|

|

Post by zuolun on Jun 9, 2015 23:56:40 GMT 7

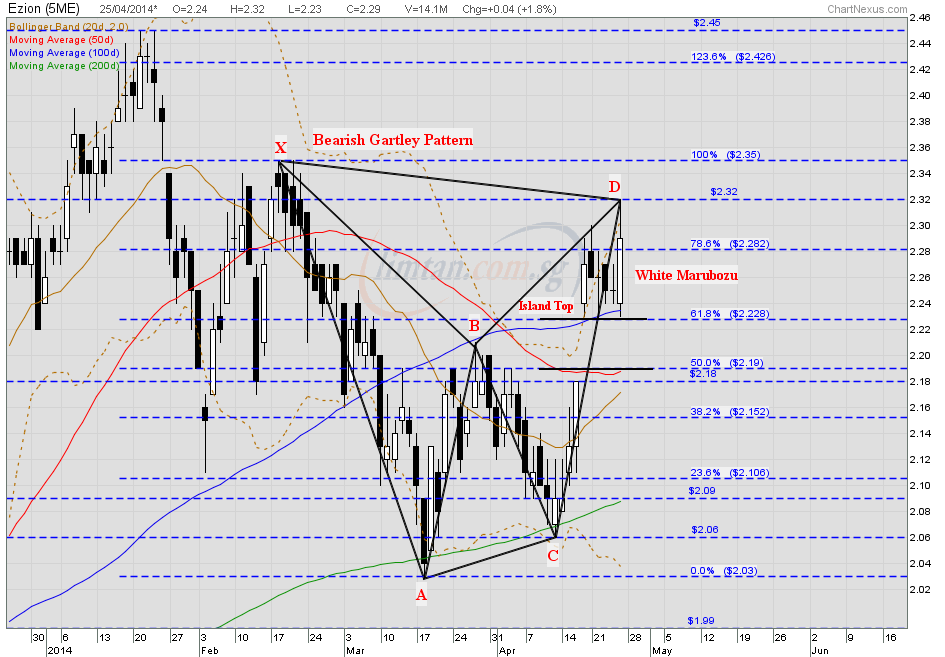

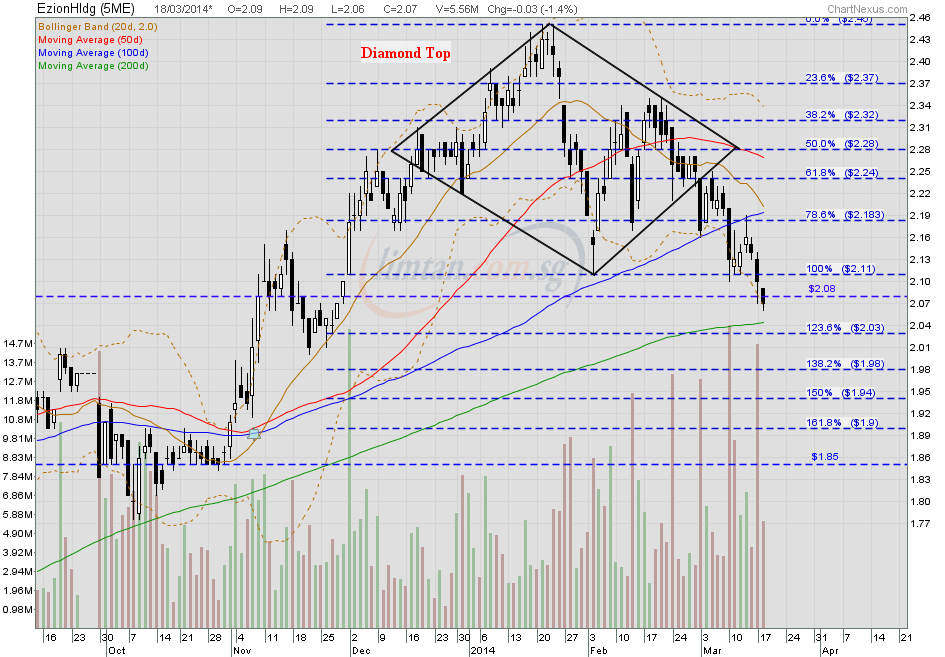

sptl123, From diamond top to mama gartley to current baby gartley; a timeframe of approx. 15 months only...Ezion is now a penny stock again. Ezion ~ Bearish Gartley BreakoutEzion closed at day's low with a black marubozu @ S$0.99 (-0.03, -2.9%) with 10.9m shares done on 9 Jun 2015.  Ezion — Bearish (Diamond, Gartley and Island Top) Chart PatternEzion had a long white marubozu @ S$2.30 (+0.05, +2.2%) on 25 Apr 2014 at 2.40pm. Immediate support @ S$2.23, immediate resistance @ S$2.30. Note: An unconfirmed chart pattern has no further meaning.  Ezion — Bearish Gartley Pattern on 25 Apr 2014 at 3.35pm Ezion — Bearish Gartley Pattern on 25 Apr 2014 at 3.35pm High volume is bearish when the stock is in distributing mode. Cheng Kay is likely to let the horse die liao...confirmation is when S$1.99 is taken out convincingly. Ezion — Bearish diamond top breakout; Interim TP S$1.90Ezion @ S$2.07 (-0.03, -1.4%) on 18 Mar 2014 at 11.35am. Immediate resistance @ S$2.11, immediate support @ S$2.03.

|

|

|

|

Ezion

Jun 10, 2015 0:44:45 GMT 7

via mobile

Post by sptl123 on Jun 10, 2015 0:44:45 GMT 7

sptl123, From diamond top to mama gartley to current baby gartley; a timeframe of approx. 15 months only...Ezion is now a penny stock again.

