|

|

Post by zuolun on Jan 18, 2014 9:03:17 GMT 7

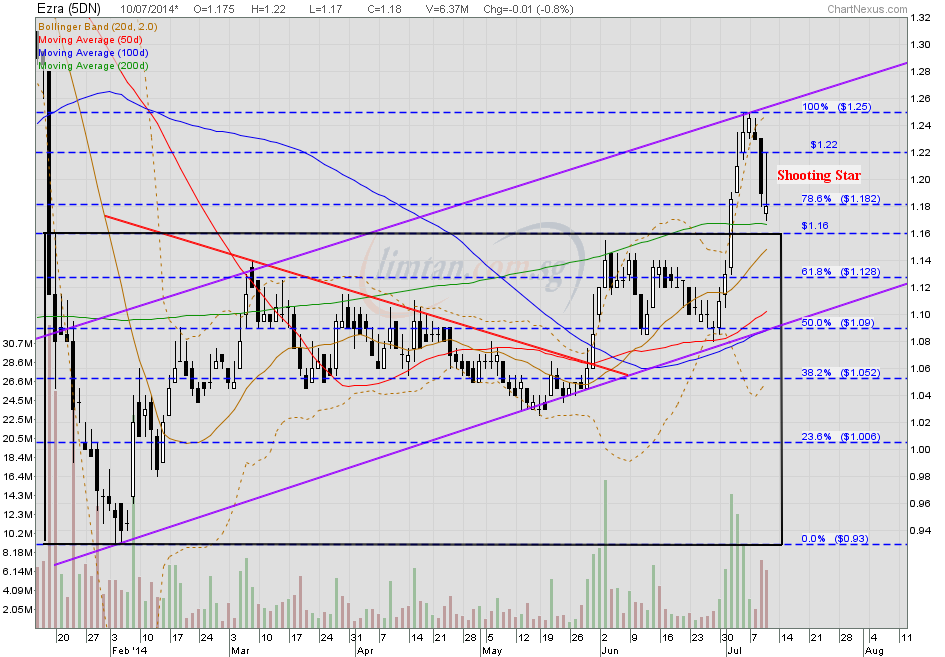

Ezra — Uptrend is broken; share price collapsedImmediate support @ S$1.08, immediate resistance @ S$1.16. Ezra closed with a long black marubozu @ S$1.115 (-0.17, -13.2%) with extremely high volume done at 32.7m shares on 17 Jan 2014.  Ezra (weekly) — Trading in a rectangle Ezra (weekly) — Trading in a rectangle

|

|

|

|

Post by zuolun on Jan 20, 2014 9:58:21 GMT 7

Using the price and the volume as a trend indicator:1. High volume is bearish when the stock is in distributing mode. 2. High volume is bullish when the stock is in accumulating mode. 3. Do not catch a stock falling on high volume or one that is rising on thin volume. Ezra — A "waterfall-decline" chart patternEzra traded with a spinning top @ S$1.075 (-0.04, -3.6%) with high volume done at 21.1m shares on 20 Jan 2014 at 11.44am. Should crucial support @ S$1.05 break convincingly, expect Ezra to hit next support @ S$0.835.

|

|

|

|

Ezra

Jun 3, 2014 19:54:45 GMT 7

Post by simplemind on Jun 3, 2014 19:54:45 GMT 7

ZL bro,

ezra attempt to breakout today with slightly higher volume. What do u think?

|

|

|

|

Ezra

Jul 9, 2014 8:27:03 GMT 7

Post by zuolun on Jul 9, 2014 8:27:03 GMT 7

ZL bro, ezra attempt to breakout today with slightly higher volume. What do u think? Ezra had a black marubozu @ S$1.20 (-0.03, -2.4%) with volume done at 1.21m shares on 9 July 2014 at 9.20am. Immediate support @ S$1.16, immediate resistance @ S$1.25.   |

|

|

|

Ezra

Jul 12, 2014 16:52:15 GMT 7

oldman likes this

Post by zuolun on Jul 12, 2014 16:52:15 GMT 7

Ezra — Trading in an upward sloping channelEzra closed with a spinning top @ S$1.195 (+0.015, +1.3%) with 2.74m shares done on 11 July 2014. Immediate support @ S$1.16, immediate resistance @ S$1.22.

