|

|

Post by zuolun on Sept 30, 2014 13:26:40 GMT 7

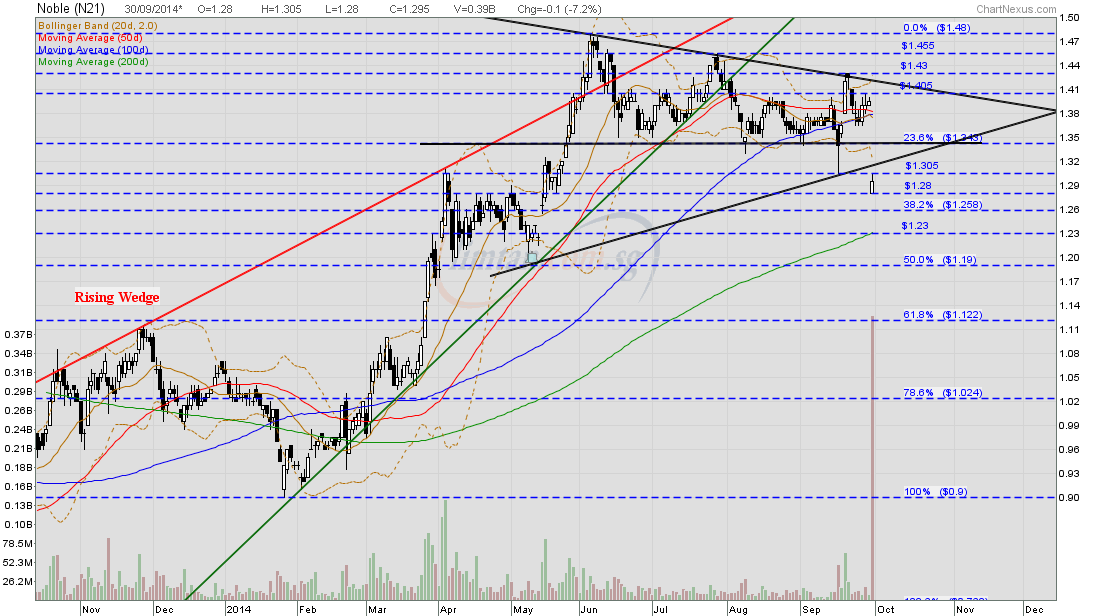

Noble is a M&A play, the bet on the upside breakout @ S$1.48 depends on the deal which is expected to close in Sep/Oct 2014. Noble gapped down with an inverted hammer @ S$1.295 (-0.10, -7.2%) with extremely high volume done at 392m shares on 30 Sep 2014 at 2.15pm on news that CIC trims stake and raises $310.6m from sale of Noble's shares dated 29 Sep 2014. Immediate support @ S$1.26, strong resistance @ S$1.305.   |

|

|

|

Post by kenjifm on Sept 30, 2014 14:57:55 GMT 7

Noble Grp price action needs to stay above 1.31 for any upside. If not, the downside will prevail.  |

|

|

|

Noble

Sept 30, 2014 15:18:46 GMT 7

Post by odie on Sept 30, 2014 15:18:46 GMT 7

Noble Grp price action needs to stay above 1.31 for any upside. If not, the downside will prevail. kenjifm, better to stay clear cos CIC is selling a lot of shares |

|

|

|

Post by kenjifm on Sept 30, 2014 15:21:48 GMT 7

Thank you odie

Noble does not fit into my criteria for investment.

Current market is seriously sideway with major up and down.

in this context, there might really be a hidden bull. Might....only.