Bro Zuolun,

我嘆!好比人生無常世事难料。 |

|

|

|

Post by sptl123 on Jun 10, 2015 23:14:53 GMT 7

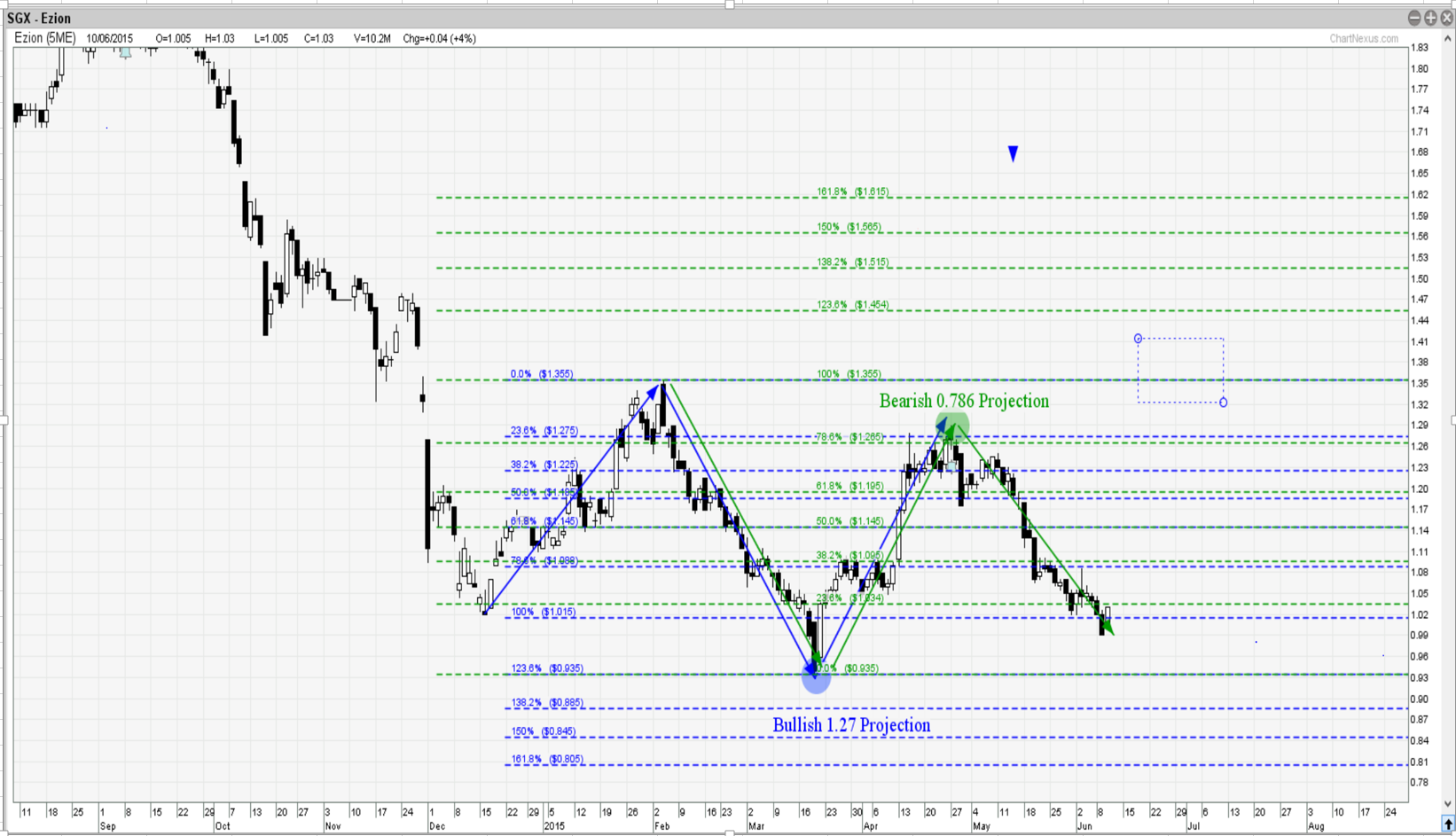

Bro Zuolun, EZION close with a Bullish Marubozu at $ 1.03 (+0.04, +4.04%) with 10.154 milliom share traded. I study the Harmonic Pattern on 1.27 and 0.786 Projection and try to breakdown the Gartley Pattern by parts and amaszing it works 100% for EZION. ( Would have hoot big big if knew earlier  ) Historical Events of Ezion:  More importantly, what is next ? Observation on the following chart: (I) Bullish 0.786 Bullish Projection: Bullish 0.786 Retracement. Price will bounce if this 0.786 critical support holds. " When a stock is selling off after a rally, the 0.786 retracement often acts as important support. If a stock declines past the 0.786 retracement, it will usually retest the original starting point (pt. X) of that prior rally." Source :http://www.harmonictrader.com/ (II) Potential Bullish AB=CD pattern if the support at 0.786 hold. Price now at potential reversal zone and need a few more candlestick to confirm the up trend reversal.  Bro Zuolun, If the above technically correct? sptl123, From diamond top to mama gartley to current baby gartley; a timeframe of approx. 15 months only...Ezion is now a penny stock again. Ezion ~ Bearish Gartley BreakoutEzion closed at day's low with a black marubozu @ S$0.99 (-0.03, -2.9%) with 10.9m shares done on 9 Jun 2015.  |

