|

|

Post by zuolun on May 2, 2014 6:27:07 GMT 7

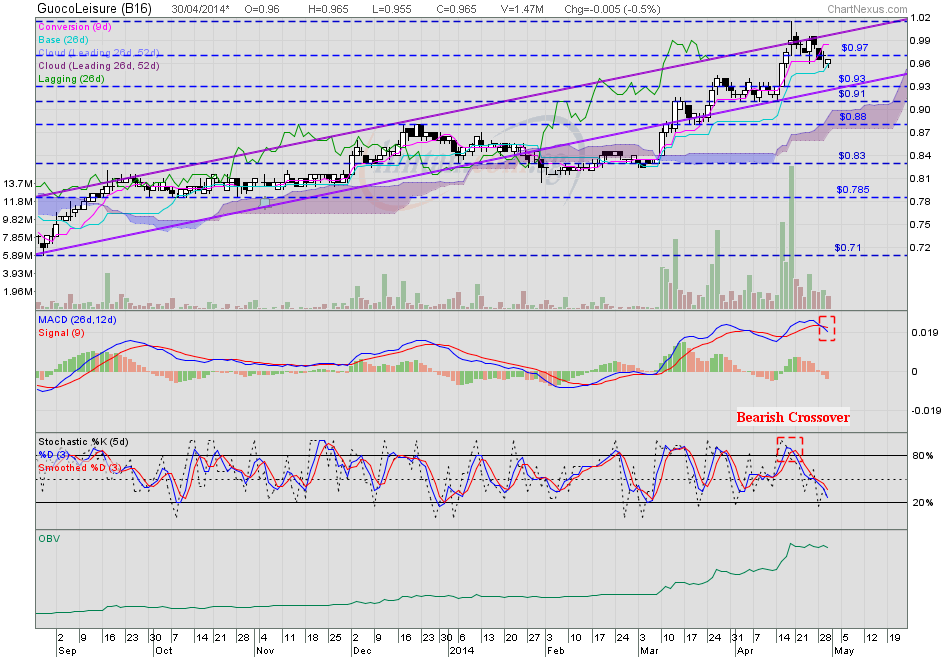

odie, Among the 4 major gameplays in the stock market; the toughest one is no. 4. 1. IPO play 2. Fundamentals & Dividends play 3. M&A play 4. Turnaround/bottom-picking play GuocoLeisure is a longterm "asset play" (No. 3 M&A play), strong buy on pullback, don't chase the price, let it come to you. GuocoLeisure Limited: Is Molokai land a failed investment? — 27 Feb 2014 GuocoLeisure — Bearish Three-Drives formationGuoco Leisure closed with a hammer @ $0.965 (-0.005, -0.5%) on 30 Apr 2014. Immediate support @ S$0.93, immediate resistance @ S$0.97. MACD crossover below the zero line, expect the share price to hit 0.93 and below.   CIMB had a BUY on Guoco Leisure dated 24 Apr 2014, TP S$1.20. CIMB had a BUY on Guoco Leisure dated 24 Apr 2014, TP S$1.20. |