One should either preserve their profit this year or only nibble in investment that give good consistent dividend with a calculated position.

|

|

|

|

Post by zuolun on Oct 28, 2014 14:51:02 GMT 7

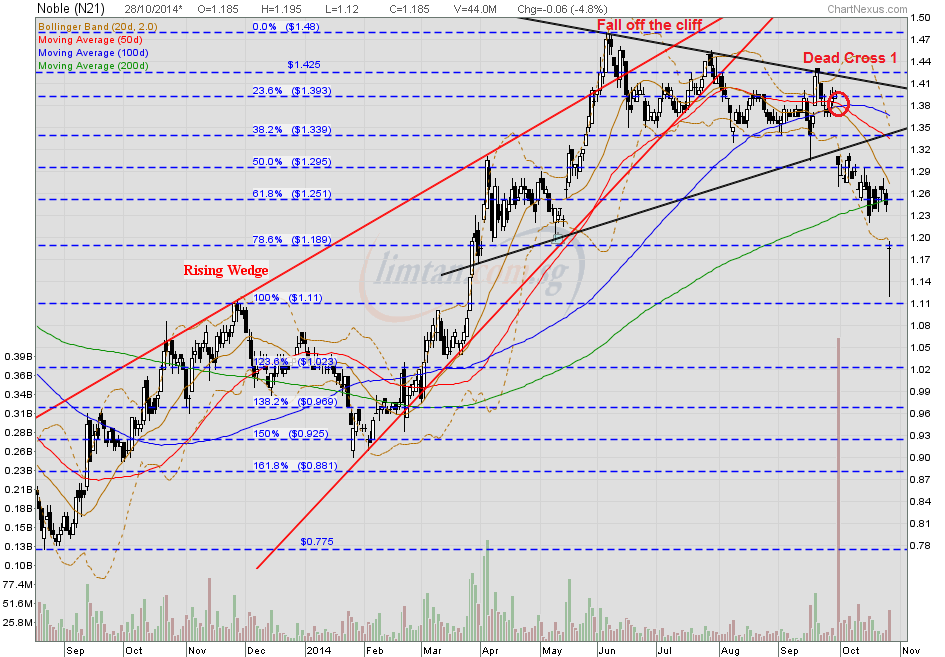

Noble — A "Waterfall Decline" with 5-Wave down, Interim TP S$0.925, Next TP S$0.775Noble gapped down with a long-legged doji @ S$1.185 (-0.06, -4.8%) with high volume done at 44m shares on 28 Oct 2014 at 4pm. Immediate support @ S$1.11, strong resistance @ S$1.25, the 200d SMA.

