|

|

Post by zuolun on Mar 27, 2014 8:35:24 GMT 7

|

|

|

|

Post by zuolun on Mar 28, 2014 23:39:39 GMT 7

AirAsia — Rounding bottom formationAirAsia closed with a white marubozu @ 2.53 (+0.09, +3.7%) on 28 Mar 2014. Strong resistance at the neckline @ 2.57, immediate support @ 2.37. Should the bullish rounding bottom breakout at 2.57 materialize, interim TP 2.68.

|

|

|

|

Post by zuolun on Apr 10, 2014 14:39:27 GMT 7

AirAsia — Rounding bottom failed, game over

|

|

|

|

Post by zuolun on May 4, 2014 11:28:02 GMT 7

|

|

|

|

AirAsia

May 14, 2014 12:12:11 GMT 7

Post by zuolun on May 14, 2014 12:12:11 GMT 7

|

|

|

|

AirAsia

May 17, 2014 10:42:32 GMT 7

Post by zuolun on May 17, 2014 10:42:32 GMT 7

AirAsia — Double Bottom Formation

|

|

|

|

Post by zuolun on Oct 22, 2014 17:31:56 GMT 7

|

|

|

|

Post by zuolun on Nov 15, 2014 6:48:51 GMT 7

|

|

|

|

Post by zuolun on Nov 20, 2014 13:11:23 GMT 7

|

|

|

|

Post by zuolun on Dec 29, 2014 10:19:35 GMT 7

|

|

|

|

Post by zuolun on Jan 2, 2015 13:33:58 GMT 7

|

|

|

|

Post by zuolun on Mar 22, 2015 15:20:31 GMT 7

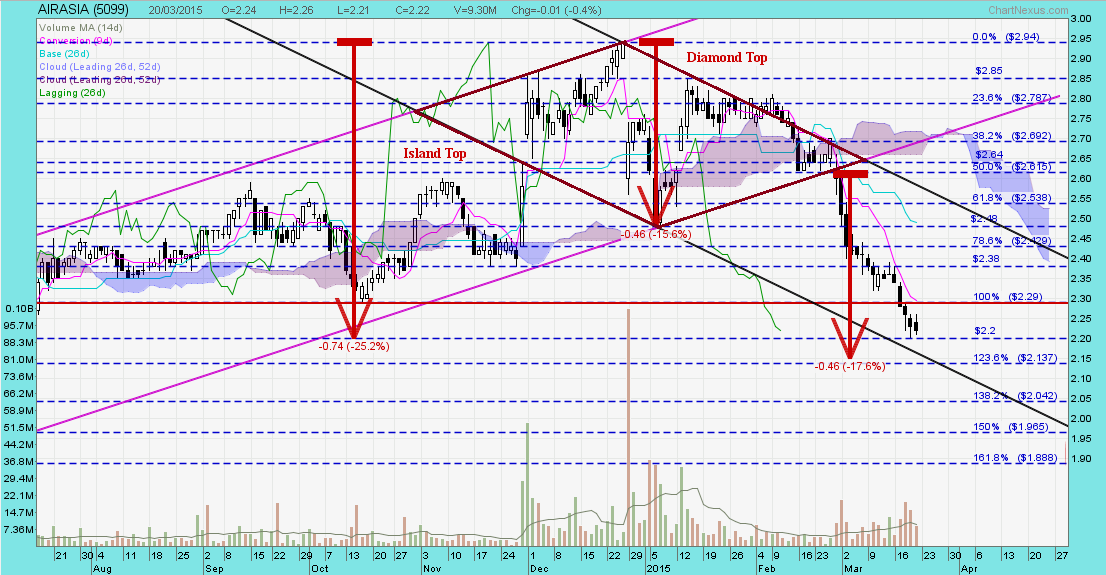

AirAsia QZ8501 SAR operation officially closed ~ 21 Mar 2015 In technical analysis, a stock that has made a new low is one that must be treated with caution and to be avoided buying for longterm investment.AirAsia ~ Diamond Top Breakout, TP RM2.16AirAsia closed with a spinning top @ RM2.22 (-0.01, -0.4%) with 9.3m shares done on 20 Mar 2015. Immediate support @ RM2.14, immediate resistance @ RM2.29.

|

|

|

|

Post by zuolun on Mar 24, 2015 18:01:03 GMT 7

AirAsia sells over 3 million seats for P1 base price ~ 23 Mar 2015 Active trade of AirAsia shares on expected higher earnings ~ 23 Mar 2015 10億租售飛機‧亞航盈虧可改善 ~ 23 Mar 2015 AirAsia: Aircrafts under sales & lease back, HLIB rated BUY TP RM3.30 23 Mar 2015 Highlights / Comments- According to Group CEO Tony Fernandes, AirAsia will enter into sales and lease back agreements for the disposal of 11 A320s, which will see AirAsia reporting a disposal gain of US$45m (RM166.5m).

