|

|

Post by zuolun on May 2, 2014 12:29:12 GMT 7

|

|

|

|

Post by me200 on May 2, 2014 13:57:32 GMT 7

As usual and expected, Malaysia government will bail MAS out.

|

|

|

|

Post by zuolun on May 2, 2014 14:11:03 GMT 7

As usual and expected, Malaysia government will bail MAS out.

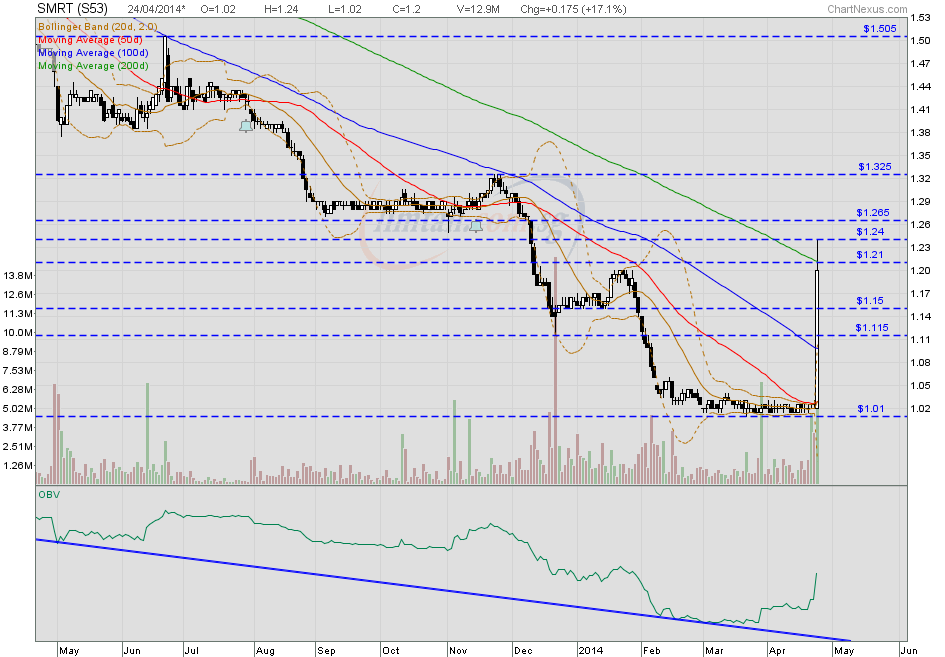

Yes, My Singaporean friend bought afew million MAS shares at average cost 20.5 sen on 10 Mar 2014, after MH370 went missing. He's in-the-money but only locked in some profit on half the qty, the balance he is still holding it; betting that MAS will be bailed out with taxpayers money.  Both MAS and SMRT are superb trading stocks which can be played both sides; long and short, short and long many rounds as they're GLC stocks (won't go bankrupt, downside is protected by dumb money or generous bail-out). MAS Vs SMRT  |

|

|

|

Post by oldman on May 2, 2014 15:42:02 GMT 7

zuolun , your friend is brave. At 22.5 sen with 16.9 bil shares in issue, its market cap is RM 3.8 billion. It has borrowings of RM 11.75 bil with cash of RM 3.87 bil and aircraft PP&E of RM 14.6 bil. In June 2013, it had a 4 for 1 rights issue at 23 sen raising RM3 bil. Appears that most of its current cash holdings may have come from this rights issue. Last year, it lost RM 1.17 bil on revenues of RM 14.5 bil. With the loss of MH 730, it is likely that its financials will be impacted in the next quarter. Am actually quite surprised that the share price has held up quite well compared to its rights price. I don't think the share price is in bargain territory yet. MAS 2013 Financial Statement

|

|

|

|

Post by zuolun on May 2, 2014 16:19:42 GMT 7

zuolun , your friend is brave. At 22.5 sen with 16.9 bil shares in issue, its market cap is RM 3.8 billion. It has borrowings of RM 11.75 bil with cash of RM 3.87 bil and aircraft PP&E of RM 14.6 bil. In June 2013, it had a 4 for 1 rights issue at 23 sen raising RM3 bil. Appears that most of its current cash holdings may have come from this rights issue. Last year, it lost RM 1.17 bil on revenues of RM 14.5 bil. With the loss of MH 730, it is likely that its financials will be impacted in the next quarter. Am actually quite surprised that the share price has held up quite well compared to its rights price. I don't think the share price is in bargain territory yet. MAS 2013 Financial Statement oldman, His gambling instinct on MAS was quite similar to Oei Hong Leong buying AIG shares in 2008. Everyone was extremely -ve on MAS after MH370 went missing last month. On Monday 10 Mar 2014 when market opened, my Singaporean friend was the only exceptional one in our group who bought afew million MAS shares at 20 sen, 20.5 sen and 21 sen, average 20.5 sen, none followed him. It reminds me of this Chinese saying, 物极必反,否极泰来! (When extremes meet, the situation is reversed.) |

