|

|

Post by zuolun on May 11, 2014 14:52:06 GMT 7

Good point. I agree. But as Zuolun correctly pointed out, if you are betting, it is much better to have a cut loss strategy and getting hit with a margin call is not a bad thing as it is a wake up call to cut your losses. At the end of the day, one has to decide whether one is making a long term investment or taking a bet when you invest in a property. For me, I don't like borrowing money to make a long term investment as you will then give yourself time pressure for the investment to perform. My experience is that my investments will seldom do well if I am under the constraints of time. So, I have a very simply policy: if I borrow money, I am making a bet. And if I make a bet, I will cut loss if I read the market wrongly... whether it is stocks or property investments. oldman, Many property buyers are not aware that borrowing a huge sum of money in hundreds of thousands or millions to buy a house is in fact a high leverage investment. Because of record low interest rate at almost zero now, whoever is able to pay the 20% downpayment and service the monthly loan installment is considered affordable. None remembered that in the late 70's to early 80's, the interest rate ever spiked up to as high as 17%. I distinctly remembered the high interest rate then because my late mum was quite happy with 13% interest paid on her Fixed Deposit parked at one finance company in the mid-70's (1973 to 1977). |

|

|

|

Post by oldman on May 11, 2014 15:00:54 GMT 7

zuolun, I think this time when our property market crashes, it will crash very badly. There are lots of new apartments all over Singapore and when the economy tanks, I think many foreigners will leave looking for greener pastures overseas. Best thing to do right now, is to have no loans and be patient. When the time is right, I am not against taking loans. Like stocks, I will only buy when it is very cheap.

|

|

|

|

Post by candy188 on May 11, 2014 15:24:53 GMT 7

Appreciate the active exchange of valuable sharings on the adverse effect of utilising leverage for investment.  Was glad that there is a stop loss feature when I utilised CFD to short Keppel Corp in 2012, fortunately, only suffered bruise.   Difficult to be a discipline trader, just not my cup of tea.  Good point. I agree. But as Zuolun correctly pointed out, if you are betting, it is much better to have a cut loss strategy and getting hit with a margin call is not a bad thing as it is a wake up call to cut your losses. At the end of the day, one has to decide whether one is making a long term investment or taking a bet when you invest in a property. For me, I don't like borrowing money to make a long term investment as you will then give yourself time pressure for the investment to perform. My experience is that my investments will seldom do well if I am under the constraints of time. So, I have a very simply policy: if I BORROW Money, I am making a bet.

And if I make a bet, I will cut loss if I read the market wrongly... whether it is stocks or property investments.

Yes, both are using leverage but I think there is different. Buy stock with leverage, one will have potential margin call if the odds is against him. If he can't top up the different, his loss may be bigger than he could handle. on the other hand, one would not face margin as long as he did not fail to pay the monthly installment despite if the property value may have reduce.

