|

|

Post by zuolun on Jul 5, 2015 8:39:22 GMT 7

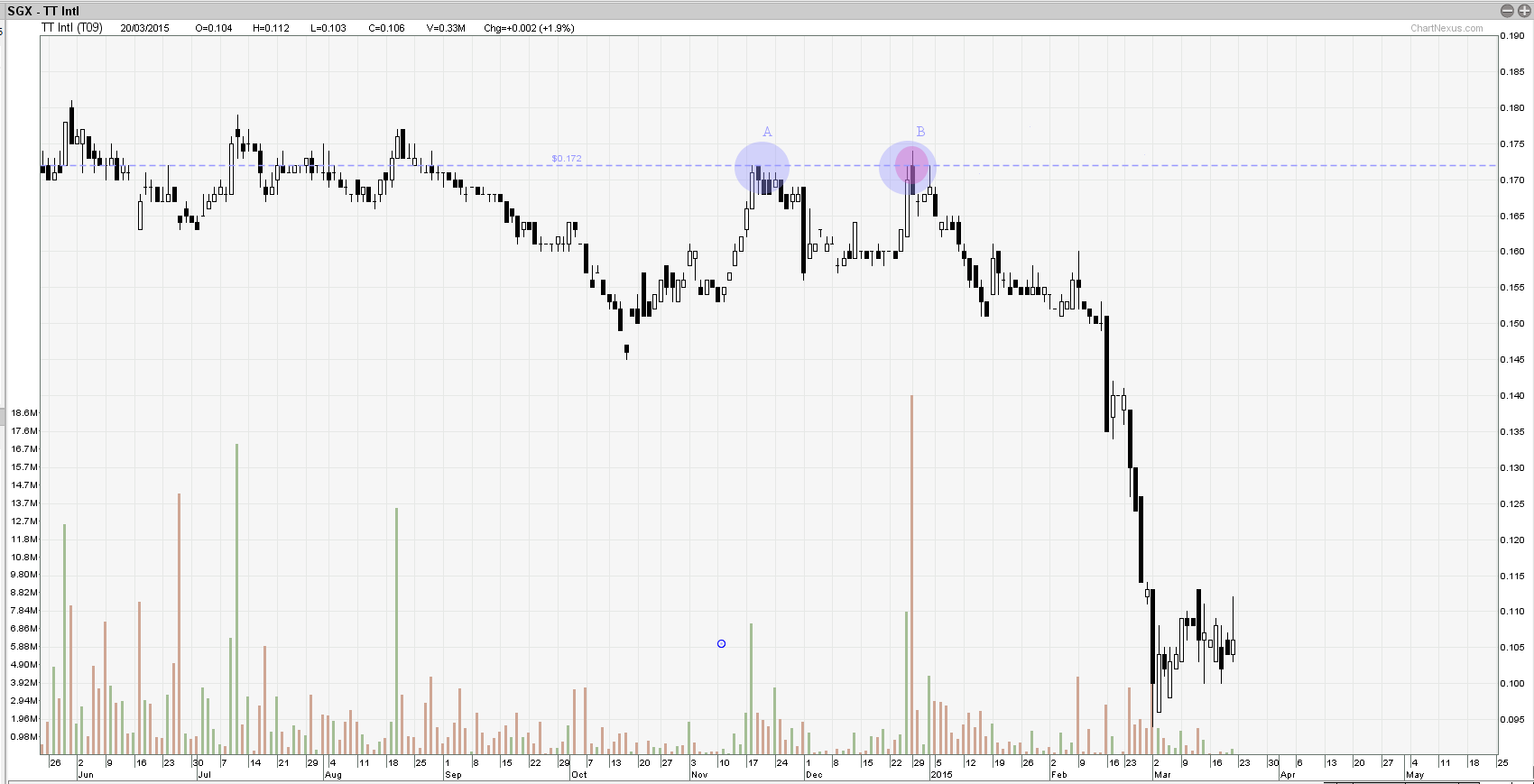

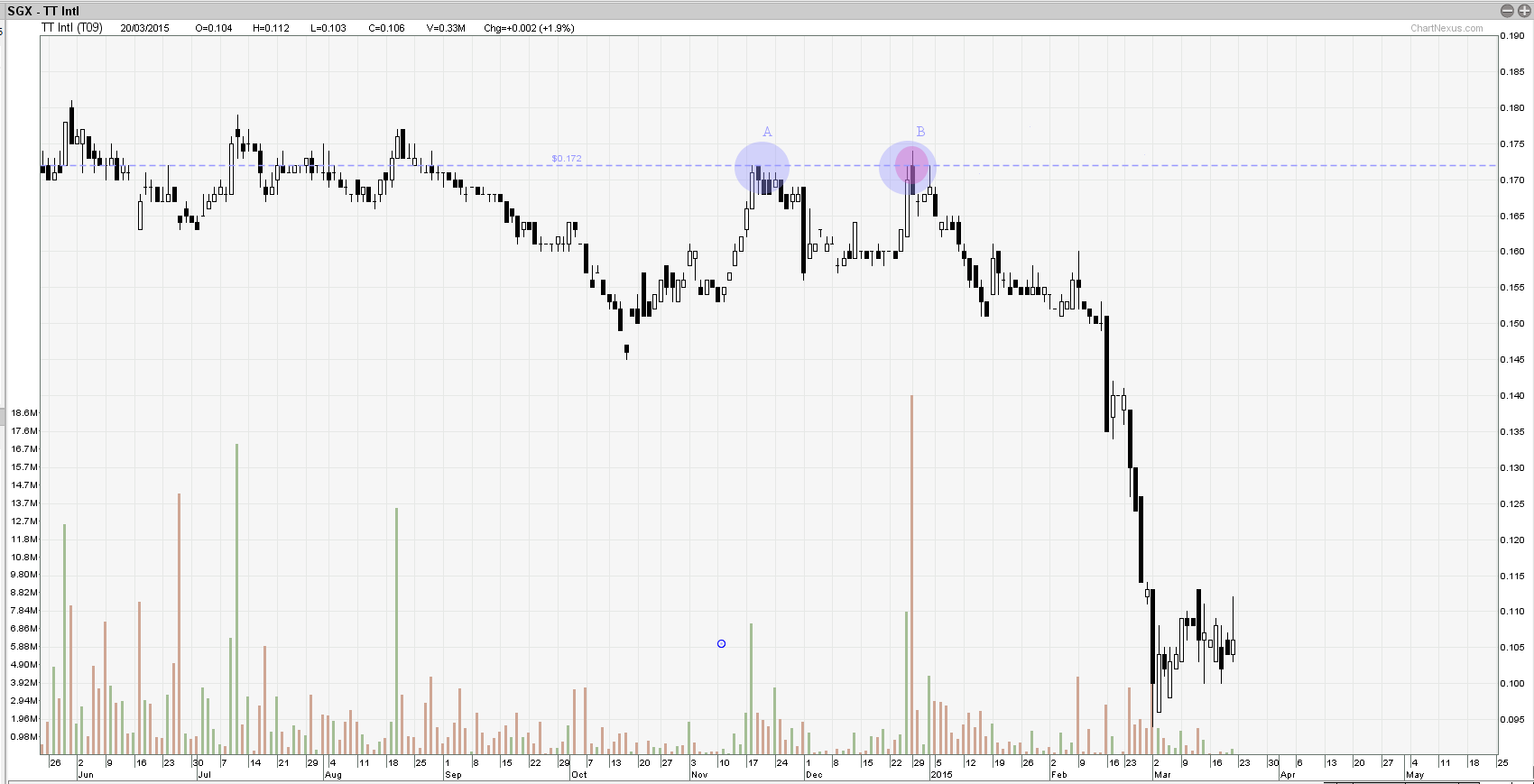

Because of the new ruling, many prices have gotten bashed down undeservedly post consolidation. This also opens opportunities for some value picking. Aiyoh...the new ruling is structured to disadvantage / kill the small retail investors. While the initiatives have disadvantaged small retail investors, we can't fully blame a group of people as the interests are far from aligned. Who's to blame for misalignment is another matter. At least that's how I view things currently. For e.g. the SGX management wants to change the perception of our micropenny market (majority of our top volume counters are micropennies). Brokers want to make more from commissions. Traders and investors want to make money with their own methods. As for how things turned out, traders and investors don't really have much say. Reading about oldman's experience with the securities committee confirms it. Agreed, Zuolun. Consolidation is even worse for stocks that are already illiquid. I will not be surprised that in the years after the consolidation, the management will then take the company private at a significant discount to asset value and quote the lower trading volume as one of the main reasons...... , Share consolidation is a brilliant way to solve SGX's long term problem — Get rid of underperformed stocks, at the expense of small retail investors  , Neither FA nor TA can help you make a good profit from this rotten stock, TT Int. If you buy 400,000 TT Int shares at the last closing price on 3 July 2015 @ S$0.071 = S$28,400 now; should the company propose a share consolidation of 400 into 1 similar to S i2i; the potential loss is unimaginative = daylight robbery. TT Int is one of the best candidates for share consolidation. TT Int's Market Cap. @ S$72. 