|

|

|

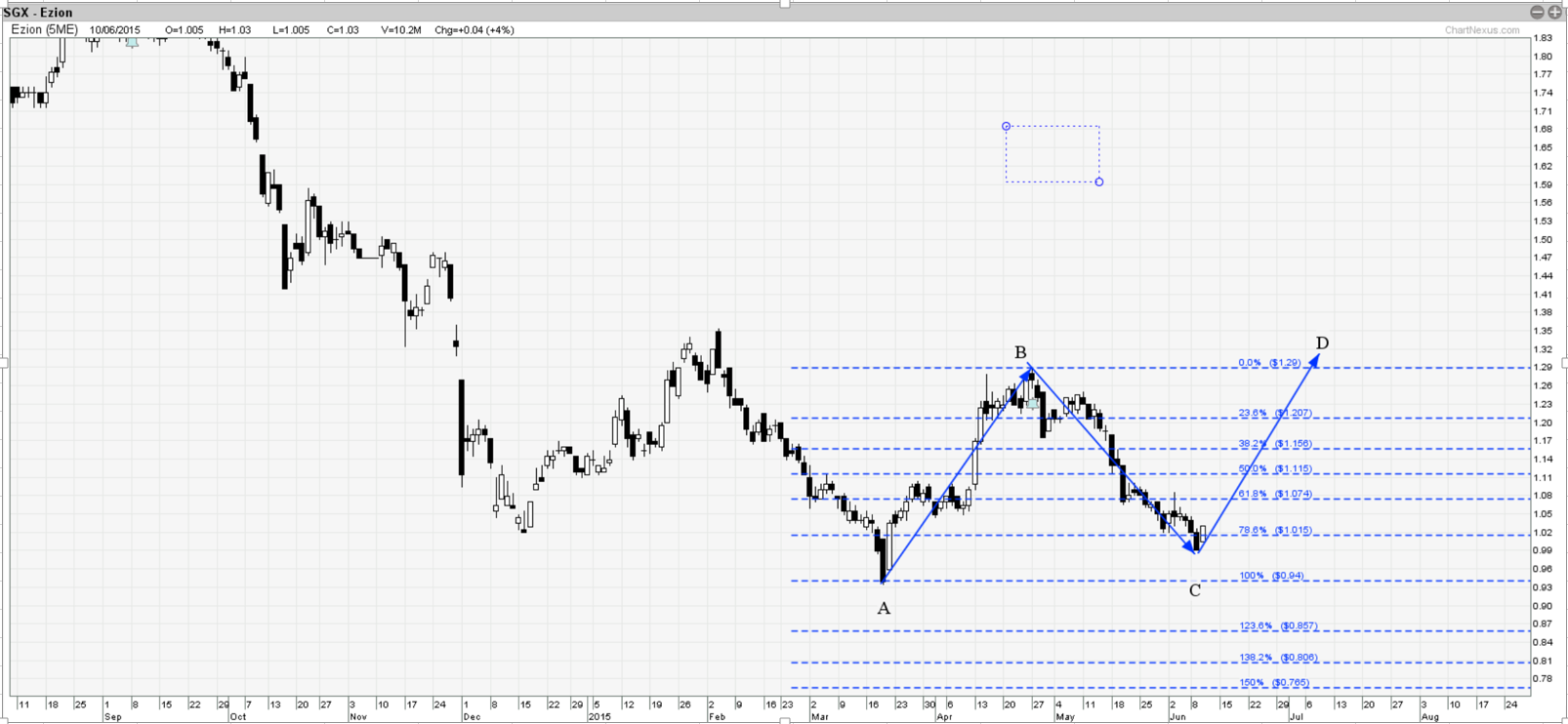

Post by zuolun on Jun 11, 2015 8:18:19 GMT 7

sptl123, From diamond top to mama gartley to current baby gartley; a timeframe of approx. 15 months only...Ezion is now a penny stock again. Ezion closed with a "one white soldier" candlestick pattern @ S$1.03 (+0.04, +4%) with 10.2m shares done on 10 Jun 2015. Immediate support @ S$0.99, immediate resistance @ S$1.05.  |

