|

|

Post by zuolun on Apr 29, 2014 11:27:17 GMT 7

Guoco Leisure — 1-lotter @ S$0.96 on sell queue on 29 Apr 2014 at 12.17 noon.

|

|

|

|

Post by zuolun on May 6, 2014 8:11:17 GMT 7

Linc Energy — 1-lotter @ S$1.13 at pre-opening 08:58:18 hrs

|

|

|

|

Post by zuolun on May 13, 2014 14:58:50 GMT 7

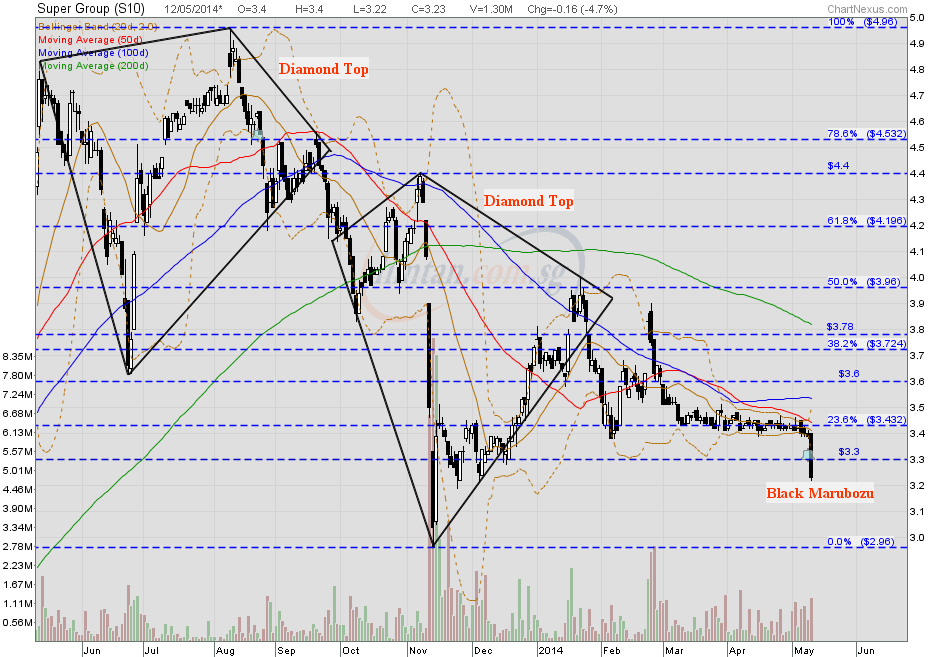

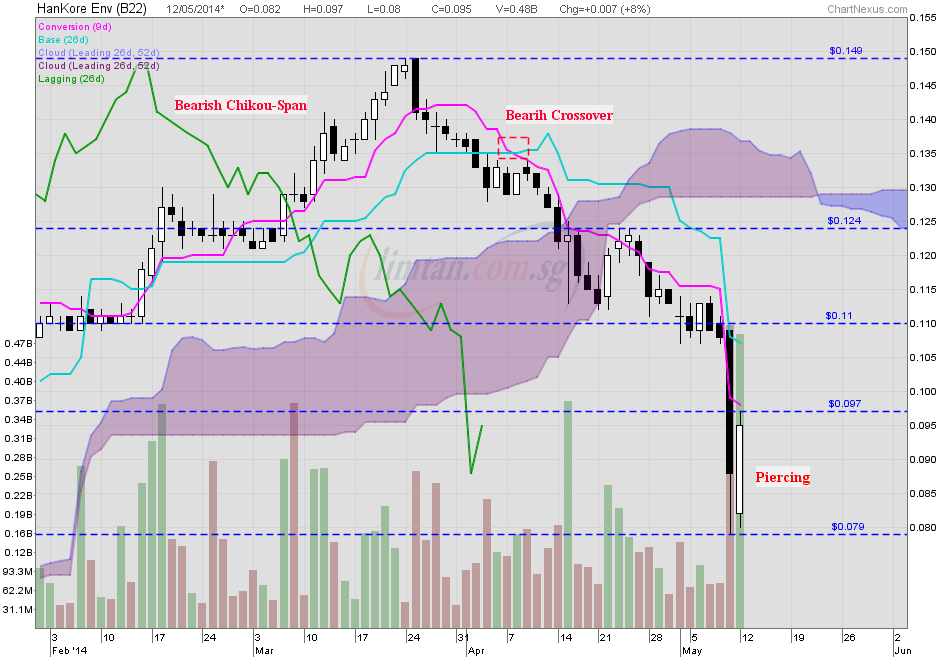

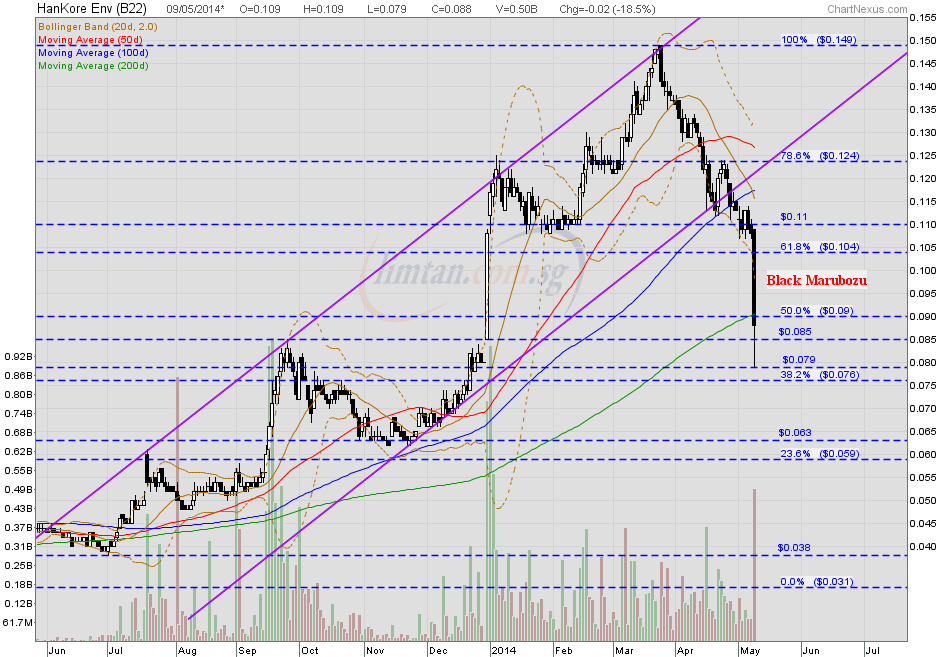

zuolun bro, thanks no worries as i don't hold oue parent i only hold F&N, Fraser Centrepoint Limited (waiting for completion of IPO before deciding to sell), Datapulse (only 20 lots), OUE C Reit (left 29 lots after i kenna the 1-lotter) , Kim Heng offshore (which i dump into the freezer) my CPF invt acct only has F&N, Fraser Centrepoint odie, 1-lotter trades could be a significant key signal/indicator used by the BBs to long or short big time. I posted the 1-lotter trade records done @ S$3.70 on SuperGroup dated 12 Nov 2013, which was 1 day prior to the price bottoming @ S$3.03 on 13 Nov 2013. The 2 red long volume bars followed by 2 green long volume bars suggested that the big shorts were all covered and the BBs were all out of SuperGroup then. Without strong hands follow-thru support-buy, SuperGroup's share price will retest the last low @ S$3.03 and hit lower low. If you look at Hankore's chart pattern, the price action and trading volume are exactly the same as SuperGroup, i.e. the 