|

|

|

|

Post by zuolun on Jan 18, 2015 14:19:08 GMT 7

|

|

|

|

Post by zuolun on Feb 16, 2015 14:51:20 GMT 7

|

|

|

|

Post by zuolun on Feb 18, 2015 11:39:58 GMT 7

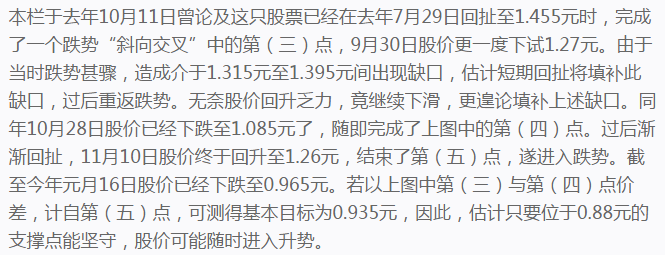

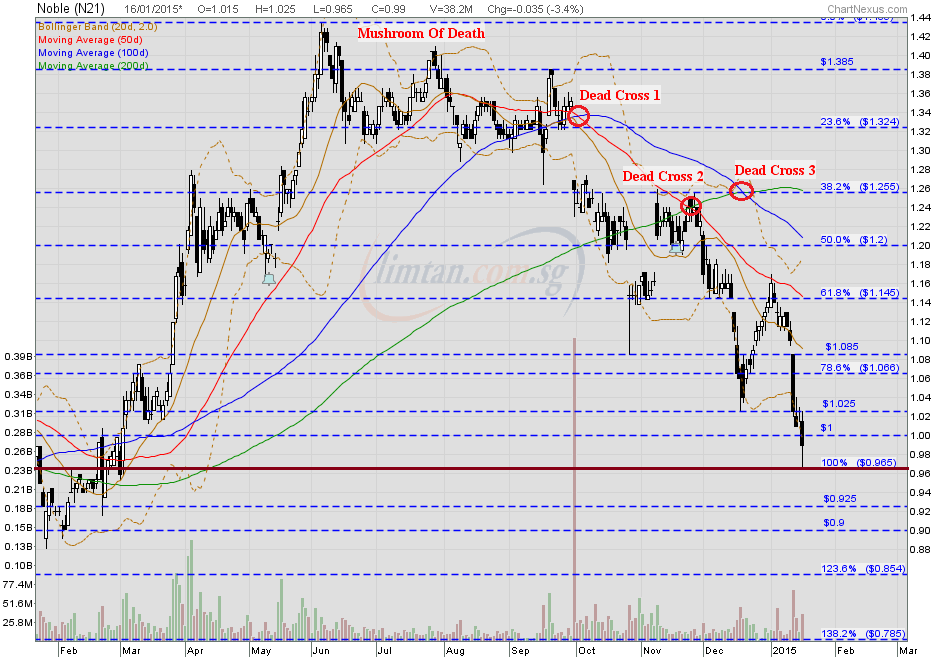

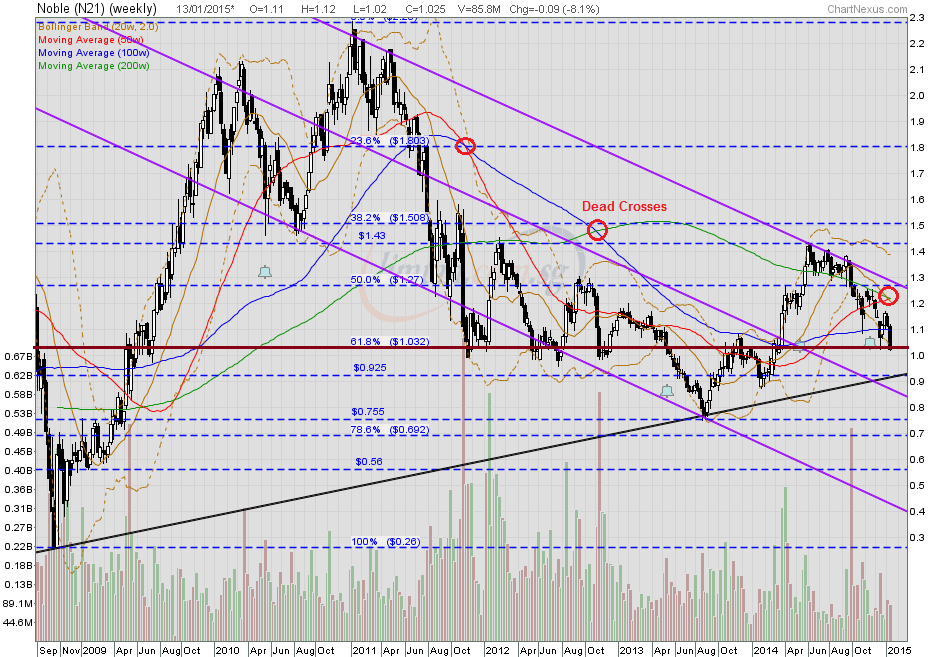

这一次,新加坡来宝集团不死一身残!  Noble's chart pattern suggests that its share price is ripe for a steep correction — 1st TP S$0.925, 2nd TP S$0.88, 3rd TP S$0.775.MAS to probe Noble on alleged accounting fraud Noble's chart pattern suggests that its share price is ripe for a steep correction — 1st TP S$0.925, 2nd TP S$0.88, 3rd TP S$0.775.MAS to probe Noble on alleged accounting fraud ~ 18 Feb 2015 Noble shares slide for 2nd day after accounting practices questioned ~ 17 Feb 2015 Noble: TP S$1.30 under review - iOCBC ~ 17 Feb 2015 SGX Announcement by Noble GroupNOBLE GROUP LIMITED