|

|

|

Post by zuolun on Jun 11, 2015 9:27:56 GMT 7

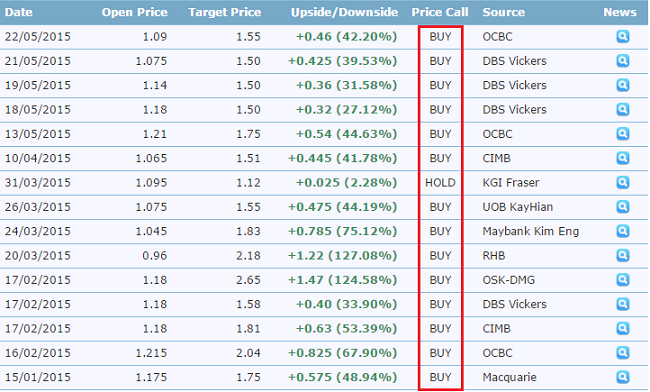

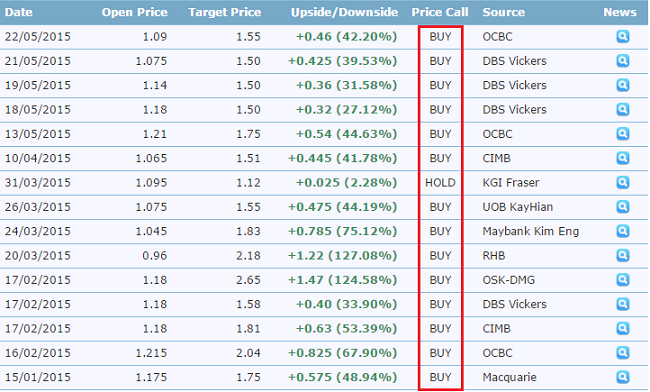

Bro Zuolun, EZION close with a Bullish Marubozu at $ 1.03 (+0.04, +4.04%) with 10.154 milliom share traded. I study the Harmonic Pattern on 1.27 and 0.786 Projection and try to breakdown the Gartley Pattern by parts and amaszing it works 100% for EZION. ( Would have hoot big big if knew earlier  ) Historical Events of Ezion: More importantly, what is next ? Observation on the following chart: (I) Bullish 0.786 Bullish Projection: Bullish 0.786 Retracement. Price will bounce if this 0.786 critical support holds. " When a stock is selling off after a rally, the 0.786 retracement often acts as important support. If a stock declines past the 0.786 retracement, it will usually retest the original starting point (pt. X) of that prior rally." Source :http://www.harmonictrader.com/ (II) Potential Bullish AB=CD pattern if the support at 0.786 hold. Price now at potential reversal zone and need a few more candlestick to confirm the up trend reversal. Bro Zuolun, If the above technically correct? , I'm thankful to oldman and really appreciate him for providing a wonderful forum (FOC) for us to discuss and exchange views/trading ideas on stocks based on TA. Dare, don’t be afraid to make mistakes, you’ll learn from them. Persistence is the Key to success. Keep on honing your skill, keep on learning and growing; the journey is tough but you're not alone.  An analysis on stock analysts' price targets on Ezion from 15 Jan to 22 May 2015: An analysis on stock analysts' price targets on Ezion from 15 Jan to 22 May 2015:- Almost all the in-house stock analysts rated 'BUY' none rated 'SELL' except KGI Fraser, the only odd one who rated 'HOLD' TP S$1.12 on 31 Mar 2015 then.

- On 10 Jun 2015, Ezion closed @ S$1.03, stock analysts' price targets on Ezion are unanimously wrong to date.

“The crowd always loses because the crowd is always wrong. It is wrong because it behaves normally.” ~ Fred C. Kelly  |

|

|

|

Post by zuolun on Jun 23, 2015 14:31:03 GMT 7

Ezion (weekly) ~ Classic Mushroom-Of-Death chart pattern, critical support @ S$0.93

|

|

|

|

Post by zuolun on Jun 25, 2015 10:22:54 GMT 7

Alternative view:Ezion ~ Descending triangle, critical support @ S$0.93 Alternative view:Ezion ~ Descending triangle, critical support @ S$0.93Ezion had a spinning top and traded @ S$1.045 (-0.02, -1.9%) with 6.7m shares done on 25 Jun 2015 at 1110 hrs. Immediate support @ S$1.02, immediate resistance @ S$1.075.  sptl123, From diamond top to mama gartley to current baby gartley; a timeframe of approx. 15 months only...Ezion is now a penny stock again. Ezion closed with a "one white soldier" candlestick pattern @ S$1.03 (+0.04, +4%) with 10.2m shares done on 10 Jun 2015. Immediate support @ S$0.99, immediate resistance @ S$1.05.  |

|

|

|

Post by sptl123 on Jun 25, 2015 10:59:36 GMT 7

Bro Zuolun, I have the following alternative view of EZION. Ascending Triangle Formation:     Let's see how it moves in the next few days. Not vested.  |

|

|

|

Post by zuolun on Jun 25, 2015 16:48:33 GMT 7

Ezion: DBS Group Research reiterated BUY, TP S$1.50 ~ 22 Jun 2015 DBS Group Research has reiterated its "buy" call on Ezion Holdings as it believes the company's stock price would soon recover to the $1.20 level. In a research note released on June 22, DBS observes that Ezion is well-positioned to benefit from the rising popularity of liftboats in this region, capitalising on its first mover-advantage. "We believe service rigs are in an early growth phase, buoyed by the substitution effect to replace typical work boats/barges in this region," says DBS. Bro Zuolun, I have the following alternative view of EZION. Ascending Triangle Formation:     Let's see how it moves in the next few days. Not vested.

|

|

|

|

Post by zuolun on Jul 15, 2015 14:55:52 GMT 7

Ezion Holdings: Hollow man or how inattention to industry fundamentals can kill ~ 13 July 2015 Ezion Holdings: Invests in Rotating Offshore Solutions, OCBC maintained BUY TP S$1.55By Low Pei Han 7 July 2015 - Ezion Holdings announced that it has entered into a subscription agreement with Rotating Offshore Solutions Pte Ltd (ROS) in which it will subscribe for 321,429 shares in ROS for a consideration of S$18m.

- The shares will constitute 30% of the enlarged share capital after completion. In satisfaction of the subscription consideration, Ezion will issue 17.5m shares at an issue price of S$1.0287.

