|

|

Post by me200 on Jul 7, 2015 19:30:14 GMT 7

Total shareholder return, which also measures the compounded annual returns to the Singapore Government, was 19.2 per cent – the highest in five years – on the back of strong performance in its Singapore and China portfolios. Temasek portfolio value hits record high - 20150707

|

|

|

|

Post by zuolun on Aug 10, 2015 7:40:52 GMT 7

|

|

|

|

Post by zuolun on Aug 25, 2015 7:18:07 GMT 7

|

|

|

|

Post by zuolun on Sept 29, 2015 7:13:28 GMT 7

|

|

|

|

Post by zuolun on Oct 3, 2015 22:53:47 GMT 7

|

|

|

|

Post by zuolun on Feb 29, 2016 9:53:58 GMT 7

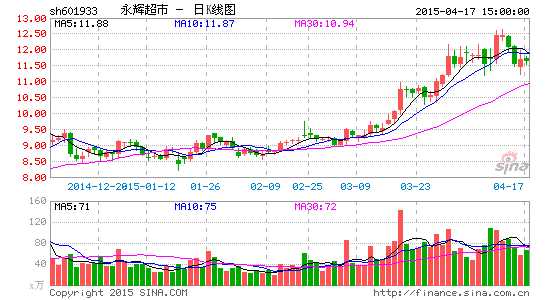

Can Chesapeake Energy avoid bankruptcy? ~ 27 Feb 2016 Are you still a CPF idiot? ~ 27 Feb 2016 Chesapeake Energy Corporation (CHK) LNG) closed @ US$2.70 (+0.14, +5.47%) on 26 Feb 2016  Chesapeake Energy Corporation (CHK) LNG) Chesapeake Energy Corporation (CHK) LNG) closed @ US$19.03 (+0.70, +3.82%) on 17 Jan 2015.  Chesapeake Energy Corporation (CHK) LNG) Chesapeake Energy Corporation (CHK) LNG) closed @ US$19.18 (-1.45, -7.03%) as at 9 Oct 2014  京东JD.Com Inc (NASDAQ:JD) set to announce quarterly earnings on Tuesday, 1 Mar 2016零售业寒冬利润放缓 永辉超市联手京东鏖战生鲜电商 京东JD.Com Inc (NASDAQ:JD) set to announce quarterly earnings on Tuesday, 1 Mar 2016零售业寒冬利润放缓 永辉超市联手京东鏖战生鲜电商 ~ 29 Feb 2016   Temasek's energy, bank holdings take a hit Temasek's energy, bank holdings take a hit ~ 26 Feb 2016 Temasek launches dual tranche Euro bond offering ~ 23 Feb 2016 Gas: Seven Energy secures $100m fresh capital ~ This, the company said, comprised $50m from existing shareholders of the group, including Temasek, Petrofac, Capital International Private Equity, Standard Chartered, International Finance Corporation and IFC African, Latin American and Caribbean Fund, by way of an open offer and $50m invested by the IDB Infrastructure Fund II, sponsored by the Islamic Development Bank and other institutional investors. ~ 18 Feb 2016 Temasek pares Alibaba stake while adding rival JD.com ~ 17 Feb 2016 Temasek's Vertex Venture 4th Israel fund oversubscribed by 50%; set for $150m final close ~ 8 Feb 2016 Temasek-backed StanChart raises $5.1bn in stake sale ~ 11 Dec 2015 Singaporeans better off without Temasek Holdings (2) ~ 7 Dec 2015 Singaporeans better off without Temasek Holdings (1) ~ 31 Oct 2015 Temasek-backed driller Integradora de Servicios Petroleros Oro Negro amends bonds 2nd time amid oil rout ~ 2 Sep 2015 Singapore's Temasek expands China investment with JD.com, Cheetah Mobile ~ 15 Aug 2015 JD.com narrows losses, buys 10% stake in Yonghui Superstores for Rmb4.31b (US$700m) ~ 10 Aug 2015  Mexico’s state government debt hits record high Mexico’s state government debt hits record high ~ 28 July 2015 Temasek entangled in Mexican oil-rig investment amid energy rout ~ 9 July 2015 Temasek among investors in Chinese travel website Tuniu’s $500m round ~ 11 Mat 2015 Oro Negro bondholders lack visibility on new rig financing ~ 17 Apr 2015 SembMar's PPL shipyard bags two jackup deals from Oro Negro ~ 1 July 2013 Trouble in Sembcorp and KeppelBy John L. Tan 27 Jan 2016 The ongoing saga surrounding Sembcorp and Keppel underscores the reasons why Government should stay out of business. Only recently, Temasek sold NOL at a huge loss (that’s our money down the tube, folks). Now Temasek is staring down the probability of absorbing the losses of Sembcorp Marine and the sales of Keppel’s stakes in M1 and Office REIT. When the market is good, a rising tide lifts all boats. It is when chips are down that the navigation skills of the captain become salient. Judging from the way Temasek and GIC navigated in the 2008 crisis, we must be very wary of how they manage our money. During that time, Government managed funds lost about a third of our national reserves! Remember their reckless gamble in UBS, Citibank, Morgan Stanley and Merrill Lynch? The unfolding saga looks like history is about to repeat itself. It is easy to gamble with the people’s money when there is little accountability and transparency. Brace yourselves.

|

|

|

|

Post by zuolun on Mar 1, 2016 14:13:06 GMT 7

|

|

|

|

Post by zuolun on Mar 6, 2016 8:45:56 GMT 7

|

|