(Incorporated in Bermuda)

ANNOUNCEMENT Noble Group Limited (" Company" or the " Group") refers to the statements about the Company made by Iceberg Research (" Iceberg"), and the statement made by the Company on 16 February 2015. The Company wishes to address some of the statements that have been made in Iceberg’s report. This release is not intended to be exhaustive. The Company feels it is important for our stakeholders to know that we take any allegations, regardless of source, seriously. Neither we, nor any of our external banking or investor stakeholders are familiar with Iceberg. We have found no address or formal contact details; the author or authors of the report have chosen to remain anonymous; and no attempt was made by Iceberg to air their concerns with the management of the Group prior to publication. If their intention, as claimed in the report, was to highlight supposed deficiencies in our accounting principles for the benefit of investors, it would have been normal to approach the Group to discuss their concerns, rather than publishing a report of this kind shortly before our annual results announcement and just before a holiday period. The Group reports its results in accordance with International Financial Reporting Standards, and the annual financial statements for 2013 and prior years have been audited by Ernst & Young who issued unqualified opinions. The carrying values of our associates, including Yancoal, are tested for impairment using discounted cash flow models that are updated every quarter. As is always the case these valuations are currently being audited as part of the FY2014 audit. The Company has interests in associates on its balance sheet at levels that may be higher or lower than that which is observable from the market traded share price. The Board of Directors and the management are comfortable that the Group’s balance sheet fairly presents its book value under IFRS. The balance sheet as of 31 December 2014 will be announced in our full year results release next week on 26 February. The reasons why the Group categorizes investments such as Yancoal and others as associates have been clearly disclosed in our annual reports. Supporting factors include board representation, material transactions between the Group and the investee (such as substantial offtake agreements) as well as the provision of essential technical information. Yancoal and the Group maintain regular dialogue on potential partnership activities. The sale of the 51% stake in Noble Agri Limited (“NAL”), to COFCO and a consortium of international financial investors, was a transformational transaction for both NAL and the Group. This transaction was concluded after an extensive due diligence process conducted by COFCO and the consortium of international financial investors, supported by a large group of international advisors, which included numerous presentations and meetings to answer more than 1,000 questions and access to a dataroom with approximately 3,500 documents. The Group received US$1.5 billion in sales proceeds for the 51% stake sale, and an intercompany loan repayment from NAL of US$1.8 billion in October 2014. Most of the proceeds and intercompany loan repayment were used to repay the Group’s short-term bank debt. Following the deleveraging that we were able to achieve with the stake sale in NAL, the Group’s gearing is at the lowest that it has ever been in its recent history. We have a solid balance sheet and industry leading liquidity headroom (the sum of readily available cash and unutilized committed facilities) of US$5.1 billion, as of 30 September 2014. Contrary to Iceberg’s allegations, we did not mislead the market in any way about the performance of NAL. In our quarterly Management Discussion & Analysis, we publicly disclose and then discuss the performance in operating income from supply chains before selling, administrative & operating expenses (“SAO”), interest and other charges for the 9 months ended 30 September 2014, versus the same period in 2013. Furthermore, it is incorrect and grossly misleading to imply the book value of NAL based on our reported re-measurement gain arising from the Group’s remaining 49% stake in NAL. The gain on disposal and the re-measurement gain need to take into account the transaction costs, accrued costs borne by the Group during the transitional period, as well as the Group’s reserve adjustments in relation to NAL. Finally, the allegations on the Group’s palm assets are again factually incorrect. In December 2014, Mimika, Papua Province issued a decree purporting to revoke PT Pusaka Agro Lestari’s (“PT PAL”) location permits and require PT PAL to cease logging activities and replant trees. Since then the Director General of Plantations at the Ministry of Agriculture has confirmed that PT PAL’s plantation business licence and a right of cultivation are in order and supports PT PAL’s continued operation. Furthermore, PT PAL represents only 20%-25% of our total palm activity, at around US$43 million (out of the total palm asset value of US$224 million). Also, any future profits or losses incurred upon the sale of the palm assets will be shared equally between the Group and the COFCO led consortium of investors. In conclusion, contrary to the misleading allegations by Iceberg, it is business as usual in our palm plantations. We would like to thank all of our banking, investor and client stakeholders who have confirmed their support over the last 24 hours. NOBLE GROUP LIMITED 17 February 2015 About Noble Group Noble Group (SGX: N21) manages a portfolio of global supply chains covering a range of industrial and energy products, as well as having a 49% interest in Noble Agri, its agricultural partnership with COFCO. Operating from over 60 locations and employing more than 40 nationalities, Noble facilitates the marketing, processing, financing and transportation of essential raw materials. Sourcing bulk commodities from low cost regions such as South America, South Africa, Australia and Indonesia, the Group supplies high growth demand markets, particularly in Asia and the Middle East. We are ranked number 76 in the 2014 Fortune Global 500. For more information please visit www.thisisnoble.com. For further details please contact: Ms. Rebecca Fung Noble Group Limited Tel: +852 2861 4625 Email: rebeccafung@thisisnoble.com Ms. Candice Adam Argentus PR Tel: +44 20 7397 2915 Email: candice.adam@argentuspr.com Mr. Martin Debelle Citadel Tel: +61 2 9290 3033 Email: mdebelle@citadelpr.com.au 新加坡来宝集团(Noble Group) ~ 2 Feb 2015   Noble — Classic MOD chart pattern, TP S$0.775Noble closed with a hammer @ S$0.99 (-0.035, -3.4%) with high volume done at 38.2m shares on 16 Jan 2015. Immediate support @ S$0.965, immediate resistance @ S$1.025.  Noble (weekly) — Trading in a downward sloping channel, biased to the downside Noble (weekly) — Trading in a downward sloping channel, biased to the downside

