|

|

Post by zuolun on Dec 9, 2014 16:15:15 GMT 7

Sino Grandness, PSL and Ezion are 3 good examples of ' make peanuts but lose coconut.' Typical bull traps are normally set up by those who're heavily vested, kena stuck deep with huge losses and awaiting for gullible retail investors to bailout at higher share prices.

|

|

|

|

Post by pain on Dec 10, 2014 15:11:18 GMT 7

Hi Bro Zuolun, Recently, I took a small position in Sembcorp though I know the weakness of oil related counters. I have worked in one of the subsidiary of Sembcorp before and thus I like their business concept especially the utilities division. In the best of odds, will it be similar to what you portray for the 3 stocks? Win peanuts, lose coconut was my favourite phrase when in Shareinvestors. It is applicable nowsaday...for many stocks to the detriments of many people. Sino Grandness, PSL and Ezion are 3 good examples of ' make peanuts but lose coconut.' Typical bull traps are normally set up by those who're heavily vested, kena stuck deep with huge losses and awaiting for gullible retail investors to bailout at higher share prices. |

|

|

|

Post by hope on Dec 10, 2014 15:21:29 GMT 7

Hi Bros

The charts above look scary....Really cannot buy? I am looking at keppel corp or sembcorp.

|

|

|

|

Post by zuolun on Feb 6, 2016 9:21:16 GMT 7

Forise's chart pattern is exactly the same as Rowsley. (Rowsley had a bearish descending triangle breakout followed by a bear pennant breakout; it hit TP S$0.114 and went further down to hit a last low @ S$0.109 on 25 Aug 2015 then.) Forise ~ Bull Trap Rowsley ~ A Big Bull Trap Rowsley — Bear Pennant Breakout, major bearish trend reversal with 5-Wave down, Interim TP S$0.142, Next TP S$0.114Rowsley had a hammer @ S$0.175 (-0.008, -4.4%) with 3.48m shares done on 8 Oct 2014 at 2.10pm. Immediate support @ S$0.153, immediate resistance @ S$0.19.  |

|

|

|

Post by zuolun on Feb 9, 2016 10:42:26 GMT 7

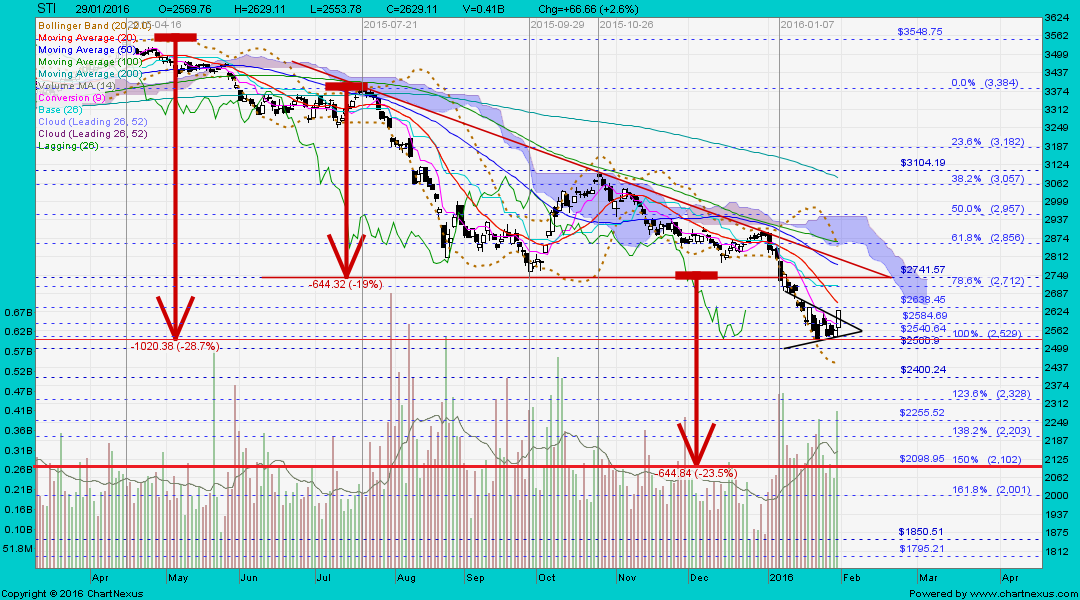

STI ~ Bull Trap (X2)STI @ 2623.21 (+64.72, +2.5%) on 5 Feb 2016 STI @ 2629.11 (+66.66, +2.6%) on 29 Jan 2016

|

|

|

|

Post by zuolun on Mar 10, 2016 7:48:47 GMT 7

FORISE ~ Bull Trap Issue and allotment of 10m new ordinary shares Issue and allotment of 10m new ordinary shares ~ 6 Nov 2015 Proposed adjustment of warrants issued to SAPO ~ 12 Jun 2015 FORISE's EGM: Seeking insights into new direction of the company ~ 28 Dec 2015 #11. Q - The previous owner under Great Group Holdings issued 138 million private warrants to an associate SAPO group. So far 10 million warrants have been converted. Can you elaborate on this as it "seems" to be something that is "hanging over" and affecting the stock price of FIL? Will the conversion of these warrants be publicly announced and shares held by SAPO be publicly announced? A - This is an old issue from the previous management. The conversion of these warrants by SAPO will be publicly announced (since it affects the entire market cap), but the shares held by SAPO will not be publicly announced since they are below the 5% threshold. Also J reminded me that these warrants will expire in July 2016. (No further elaboration as the management team do not appear to be too concerned with these warrants issued to SAPO).

|

|