|

|

Post by zuolun on Dec 22, 2014 6:02:45 GMT 7

|

|

|

|

Post by zuolun on Dec 23, 2014 11:50:28 GMT 7

|

|

|

|

Post by zuolun on Dec 26, 2014 14:14:40 GMT 7

Curse of Oil Wealth (Full Documentary) — 24 Oct 2014

|

|

|

|

Post by zuolun on Jan 1, 2015 16:36:06 GMT 7

China oil giant probes 'worthless' deals in Indonesia — 19 Dec 2014 Avon exposes ugly side of doing business in China — 18 Dec 2014 Kickback(回佣 / 回扣)A kickback is a payment of money, favors, or some other valuable to another individual to perform a certain desired action or to make an important decision in the kickbacker's favor. The desired action is often a referral that results in a transaction that benefits the person who paid the kickback. A kickback can be either legal or illegal, depending on the circumstances of the action. A kickback is generally done in secret. In investing, a common kickback is a broker's reduced commission charged to someone who invests frequently through the broker. Another example is referral payments for finding clients. Kickbacks occur not only in business, but also in government sectors. The US government has laws that prohibit kickback behavior.

Example:

The CEO of a listed company, ABC invested company's fund, $1 billion in a company called XYZ with full knowledge that it would go bankrupt soon. Prior to the investment decision, he had liaised a 50/50 split with the owner of company XYZ that each would get $500 million once he got the money. After a while, company XYZ really went bankrupt. It didn't affect the CEO personally as the $1 billion in losses were attributable to the listed company ABC. So what's rightfully company ABC’s money has now become the CEO's personal money, and it’s all legal and above board. 贪污风险知多少(简体版) 测试一: 回佣

|

|

|

|

Post by hope on Jan 1, 2015 22:47:03 GMT 7

Bro zuolun, happy new year to you.

Interesting read that companies can engineered such move and CEO can make so much $$ by buying going to be bankrupt company,

so it is quite risky to buy share in small set up, as cheng Kay can suka suka make such under table deal, compared to blue chips company?

|

|

|

|

Post by zuolun on Jan 2, 2015 6:47:22 GMT 7

Bro zuolun, happy new year to you. Interesting read that companies can engineered such move and CEO can make so much $$ by buying going to be bankrupt company, so it is quite risky to buy share in small set up, as cheng Kay can suka suka make such under table deal, compared to blue chips company? hope, To make big money on any stock; concerted effort to entice gullible investors to buy a stock at extremely overvalued / high prices must be made by various cheng kays (major big players) who had earlier purchased a major stake at dire cheap prices. Read the details of RH PetroGas and its major substantial shareholder, Kim Eng — to know the ugly side of the stock market gameplay and watch the Cantonese video clip below — to understand how the big Chinese boss, a major cheng kay did a fundamental analysis on the company stock. 刘青云 教识你证券交易所运作, 股权, 股价, 经纪, 黑市买卖, 假消息 |

