|

|

Post by zuolun on Apr 8, 2015 16:43:17 GMT 7

MAS expected to ease monetary policy: Analysts ~ 2 Apr 2015 Why Singapore is likely to ease again ~ With depreciation risks likely to remain on the Singapore dollar, the Monetary Authority of Singapore will ease policy at its April meeting, says Sim Moh Siong, FX strategist at Bank of Singapore. ~ 22 Mar 2015 08 Apr 2015 13:38 CST DJ BMI Research Thinks Singapore May Ease Again -- Market Talk0537 GMT [Dow Jones] BMI Research says the Monetary Authority of Singapore may ease its currency policy again amid lackluster economic growth prospects. The central bank may lower the centre of the undisclosed band in which it keeps the local dollar versus its trade-weighted peers when it reviews policy on April 14. "Singapore's economy is mired in a rough patch of mediocre economic growth and deflation. As a result of continued headwinds stemming both from domestic economic restructuring and poor external demand dynamics, we have lowered our 2015 real GDP growth forecast to 2.9% from 3.3% previously," BMI says. It notes that the two main reasons for Singapore's soft growth are the ongoing economic slowdown in China and the domestic economic restructuring process to move away from dependence on foreign labor.

|

|

|

|

Post by zuolun on Apr 22, 2015 9:43:51 GMT 7

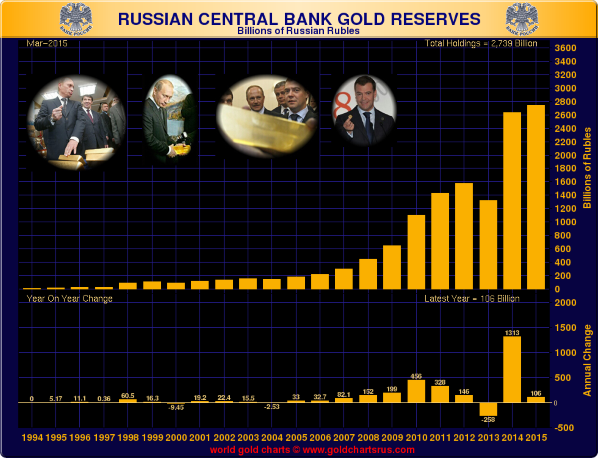

5 failed currencies and why they crashedUsury, 0% interest rates, and worthless currenciesAussie dollar near parity with Kiwi before Australian price data ~ 22 Apr 2015 HKMA sells HK$7.75b to keep Hong Kong dollar within its trading band ~ 21 Apr 2015 Hong Kong buys $6.85b in April to defend currency peg ~ 21 Apr 2015 Stocks firm after China stimulus, euro hit by Greek anxiety ~ 21 Apr 2015 U.S. govt wants 5 banks to settle forex case by mid-May ~ 21 Apr 2015 ECB's Constancio - default no reason to quit euro as Greece cash pinch worsens ~ 20 Apr 2015 Central banks prepare to flood FX markets with euros ~ 20 Apr 2015 Currency wars still raging… ~ 17 Apr 2015 Russia boosts gold reserves by 1m ounces (up by 2.6% in Mar 2015), sells U.S. treasuries ~ 22 Apr 2015    Russia "ditches" U.S. Petrodollar Russia "ditches" U.S. Petrodollar ~ 15 Jan 2015 Euro swaps benchmark fixed at a negative rateBy Joel Lewin 21 Apr 2015 A key money market rate European banks charge to lend to each other and which serves as the reference level for derivatives contracts has fallen into negative territory for the first time, as the European Central Bank stimulus effort intensifies the downward trajectory of eurozone interest rates. The euro interbank lending rate for three-months — widely known as Euribor — broke new ground when it was fixed at minus 0.001 per cent on Tuesday. That came after the London based euro interest rate fixing for three months entered negative territory for the first time last week. Short-term money market rates such as Euribor are a key reference level used in the vast interest rate swaps market and also for interest rate futures contracts. Euribor also underpins the cost of consumers’ mortgages and what they are paid on savings products. Some strategists believe a decline in savings rates could help stimulate wider demand by making it less attractive to save. “As it goes further into negative territory it’s going to have a psychological impact on people. It will impact the savers’ rates and if there is no incentive to save you would rather spend,” said Khagendra Gupta, fixed-income analyst at JPMorgan. The ECB has aggressively eased monetary policy in the hope of stimulating growth and staving off a damaging deflationary spiral. It tested new waters in June 2014 when it introduced a negative deposit rate — meaning banks have to pay to park money at the central bank — which sparked a steady decline in interest rates across the region. Since the ECB launched its $1.1tn bond-buying programme in March, rates have fallen even further, and that is now pulling key interbank lending rates into negative territory, raising the prospect of distorting financial markets. “A negative interest rate completely counters the incentive that lenders normally face,” said Lena Komileva, chief economist at G+ Economics. “The risk is it distorts markets by distorting the incentive to bring borrowers and lenders together, which markets are there to do.’’ She warned: “In some cases, by drying up money market activity in peripheral countries, negative rates may prove contractionary, rather than stimulating.” Some strategists have suggested that with the ECB base rate at minus 20 basis points, banks have little choice, but to take the less negative rate offered by Euribor. “Because policy rates have been lowered and excess liquidity in the system has been increased, it means banks are willing to lend to each other for less,” said Nishay Patel, rates strategist at JPMorgan. Many traders had been prepared for a move to negative yields. “The Swiss were the first to go negative. The real money markets people found it difficult to get their heads around negative yields, but it doesn’t have much of an effect on the treasury management side of the business. The cash flows work for the asset managers,” said one trader.

|

|

|

|

Post by zuolun on Apr 30, 2015 9:03:40 GMT 7

|

|

|

|

Post by zuolun on May 27, 2015 5:31:16 GMT 7

|

|

|

|

Post by zuolun on Jun 9, 2015 12:15:36 GMT 7

|

|

|

|

Post by zuolun on Jun 12, 2015 9:11:24 GMT 7

|

|

|

|

Post by zuolun on Jun 12, 2015 16:32:03 GMT 7

|

|

|

|

Post by zuolun on Jun 14, 2015 13:53:48 GMT 7

|

|

|

|

Post by zuolun on Jun 20, 2015 12:09:25 GMT 7

|

|

|

|

Post by zuolun on Aug 4, 2015 12:55:21 GMT 7

|

|

|

|

Post by zuolun on Aug 13, 2015 16:30:43 GMT 7

|

|

|

|

Post by zuolun on Aug 14, 2015 23:00:24 GMT 7

|

|

|

|

Post by zuolun on Aug 18, 2015 11:10:29 GMT 7

|

|

|

|

Post by zuolun on Aug 25, 2015 7:56:43 GMT 7

|

|

|

|

Post by zuolun on Aug 31, 2015 5:07:39 GMT 7

|

|