- This represents approx 1.09% of the enlarged issued share capital of the Ezion.

- ROS is headquartered in Singapore and is an engineering solution provider for the offshore oil and gas industry.

- Pending more details from management, we maintain our BUY rating and fair value estimate of S$1.55 on Ezion.

|

|

|

|

Post by zuolun on Dec 12, 2015 15:19:49 GMT 7

Singapore oil stocks could be heading for more trouble ~ CMC Markets says investors should re-examine Singapore oil stocks following a plunge in oil prices last Friday. The brokerage says Keppel Corp (BN4.SG) is vulnerable. "Not only have they rebounded the most [among Singapore oil stocks], fresh news over a huge turnout at a political protest in Brazil could also lead to a reassessment of Keppel Corp's close association to their key clients in Brazil, who are themselves embroiled in a corruption scandal," Nicholas Teo a market analyst at CMC Markets said in a note on Monday. According to CMC Markets, SembCorp Marine (S51.SG) might also see selling pressure, as it has exposure to similar clients as Keppel Corp. The brokerage add that Keppel has not booked any significant orders year-to-date. "Furthermore, the current orders they have on hand may also prove vulnerable to cancellations due to the bleak outlook for oil," Teo says. Shares of the other two oil firms, Ezion (5ME.SG) and Ezra (5DN.SG) have lost back almost their entire January rally and are languishing near their December lows, CMC adds. ~ 16 Mar 2015 Why is no one paying attention to Singapore oil stocks anymore? ~ 12 Mar 2015 Never catch a falling knife: "At the end of the day, the stock market is about supply and demand and if lots more investors want to sell, it is likely that the prices will drift southwards. Investors may have to sell these non related stocks to cover for their losses in the related sectors. There may also be forced selling for those who have bought shares with margin and are currently under margin calls. " ~ oldman Ezion closed with a black marubozu @ S$0.565 (-0.01, -1.7%) with 4.75m shares done on 11 Dec 2015. Immediate support @ S$0.535, immediate resistance @ S$0.60.  Ezion (weekly) ~ Mushroom-Of-Death, interim TP S$0.445, next TP S$0.31 Ezion (weekly) ~ Mushroom-Of-Death, interim TP S$0.445, next TP S$0.31 Groupthink: “The crowd always loses because the crowd is always wrong. It is wrong because it behaves normally.” ~ Fred C. KellyDon't trust people so readily Groupthink: “The crowd always loses because the crowd is always wrong. It is wrong because it behaves normally.” ~ Fred C. KellyDon't trust people so readily ~ Almost all in-house stock analysts rated 'BUY' on Ezion in 2015, except KGI Fraser  Ezion closed @ S$1.325 (-0.08, -5.7%) with 36,585,000 shares done on 28 Nov 2014. Most of the in-house stock analysts rated BUY on Ezion from 2 Jun to 12 Nov 2014 except Credit Suisse, Gerald Wong the only odd one who rated SELL 'Underperform' on Ezion TP S$1.80 on 9 July 2014, based on its last traded share price @ S$2.10 on 7 July 2014, then.  |

