Post by zuolun on Sept 18, 2015 9:31:50 GMT 7

China cuts U.S. treasuries holdings to US$1.2408t in July 2015 ~ 17 Sep 2015

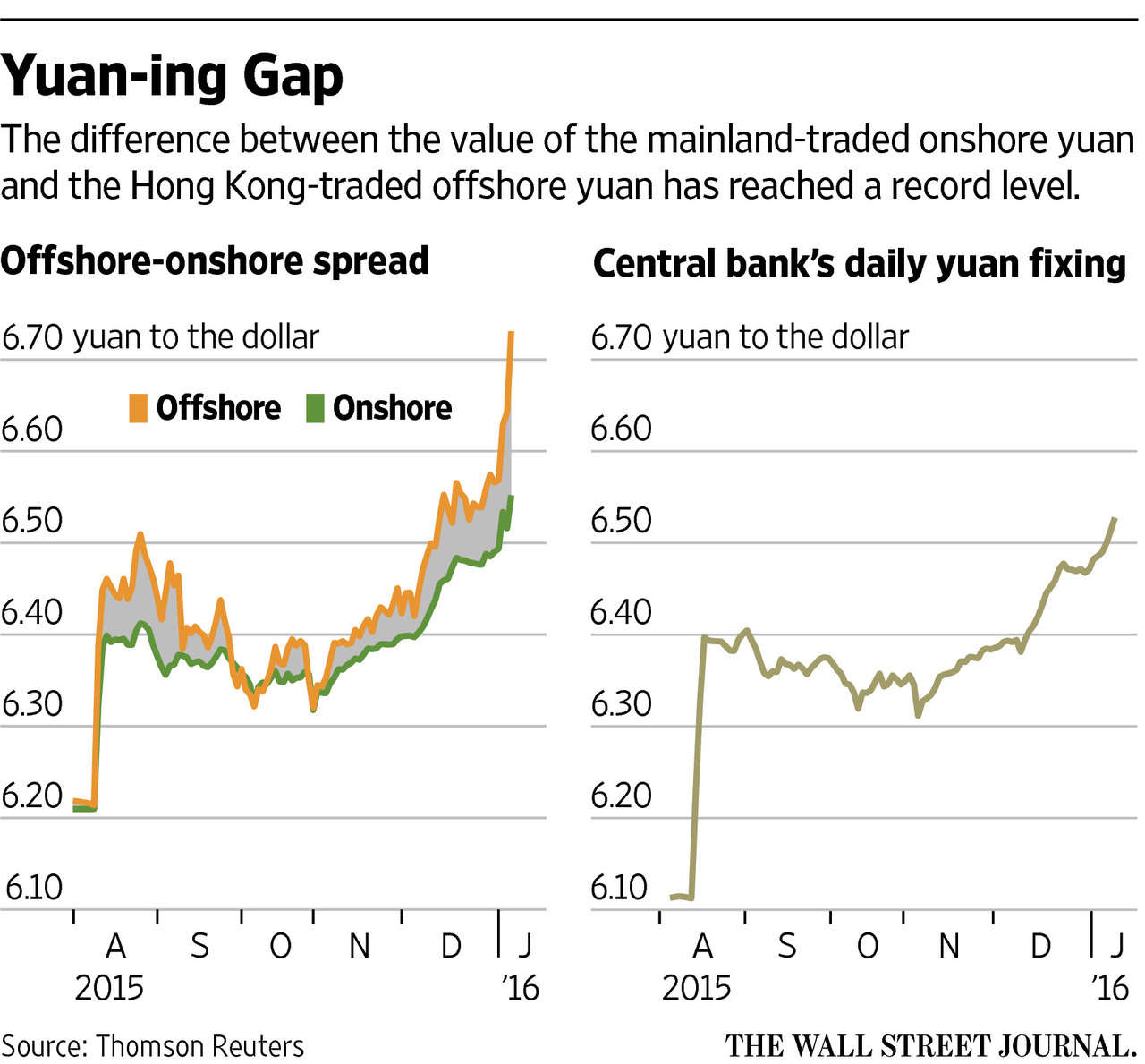

Why China's Yuan may be set for 15% devaluation ~ 16 Sep 2015

Foreigners sell treasuries in July; China's U.S. debt holdings fall ~ 16 Sep 2015