|

|

|

Post by zuolun on May 7, 2014 12:25:39 GMT 7

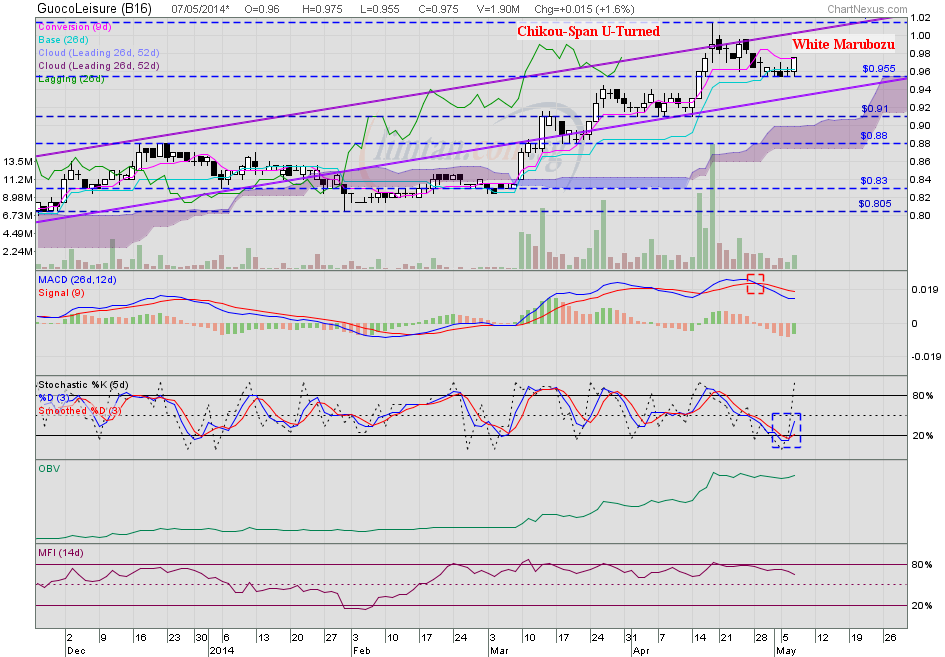

Guoco Leisure — Bouncing up due to oversoldGuoco Leisure had a white marubozu @ $0.975 (+0.015, +1.6%) with volume done at 1.9m shares on 7 May 2014 at 1.20pm Immediate support @ S$0.955, next support @ S$0.93, strong resistance @ S$1.015. Chikou-Span had a +ve U-turn.

|

|

|

|

Post by zuolun on May 9, 2014 16:50:46 GMT 7

GuocoLeisure — Bearish Three-Drives, crucial support @ S$0.88Guoco Leisure closed with a hanging man @ $0.955 (-0.005, -0.5%) with volume done at 1.55m shares on 9 May 2014. Immediate support @ S$0.955, next support @ S$0.93, strong resistance @ S$1.015.

|

|

|

|

Post by odie on May 21, 2014 13:10:57 GMT 7

Zuolun bro,

Guocoleisure seems to be moving.

Any chart updates for NOL and guocoleisure.

