|

|

Ezion

Jul 9, 2014 8:12:10 GMT 7

Post by zuolun on Jul 9, 2014 8:12:10 GMT 7

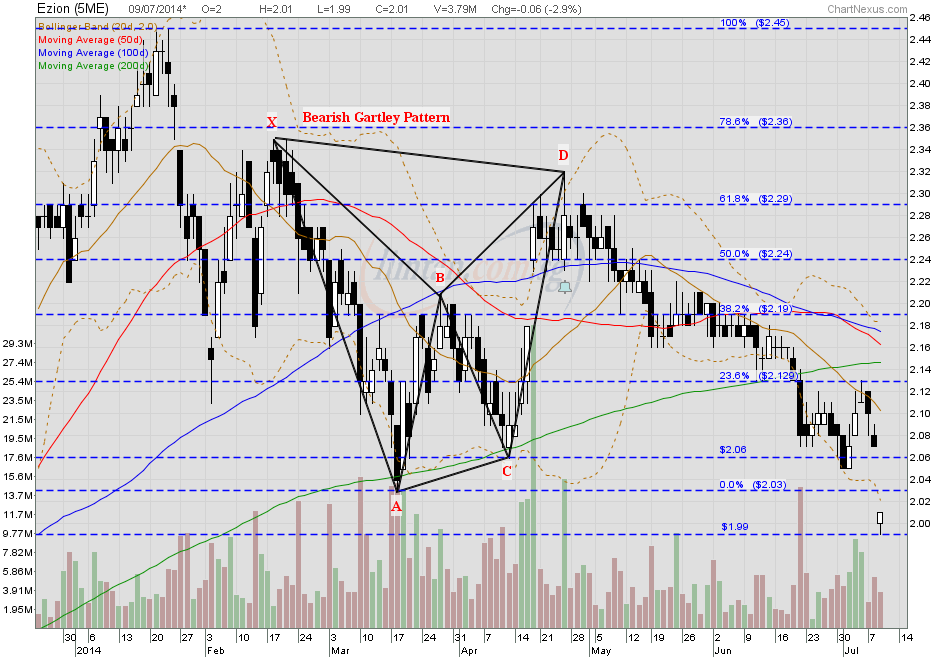

Ezion — Bearish Gartley Breakout; critical support @ S$1.99Ezion gapped down and had a hammer @ S$2.01 (-0.06, -2.9%) with 3.79m shares done on 9 July 2014 at 9.07am.  Ezion — Bearish Gartley Breakout; critical support @ S$1.99