PBOC acts further to protect the yuan; reserves record historical drop in Aug 2015 ~ 15 Sep 2015

Hayman Capital's Bass: China's real problem is its banking sector ~ 15 Sep 2015

China's devaluation of Yuan has sparked global currency war ~ 15 Sep 2015

Yuan volatility drops as stability seen before Xi visits U.S. ~ 15 Sep 2015

China actually has 2 currencies—and it’s fiddling around with both ~ 10 Sep 2015

China ripple effect will hurt these currencies ~ 10 Sep 2015

Perfect storm of PMI egress ~ 1 Sep 2015

Global economy is heading for a perfect storm ~ 27 Aug 2015

How the West re-colonized China ~ 26 Aug 2015

IMF official says 'premature' to speak of Chinese crisis ~ 22 Aug 2015

Why China's devaluation is a peace offering misunderstood by the world ~ 22 Aug 2015

IMF freezes benchmark currency basket until Oct 2016, defers any yuan addition ~ 19 Aug 2015

China’s currency moves ~ 17 Aug 2015

China's Yuan and a potential global currency war ~ 13 Aug 2015

Why did China devalue its currency? Two big reasons ~ 11 Aug 2015

CNY: Devaluation pause is a part of the plan ~ 14 Aug 2015

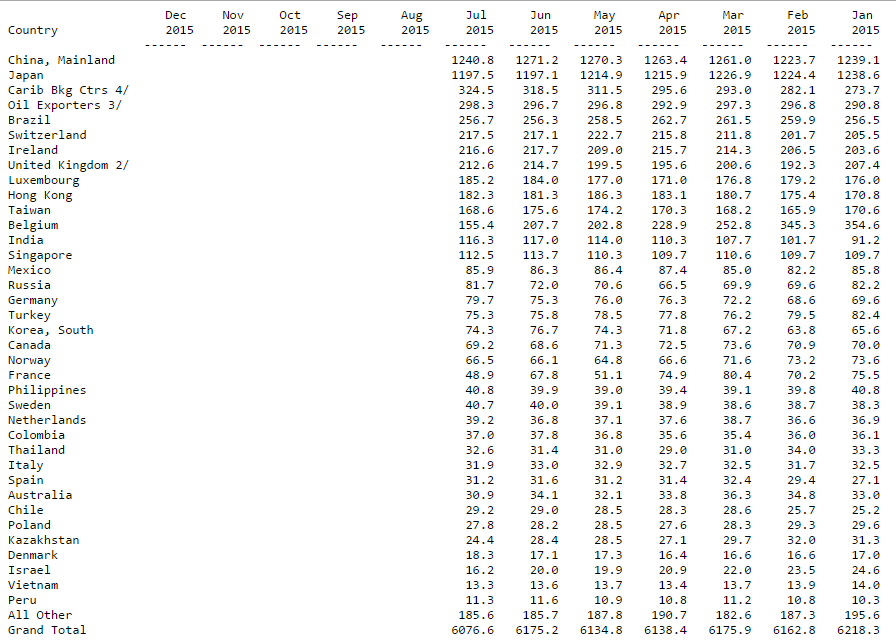

China held US$1.2408t in U.S. Treasuries as at July 2015, its holdings peaked at $1.317t in Nov 2013.

MAJOR FOREIGN HOLDERS OF TREASURY SECURITIES (in billions of dollars) HOLDINGS 1/ AT END OF PERIOD

The reasons why China buys U.S. treasury bonds

Understanding the sources of friction in U.S.-China trade relations

It all makes sense when you realise there are TWO US dollar currencies ~ 29 Sep 2014

Chinese yuan, ever-more a global currency ~ 17 May 2014

Central bank currency swaps key to int'l monetary system ~ 1 Apr 2014

Why the People’s Bank of China is stronger than you think ~ 22 Nov 2013

China's currency policy: An analysis of the economic issues ~ 22 Jul 2013

China's currency: A summary of the economic issues

October 2010

Over the past several years, the Chinese government has maintained a policy of intervening in currency markets to limit or halt the appreciation of its currency, the renminbi (RMB) against other major currencies, especially the U.S. dollar.