1 red long volume bar followed by 1 green long volume bar suggested that the big shorts were all covered and the BBs were all out of Hankore last Friday 12 May 2014. Hankore's share price will retest the last low @ S$0.079 and hit lower low. This scenario is not a case of demand and supply determine price, it's a typical bull trap step up to trap the bulls. A dead cat bounce in a strong downtrend is meant for the old stale bulls stuck at much higher prices to get out; to be replaced by new silly bulls.  SuperGroup — Bearish Diamond Top (1+1) Breakout, interim TP S$2.34SuperGroup closed with a long black marubozu @ S$3.23 (-0.16, -4.7%) with volume done at 1.3m shares on 12 May 2014. Immediate support @ S$2.96, strong resistance @ S$3.30.  I noticed most China-based stocks listed outside the PRC all have identifical chart pattern, i.e. they're able to attract huge crowd for gambling only. When the game is on especially 'goreng' just initiated, they're gems but after game over, they're germs.  Hankore — A Dead Cat Bounce Hankore — A Dead Cat BounceHankore closed with a piercing pattern @ S$0.095 (+0.007, +8%) with extremely high volume done at 484m shares on 12 May 2014. Immediate support @ S$0.079, strong resistance @ S$0.11.  |

|

|

|

Post by odie on May 13, 2014 15:09:29 GMT 7

zuolun bro,

super 1-lotter at 3.70 was a sell down

my oue c reit 1-lotter buy my 1 lot at 0.80 but not sure if buy up.....