|

|

|

|

Post by zuolun on Feb 27, 2015 12:06:23 GMT 7

Noble traded @ S$1.00 (-0.06, -5.7%) with 69.42m shares done on 27 Feb 2015 at 1.30pm. Noble's 1st TP S$0.925, 2nd TP S$0.88, 3rd TP S$0.775 — still valid ~ 27 Feb 2015 Here’s what analysts have to say about the accounting fraud claims versus Noble ~ 27 Feb 2015 Noble says Iceberg author a former staff; group posts US$240m Q4 loss ~ 27 Feb 2015 Noble overstated commodity values by at least US$3.8b, says Iceberg in second report ~ 26 Feb 2015 Accounting fraud allegations “without substance”, says Noble ~ 26 Feb 2015 Noble says auditor EY seeks more time, refutes Iceberg's fresh allegations ~ 26 Feb 2015 Iceberg unleashes second report on Noble, takes aim at “suspicious” cash flows ~ 26 Feb 2015 Macquarie says Noble selloff overdone, dismisses Iceberg report as “sensational” ~ 16 Feb 2015 World's biggest sovereign wealth fund dumps dozens of coal companies ~ 5 Feb 2015 Noble’s FY14 net profit falls 46% to US$132 million; hit by impairment charges and provisionsBy PC Lee 26 Feb 2015 Noble Group ( Financial Dashboard), the global supply chain manager and commodity trader, reported a 46% fall in FY14 net profit of US$132 million ($178 million), or 1.6 US cents per share, from US$243.5 million a year ago. In a filing to the SGX, Noble said the group had taken significant charges for impairments and provisions totalling US$438 million, “in line with many other companies in the commodities sector”, including a US$200 million impairment against its interest in Yancoal. Although full-year revenue rose 4% to US$85.8 billion from US$82.4 billion a year ago, operating income from supply chains dipped 6% to US$1.49 billion. Total operating income also fell 29% to US$1.02 billion. Meanwhile, losses on supply chain assets widened more than six-fold to US$290.1 million while loss from discontinued agricultural operations narrowed 77% to US$109.4 million. In addition, payables to creditors rose by more than 20% from US$8.3 billion to US$10.9 billion despite Noble selling down Noble Agri. Noble’s results were announced even as its accounting practices were questioned by a group calling itself Iceberg Research. The initial report a week ago sparked a decline of as much as 15% in the stock in two days. Noble has denied the allegations, including overstatement of the value of a stake in Yancoal Australia. Noble said it has written down the value of Yancoal by US$200 million as part of US$438 million in impairments for last year, which includes losses from joint ventures. Earlier today, Noble said Ernst & Young LLP agreed to sign off on the accounts, hours after an initial delay in securing the auditor’s approval sent its bonds tumbling. The delay occurred after the company said Ernst & Young needed more time to review its own internal processes after Iceberg published a second report. As at end Dec 2014, Net debt/Capitalisation stood at 37.8%, down from 49.7% in end Dec 2013. Book NAV per share stood at 0.75 US cents, down from 0.78 US cents in FY13. CEO Yusuf Alireza said, “We continue to take a realistic long term view of the carrying value of the investments on our balance sheet and this has meant that the results reflect significant non-cash charges. This should not, however, mask the record performance from our core operations in extremely challenging markets.” The board has recommended a FY14 dividend payout of 0.95 cents per share, representing 35% of net profits. The stock last closed at $1.06 before it was suspended, giving it a market cap of $7.14 billion. Noble will resume trading tomorrow. |