This policy appears to be largely intended to keep China's export industries competitive internationally and to attract foreign direct investment (FDI), which have been major factors behind China's rapid economic growth.

Critics charge that this policy constitutes a form of currency manipulation that is intended to make Chinese exports cheaper, and imports into China more expensive, than they would be under a floating exchange system.

Some claim that China's currency policy is a major cause of the large U.S. trade imbalance with China and the loss of numerous U.S. jobs.

Many Members of Congress have urged the Obama Administration to designate China as a "currency manipulator" in order to pressure it to let the RMB appreciate, and several bills have been introduced (including H.R. 2378, S. 1254, S. 1027, and S. 3134) which seek to address China's currency policy.

On September 29, 2010, the House approved an amendment in the nature of a substitute to H.R. 2378 (by a vote of 348 to 79). The bill would attempt to apply U.S. countervailing laws to certain fundamentally undervalued currencies.

From July 2005 to July 2008, the RMB was allowed to gradually appreciate against the dollar, rising by about 21% over this period. However, once the effects of the global economic crisis began to become apparent, China halted appreciation of the RMB to the dollar in an effort to limit job losses in industries dependent on trade.

From July 2008 to late June 2010, China kept the exchange rate of the RMB at roughly 6.83 yuan (the base unit of the RMB) to the dollar.

On June 19, 2010, the Chinese central bank stated that, based on current economic conditions, it had decided to "proceed further with reform of the RMB exchange rate regime and to enhance the RMB exchange rate flexibility." Events following the announcement demonstrate that a flexible RMB exchange rate could move both up and down over short periods of time. By September 23, the RMB had appreciated by about 1.9% to 6.7 yuan.

Many U.S. officials have criticized the slow pace of RMB's appreciation. Many economists have argued that RMB appreciation is an important factor in helping to rebalance the world economy. They have also urged China to implement policies to make consumer demand, rather than exports and fixed investment, the main sources of economic growth.

Some see RMB appreciation as a way of boosting China's imports, which could contribute to a faster global economic recovery. While Chinese officials acknowledge the need to rebalance the economy, they have strongly resisted international pressure to appreciate and reform the currency, calling it "protectionism." Some attribute this policy to concerns by the Chinese government that implementing policy changes too rapidly could lead to social instability.

While the Obama Administration has pushed China to appreciate its currency, it has also encouraged it to continue purchasing U.S. Treasury securities. China is the largest foreign holder of U.S. Treasury securities, which totaled $847 billion as of July 2010.

Some analysts contend that, although an appreciation of China's currency could help boost U.S. exports to China, it could also lessen China's need to buy U.S. Treasury securities, which could push up U.S. interest rates. It could result in higher prices of Chinese-made goods for U.S. consumers, as well as for Chinese-made inputs that U.S. firms use in their production. Many economists contend that, even if China significantly appreciated its currency, the United States would still need to increase its savings and reduce domestic demand (particularly the budget deficit), and China would have to lower its savings and increase consumption, in order to reduce trade imbalances in the long run.

Why China's Yuan may be set for 15% devaluation ~ 16 Sep 2015

Foreigners sell treasuries in July; China's U.S. debt holdings fall ~ 16 Sep 2015

PBOC acts further to protect the yuan; reserves record historical drop in Aug 2015 ~ 15 Sep 2015

Hayman Capital's Bass: China's real problem is its banking sector ~ 15 Sep 2015

China's devaluation of Yuan has sparked global currency war ~ 15 Sep 2015

Yuan volatility drops as stability seen before Xi visits U.S. ~ 15 Sep 2015

China actually has 2 currencies—and it’s fiddling around with both ~ 10 Sep 2015

China ripple effect will hurt these currencies ~ 10 Sep 2015

Perfect storm of PMI egress ~ 1 Sep 2015

Global economy is heading for a perfect storm ~ 27 Aug 2015

How the West re-colonized China ~ 26 Aug 2015

IMF official says 'premature' to speak of Chinese crisis ~ 22 Aug 2015

Why China's devaluation is a peace offering misunderstood by the world ~ 22 Aug 2015

IMF freezes benchmark currency basket until Oct 2016, defers any yuan addition ~ 19 Aug 2015

China’s currency moves ~ 17 Aug 2015

China's Yuan and a potential global currency war ~ 13 Aug 2015

Why did China devalue its currency? Two big reasons ~ 11 Aug 2015

CNY: Devaluation pause is a part of the plan ~ 14 Aug 2015

China held US$1.2408t in U.S. Treasuries as at July 2015, its holdings peaked at $1.317t in Nov 2013.

