|

|

Post by zuolun on May 11, 2015 10:03:57 GMT 7

The major cheng kay had already run road last year, end-May 2014.  Osim ~ Bearish Symmetrical Triangle Breakout, Interim TP S$1.325 Osim ~ Bearish Symmetrical Triangle Breakout, Interim TP S$1.325Osim closed with a doji unchanged @ S$1.67 with 5.86m shares done on 8 May 2015. Immediate support @ S$1.62, immediate resistance @ S$1.745.  |

|

|

|

Post by pain on May 11, 2015 13:24:40 GMT 7

The uDivine massage chair that I bought 2 years ago is leather flaking and customer feedback email has no response to this issue. This is their major selling item with defective leather issue. OSIM's management is definitely not aligned to the basic customer needs. I really feels like buying 100 shares of OSIM and goes to their AGM (Ron Sim) on this issue.  |

|

|

|

Osim

May 11, 2015 16:04:15 GMT 7

pain likes this

Post by oldman on May 11, 2015 16:04:15 GMT 7

Sounds like the older massage chairs are probably better built.... which may be a concern for shareholders..... I bought the OSIM uDream massage chair 4 years and it is still in very good condition. Leather is still as good as new. The uDivine massage chair that I bought 2 years ago is leather flaking and customer feedback email has no response to this issue. This is their major selling item with defective leather issue. OSIM's management is definitely not aligned to the basic customer needs. I really feels like buying 100 shares of OSIM and goes to their AGM (Ron Sim) on this issue.  |

|

|

|

Osim

May 12, 2015 10:28:08 GMT 7

oldman likes this

Post by pain on May 12, 2015 10:28:08 GMT 7

Finally managed to get hold of their customer service. It is a defective leather issue which they will replace whole at customer's cost of $98. Leadtime is about 3 months. Disappointed that since OSIM knows that the leather is not suitable for our climate, it should be at their cost. Needs to monitor the status myself next month. A lesson learnt... Sounds like the older massage chairs are probably better built.... which may be a concern for shareholders..... I bought the OSIM uDream massage chair 4 years and it is still in very good condition. Leather is still as good as new. The uDivine massage chair that I bought 2 years ago is leather flaking and customer feedback email has no response to this issue. This is their major selling item with defective leather issue. OSIM's management is definitely not aligned to the basic customer needs. I really feels like buying 100 shares of OSIM and goes to their AGM (Ron Sim) on this issue.  |

|

|

|

Post by zuolun on Jun 25, 2015 15:55:25 GMT 7

Osim: RHB maintained NEUTRAL, TP S$2.00 ~ 25 Jun 2015 Osim ~ Classic "Mushroom Of Death" chart pattern, interim TP S$1.325Osim had a black marubozu and traded @ S$1.635 (-0.03, -1.8%) with 2.35m shares done on 25 Jun 2015 at 0435 hrs. Critical support @ S$1.62, immediate resistance @ S$1.69.