|

|

|

Post by zuolun on Mar 1, 2015 7:18:03 GMT 7

|

|

|

|

Post by zuolun on Mar 2, 2015 16:26:10 GMT 7

|

|

|

|

Noble

Mar 3, 2015 15:22:43 GMT 7

Post by pain on Mar 3, 2015 15:22:43 GMT 7

Noble is one of the stocks for trading purposes. Observed a hammer and a potential morning star/ bullish engulfing pattern with today's price action. The window between $1.02 to $1.05 will be a resistance. Bearish belt hold on 1 Mar. High volume seen last few day. Richard Elman bought 4.8 mil of shares. Iceberg 3rd report on debt ratings not released yet. Talking to myself again.... Attachments:

|

|

|

|

Post by zuolun on Mar 3, 2015 15:49:19 GMT 7

Noble is one of the stocks for trading purposes. Observed a hammer and a potential morning star/ bullish engulfing pattern with today's price action. The window between $1.02 to $1.05 will be a resistance. Bearish belt hold on 1 Mar. High volume seen last few day. Richard Elman bought 4.8 mil of shares. Iceberg 3rd report on debt ratings not released yet. Talking to myself again.... , Noble's share price spikes to high of S$1.03 today is due to short squeeze.  Richard Elman has to continue to buy much more Noble shares; a repeat of the Olam wayang show.  |

|

|

|

Post by pain on Mar 6, 2015 11:39:06 GMT 7

Bro Zuolun, Yup. The whole thing is more of a wayang show. Needs more big guys to buy. However, I am of the opinion that there are no concrete evidence of any wrongdoings in Noble's account. But market forces determine the price, not my opinion. Resistance is strong at $1.05. Probably the people are waiting for the 3rd Iceberg report. Hmmm...  Noble is one of the stocks for trading purposes. Observed a hammer and a potential morning star/ bullish engulfing pattern with today's price action. The window between $1.02 to $1.05 will be a resistance. Bearish belt hold on 1 Mar. High volume seen last few day. Richard Elman bought 4.8 mil of shares. Iceberg 3rd report on debt ratings not released yet. Talking to myself again.... , Noble's share price spikes to high of S$1.03 today is due to short squeeze.  Richard Elman has to continue to buy much more Noble shares; a repeat of the Olam wayang show.  |

|

|

|

Post by zuolun on Mar 6, 2015 13:39:37 GMT 7

|

|