- We are generally positive on AirAsia strategic decision on the deal, which will allow AirAsia to free-up its balance sheet (from heavy debts and gearing ratio) and improve its cashflow with the proceeds of US$271m (RM1bn), as well as taking advantage of the strengthened US$ trend.

- Note that AirAsia has guided for the disposal of its older fleet A320s since early 2014, which has seen a slow progress. Furthermore, it has already set up a new aircraft leasing company, which will eventually take over all the A320s (booked under AirAsia Malaysia) that is currently leased out to JVs and associates.

- Tony has also quashed recent market rumours on AirAsia raising equity cash, given the airline’s strong cash position. Furthermore, the recent disposal of 25% stake in AAE to Expedia has further improved its cash level by US$86.25m (RM320m), adding to its strong cash level of RM1.3bn as at end FY14.

- We concur with the management on the group’s current strong cashflow position. The group aims to reserve its cash level for FY15, after cutting its fleets delivery for the year.

- Management is also expected to uphold its dividend policy of 20% payout from its net operating profits subject to capex requirements (established back in 2011). AirAsia usually only announce dividend payout by end April (not during 4Q result in Feb). For the past 4 years, AirAsia has been paying net dividend of 4sen for FY13, 24 sen (including 18 sen special dividend) for FY12, 5 sen for FY11 and 2.8 sen for FY10.

Risks- World crisis (ie. war, terrorism and epidemic outbreak); surge in jet fuel price; US$ appreciation; weak air travel demand; and high speed train infrastructure bet ween Singapore and Pulau Pinang.

ForecastsRatingPositives- Sustaining lowest cost LCC operator in Asia with largest network and strong brand name;

- Low jet fuel price;

- Increasing ancillary income; and

- Routes rationalization of major competitor MAS.

Negatives- Higher cost of living faced by consumers (from GST implementation and subsidy rationalization); and

- Regional air-demand slowdown and political issues.

- Strengthening of US$.

Valuation- Maintained Buy with unchanged TP of RM3.30 based on unchanged 10% discount to SOP.

AirAsia ~ Trading in a downward sloping channel, expect a technical reboundAirAsia closed with a bullish harami @ RM2.21 (+0.03, +1.4%) with 17.3m shares done on 24 Mar 2015. Immediate support @ RM2.18, immediate resistance @ RM2.24.

|

|

|

|

Post by sptl123 on Mar 24, 2015 21:58:26 GMT 7

Bro Zuolun, AirAsia was in my radar screen after your post on the 22nd March 2015. I study your post today and went to study more and found:

RM 2.19-2.21 is a strong support.

+ve Divergences of MFI MFI has a buy signal  Am I correct to say that the above also support that a technical rebound is in near term? Bro Zuolun, if a long position is taken at current level, technically, the rebound will raised to what level before continue to trade downward? AirAsia ~ Trading in a downward sloping channel, expect a technical reboundAirAsia closed with a bullish harami @ RM2.21 (+0.03, +1.4%) with 17.3m shares done on 24 Mar 2015. Immediate support @ RM2.18, immediate resistance @ RM2.24.  |

|

|

|

Post by zuolun on Mar 24, 2015 23:04:16 GMT 7

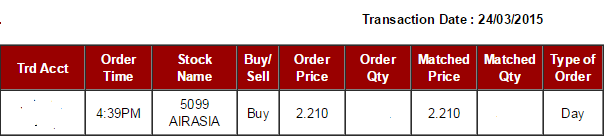

Bro Zuolun, AirAsia was in my radar screen after your post on the 22nd March 2015. I study your post today and went to study more and found:

RM 2.19-2.21 is a strong support.

+ve Divergences of MFI MFI has a buy signal Am I correct to say that the above also support that a technical rebound is in near term? Bro Zuolun, if a long position is taken at current level, technically, the rebound will raised to what level before continue to trade downward? , Yes, agree with you!  I'm quite surprised that you could read my charts well and grasp most of the key points (重点). BTW, I bought AirAsia @ RM2.21 on 24 Mar 2015 at 4.39pm.  AirAsia ~ Expect a technical rebound, interim TP RM2.38, next TP RM2.48 AirAsia ~ Expect a technical rebound, interim TP RM2.38, next TP RM2.48AirAsia closed with a bullish harami @ RM2.21 (+0.03, +1.4%) with 17.3m shares done on 24 Mar 2015. Immediate support @ RM2.18, immediate resistance @ RM2.24.  |

|