|

|

|

|

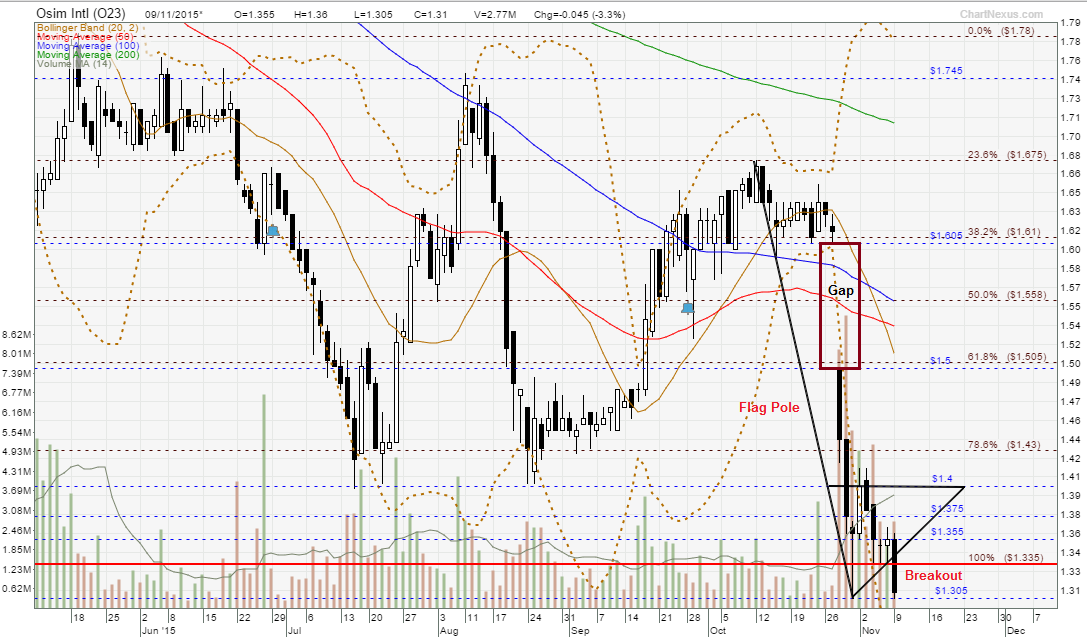

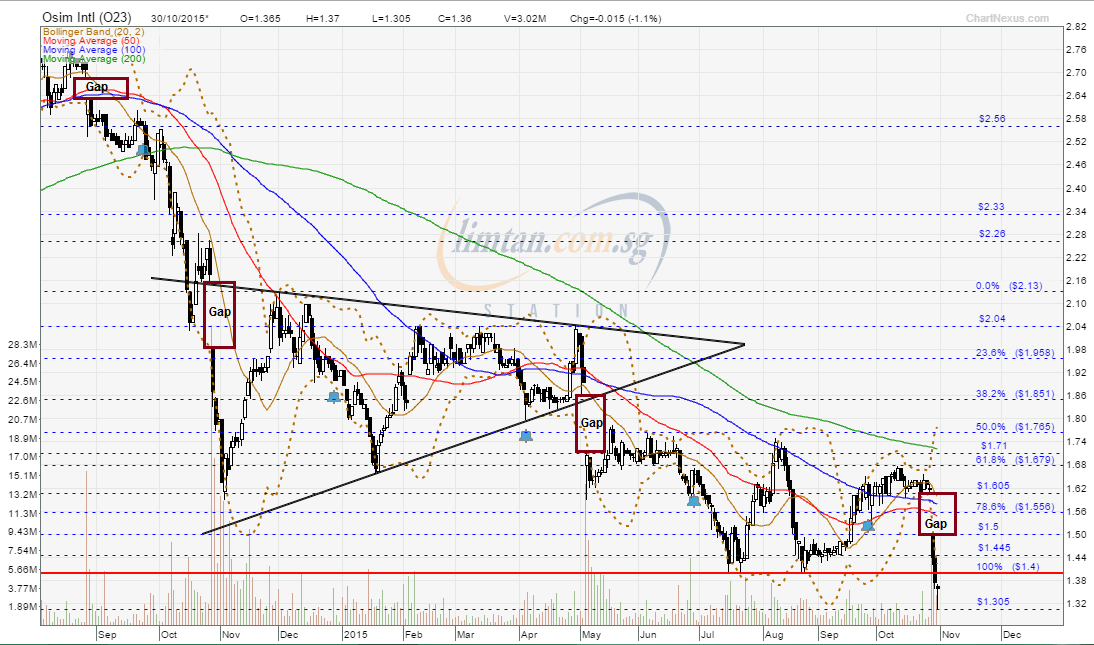

Post by zuolun on Oct 28, 2015 16:53:34 GMT 7

Osim's latest earnings: Revenue dives, again ~ 28 Oct 2015 Osim Q3 net profit down 62% ~ 27 Oct 2015 Osim ~ Bearish Symmetrical Triangle Breakout, Interim TP S$1.325Osim gapped down and closed with a black marubozu @ S$1.44 (-0.175, -10.8%) with 8.17m shares done on 28 Oct 2015. Immediate support @ S$1.40, immediate resistance @ S$1.50. "Gap-Trading" Strategies The major cheng kay had already run road last year, end-May 2014.  Osim ~ Bearish Symmetrical Triangle Breakout, Interim TP S$1.325 Osim ~ Bearish Symmetrical Triangle Breakout, Interim TP S$1.325Osim closed with a doji unchanged @ S$1.67 with 5.86m shares done on 8 May 2015. Immediate support @ S$1.62, immediate resistance @ S$1.745.