|

|

|

Post by zuolun on Jan 3, 2015 10:02:53 GMT 7

|

|

|

|

Post by zuolun on Feb 18, 2015 8:36:31 GMT 7

|

|

|

|

Post by zuolun on Feb 19, 2015 7:05:39 GMT 7

Why I left Singapore for Malaysia for good ~ 12 Feb 2015 Top 10 reasons why Singapore is the best place to work in for foreign workers ~ 16 Apr 2011 Of migration and the Singaporean diaspora ~ 14 Apr 2009  10 Most Densely Populated CountriesEnlightening speech with a FT citizen 10 Most Densely Populated CountriesEnlightening speech with a FT citizen I was in a remote western region in China and we were stranded at this small lousy airport. And there is only 1 Indian man (age 59, I found out from him later). No one could help him and I knew I was the only one and of course being kind hearted, and naive Singaporean, I voluntarily went. I saw his "RED passport" and we connected!!! Then we started to discuss the Punggol East By-election, the government and the policies. (Please do not assume a RED passport is automatic bred and bornt in Singapore... I was lambasting how Singapore has transformed from a lovely state to a state where everyone has become emotionless and working round the clock to pay for everything and to survive.) 15 minutes into the discussion, he told me he is FT who came to Singapore 10 years ago and quickly offered PR and new citizen in less than 2 years. By the way, this guy is not Foreign Trash, he is Senior Management in Fortune 500 (the ranking is below 50) and paid over $20,0000++ a month. Below are questions from me and answers from him:- Me: The government is doing a bad job and people are suffering. FT: I read the Straits Times and every survey is indicating good, I dont agree what you said is true and today. (I said, you really believe that BS? You did not have time to browse the web than to believe the propaganda...I went on to tell him many examples like AIM etc, he was shocked... but the newspaper version is so different.... but anyway he said he did not have time, working very long hours every day) Me: Well, do you feel we imported too many FT, especially low quality ones from neighbouring regions. FT: Yes, totally agreed, its getting too crowded and also the pay for average guy is getting lower but living expenses are sky high. (But he was a FT himself but of course this man used to work in the US and UK for many years before arriving into SG, probably what they called a real FT) Me: If Singapore is so good, are you going to retire in Singapore? FT: Retire in Singapore? (shrugs with a laugh) Me: Why? You said Singapore is so good etc.... And you said those surveys damn good. FT: Honestly speaking, my pay is crossing $20,000 a month but I wont retire here. First, our CPF is trapped and the medical cost and daily expenses are so high. I am going to renounce and take all the cash and move back to India. Anyway, I also dont want to die in a foreign land. Me: Arent you one of us? FT: In a way but I still need to go back, this place is getting too expensive to live and I dont want my body to be resting here, I am not bornt here. Me: $20k a month you telling me this? How about those making $5000 or .... FT: Dont pretend you dont know, they work and pay all their lives until they die. And I am not going to be in that position. Me: Your kids in Singapore? FT: I sent them to UK and US and told them not to come back. Me: Singapore is such great place, you told me and why.... ahhhhh (cynicism) FT: I could not imagine that they be paid $2500 after their graduation, compete with millions of foreigners and pay a debt of 30 years for that million dollar HDB. And education in US is more prestigious and they can get into Fortune 500 companies easily and they buy houses and drive cars etc. And if they really return to SG (which I doubt so.. because they are originally from Calcutta and honestly, they dont really like Singapore), they will be Foreign Talent and be paid very high like me, no need to fight with those foreigners. Me: They did not serve NS huh? FT: You asking me silly questions, I did not convert them PR before 18... I found way to go around it (laugh very hard) Me: Warao (Singapore style). You enjoy so much from Singapore and how you going to thank us? FT: I voted PAP every GE, and that is thank you. And they gave me PR, new citizenship and also my HDB (I sold at record profits and now living in nice condo in Jurong East). When I retire, I will sell and take all the CPF to India. I really appreciate Singapore.

|

|

|

|

Post by zuolun on Apr 25, 2015 10:51:00 GMT 7

Evidence The Titanic Was Sunk on Purpose ~ 31 July 2013

|

|

|

|

Post by zuolun on May 5, 2015 8:15:52 GMT 7

|

|

|

|

Post by zuolun on Jun 14, 2015 10:59:19 GMT 7

Behind the Chinese govt’s brazen bid to pump up its stock market ~ 1 Jun 2015 If these aren't signs of a potential bubble then I don't know what is. A short write up on yesterday's Today paper quoted some Chinese 60 year old lady saying she is buying stocks with the hope that the "blind cat catches the mouse". In any stock market, it's all about supply and demand. From a chartist's point of view; buy stocks with good momentum and volume, which can reward you a good profit. Do not buy stocks with low or no volume and sit on them, these stocks are dead and dire cheap for a reason. (Bottom-fishing is the toughest gameplay in the stock market.) Watch the video clip and listen carefully from 1:50 to 1:59... the speaker has revealed an important fact about the stock market gameplay. "In the stock markets today, there are good companies that are overpriced and there are worthless companies that are overpriced. If you are going to be a fool and pay absurd prices because you think that a greater fool will appear in the future, make sure you buy a goat and not a monkey." Do not buy stocks that even worms also won't grow on them!