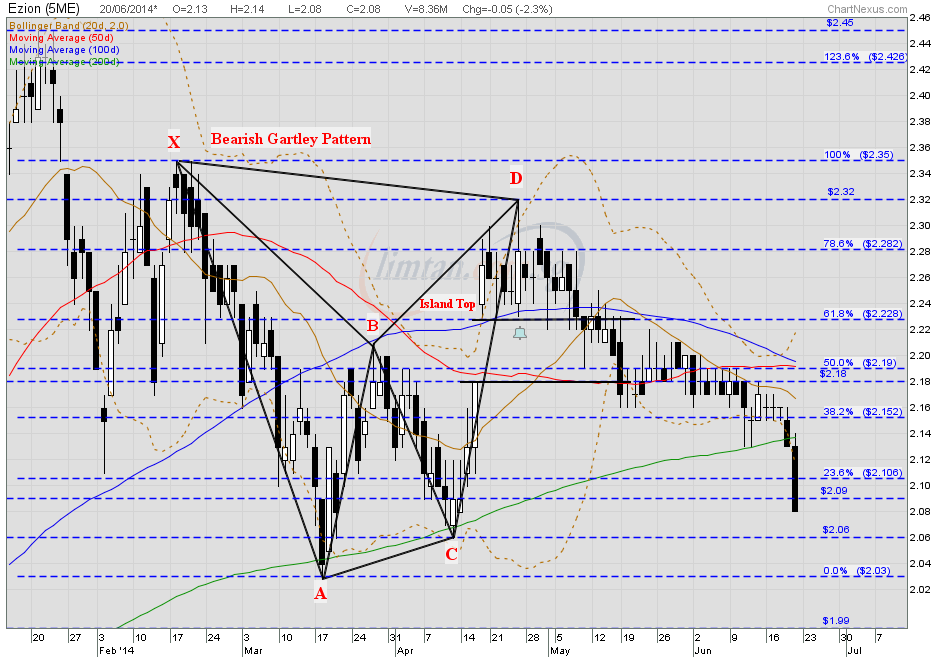

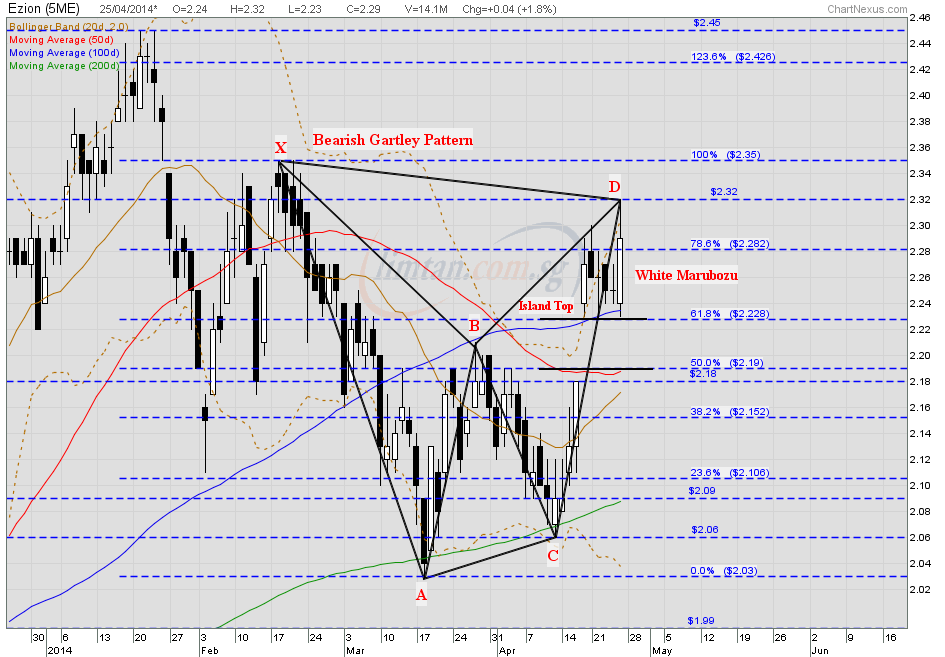

Ezion had a long black marubozu @ S$2.08 (-0.05, -2.3%) on 20 Jun 2014 at 2.35pm Immediate support @ S$2.03, immediate resistance @ S$2.15.  Ezion — Bearish Gartley Pattern on 25 Apr 2014 at 3.35pm

|

|

|

|

Post by zuolun on Jul 12, 2014 15:49:24 GMT 7

Ezion's chart looks toppish but bearish trend reversal requires confirmation, i.e. another black marubozu is needed to break down the major support @ S$1.99 convincingly. Ezion closed with a hammer @ S$2.01 (+0.035, +1.8%) with 13.1m shares done on 11 July 2014. Immediate support @ S$1.90, immediate resistance @ S$2.03. Chart Pattern: Cheng Kay run road liao...TP S$1.77.  |