|

|

|

|

Osim

Nov 18, 2015 16:38:58 GMT 7

oldman likes this

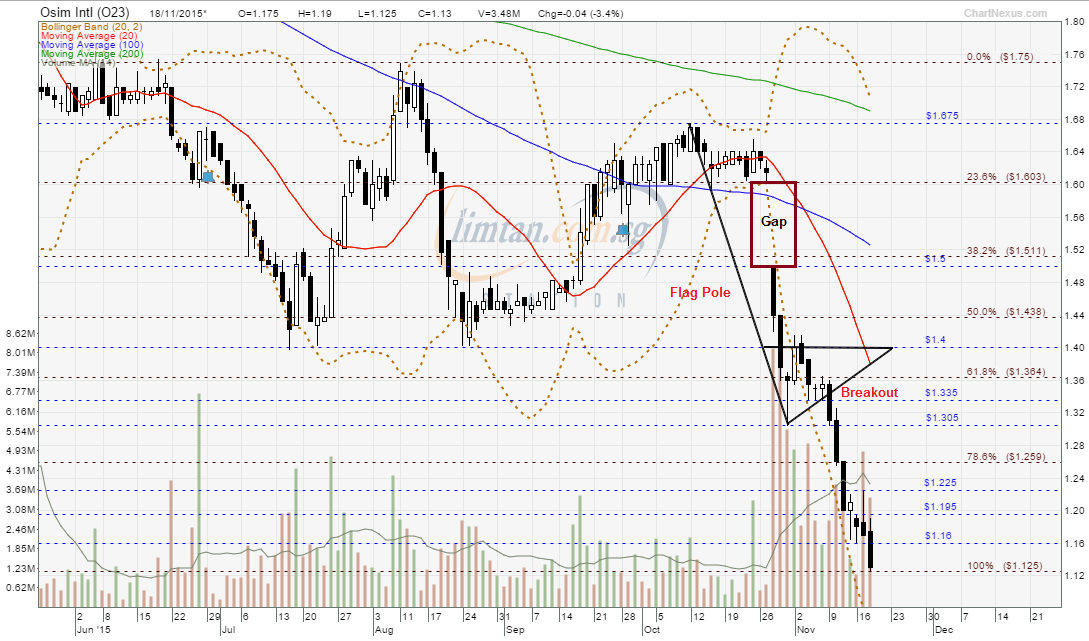

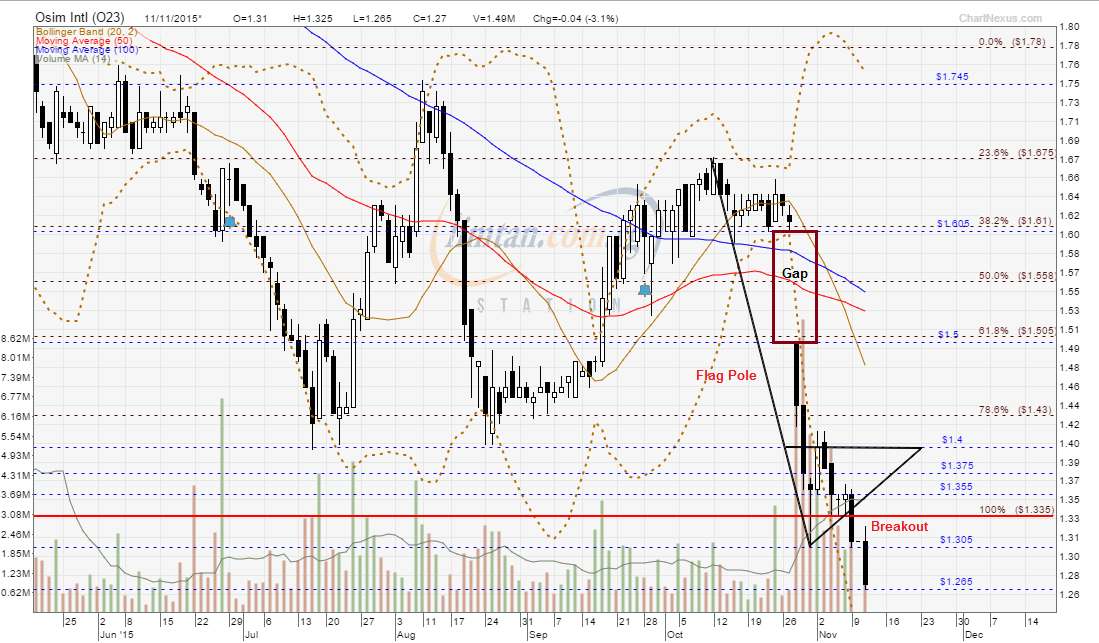

Post by zuolun on Nov 18, 2015 16:38:58 GMT 7

Perpetual and retail bonds flood the Singapore capital market with lower yieldsSingapore Chili Crab IPO surges in trading debut ~ 9 Nov 2015 Singapore Chili-Crab IPO attracts Temasek arm, Osim founder ~ 28 Oct 2015 Costly celebrity campaigns fail to boost Osim’s plunging sales ~ 30 Sep 2015 International bonds: OSIM, 2016, SGD (conv.) (XS0635636920)Osim's war chest news ~ 24 Oct 2014 Right after Osim's convertible bonds issue, OCBC maintained BUY TP S$3.21 ~ 28 Aug 2014 OSIM 5-year S$170m (upsize option of S$30m) zero-coupon bond @ 2% ~ 28 Aug 2014 The major cheng kay had already run road last year, end-May 2014. Osim ~ Bear Flag Breakout, interim TP S$0.965, next TP$0.76Osim closed with a black marubozu @ $1.13 (-0.04, -3.4%) with 3.48m shares done on 18 Nov 2015. Immediate support @ S$0.995, immediate resistance @ S$1.18.    Osim: Singapore’s big loser of the week Osim: Singapore’s big loser of the week ~ 1 Nov 2015 All the 3 gaps in Osim's chart earlier were not closed, the latest, the 4th gap was created on 28 Oct 2015.

|

|

|

|

Osim

Jan 15, 2016 7:42:30 GMT 7

Post by zuolun on Jan 15, 2016 7:42:30 GMT 7

|

|

|

|

Osim

Jan 24, 2016 23:08:25 GMT 7

Post by zuolun on Jan 24, 2016 23:08:25 GMT 7

|

|

|

|

Osim

Jan 26, 2016 7:32:44 GMT 7

Post by zuolun on Jan 26, 2016 7:32:44 GMT 7

|

|

|

|

Osim

Mar 7, 2016 13:29:35 GMT 7

Post by zuolun on Mar 7, 2016 13:29:35 GMT 7