|

|

|

Ezion

Feb 3, 2016 7:59:08 GMT 7

Post by zuolun on Feb 3, 2016 7:59:08 GMT 7

Macquarie rated Ezion as 'Outperform' TP S$0.70 ~ 29 Jan 2016 Ezion likely facing $700m in write-downs over next two years ~ 28 Jan 2016 “Bad news, sir, we have found more oil.” ~ 23 Jan 2016 Ezion ~ Trading in a downward sloping channel, interim TP S$0.445, next TP S$0.31Ezion closed with an inverted hammer @ S$0.495 (-0.005, -1%) with 4.75m shares done on 2 Feb 2016. Immediate support @ S$0.48, immediate resistance @ S$0.535.  Ezion kept at ‘sell’ with lower 11 cents target by KGI Fraser on long downcycle Ezion kept at ‘sell’ with lower 11 cents target by KGI Fraser on long downcycleBy PC Lee January 28, 2016 : 3:48 PM MYT KGI Fraser Securities is maintaining its “sell” call on specialised vessels supplier Ezion but cutting its target price to 11 cents from 47 cents. KGI says the current trends of utilisation and daily charter rates point to a prolonged downcycle in the offshore oil industry. The rig oversupply may last longer than expected as owners are not scrapping rigs fast enough to balance the supply, KGI says. Globally, 75 jack-up rigs are scheduled for delivery in 2016, citing RigLogix estimates. Offshore exploration and production companies are also expected to cut budgets by a further 20%‐30%. As at 3.48pm, Ezion is down 2% at 49 cents compared to a 0.2% rise in the benchmark Straits Times Index. Ezion is preferred pick of DBS among oil and gas shipping firms, TP S$1.0015 Jan 2016 Ezion - Trimmed FY16-17 net profit by 28-32%, after imputing a higher discount on average charter rates. Ezion remains our preferred Oil & Gas pick. We reiterate our BUY call on Ezion, TP is unchanged at S$1.00, pegged to 0.8x P/BV. Rerating catalysts stem from earnings recovery with the resumption of service rigs currently under repair/upgrades in 1H16, delivery of newbuild liftboats, and successful diversification of customer base to win new charter contracts, while minimising rate reduction pressure from O&G customers. We have trimmed our FY16-17 net profit by 28-32%, after imputing a higher 15% discount (5% previously) this year and a further 5% next year on average charter rates. Ezion remains our preferred Oil & Gas pick.