|

|

|

Post by zuolun on Jul 17, 2014 8:16:51 GMT 7

|

|

|

|

Post by zuolun on Jul 17, 2014 13:20:01 GMT 7

|

|

|

|

Post by zuolun on Nov 19, 2014 3:25:31 GMT 7

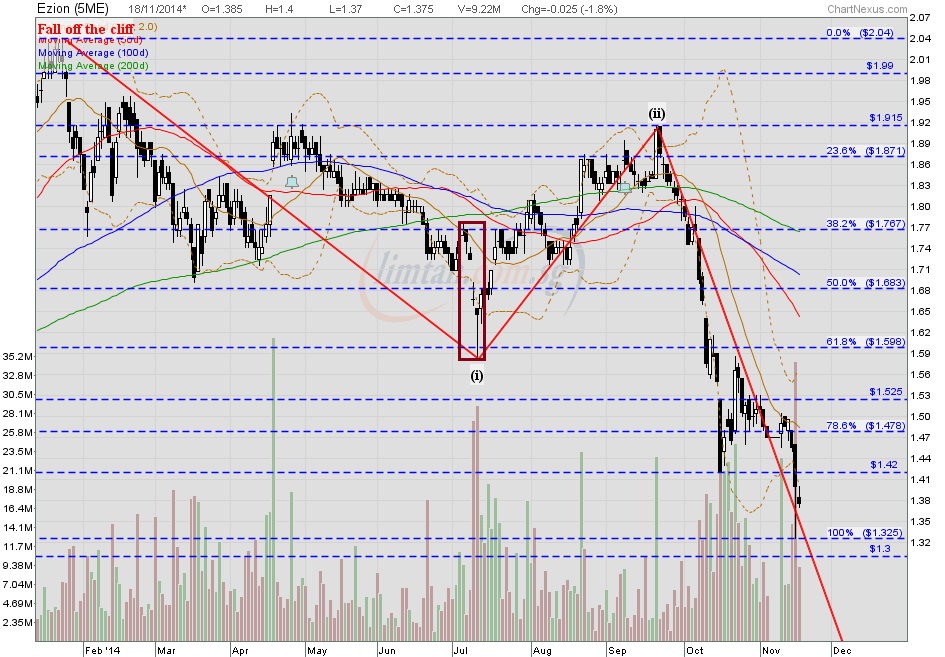

Ezion — A "Waterfall Decline", Interim TP S$1.16, Next TP S$1.05Ezion closed with a spinning top @ S$1.375 (-0.025, -1.8%) with high volume done at 9.22m shares on 18 Nov 2014. Immediate support @ S$1.325, immediate resistance @ S$1.42.  Ezion — H&S breakout, critical support @ S$1.99Ezion closed with a hammer @ S$2.01 (+0.035, +1.8%) with 13.1m shares done on 11 July 2014. Immediate support @ S$1.90, immediate resistance @ S$2.03. Chart Pattern: Cheng Kay run road liao...TP S$1.77.

|

|

|

|

Post by zuolun on Nov 23, 2014 10:19:21 GMT 7

Ezion — A "Waterfall Decline", Interim TP S$1.16, Next TP S$1.05Ezion closed with a white marubozu @ S$1.425 (+0.04, +2.9%) with high volume done at 19m shares on 21 Nov 2014. Immediate support @ S$1.325, immediate resistance @ S$1.46.  Ezion (weekly) — Uptrend is broken, biased to the downside Ezion (weekly) — Uptrend is broken, biased to the downside

|

|

|

|

Post by zuolun on Dec 3, 2014 15:12:18 GMT 7

Ezion kept at ‘Add’ with $2.04 price target by CIMB — 2 Dec 2014 The power of the in-house stock analysts reviews has its limitsEzion — Downtrend intact, Interim TP S$1.16, Next TP S$1.05Ezion had a spinning top @ S$1.155 (-0.015, -1.3%) with 11.4m shares done on 3 Dec 2014 at 4.10pm.  Ezion closed @ S$1.325 (-0.08, -5.7%) with 36,585,000 shares done on 28 Nov 2014. Most of the in-house stock analysts rated BUY on Ezion from 2 Jun to 12 Nov 2014 except Credit Suisse, Gerald Wong the only odd one who rated SELL 'Underperform' on Ezion TP S$1.80 on 9 July 2014, based on its last traded share price @ S$2.10 on 7 July 2014, then.  Why buy back Teras Conquest 4 within two years of selling it? Why buy back Teras Conquest 4 within two years of selling it? — 30 Aug 2014 Why is AusGroup Ltd paying S$55m to acquire net liabilities from Ezion? — 30 Aug 2014 M'sian billionaire Quek firms to buy 100m Ezion shares @ S$1.94 per share — 17 April 2014 Ezion's chart showed that major BBs initial run road's timing coincided with these 2 stock analysts' strong opposing views in mid-July 2014:

- DMG/OSK, LEE Yue Jer: Clearing the air on unwarranted negativity; upgrading to Top Buy

- Credit Suisse, Gerald Wong: A service rig is not a liftboat; Underperform TP S$1.80