|

|

|

|

Post by zuolun on Jul 5, 2015 19:48:16 GMT 7

|

|

|

|

Post by zuolun on Aug 13, 2015 14:50:59 GMT 7

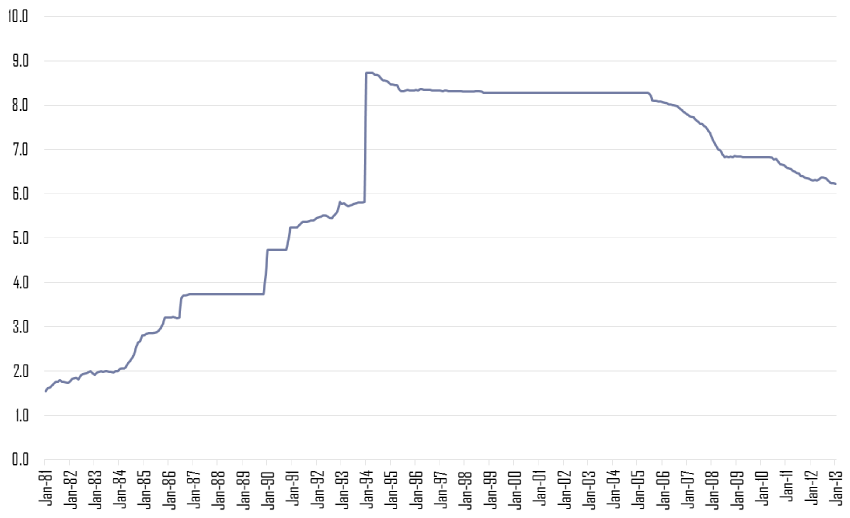

S-chips listed on the SGX are strictly for gambling purposes, nothing else"Those who cannot remember the past are condemned to repeat it." ~ George SantayanaPBoC: We won't send yuan 10% down ~ 13 Aug 2015 China’s currency U-turn: PBoC devalues the yuan ~ 13 Aug 2015 China drops value of the yuan against dollar for third day ~ 13 Aug 2015 How to anger Asia, Fed in one shot: Devalue the yuan ~ 11 Aug 2015  China’s exchange rate policy China’s exchange rate policy ~ During the era of the command economy, the value of the renminbi was set to unrealistic values in exchange with western currency and severe currency exchange rules were put in place. With the opening of the mainland Chinese economy in 1978, a dual-track currency system was instituted, with renminbi usable only domestically, and with foreigners forced to use foreign exchange certificates. The unrealistic levels at which exchange rates were pegged led to a strong black market in currency transactions. In the late 1980s and early 1990s, China worked to make the RMB more convertible. Through the use of swap centres, the exchange rate was brought to realistic levels and the dual track currency system was abolished. As of 2013, the renminbi is convertible on current accounts but not capital accounts. The ultimate goal has been to make the RMB fully convertible. However, partly in response to the Asian financial crisis in 1998, China has been concerned that the mainland Chinese financial system would not be able to handle the potential rapid cross-border movements of hot money, and as a result, as of 2012, the currency trades within a narrow band specified by the Chinese central government. Yuan Exchange Rate (per USD), 1981-2013 (Monthly) Chinese students in US urge justice for Tiananmen massacre Chinese students in US urge justice for Tiananmen massacre ~ 4 Jun 2015 Tiananmen Square Massacre - June 4 1989Is Hollywood funding Chinese propaganda? ~ 3 May 2012 Reality check: - It’s never going to happen in the way that you would like, Hollywood.

- China can sign whatever contracts you want signed – but,

- in the end, they will not honor them and you will leave, beaten, with your tails between your legs.

China's Cultural Revolution 1966-1976From the "Great Leap Forward" to the "Great Famine" 1958 to 1961历史回顾 – 从大跃进到大饥荒 China's Cultural Revolution 1966-1976From the "Great Leap Forward" to the "Great Famine" 1958 to 1961历史回顾 – 从大跃进到大饥荒

|

|

|

|

Post by zuolun on Sept 18, 2015 9:57:50 GMT 7

|

|