797m as at 30 Jun 2015  Insider Trades Insider Trades showed that major SSHs, Sng Sze Hiang & Tong Jia Pi Julia have been actively trading its own shares since mid-Mar 2015.  TT Int's Shareholdings as at 30 Jun 2014 TT Int's Shareholdings as at 30 Jun 2014 Bro Zuolun, A) Double Bottom works for TT International. B) The latest price actions of TT International meet the perfect ration of an IDEAL Bullish AB=CD Pattern. C) After the completion of such pattern, price suppose to trend up. However, Bro Zuolun, have you ever seen a failed or false break out of such pattern after it has emerged and completed then price continue to go down? A) Double Bottom  B) AB=CD   TT International Bro Zuolun, I feel sorry for my best friend who still have very large holding of this stock at very high cost. I could not advise him earlier last year because I have not joined Pertama and I knew nothing about TA then. What is the next TP from TA? This stock has very bad FA but there were invincible hands keeping the stocks alive in the last 2 years. It has been losing money for many years and owes tons of money. I just can not understand why it was still traded at around 0.15 to 0.17 last year when the net value of the asset is a big-negative. What keeping the Retail Investor hopeful was the opening of BigBox. But one day (point B on chart) before BigBox start for business, on the 29th Dec 2014, Chng-kay run road and a double-Top formed and the price fall off the cliff. I see more trouble: Julia and Tong has been accepting and never ever rejecting buying back stocks from scheme creditors until 20 March 2015. The Director has on 19 March 2015 rejected the 235,480 shares offered to her and her spouse by certain scheme creditors |