This is the response from DMG/OSK Research Analyst LEE Yue Jer, after Credit Suisse Research initiated coverage of Ezion with an Underperformance rating and a price target of S$1.80. Ezion Holdings - Clearing the air on unwarranted negativity DMG/OSK upgrading to Top Buy15 July 2014 Analyst' s Response Here' s something I don' t do very often, but I've been convinced that the air needs to be cleared. Basically, a friendly competitor put out a sell initiation on Ezion yesterday (9 July, Wednesday) causing the share price to take a dive. However, a fund manager told me that Ezion' s management has called the report " factually inaccurate" , and I' m just going to point out some rather glaring issues. 1) A liftboat/service rig is NOT a drilling rigThe report states that new jackup rigs coming to the market could drive down dayrates and utilisation rates of " older assets" , and compares Ezion' s converted service rigs to these old assets. However, these are separate markets - a old jackup drilling rig commands USD100k/day dayrates, whereas Ezion' s service rigs generally get USD40-60k/day. In fact, I' d argue that lower prices for old drilling rigs is a GOOD thing for Ezion - they can pick up jackup platforms for conversions to service rigs at even more attractive prices. Remember that a jackup rig is for drilling, whereas liftboats/service rigs are generally for maintenance and accommodation services. So, comparing drilling rigs to service rigs is an apples-to-oranges comparison. 2) Ezion has begun calling all its units " service rigs"Even the newbuild ones! (This sort of demolishes the entire sell thesis, actually) Units 30 and 31 in their fleet, for Petronas and a " Southeast Asian" client, are actually newbuilds but Ezion has named the units " service rigs" . Management has confirmed that going forward, this is company policy and future units in their fleet will be referred to as " service rigs" . I' ve actually suggested to management to rename them all " service platforms" , to break the unintentional mental link with drilling rigs, but let' s see whether they take this up. 3) The working life of a converted service rig and a new liftboat should conservatively be 10 and 25 years respectively, inline with Ezion' s depreciation policyExperience shows that they can be used for even longer - Ezion has one service rig (Unit 16, Atlantic Esbjerg) which was converted 10 years ago and is still in operation to Maersk in the North Sea. Hercules Offshore has 3 liftboats, the Bonefish, Gemfish and Tapertail, which were built in 1978-79 (making them 35-36 years old today) and are still operational. Thus, the DCF model which was built using 5/15 year working lives for these assets is far too conservative, and has slashed the assets' working life by at least 50%. 4) More competition is to be welcomedCurrently, liftboats are only slowly making headway into the Asia Pacific market because of a lack of competition. For audit and governance purposes, oil majors require a proper tender process for each asset chartered in, and this is currently impossible without competitors. Additional players in the market would allow this process to be conducted, leading to wider acceptance of service rigs. Also, if the report is right in estimating that liftboat demand could grow by 80 units in the Asia Pacific, this actually indicates that demand is growing so fast that the market can absorb another two large players (Ezion currently has a fleet of 34 units including those on JV). Ezion' s first-mover advantage will stand it in good stead over the next few years, given the low market penetration of liftboats and the rising demand from an increasing number of fixed platforms in the region. 5) Mathematical inconsistencies 1: The report used a 15-year life for liftboats assuming 100% utilisation, and equated that to " an 83% utilisation over a useful life of 25 years" , and implies that this is a reasonable utilisation rate. Two issues - this assumption actually equates to 60% utilisation over 25 years. Second, Ezion' s units are generally fixed on 3 to 8 year contracts. A reasonable utilisation rate over the entire 30-year lifespan should actually fall in the range of 90-97%. 6) Mathematical inconsistencies 2: The report calculated a Valuation of USD992m for the service rigs. Note that Ezion has 15 service rigs on their book and 5 on 50% JV. So let' s call it 17.5 units' worth. Dividing USD992m by 17.5 units, the valuation of an average service rig is USD56.7m. However, let' s recall that most of Ezion' s service rigs actually COST USD60m to purchase and refurbish. Their valuation estimate somehow comes out to below the asset acquisition cost! If this were true I don' t think Ezion would be in business! Take a step backThe downside risk is now less than 10%. In the worst case scenario, if asset lives are halved, the company is worth SGD1.80 per share. The upside is more than 50% to my TP, and more than 40% to consensus TP. The risk-reward ratio is extremely favorable and the stock has pulled back 23% from the peak. The company is telling investors about the factual inconsistencies in the report, and doing some second order thinking, we can anticipate a reversal in sentiment once the air is cleared. It' s time to get in now while the market is panicking and asking questions after the selling. Source : DMG/OSK Research Analyst : LEE Yue Jer, CFA Ezion Holdings - A service rig is not a liftboat; Credit Suisse initiate coverage of Ezion with an UNDERPERFORM rating and a target price of S$1.80 — 9 July 2014