|

|

|

|

Post by zuolun on May 11, 2014 15:46:10 GMT 7

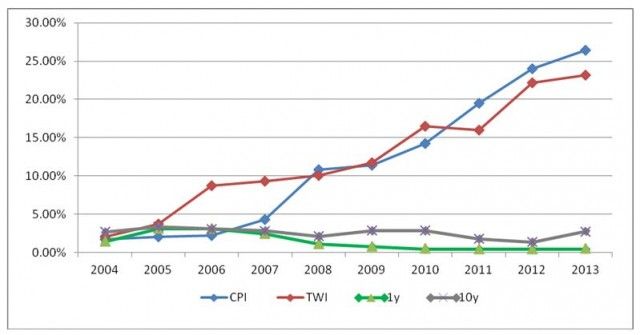

zuolun, I think this time when our property market crashes, it will crash very badly. There are lots of new apartments all over Singapore and when the economy tanks, I think many foreigners will leave looking for greener pastures overseas. Best thing to do right now, is to have no loans and be patient. When the time is right, I am not against taking loans. Like stocks, I will only buy when it is very cheap.  oldman, Our currency (S$) will crash 1st, followed by the stock market, then the SG property market crashes, last...it'll be a triple whammy!  S$: MAS fighting yesterday’s battles?17 Apr 2014 “Maginot Mentality” a term that is a byword for leadership who takes comfort in the past, unable to recognize fundamental changes had taken place. On Feb 14th after its monetary policy review, the MAS announced the gradual appreciation of the S$ remained the “appropriate policy stance”. The writer wonders if policy-makers are afflicted by their own “Maginot Mentality” – overly comfortable with ultra low interest rates, unable to recognize that the ground had shifted. Given the S$ correlation to US interest rates, the MAS may well be fighting yesterday’s battles when the Federal Reserve eventually raise rates, thereby rendering MAS’s policy ineffective or even counter-productive. MAS policy targets a gradual appreciation of the S$ Nominal Effective Exchange Rate (NEER) which represents the undisclosed trade weighted value of S$ in relation to Singapore’s main trading partners. It is meant that the NEER should be strong enough to control imported inflation, thus supporting economic growth. Until 10 years ago, targeting an appreciation of the NEER kept inflation in check. But things began to go awry from 2005 onwards.  The above chart shows the cumulative year by year increase in inflation (blue) and the cumulative appreciation of the S$ against trade weighted index as a proxy to NEER (red). You can see that inflation start to accelerate in 2007 but throughout the 10 year period, the NEER has appreciated almost in lock step with inflation. However, this should not be the case since the appreciation of the NEER is meant to curb inflation. In addition, since 2008 the 1 year deposit rate (green) flat lined close to 0.5% and the 10 year bond yield (grey) averaged 2.5%. By relying solely on NEER appreciation, MAS had produced negative real interest rates by mimicking the monetary conditions from the West despite the absence of their problems of low growth, high unemployment and potential deflation. Why did the NEER appreciation failed to curb inflation? The answer is the FT policy which flooded the economy with foreign workers and the Profit Maximization Strategy which work hand in glove with the latter. Transport costs (Goods Vehicle and Bus COE +500%), real estate (Residential +89%, Industrial +138%) and rents (+52% last 4 years), among others, have driven inflation to an extent that any disinflationary benefit from the appreciation of the NEER has been overtaken. Negative real interest rates caused homebuyers to over-estimate affordability, developers to bid up land prices, businesses to over-expand, unproductive ones to thrive, banks lending too much and large companies to overpay for acquisitions. This created far greater demand for resources than the economy can cope. The present policies caused the Singapore economy to grow well above the rate it could naturally sustain, are inflationary and the root cause of unaffordable housing, high cost of living and poor returns on savings. The NEER policy alone cannot curb these excesses as the link between the NEER and inflation may be irretrievably broken by present government policies. The writer suggests the MAS apply interest rate targeting to guide the economy along a sustainable growth path. In any case, the S$ will be weakened by higher US rates which would worsen inflation. This will force the MAS to raise interest rates belatedly when it should act preemptively to forestall risks. The role of central banking had been famously described as “taking away the punch bowl just as the party gets going”, i.e. raise interest rates when growth is too strong in order to balance the risks and trade-offs in the economy. When interest rates overtake inflation, the unnatural speed of the economy will slow. Uncompetitive industries such as those on low productivity and addicted to labour inputs tend not to survive in such monetary conditions. The creative destruction improves the economy’s productivity by ridding it of excessive labor reliance and resource usage. Higher rates enforce discipline on pricing since cost of financing is no longer cheap. Citizens’ savings and CPF earn a real return and will not be sacrificed for low financing costs to the business and corporate sector. Unfortunately, the MAS’ role is to support government policies, not to lean against economic risks and excesses by acting according to its own judgment on growth and inflation. However, monetary policy is too important to be left to politicians who by nature tend to favour one part of the electorate over another according to ideology. It is for this reason that central banks, an indispensable check and balance in advanced countries, are free from political control. Singapore lacks such diligent niceties which stand in the way of the growth at all costs strategy. But the institutional lack of check and balance has heightened risks to economic stability due to inflation, elevated property prices, excessive bank lending, among others. An early rise in interest rates back in 2011-2012 would have lessened these risks. This is all the more ironic given the government’s “foresight” in “long term planning”. Chris K* The writer has spend his entire career in managing balance sheet currency, interest rates and liquidity risks. As such, determining the direction of central bank monetary policy is a crucial element of his job. |

|

|

|

Post by oldman on May 11, 2014 15:54:14 GMT 7

zuolun, I think MAS will raise rates sooner rather than later. They need to keep the Sing $ strong... or at least, they will try very hard. I think property prices will fall first...

|

|

|

|

Post by zuolun on May 11, 2014 16:09:37 GMT 7

zuolun, I think MAS will raise rates sooner rather than later. They need to keep the Sing $ strong... or at least, they will try very hard. I think property prices will fall first... oldman, Later when I've more time, I'll show you some interesting charts on the S$, the SG stock market and the SG property market.  |

|

|

|

Post by zuolun on May 11, 2014 21:39:25 GMT 7

oldman, Many property buyers are not aware that borrowing a huge sum of money in hundreds of thousands or millions to buy a house is in fact a high leverage investment. Because of record low interest rate at almost zero now, whoever is able to pay the 20% downpayment and service the monthly loan installment is considered affordable. None remembered that in the late 70's to early 80's, the interest rate ever spiked up to as high as 17%. I distinctly remembered the high interest rate then because my late mum was quite happy with 13% interest paid on her Fixed Deposit parked at one finance company in the mid-70's (1973 to 1977). Wow...I thought 17% was already very high then...so the 30-Year Mortgage Rate in 1981 was @ 18.5%  The Economy Is Bad, but 1982 Was Worse The Economy Is Bad, but 1982 Was Worse — 20 Jan 2009 Some of the other key differences between 2009 and the early 1980s:Prime Rate 1981: 20.5% 2009: 3.25% (Current) Inflation 1980: 14.8% 2008: 0% (December) Unemployment Rate 1982: 10.8% 2008: 7.2% (December) 30-Year Mortgage Rate 1981: 18.5% 2009: 4.96% (Current) Real Gas Price (2008 dollars) 1981: $3.45 per gallon 2009: $1.82 (Current) |