|

|

|

|

Post by zuolun on Oct 9, 2014 14:35:07 GMT 7

|

|

|

|

Post by zuolun on Nov 26, 2014 15:10:48 GMT 7

|

|

|

|

Post by zuolun on Dec 8, 2014 18:24:48 GMT 7

|

|

|

|

Ezra

Mar 7, 2015 23:45:23 GMT 7

Post by simplemind on Mar 7, 2015 23:45:23 GMT 7

ZL bro,

what do u think of Ezra?

cheers

|

|

|

|

Ezra

Mar 8, 2015 5:31:32 GMT 7

Post by zuolun on Mar 8, 2015 5:31:32 GMT 7

|

|

|

|

Post by zuolun on Mar 17, 2015 11:44:48 GMT 7

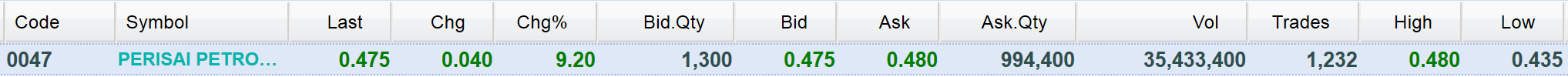

Ezra hit low of S$0.43, high of S$0.48 and traded @ S$0.445 (-0.035, -7.3%) with 8.495m shares done on 17 Mar 2015 at 12.45pm. See the big picture of oil and oil related companies...all the charts are pointing down = "one-way ticket".  Ezra Vs Ezion Ezra Vs Ezion ~ Ezra's chart pattern was not only similar but identical to Ezion's, prior to its collapse in 2008. Singapore oil stocks could be heading for more trouble ~ CMC Markets says investors should re-examine Singapore oil stocks following a plunge in oil prices last Friday. The brokerage says Keppel Corp (BN4.SG) is vulnerable. "Not only have they rebounded the most [among Singapore oil stocks], fresh news over a huge turnout at a political protest in Brazil could also lead to a reassessment of Keppel Corp's close association to their key clients in Brazil, who are themselves embroiled in a corruption scandal," Nicholas Teo a market analyst at CMC Markets said in a note on Monday. According to CMC Markets, SembCorp Marine (S51.SG) might also see selling pressure, as it has exposure to similar clients as Keppel Corp. The brokerage add that Keppel has not booked any significant orders year-to-date. "Furthermore, the current orders they have on hand may also prove vulnerable to cancellations due to the bleak outlook for oil," Teo says. Shares of the other two oil firms, Ezion (5ME.SG) and Ezra (5DN.SG) have lost back almost their entire January rally and are languishing near their December lows, CMC adds. ~ 16 Mar 2015 Why is no one paying attention to Singapore oil stocks anymore? ~ 12 Mar 2015

|

|

|

|

Post by zuolun on Apr 3, 2015 16:44:19 GMT 7

|

|

|

|

Post by sptl123 on Apr 3, 2015 17:34:14 GMT 7

Bro Zuolun, On your post On Dec 8, 2014 at 7:24pm " Ezra — A "Waterfall Decline", interim TP S$0.45

Ezra closed with a long black marubozu @ S$0.56 (-0.045, -7.4%) with 10.7m shares done on 8 Dec 2014.

Price now went below your TP. If anyone long the short since, in 4 months the return from gain is about 75% annually  . That is a good example of your: whack a kitty with One Good Trade.  I learned 3 lessons: 1) There are plenty of opportunities in the market. It is so easy to make good money if you have the kung-Fu. 2) There are just enough risk investing in stock market. It can make a poor person very poor. 3) Remind me of The three rules to survive in trading, "Cut loss, cut loss and cut loss". I have many relatives still holding counters such as Jadason, Life Brandz, Advance SCT, and Metech(Aka Centillion) . The value of these stock now is only about 1-3% of their prime-day  |

|

|

|

Post by zuolun on Jun 2, 2015 12:18:31 GMT 7

|

|

|

|

Ezra

Jun 2, 2015 21:10:32 GMT 7

Post by sptl123 on Jun 2, 2015 21:10:32 GMT 7

Bro Zuolun, I have 2 questions: 1) In the following chart, why the 100% is at the point ($0.59)? 2) Ezra fall off the cliff but what is the reason for its subsidiary to close so high today?  |

|