|

|

|

|

Post by zuolun on Dec 8, 2014 17:58:10 GMT 7

|

|

|

|

Post by zuolun on Jan 17, 2015 15:55:19 GMT 7

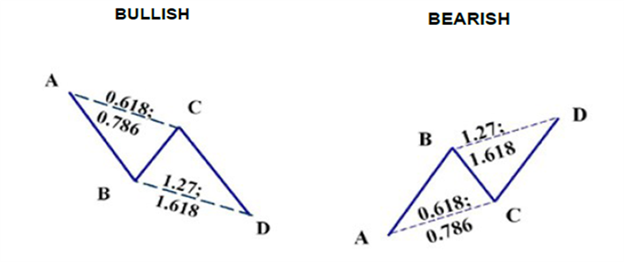

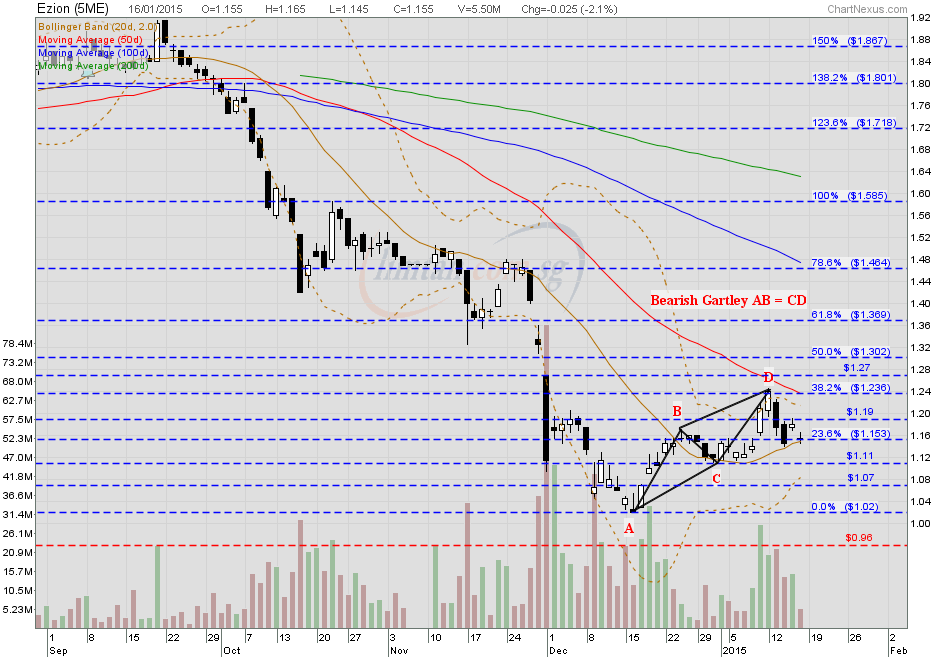

Bearish Gartley AB = CD pattern Ezion — Bearish Gartley AB = CD Breakout, Interim TP S$0.96 Ezion — Bearish Gartley AB = CD Breakout, Interim TP S$0.96Ezion closed with a doji @ S$1.155 (-0.025, -2.1%) with 5.5m shares done on 16 Jan 2015. Immediate support @ S$1.11, immediate resistance @ S$1.19.