|

|

|

|

Ezion

Feb 23, 2016 12:09:37 GMT 7

Post by zuolun on Feb 23, 2016 12:09:37 GMT 7

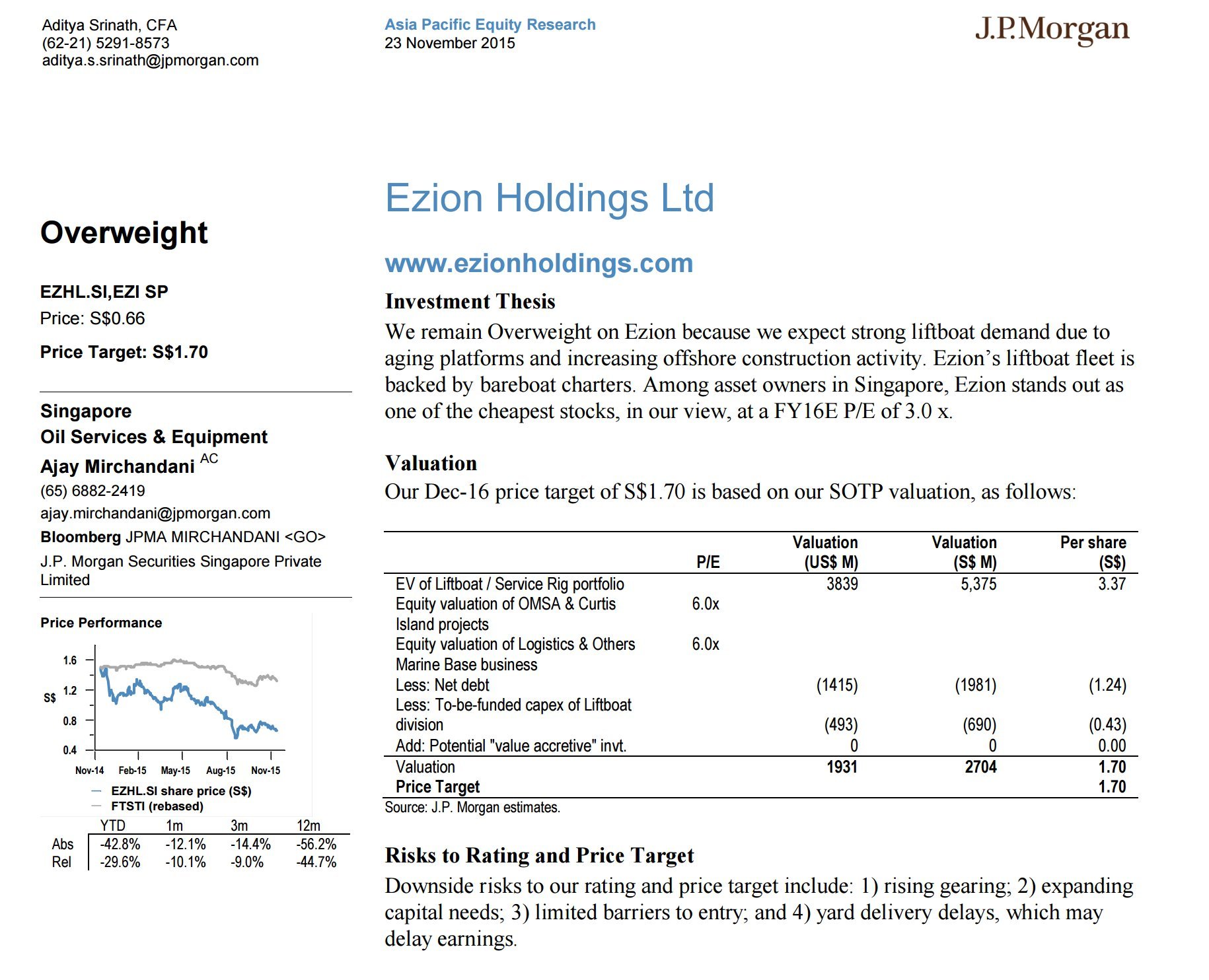

Ezion: Profit Guidance for 4Q2015 and FY2015 ~ 22 Feb 2016 Ezion forges another offshore wind joint venture in China ~ 22 Feb 2016 Ezion ~ Trading in a rectangle, interim TP S$0.445, next TP S$0.31Ezion had a black marubozu and traded @ S$0.50 (-0.02, -3.8%) with 12.9m shares done on 23 Feb 2016 at 1310 hrs. Immediate support @ S$0.48, immediate resistance @ S$0.535.  Ezion's profit guidance Ezion's profit guidance indicates that almost all the in-house stock analysts' bullish 'BUY' call on Ezion in 2015 had been disastrous except KGI Fraser and fund manager, Andre Wheeler, whose extremely bearish views were right; it means Ezion is the best stock for short, not long. JP Morgan's extremely bullish 'Overweight' rating on Ezion with TP S$1.70 dated 23 Nov 2015 was the champion among all of them.  KGI Fraser: Write-downs required to bring values to reality, maintained 'SELL' on Ezion, TP S$0.11 KGI Fraser: Write-downs required to bring values to reality, maintained 'SELL' on Ezion, TP S$0.1128 Jan 2016 Slash forecasts and TP; maintain SELL. Given the current trends of utilization and dayrates in the offshore industry, we now expect a prolonged down cycle as the rig oversupply may last longer than we had initially expected. Major offshore E&P companies are slashing budgets by a further 20-30% in 2016, according to Bloomberg Intelligence. This marks the first time since the 1980s where global capex has been reduced for two consecutive years. We thus lower our FY16-17 forecasts by 15-21% based on lower utilization rates of 60%/60% (previously 65%/70%) for FY16/17F, while keeping FY15F unchanged. As a result, we cut our TP to S$0.11, pegged to 6x FY16F EV/EBITDA (previously 0.4x FY16Y P/B), which