|

|

|

Post by zuolun on May 4, 2014 11:03:06 GMT 7

Yes, My Singaporean friend bought afew million MAS shares at average cost 20.5 sen on 10 Mar 2014, after MH370 went missing. He's in-the-money but only locked in some profit on half the qty, the balance he is still holding it; betting that MAS will be bailed out with taxpayers money.  Both MAS and SMRT are superb trading stocks which can be played both sides; long and short, short and long many rounds as they're GLC stocks (won't go bankrupt, downside is protected by dumb money or generous bail-out). — “The main issue is MAS’ profitability and not so much the missing plane. It is up to Khazanah (Nasional Bhd) on whether to prop up the price." Hong Leong Investment Bank (HLIB) Research said it expects minimal expenses to be borne by MAS over the MH370 incident and any compensation would likely be covered by insurance, as with previous cases. As at Apr 2012, Khazanah owned 49% of MAS and the airline had a workforce of 19,000 staff members then. klia2 opens its door without a glitch — 2 May 2014 WELCOME TO KLIA 2 — 28 Apr 2014 |

|

|

|

Post by oldman on May 8, 2014 14:22:02 GMT 7

|

|

|

|

Post by zuolun on May 8, 2014 14:51:41 GMT 7

oldman, Based on the price action and trading volume analysis, it seemed to me that the gatekeeper knew about the above -ve news much earlier... As such, I had specially included MAS in the Malaysian rotten stocks list yesterday dated 7 May 2014. I forgot to change the heading; it should be Eleven (11) instead of Ten (10).  Ten (10) Malaysian rotten stocks as at 7 May 20141. CSL 2. Cybertowers 3. DVM 4. GPRO 5. Industronics 6. MNC Wireless 7. Solution 8. Stone Master 9. Visdynamics 10. Xinghe  Ten (10) Malaysian rotten stocks as at 5 May 2014 Ten (10) Malaysian rotten stocks as at 5 May 2014 Ten (10) Malaysian rotten stocks as at 5 May 2014 at 11.15am. Ten (10) Malaysian rotten stocks as at 5 May 2014 at 11.15am. |

|

|

|

Post by zuolun on May 16, 2014 10:13:19 GMT 7

|

|

|

|

Post by me200 on May 16, 2014 14:57:40 GMT 7

Najib now said it is too late to rescue MAS.... it may amounting to bankrupt.

納吉:現在拯救馬航已太晚

納吉接受《華爾街日報》訪問時說,馬航在面對連年虧損及公司與職工會之間的紛爭後,有數個選項能夠重組該公司,其中一個方式是宣佈破產

As usual and expected, Malaysia government will bail MAS out.

|

|

|

|

Post by oldman on May 19, 2014 9:31:04 GMT 7

MAS now at 15 sen. Still rather watch from the sidelines.  |

|

|

|

Post by zuolun on May 19, 2014 11:02:14 GMT 7

|

|

|

|

Post by zuolun on May 28, 2014 19:12:55 GMT 7

|

|

|

|

Post by oldman on Jul 3, 2014 9:10:28 GMT 7

Exclusive: State fund plans to take Malaysia Airlines private for restructuring: sources - 2nd July 2014 At MAS's current price of 21 sen per share, majority shareholder Khazanah would need to pay only 1.05 billion ringgit ($328 million) for the 30.6 percent of shares it does not already own, according to Reuters calculations.

MAS would have a "break-up" value of 4.15 billion ringgit, well above its current market value of 3.4 billion ringgit, Maybank Research said in an April report. The airlines' profitable units include MAS Engineering, Airport Terminal Services and its budget airline unit Firefly.

|

|

|

|

Post by zuolun on Jul 8, 2014 14:00:14 GMT 7

|

|