|

|

|

|

Post by zuolun on Mar 17, 2015 11:58:38 GMT 7

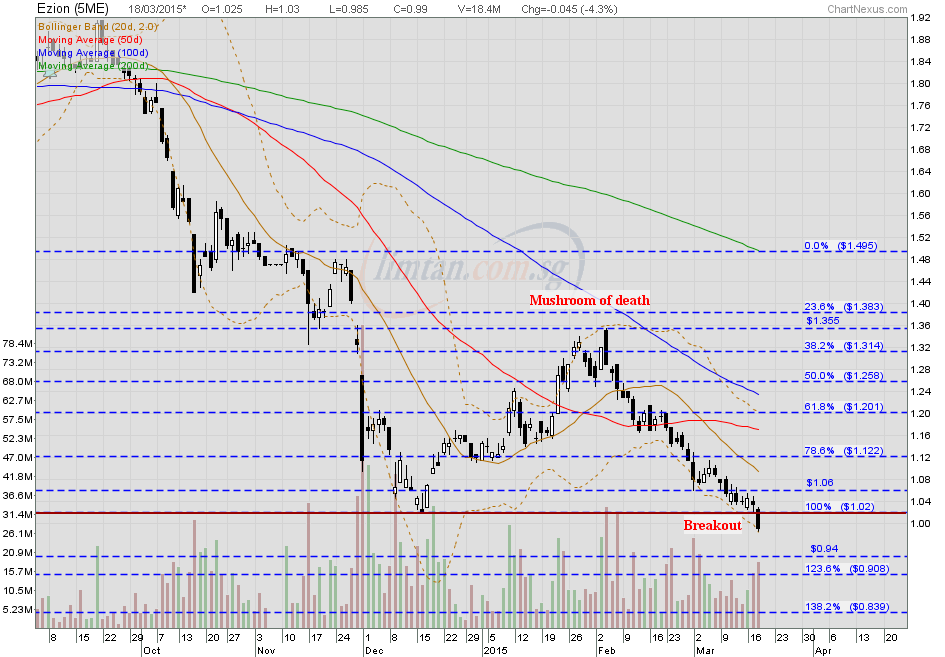

Ezion traded @ S$1.03 (-0.015, -1.4%) with 5.66m shares done on 17 Mar 2015 at 12.55pm. See the big picture of oil and oil related companies...all the charts are pointing down = "one-way ticket".  Ezra Vs Ezion Ezra Vs Ezion ~ Ezra's chart pattern was not only similar but identical to Ezion's, prior to its collapse in 2008. Singapore oil stocks could be heading for more trouble ~ CMC Markets says investors should re-examine Singapore oil stocks following a plunge in oil prices last Friday. The brokerage says Keppel Corp (BN4.SG) is vulnerable. "Not only have they rebounded the most [among Singapore oil stocks], fresh news over a huge turnout at a political protest in Brazil could also lead to a reassessment of Keppel Corp's close association to their key clients in Brazil, who are themselves embroiled in a corruption scandal," Nicholas Teo a market analyst at CMC Markets said in a note on Monday. According to CMC Markets, SembCorp Marine (S51.SG) might also see selling pressure, as it has exposure to similar clients as Keppel Corp. The brokerage add that Keppel has not booked any significant orders year-to-date. "Furthermore, the current orders they have on hand may also prove vulnerable to cancellations due to the bleak outlook for oil," Teo says. Shares of the other two oil firms, Ezion (5ME.SG) and Ezra (5DN.SG) have lost back almost their entire January rally and are languishing near their December lows, CMC adds. ~ 16 Mar 2015 Why is no one paying attention to Singapore oil stocks anymore? ~ 12 Mar 2015 |

|

|

|

Ezion

Mar 18, 2015 16:33:40 GMT 7

Post by zuolun on Mar 18, 2015 16:33:40 GMT 7

Whack a kitty with One Good Trade   Ezion's long black candle today signaled a big mad crowd running out of a house which is on fire now. Ezion ~ Classic MOD chart pattern Interim TP S$0.91, Next TP S$0.84Ezion closed with a long black marubozu @ S$0.99 (-0.045, -4.3%) with 18.42m shares done on 18 Mar 2015. Immediate support @ S$0.94, immediate resistance @ S$1.02.

|

|

|

|

Post by zuolun on Mar 19, 2015 14:18:19 GMT 7

sptl123, I forgot to tell you this important msg...Whenever you read MER's review(s) on all stocks; make sure you go check the latest status/details of the respective structured warrants (call and put) issued by MER.  他说上涨机率有70%,但他却选择放空? 看懂了,你就不会再问别人看涨看跌。 他说上涨机率有70%,但他却选择放空? 看懂了,你就不会再问别人看涨看跌。 ~ 10 Mar 2015 Ezion traded @ S$0.94 (-0.05, -5.1%) with 21.1m shares done on 18 Mar 2015 at 3.20pm. Credit metrics of smaller SGX-listed O&G and related companies as at 30 Sep 2014Ezion Holdings – risk-reward couldn’t get any better, says MERMacquarie Research 19 Mar 2015 Yesterday, Ezion Holdings tumbled below the $1 level for the first time since December 2012, taking its stock loss over the last month to -22% versus the STI’s -1% fall. Macquarie Equities Research (MER) believes that Ezion has now fallen well below its bear case and that investors looking for a beaten down, fundamentally strong, liquid and cheap stock, should look no further… Below are excerpts from the research report released yesterday on 18 March 2015: Time to pull the triggerPunished (down -22% in last 1 month versus -1% for FSSTI) for being in a bad egg basket (oil services stocks), Ezion has now fallen well below its bear case, in MER’s view. For investors looking for a beaten down, fundamentally strong, liquid and cheap stock, MER thinks they should look no further. Despite including bear case assumptions in MER’s model now (MER estimates are 10% below consensus for 2015-16), Ezion is trading at 5 times of its 2015E price-to-earnings (with 18% profit compound annual growth rate over 2014-17) and 0.8 times 2015 price-to-earnings (with 16% return-on-equity). Bear case assumptions:Bear case assumption #1: Idle time and lower dayrates: MER is now assuming 6 months idle time and 15% day rate reduction across the board for all 37 units when their contracts expire. Bear case assumption #2: Delay in deliveries: Out of the 17 pending ones, MER assumes only 10 will be delivered in 2015 (versis 15 earlier) and 7 in 2016. What the market is overlooking:Not a typical contractor; No speculative builds; All 37 vessels have firm contracts from NOCs: All of Ezion’s vessels have locked-in contracts for 3-7 years, and that too from top national oil companies (NOCs) such as Petronas, Pemex and ONGC. There have been no cancellations and none are likely, in MER’s view. Liftboats are part of the “production phase” of capital expenditure and hence less risky: Unlike oil rigs or support vessels which are part of “exploration” exploration and production capital expenditure for oil companies, lift boats support the “oil production platforms”. Leverage well maintained and will only go down as vessels are delivered: For a contractor, Ezion’s 86% leverage level is well maintained and will go down gradually as 17 vessels are delivered, in MER’s view. The 6 contracts expiring in 2015 are all on the verge of re-contracts without dayrate reductions and with the same oil company: MER thinks this is a big vote of confidence in Ezion’s vessel quality and bargaining power. 14 other vessels are working smoothly and have contracts until 2019 while 17 more are to be delivered over 2015-16:Earnings and target price revisionRevising earnings downwards by 8% and 5% for 2015 and 2016 as MER builds in lower dayrates and delays. Revising target price on Ezion Holdings to S$1.50 from S$1.75. MER believes the stock price catalyst to be the re-contracting of the orders expiring in 2015. MER’s action and recommendationThe risk-reward couldn’t get any better: At current valuations, MER believes the market is pricing in all possible risks – cancellations, delays and dayrate cuts. There is only upside to these assumptions, in MER’s view.