|

|

|

Post by zuolun on Nov 23, 2015 12:49:07 GMT 7

|

|

|

|

Post by zuolun on Jan 29, 2016 12:43:20 GMT 7

|

|

|

|

Post by zuolun on Mar 5, 2016 11:59:54 GMT 7

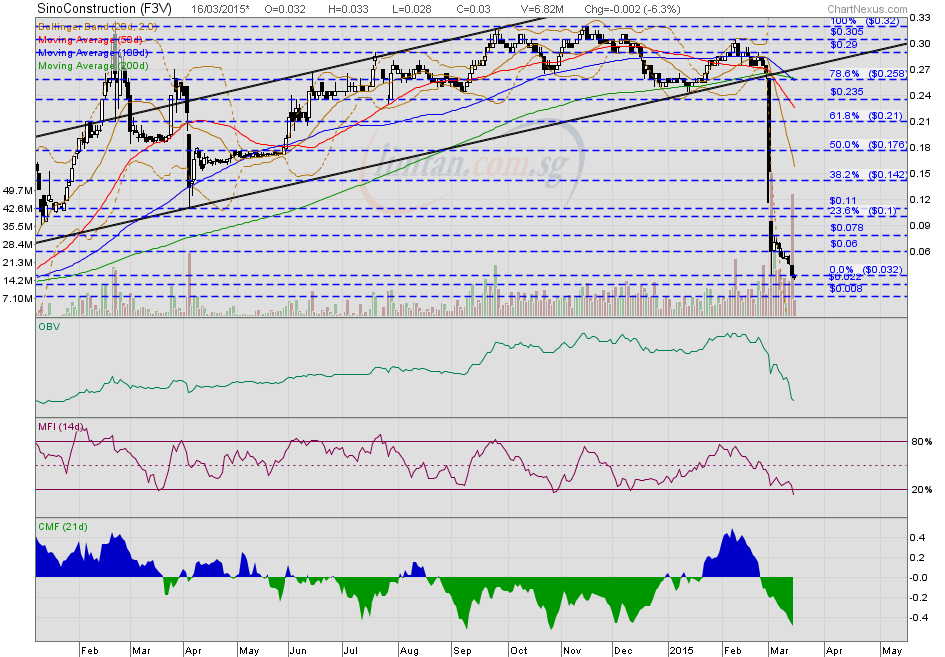

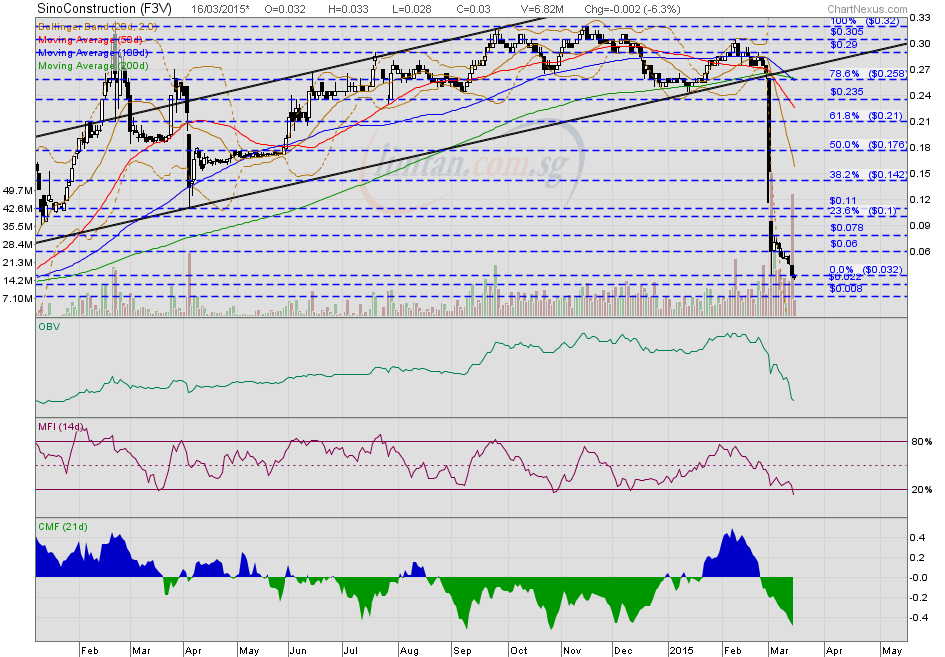

Never catch a falling knifeBy oldman Oct 17, 2013 If a share crashes from $2.40 to 14cts, this share may now look 'cheap' compared to its trading price in the past. If one buys the share at 14cts and it then collapses further to 5cts, his loss is as significant as someone who bought it at its height. Let me share some numbers to illustrate this point. If you were to have bought at the height of $2.40 and the share collapses to 5cts, your loss is 98%. If you were to have bought at 14cts and it collapses to 5cts, your loss is 64%. Assuming that in both cases, you invested $10,000 in the stock. Scenario 1 will mean that you have lost $9,800. For Scenario 2, you would have lost $6,400. Hence, in both cases, the loss is very significant as compared to the initial capital. This is why investors must realise that it is foolish to think that buying a share that has collapsed from $2.40 to 14cts is a safe bet. It is not. A share is not cheap just because it has collapsed in price. You must still do your due diligence to arrive at a fair value for the shares that you intend to buy. The market is not always right with regards to the share price. The share price is determined by demand and supply and many