sino Grandness, PSL and Ezion are 3 good examples of ' make peanuts but lose coconut.' Typical bull traps are normally set up by those who're heavily vested, kena stuck deep with huge losses and awaiting for gullible retail investors to bailout at higher share prices. Hi Bros The charts above look scary....Really cannot buy? I am looking at keppel corp or sembcorp. pain & hope, 买入任何下降趋势中的股票之前,一定要摸摸庄家的底。SembCorp's share price would have plunged much lower to-date if the company did not execute and follow-thru its 'Daily share buyback programme'. SembCorp has been buying back it shares on the open market |

|

|

|

Post by hope on Dec 10, 2014 22:35:30 GMT 7

Thanks zuolun for the update.

I am not aware that there is buy back from the company for the past days... I thought it is holding well and therefore might be a good time to buy some.

I will wait a while more before buying.

Good night.

|

|

|

|

Post by zuolun on Dec 11, 2014 10:12:23 GMT 7

Thanks zuolun for the update. I am not aware that there is buy back from the company for the past days... I thought it is holding well and therefore might be a good time to buy some. I will wait a while more before buying. Good night. hope, Let the BBs short till bare bones, do not catch a falling knife; in a bear market, any technical rebounds = short / sell on strength, not buy.   |

|

|

|

Post by hope on Dec 11, 2014 10:14:14 GMT 7

Bro, can give a shout here when time to buy ?

|

|

|

|

Post by zuolun on Dec 11, 2014 12:33:34 GMT 7

Bro, can give a shout here when time to buy ? "It is said that if you know your enemies and know yourself, you will not be imperiled in a hundred battles; if you do not know your enemies but do know yourself, you will win one and lose one; if you do not know your enemies nor yourself, you will be imperiled in every single battle." How well do you know yourself? — A high margin of safety is a strategic approach to investing, which means you're fighting on high ground; whereas intraday scalping strategy winning 1 to 2 bids of profit is that, you're fighting on low ground. The Pipeline (The Pablo and Bruno story)The Best Management Advice From ‘The Art Of War’By Max Nisen 3 Jan 2014 “The Art Of War” is one of the most famous books of all time, said to be written by the legendary Chinese general Sun Tzu around the fifth century B.C. Some of the advice is pretty narrowly focused and dated (for instance, what generals should do when confronted with different types of terrain). But a lot of it is applicable to leadership and management today despite being thousands of years old. We’ve broken out a few of the best pieces of business advice from the timeless classic. “A wise general makes a point of foraging on the enemy. One cartload of the enemy’s provisions is equivalent to twenty of one’s own, and likewise a single picul of his provender is equivalent to twenty from one’s own store.”This sentiment is pretty much universally applicable to business. Something obtained cheaply or for free is vastly more valuable than drawing from company cash or savings to buy it. In practice, that means both looking for things that are underpriced and having funds available when demand and prices are low. “When you engage in actual fighting, if victory is long in coming, then men’s weapons will grow dull and their ardor will be damped. If you lay siege to a town, you will exhaust your strength.”This is a concept that’s repeated several times. When a project or initiative takes too long, people get tired or bored, the competition knows too much about it, it gets outdated, and other companies or people take advantage. “To see victory only when it is within the ken of the common herd is not the acme of excellence.”A strategy, product, or concept that is obvious has probably already been done. Those that are the best are the ones that succeed without people really noticing. They not only become part of the fabric of people’s lives, they’re also not as easily replicated. “The clever combatant looks to the effect of combined energy, and does not require too much from individuals. Hence his ability to pick out the right men and utilize combined energy.”Another axiom in the book compares using combined energy to rolling logs or stones. People moving together with momentum go dramatically faster. Depending on individuals alone means they’ll wear out, accomplish less, and leave other people behind. “If you order your men to roll up their buff-coats, and make forced marches without halting day or night, covering double the usual distance at a stretch, doing a hundred LI in order to wrest an advantage, the leaders of all your three divisions will fall into the hands of the enemy.”Here, a “Li” equals 500 meters. Tzu goes on to say that if you do something like this, the strongest men will be in front, the less motivated will fall behind, and a tiny fraction will reach their destination. Pushing incredibly hard to get ahead of a competitor might gain temporary advantage, but it will be very short-lived. |

|

|

|

Post by zuolun on Dec 12, 2014 16:15:36 GMT 7

Hi Bros The charts above look scary....Really cannot buy? I am looking at keppel corp or sembcorp. SembCorp closed with a doji @ S$4.24 (-0.05, -1.2%) with 1.83m shares done on 12 Dec 2014. Despite company's daily share buy-back, the stock is still the prime target of The Flying Guillotine 血滴子  |

|

|

|

Post by zuolun on Dec 17, 2014 5:31:49 GMT 7

Hi Bro Zuolun, Recently, I took a small position in Sembcorp though I know the weakness of oil related counters. I have worked in one of the subsidiary of Sembcorp before and thus I like their business concept especially the utilities division. In the best of odds, will it be similar to what you portray for the 3 stocks? Win peanuts, lose coconut was my favourite phrase when in Shareinvestors. It is applicable nowsaday...for many stocks to the detriments of many people. Hi Bros The charts above look scary....Really cannot buy? I am looking at keppel corp or sembcorp. SembCorp closed with a doji @ S$4.24 (-0.05, -1.2%) with 1.83m shares done on 12 Dec 2014. Despite company's daily share buy-back, the stock is still the prime target of The Flying Guillotine 血滴子  SembCorp hit a new low of S$4.06 and closed @ S$4.10 (-0.02, -0.5%) with 3.48m shares done on 16 Dec 2014 despite its 'Daily share buyback programme'. The S$4 mark is unlikely to hold.  "A stock is never too high to buy and never too low to short." — Jesse LivermoreSembCorp Ind — A "Waterfall Decline", Interim TP S$3.65SembCorp Ind closed with a black marubozu @ S$4.14 (-0.07, -1.7%) with 3.43m shares done on 8 Dec 2014. Immediate support @ S$3.92, immediate resistance @ S$4.30.  |

|

|

|

Post by pain on Dec 18, 2014 11:00:28 GMT 7

I remembered the lone swordman (Temasek) with the long sword was the person who broke the 血滴子。。  [/quote] SembCorp closed with a doji @ S$4.24 (-0.05, -1.2%) with 1.83m shares done on 12 Dec 2014. Despite company's daily share buy-back, the stock is still the prime target of The Flying Guillotine 血滴子  SembCorp hit a new low of S$4.06 and closed @ S$4.10 (-0.02, -0.5%) with 3.48m shares done on 16 Dec 2014 despite its 'Daily share buyback programme'. The S$4 mark is unlikely to hold.  "A stock is never too high to buy and never too low to short." — Jesse LivermoreSembCorp Ind — A "Waterfall Decline", Interim TP S$3.65SembCorp Ind closed with a black marubozu @ S$4.14 (-0.07, -1.7%) with 3.43m shares done on 8 Dec 2014. Immediate support @ S$3.92, immediate resistance @ S$4.30.  [/quote] |

|