MAJOR FOREIGN HOLDERS OF TREASURY SECURITIES (in billions of dollars) HOLDINGS 1/ AT END OF PERIOD

The reasons why China buys U.S. treasury bonds

Understanding the sources of friction in U.S.-China trade relations

It all makes sense when you realise there are TWO US dollar currencies ~ 29 Sep 2014

Chinese yuan, ever-more a global currency ~ 17 May 2014

Central bank currency swaps key to int'l monetary system ~ 1 Apr 2014

Why the People’s Bank of China is stronger than you think ~ 22 Nov 2013

China's currency policy: An analysis of the economic issues ~ 22 Jul 2013

China's currency: A summary of the economic issues

October 2010

Over the past several years, the Chinese government has maintained a policy of intervening in currency markets to limit or halt the appreciation of its currency, the renminbi (RMB) against other major currencies, especially the U.S. dollar.

This policy appears to be largely intended to keep China's export industries competitive internationally and to attract foreign direct investment (FDI), which have been major factors behind China's rapid economic growth.

Critics charge that this policy constitutes a form of currency manipulation that is intended to make Chinese exports cheaper, and imports into China more expensive, than they would be under a floating exchange system.

Some claim that China's currency policy is a major cause of the large U.S. trade imbalance with China and the loss of numerous U.S. jobs.

Many Members of Congress have urged the Obama Administration to designate China as a "currency manipulator" in order to pressure it to let the RMB appreciate, and several bills have been introduced (including H.R. 2378, S. 1254, S. 1027, and S. 3134) which seek to address China's currency policy.

On September 29, 2010, the House approved an amendment in the nature of a substitute to H.R. 2378 (by a vote of 348 to 79). The bill would attempt to apply U.S. countervailing laws to certain fundamentally undervalued currencies.

From July 2005 to July 2008, the RMB was allowed to gradually appreciate against the dollar, rising by about 21% over this period. However, once the effects of the global economic crisis began to become apparent, China halted appreciation of the RMB to the dollar in an effort to limit job losses in industries dependent on trade.

From July 2008 to late June 2010, China kept the exchange rate of the RMB at roughly 6.83 yuan (the base unit of the RMB) to the dollar.

On June 19, 2010, the Chinese central bank stated that, based on current economic conditions, it had decided to "proceed further with reform of the RMB exchange rate regime and to enhance the RMB exchange rate flexibility." Events following the announcement demonstrate that a flexible RMB exchange rate could move both up and down over short periods of time. By September 23, the RMB had appreciated by about 1.9% to 6.7 yuan.

Many U.S. officials have criticized the slow pace of RMB's appreciation. Many economists have argued that RMB appreciation is an important factor in helping to rebalance the world economy. They have also urged China to implement policies to make consumer demand, rather than exports and fixed investment, the main sources of economic growth.

Some see RMB appreciation as a way of boosting China's imports, which could contribute to a faster global economic recovery. While Chinese officials acknowledge the need to rebalance the economy, they have strongly resisted international pressure to appreciate and reform the currency, calling it "protectionism." Some attribute this policy to concerns by the Chinese government that implementing policy changes too rapidly could lead to social instability.

While the Obama Administration has pushed China to appreciate its currency, it has also encouraged it to continue purchasing U.S. Treasury securities. China is the largest foreign holder of U.S. Treasury securities, which totaled $847 billion as of July 2010.

Some analysts contend that, although an appreciation of China's currency could help boost U.S. exports to China, it could also lessen China's need to buy U.S. Treasury securities, which could push up U.S. interest rates. It could result in higher prices of Chinese-made goods for U.S. consumers, as well as for Chinese-made inputs that U.S. firms use in their production. Many economists contend that, even if China significantly appreciated its currency, the United States would still need to increase its savings and reduce domestic demand (particularly the budget deficit), and China would have to lower its savings and increase consumption, in order to reduce trade imbalances in the long run.