|

|

|

|

Post by zuolun on Mar 20, 2015 14:39:35 GMT 7

Ezion traded @ S$1.03 (+0.09, +9.6%) with 41.52m shares done on 20 Mar 2015 at 3.35pm. Immediate support @ S$0.985, immediate resistance @ S$1.06. Severe short-squeeze at its best, spike 9.6% today, Ezion still got plenty of stale bulls awaiting for retail players to bail them out.  Most of the in-house stock analysts rated BUY on Ezion from 2 Jun to 12 Nov 2014 except Credit Suisse, Gerald Wong the only odd one who rated SELL 'Underperform' on Ezion TP S$1.80 on 9 July 2014, based on its last traded share price @ S$2.10 on 7 July 2014, then.  |

|

|

|

Post by zuolun on Mar 20, 2015 21:08:55 GMT 7

Ezion closed @ S$1.035 (+0.095, +10.1%) with 49.3m shares done on 20 Mar 2015. Immediate support @ S$0.985, immediate resistance @ S$1.06. Ezion: RHB's analyst, Lee Yue Jer maintains BUY TP S$2.18 (132% upside) ~ 20 Mar 2015 Ezion's chart showed that major BBs initial run road's timing coincided with these 2 stock analysts' strong opposing views in mid-July 2014:

- DMG/OSK, LEE Yue Jer: Clearing the air on unwarranted negativity; upgrading to Top Buy

- Credit Suisse, Gerald Wong: A service rig is not a liftboat; Underperform TP S$1.80