|

|

|

|

Post by zuolun on May 13, 2014 16:11:00 GMT 7

zuolun bro, super 1-lotter at 3.70 was a sell down my oue c reit 1-lotter buy my 1 lot at 0.80 but not sure if buy up..... odie, Yes, SuperGroup 1-lotter at 3.70 was a sell down and also a "cheng Kay" run road and let the horse die liao... Take a look at Innopac's chart pattern at point B, 1 green long volume bar followed by 1 red long volume bar and at point C was the last chance "cheng Kay" gave retailers to follow SELL and completely get out, not buy...those new silly bulls who jumped in during the dead cat bounce at point C to point D were at extremely high risk because "cheng Kay" had already run road and let the horse die liao... Drag any strong downtrend stock out; it will show you the same scenario.   |

|

|

|

Post by odie on May 13, 2014 18:55:11 GMT 7

zuolun bro,

does it mean hankore is in danger of collapsing too?

but it has a red vol bar followed by a green vol bar which is different from super's vol bar (green first then red)

the bullish harami seems to be a bull trap

|

|

|

|

Post by zuolun on May 13, 2014 21:55:02 GMT 7

zuolun bro, does it mean hankore is in danger of collapsing too? but it has a red vol bar followed by a green vol bar which is different from super's vol bar (green first then red) the bullish harami seems to be a bull trap odie, Hankore has already collapsed not "in danger of collapsing".  It is equivalent to a weak new IPO with no more stabilizing manager around to stabilize the share price. The "cheng kay run road" signal is crucial for retailers to follow and exit together as subsequent volume bars (whether red or green doesn't matter) all should be short ones. On 9 May 2014 Hankore had 1 red bar followed by 1 green bar; on 12 Nov 2013 SuperGroup had 1 red bar + another red bar followed by 2 green bars. (You should be able to check back all the details from your charting software.) I repost the 1st extremely long red volume bar 1st appeared on Hankore's chart and SuperGroup's chart below.   |

|

|

|

Post by zuolun on Jul 23, 2014 9:06:30 GMT 7

NOL — 1-lotters @ 94c and 94.5c on 23 July 2014, 09:58:19 hrs

|

|

|

|

Post by zuolun on Sept 1, 2014 8:39:43 GMT 7

NOL — 1-lotter @ S$1.01 at pre-opening on 1 Sep 2014, 09:58:25 hrsNOL — 1-lotters @ 94c and 94.5c on 23 July 2014, 09:58:19 hrs

|

|

|

|

Post by zuolun on Sept 24, 2014 8:47:23 GMT 7

Valuetronics — 1 lotters on 24 Sep 2014 at 09:00:00 hrs sharp and 09:20:18 hrs

|

|

|

|

Post by victor on Sept 26, 2014 20:04:52 GMT 7

Looks like there is a big seller who is not done yet!  do u means to say , he will be pushing the price higher for him to sell valuetronics? Thanks |

|

|

|

Post by victor on Sept 26, 2014 20:39:59 GMT 7

Looks like there is a big seller who is not done yet!  do u means to say , he will be pushing the price higher for him to sell valuetronics? Thanks I just bought this one at 430, i know disclaimer, and i trade very small 20 lots. thanks. |

|

|

|

Post by oldman on Sept 27, 2014 5:41:35 GMT 7

If you are trying to buy and you are hit with a 1- lotter, it does not feel half as bad as when you are trying to sell and you are hit with a 1-lotter. This is especially so when the stock you are trying to sell is a micro penny stock. I have been hit this way recently and I end up having to pay for selling a stock! Yes, the sale price did not cover the $25 minimum commission! I always tell myself that this is part and parcel of investing. In case you are wondering, when I start collecting a stock, it is not uncommon for me to be present in both buy and sell queues.  |

|

|

|

Post by chlio on Sept 28, 2014 5:38:04 GMT 7

Hi Dr. Leong,

In other words, do you mean that you were hit by a sale of 1 lot for a micro-penny stock at less than 2.5 cts such that the sale is less than the commission of $25?

|

|

|

|

Post by oldman on Sept 28, 2014 5:59:46 GMT 7

Even worse than that. Micropennies to me are stocks less than 1ct! Sorry, I cannot say which stock this is but one day, when I have collected enough, I may share the name of the stock. To me as an investor, it is the total market capitalisation that matters, not the absolute price of the stock. If the market capitalisation is much less than its asset value, I am still interested, regardless of whether it is a micro penny stock. Of course, for micro penny stocks, the downside is that when I am in collecting mode, these 1 lotters really cheese me off.  Hi Dr. Leong, In other words, do you mean that you were hit by a sale of 1 lot for a micro-penny stock at less than 2.5 cts such that the sale is less than the commission of $25? |

|