times, it does not truly reflect its fair intrinsic value. There is no margin of safety when a share collapses in price. Margin of safety is only applicable when you buy below its fair intrinsic value. The only way to estimate the intrinsic value is to analyse the company using traditional fundamental analysis methods. On the other hand, if you are a trader, you probably do not care about the fundamentals as you are trading based on the momentum of the stocks. Good traders have a good sense of demand and supply. If they sense heavy selling from fund managers or know of forced selling by the banks, they are unlikely to be buyers. Say ‘no’ to China stocksMMP Resources (formerly Sino Construction) ~ Share price had collapsed massively to hit low of S$0.004 (-0.113, -95.8%) on 27 Jan 2016 since Sino Construction's share price collapsed and closed @ S$0.117 (-0.148, -55.8%) on 2 Mar 2015 then. In technical analysis, a stock that has made a new low is one that must be treated with caution and to be avoided buying for longterm investment.MMP Resources closed with an inverted hammer @ S$0.008 (+0.001, +14.3%) with 19.2m shares done on 4 Mar 2016. Immediate support @ S$0.006, immediate resistance @ S$0.01.  Sino Construction ~ Uptrend is broken, share price collapsed, interim TP S$0.022, next TP S$0.008Sino Construction's share price collapsed further to low of S$0.028 and traded @ S$0.03 (-0.002, -6.3%) with 6.82m shares done on 16 Mar 2015 at 11.55am.

|

|