This is the response from DMG/OSK Research Analyst LEE Yue Jer, after Credit Suisse Research initiated coverage of Ezion with an Underperformance rating and a price target of S$1.80. Ezion Holdings - Clearing the air on unwarranted negativity DMG/OSK upgrading to Top Buy15 July 2014 Analyst' s Response Here' s something I don' t do very often, but I've been convinced that the air needs to be cleared. Basically, a friendly competitor put out a sell initiation on Ezion yesterday (9 July, Wednesday) causing the share price to take a dive. However, a fund manager told me that Ezion' s management has called the report " factually inaccurate" , and I' m just going to point out some rather glaring issues. 1) A liftboat/service rig is NOT a drilling rigThe report states that new jackup rigs coming to the market could drive down dayrates and utilisation rates of " older assets" , and compares Ezion' s converted service rigs to these old assets. However, these are separate markets - a old jackup drilling rig commands USD100k/day dayrates, whereas Ezion' s service rigs generally get USD40-60k/day. In fact, I' d argue that lower prices for old drilling rigs is a GOOD thing for Ezion - they can pick up jackup platforms for conversions to service rigs at even more attractive prices. Remember that a jackup rig is for drilling, whereas liftboats/service rigs are generally for maintenance and accommodation services. So, comparing drilling rigs to service rigs is an apples-to-oranges comparison. 2) Ezion has begun calling all its units " service rigs"Even the newbuild ones! (This sort of demolishes the entire sell thesis, actually) Units 30 and 31 in their fleet, for Petronas and a " Southeast Asian" client, are actually newbuilds but Ezion has named the units " service rigs" . Management has confirmed that going forward, this is company policy and future units in their fleet will be referred to as " service rigs" . I' ve actually suggested to management to rename them all " service platforms" , to break the unintentional mental link with drilling rigs, but let' s see whether they take this up. 3) The working life of a converted service rig and a new liftboat should conservatively be 10 and 25 years respectively, inline with Ezion' s depreciation policyExperience shows that they can be used for even longer - Ezion has one service rig (Unit 16, Atlantic Esbjerg) which was converted 10 years ago and is still in operation to Maersk in the North Sea. Hercules Offshore has 3 liftboats, the Bonefish, Gemfish and Tapertail, which were built in 1978-79 (making them 35-36 years old today) and are still operational. Thus, the DCF model which was built using 5/15 year working lives for these assets is far too conservative, and has slashed the assets' working life by at least 50%. 4) More competition is to be welcomedCurrently, liftboats are only slowly making headway into the Asia Pacific market because of a lack of competition. For audit and governance purposes, oil majors require a proper tender process for each asset chartered in, and this is currently impossible without competitors. Additional players in the market would allow this process to be conducted, leading to wider acceptance of service rigs. Also, if the report is right in estimating that liftboat demand could grow by 80 units in the Asia Pacific, this actually indicates that demand is growing so fast that the market can absorb another two large players (Ezion currently has a fleet of 34 units including those on JV). Ezion' s first-mover advantage will stand it in good stead over the next few years, given the low market penetration of liftboats and the rising demand from an increasing number of fixed platforms in the region. 5) Mathematical inconsistencies 1: The report used a 15-year life for liftboats assuming 100% utilisation, and equated that to " an 83% utilisation over a useful life of 25 years" , and implies that this is a reasonable utilisation rate. Two issues - this assumption actually equates to 60% utilisation over 25 years. Second, Ezion' s units are generally fixed on 3 to 8 year contracts. A reasonable utilisation rate over the entire 30-year lifespan should actually fall in the range of 90-97%. 6) Mathematical inconsistencies 2: The report calculated a Valuation of USD992m for the service rigs. Note that Ezion has 15 service rigs on their book and 5 on 50% JV. So let' s call it 17.5 units' worth. Dividing USD992m by 17.5 units, the valuation of an average service rig is USD56.7m. However, let' s recall that most of Ezion' s service rigs actually COST USD60m to purchase and refurbish. Their valuation estimate somehow comes out to below the asset acquisition cost! If this were true I don' t think Ezion would be in business! Take a step backThe downside risk is now less than 10%. In the worst case scenario, if asset lives are halved, the company is worth SGD1.80 per share. The upside is more than 50% to my TP, and more than 40% to consensus TP. The risk-reward ratio is extremely favorable and the stock has pulled back 23% from the peak. The company is telling investors about the factual inconsistencies in the report, and doing some second order thinking, we can anticipate a reversal in sentiment once the air is cleared. It' s time to get in now while the market is panicking and asking questions after the selling. Source : DMG/OSK Research Analyst : LEE Yue Jer, CFA Ezion Holdings - A service rig is not a liftboat; Credit Suisse initiate coverage of Ezion with an UNDERPERFORM rating and a target price of S$1.80 — 9 July 2014  |

|

|

|

Post by zuolun on Mar 24, 2015 16:31:08 GMT 7

Ezion closed @ S$1.055 (+0.02, +1.9%) with 10.59m shares done on 24 Mar 2015. Ezion: Misunderstood and mispriced; MaybankKE's analyst, Yeak Chee Keong rated BUY, TP S$1.83 (+77%) By Frankie Ho 24 Mar 2015 Ezion has been misunderstood by investors and should not be seen in the same light as offshore drillers, some of which have had contracts terminated and are struggling with weaker charter rates, according to Maybank Kim Eng. "We believe the market has been spooked by recent contract cancellations and rate cuts in the offshore drilling market. It incorrectly associates those risks with Ezion," Maybank Kim Eng analyst Yeak Chee Keong wrote in a note today. Ezion, a liftboat supplier, is exposed to the more stable business of servicing and maintaining offshore platforms, and has contracts lasting three to seven years for all its vessels, Yeak noted. "Demand for liftboats is strong as customers are sustaining production with greater efficiency by using liftboats, although they are also appealing for discounts to help cut overall costs. "This is unlike the drop in offshore drilling rates, which arises from weak drilling demand and a supply glut." Shares of its closest peer, London-listed Gulf Marine Services, have risen 25% year to date, while those of Ezion have declined 7%. Both companies' operational metrics are similar, but Gulf Marine Services trades at 6.4 times projected FY2015 earnings versus Ezion's 4.8 times. "This disparity is puzzling, as Ezion is not inferior to Gulk Marine Services in any way, in our opinion," said Yeak. "We believe this is due to the market’s incorrect association of Ezion’s business with that of offshore drillers." Maybank Kim Eng has a "buy" call and $1.83 price target on Ezion. Ezion shares closed flat at $1.035 yesterday. |

|