Thanks

|

|

|

|

Post by zuolun on May 21, 2014 13:31:54 GMT 7

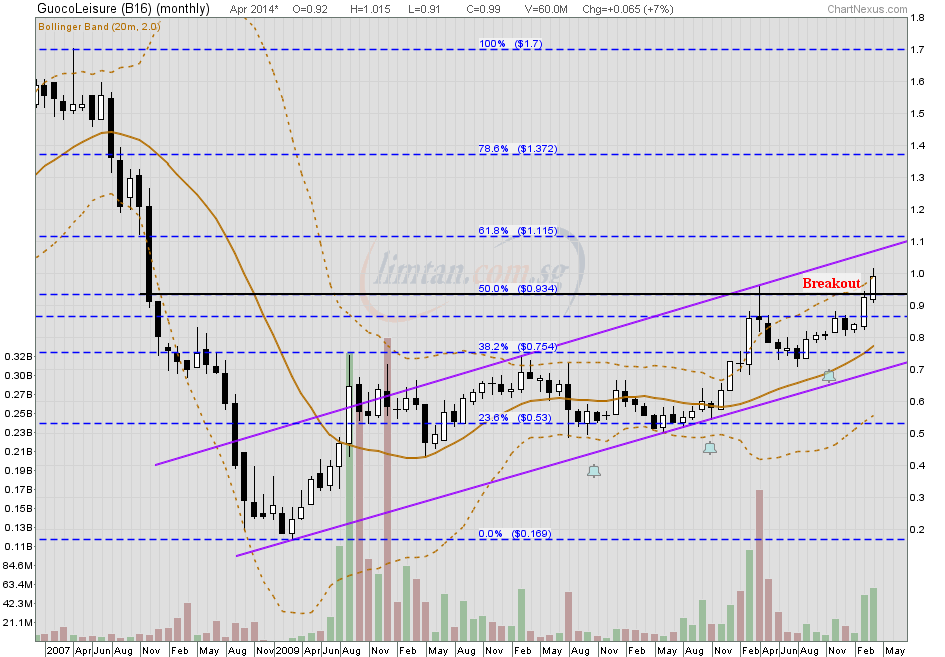

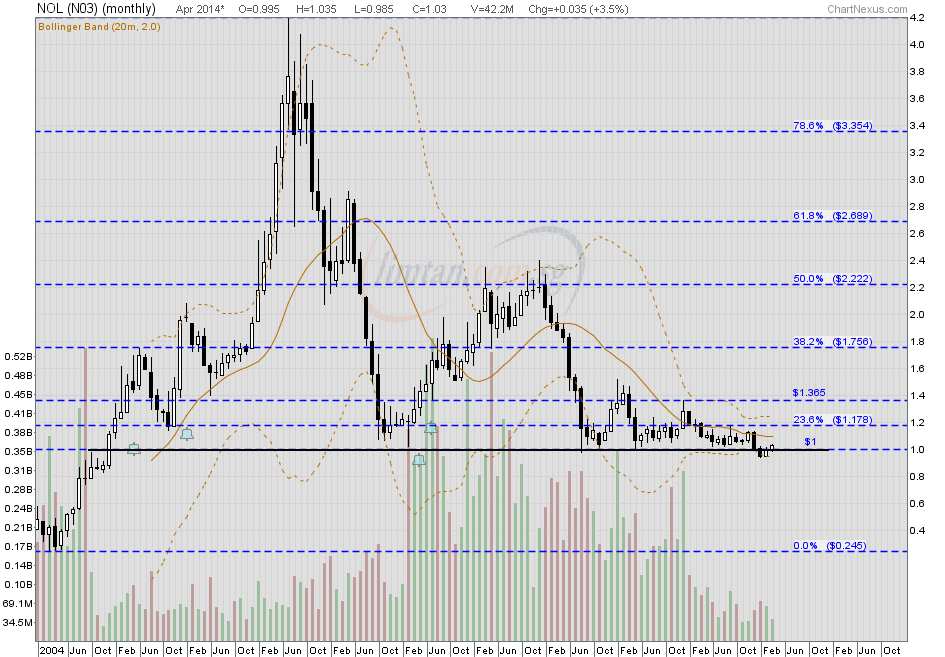

Zuolun bro, Guocoleisure seems to be moving. Any chart updates for NOL and guocoleisure. Thanks odie, No major changes; 1. Guocoleisure is a mid-term uptrend stock (asset play). 2. NOL is a long-term downtrend stock (turnaround play).   |

|

|

|

Post by odie on May 21, 2014 20:38:27 GMT 7

thanks for update, zuolun bro will watch bradley closely too  |

|

|

|

Post by odie on May 23, 2014 20:57:49 GMT 7

zuolun bro,

guocoleisure closed with a doji with low vol

stoch and rsi are high and rsi is overbought

|

|

|

|

Post by odie on May 25, 2014 13:28:18 GMT 7

zuolun bro,

what would be a good price to get in?