is inline with its global peer average. Our TP also implies 0.2x Adjusted FY16F P/B. We expect massive write-downs as down cycle continues. Against the backdrop of an industry oversupply and further capex cuts, we expect companies to write-down the value of their assets in the next two years to reflect the realities of the current market. We are expecting a S$700m (~30% of total FY16F PPE value, based on current market values) write-down of Ezion’s total assets over the next two years, resulting in its net gearing rising to 2.8x, well above the 0.7x peer average. We believe this figure is conservative and may present more downside as offshore rig utilization rates remain around the 60-70% levels for the next two years. There are still ~75 jackups scheduled to be delivered this year, according to RigLogix, while current owners are not scrapping rigs fast enough to balance the markets. Multiple downside risks; no visible upside. We expect to see multiple downside risks for Ezion in the next three years given the aging profile of its fleet. The average jackup age securing new contracts over the past year is 22 years old, and are only usually for short term contracts (<1 year). This places Ezion in a tight spot as ~60% of its units are >30 years old and we believe it is unlikely that these units will secure contracts in the next three years. In addition, the planned US$350m remaining capex for the 9 units to be delivered over the next 12 months will result in negative free cash flows over the period, which we expect to put pressure on its balance sheet. Ezion’s net gearing is currently at 1.3x (but 2.8x assuming our estimated write-downs) vs 0.7x peer average (even after peers have taken 10-30% write-downs in recent quarters).

|

|

|

|

Ezion

Mar 2, 2016 13:46:44 GMT 7

Post by zuolun on Mar 2, 2016 13:46:44 GMT 7

|

|