The danger of short is to be caught in a situation where a stock is suddenly offered with cash offer higher than the prevailing share price due to privatisation; those who shorted OSIM are "short-squeezed" and sitting on heavy losses now.  OCBC says Ron Sim's offer to privatise OSIM is reasonable OCBC says Ron Sim's offer to privatise OSIM is reasonable ~ 7 Mar 2016 OSIM CEO makes cash offer of S$1.32 per share to privatise company ~ 7 Mar 2016 Maybank Kim Eng recommends OSIM shareholders hold out for better offerBy Chan Chao Peh March 7, 2016 : 11:21 AM MYT Maybank Kim Eng is suggesting that shareholders of OSIM International, which is being privatised by founder and chairman Ron Sim, hold out for a better offer. Earlier this morning, Sim, who owns 68.31% of the company, made an offer of $1.32 per share to privatise and then delist the massage chair maker. Maybank Kim Eng notes that at this offer price of $1.32, OSIM is valued at 9.1 times historical EV/EBITDA, 16.3 times trailing P/E and 2.6 times P/B. This valuation levels are “somewhat below” regional specialty retailers, which on average are priced at 14.8 times EV/EBITDA, 33 times trailing P/E, and 4.1 times P/B. OSIM’s share price surged just before this privatisation offer was announced. Nevertheless, the brokerage notes that OSIM has been sold down so much in the last 12 months, from the $2 level between late 2013 and 2014. “As such, investors might hold out for a better offer,” the brokerage states. OCBC, on the other hand, has recommended that minority shareholders to accept, noting that Sim’s offer price represents a 31.8% and 33.5% premium over the volume weighted average price for the corresponding one-month and three-month periods, respectively. The offer price of $1.32 is also 61% higher than OCBC’s fair value on the company at 82 cents. “Given the tough environment ahead and the lack of strong drivers for earnings, we view this offer to be reasonable and recommend shareholders to accept the offer,” writes analyst Jodie Foo in a March 7 note, hours after the privatisation offer was announced. Shares of OSIM, which is now on a trading halt, last traded at $1.225. |

|