|

|

|

Post by oldman on May 29, 2014 8:07:16 GMT 7

|

|

|

|

Post by chlio on May 29, 2014 9:51:55 GMT 7

I wonder what kind of events, external or internal, will trigger a crash or a huge drop of property prices or strength of S$. They have explicitly stated a strong S$ is favoured due to being an open economy, buying goods and raw materials using a strong S$. For property prices, I believe they have all the power to keep it stable, at today's level. After all, the government owns the bulk of real estate, be it public housing, private residential, commercial and industrial. Usually we see a fall as sudden, but can we also have a gradual decline when our factories no longer assemble goods that people want, geographical advantage that ceases to serve the shipping industry, services which are replicated elsewhere? Can a doomsday scenario happen to Singapore during my life time?  |

|

|

|

Post by oldman on May 29, 2014 10:10:04 GMT 7

Sadly, you too will experience many cycles of boom and bust in your lifetime. Our Singapore economy is too dependent on the worldwide economy. Or put another way, our local economy cannot sustain itself. So, the boom and bust in Singapore is likely to come from external factors, totally out of our control. Hence, it is very important for us here to be in touch with what is happening globally, especially in the US and China. I think it is very logical for Singapore to have a strong currency. We don't really export much. In fact, we import almost everything. Hence, the stronger our currency is, the more we can buy from outside. Problem is that our currency is also very dependent on how foreigners view our economy. Now, everyone wants a part of Singapore and hence, our currency remains very strong. This may not be the case when the world goes into a recession. Then, we may have a double whammy effect of both currency depreciation and a recession. This is why I will not be surprised that MAS will increase the interest rates as soon as it sees weakness in our local currency... as this is really one of the few things that is under the control of our government. I still feel that this is a good time to accumulate your cash reserves.  I wonder what kind of events, external or internal, will trigger a crash or a huge drop of property prices or strength of S$. They have explicitly stated a strong S$ is favoured due to being an open economy, buying goods and raw materials using a strong S$. For property prices, I believe they have all the power to keep it stable, at today's level. After all, the government owns the bulk of real estate, be it public housing, private residential, commercial and industrial. Usually we see a fall as sudden, but can we also have a gradual decline when our factories no longer assemble goods that people want, geographical advantage that ceases to serve the shipping industry, services which are replicated elsewhere? Can a doomsday scenario happen to Singapore during my life time?  |

|

|

|

Post by zuolun on May 29, 2014 11:13:30 GMT 7

Sadly, you too will experience many cycles of boom and bust in your lifetime. Our Singapore economy is too dependent on the worldwide economy. Or put another way, our local economy cannot sustain itself. So, the boom and bust in Singapore is likely to come from external factors, totally out of our control. Hence, it is very important for us here to be in touch with what is happening globally, especially in the US and China. I think it is very logical for Singapore to have a strong currency. We don't really export much. In fact, we import almost everything. Hence, the stronger our currency is, the more we can buy from outside. Problem is that our currency is also very dependent on how foreigners view our economy. Now, everyone wants a part of Singapore and hence, our currency remains very strong. This may not be the case when the world goes into a recession. Then, we may have a double whammy effect of both currency depreciation and a recession. This is why I will not be surprised that MAS will increase the interest rates as soon as it sees weakness in our local currency... as this is really one of the few things that is under the control of our government. I still feel that this is a good time to accumulate your cash reserves.  oldman, "this is a good time to accumulate your cash reserves"...this coincides with Peter Lim's "Bull market is the time to build cash." |

|

|

|

Post by zuolun on May 29, 2014 12:32:39 GMT 7

I wonder what kind of events, external or internal, will trigger a crash or a huge drop of property prices or strength of S$. They have explicitly stated a strong S$ is favoured due to being an open economy, buying goods and raw materials using a strong S$. For property prices, I believe they have all the power to keep it stable, at today's level. After all, the government owns the bulk of real estate, be it public housing, private residential, commercial and industrial. Usually we see a fall as sudden, but can we also have a gradual decline when our factories no longer assemble goods that people want, geographical advantage that ceases to serve the shipping industry, services which are replicated elsewhere? Can a doomsday scenario happen to Singapore during my life time?  Watch how drastic the price of Gold sinks may give you the feel of a crash. |

|

|

|

Post by oldman on Jun 17, 2014 22:00:03 GMT 7

|

|