there seems to be a gap at 1.03 to 1.035

thanks

not vested

|

|

|

|

Post by odie on May 27, 2014 20:36:18 GMT 7

bro zuolun, got some guocoleisure at 1.05 and nol at 97.5  |

|

|

|

Post by zuolun on May 27, 2014 22:03:47 GMT 7

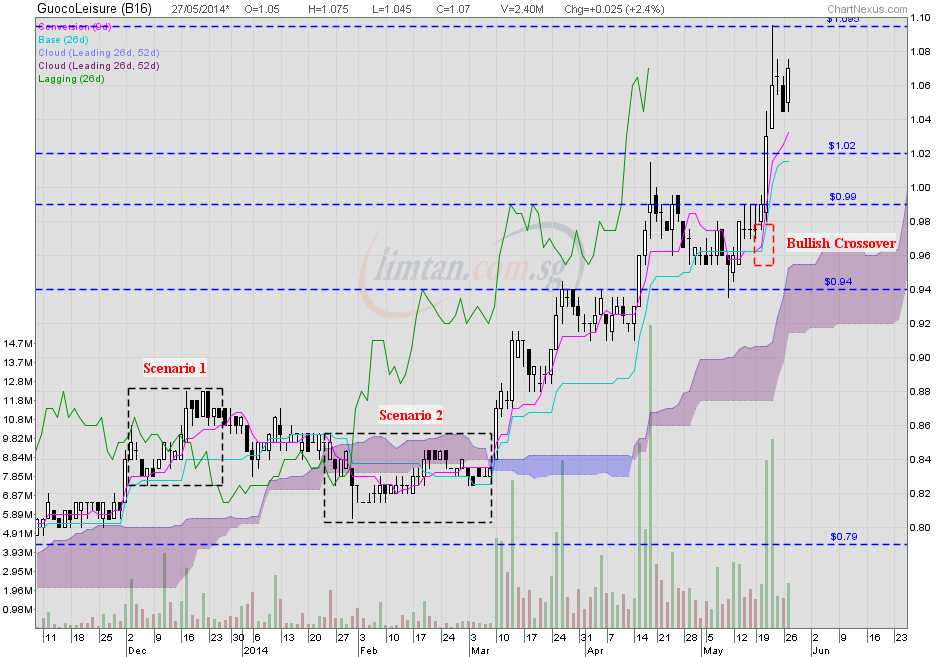

bro zuolun, got some guocoleisure at 1.05 and nol at 97.5  odie, If you use ichimoku, you must always ensure that, A) the price trades above the purple cloud; not inside or below it. B) Should the price trade inside or below the purple cloud with the Tenkan-Sen crosses below the Kijun-Sen and the Chikou-Span crosses below the share prices, run road and get out fast, can always get back when price is above the purple cloud again. (refer to scenario 1 and scenario 2 on GuocoLeisure's ichimoku). Guoco Leisure — Symmetrical Triangle Formation, upside breakout TP S$1.15Guoco Leisure closed with a white marubozu @ S$1.07 (+0.025, +2.4%) on 27 May 2014. Immediate support @ S$1.02, immediate resistance @ S$1.09.   |

|

|

|

Post by odie on May 28, 2014 7:55:11 GMT 7

Thanks zuolun bro for insights Will monitor  |

|

|

|

Post by odie on May 28, 2014 8:24:46 GMT 7

Bro zuolun,

Guocoleisure now 1.09 +0.02

Think it broke up

|

|

|

|

Post by zuolun on May 28, 2014 12:02:18 GMT 7

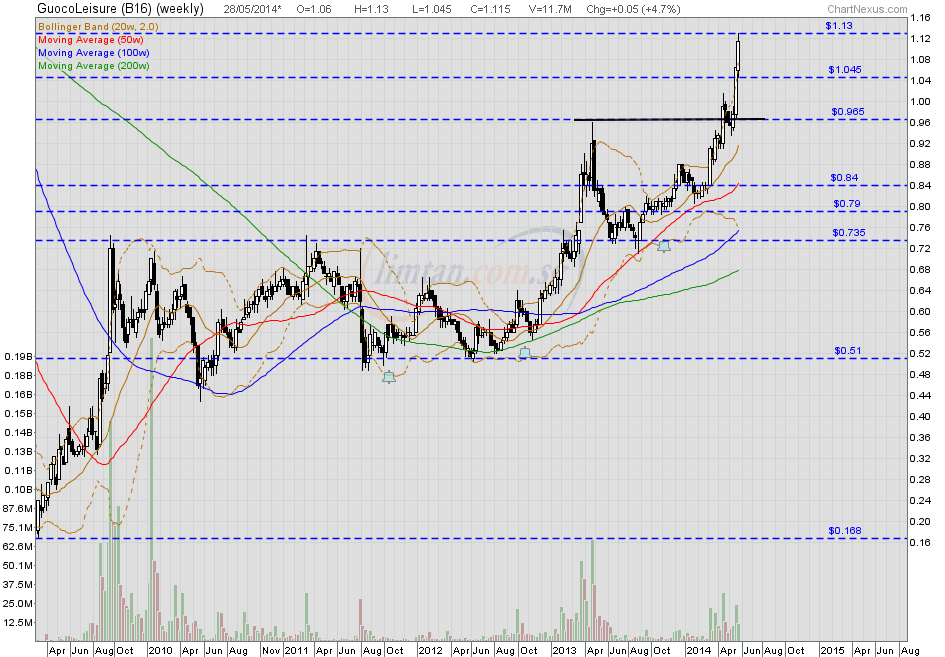

Thanks zuolun bro for insights Will monitor  Bro zuolun, Guocoleisure now 1.09 +0.02 Think it broke up odie, GOOD LUCK!   Guoco Leisure (weekly) — Golden Cross Guoco Leisure (weekly) — Golden Cross |

|

|

|

Post by odie on May 28, 2014 12:18:38 GMT 7

Bro zuolun, Thanks for update and well wishes  |

|

|

|

Post by odie on May 30, 2014 20:57:42 GMT 7

Bro zuolun, Guocoleisure broke up above yr tgt price of 1.15 and closed at 1.155 Vol on 28 may is ard 13m and 30 may is ard 14m MACD, RSI and stoch are still high chikou span is still pointing up  Any updates on this, bro zuolun? thanks in advance, enjoy your weekend  |

|