Post by oldman on May 29, 2014 13:51:48 GMT 7

I think fundamentally our CPF system is very sound. It is a forced savings by the individual for the individual. The more you earn, the more forced savings you will have and this encourages our young to work hard to build up their own nest eggs. Also, CPF gives 2.5% interest per year which is very much better than the bank's deposit rates which is at best, 0.75% a year.

I used to work in the UK and we all have to contribute to a superannuation fund. I think this is a collective fund where everyone puts money into a common fund and the fund then pays out the individual pensions (one just has to pray that these funds remain intact when your pensions are due!). But, I cannot touch any of this money until I reach the age of 60. When I reach this age, I will get a certain amount of money every year for the rest of my life. When I turn 60, I am looking forward to going on holiday to the UK every year to collect my pension!

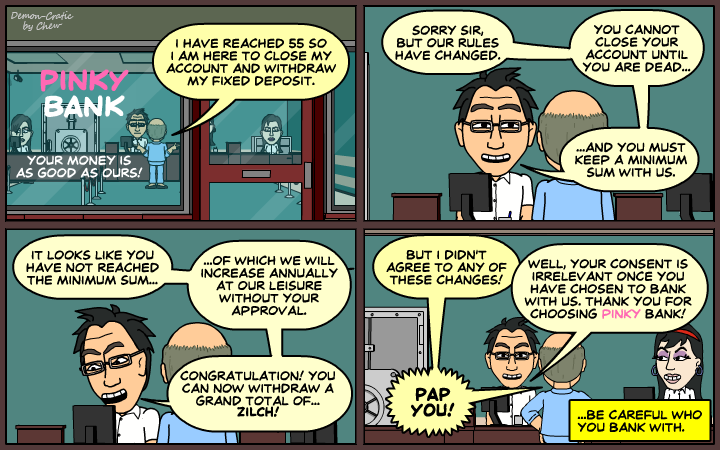

But before that, when I reach the age of 55, I hope to draw some cash out of my CPF account. Also, our CPF system is a lot more flexible as we can use a portion of our CPF to buy properties and shares whenever there is enough money in it. We can also use it to pay certain medical and hospital expenses.

Whether our sovereign funds make more money than the 2.5%, is really their business as they are simply borrowing money from us. We still get our 2.5% a year regardless. Ours is a guaranteed amount, theirs is not. Yes, there is a very minute risk of the sovereign funds losing all their money but really, this is a very very minute risk. Also, given that our sovereign funds are ultimately owned by our government, they can simply print more money.

As regards to the interest rates being lower than the inflation rate, we just have to learn to live with it. To me, there is no point having a higher interest rate than the inflation rate only to see the value of your currency depreciate in value. Take the Malaysian ringgit for example. They have much higher interest rates there and you may feel better off there. But the reality is that the Malaysian ringgit has fallen in value compared to the Singapore dollar and at the end of the day, we are better off here in Singapore.

So, I really don't see any major issues with our CPF system. Just that our government needs to communicate this better and clearly articulate how CPF works with our sovereign funds and the protection that is in place for these funds.

Pasture is always greener on the other side; sometimes, the moon is rounder as well. We heard this so many times. We are also hearing this now and again from the same group of people who have left to join the other side.

Pasture is always greener on the other side; sometimes, the moon is rounder as well. We heard this so many times. We are also hearing this now and again from the same group of people who have left to join the other side.

There was some arguments over in one Forum where one Singaporean who has migrated to New Zealand could not agree with some posts about the short comings of Singapore’s CPF system. That die-hard New Zealand Convert (NZC) was convinced that the Singapore’s CPF system is much superior when compare to the New Zealand’s Pension System and we must be thankful to our leaders who has the wisdom. After that, another US guy, who did not identify if he is a migrant, joined in to say that Singaporeans should not grumble about the CPF system as it is far superior system than his US Social Security system where he could only see how much monthly allowances he could draw in the golden years when he received his Social Security statement. Then a Malaysian laughed at the Singapore’s CPF mere returns that would diminish the saving and turn it into just peanuts if Singapore CPF don’t raise the interest rate to match the inflation. Thereafter, a Hong-Ki joined in to give the same remark.

I am very confused as to who and whose system is better but I am convinced that if everyone of us put in effort to improve our CPF system, it will again be the best system in the World once more.

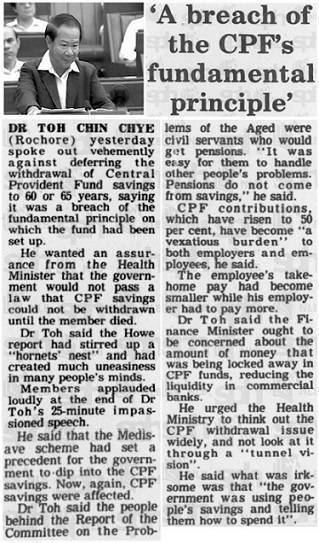

We are only one small step behind. Yes, we have a set back; our sovereignty funds lost a lot of money in the last recession. That may be the very reason why our Singaporeans condemned the CPF system when they knew that the sovereignty funds are mostly from CPF buying up the bonds that might have fueled the sovereignty funds. That might be the very reason giving the perception why the Government has to shift the “goal posts” in CPF and “lock up’ more citizen’s CPF contribution.

The Singaporeans today are unlike those we used to see 10 years ago. They can become very restless when they could not understand why the Government has such CPF policies and why Government die die must import so many foreign talent to take away their jobs. Of course, there may some very good reasons but some Singaporeans are just not listening.

Presently, don’t think we can or want to do much than just to voice our frustrations. Hopefully, our elite groups, the politicians, can pick up the message. One thing for sure, the Singaporeans will always have right to choose who to be the next Government when 2016 comes. That is promised under the present Constitution and hope it will not be taken away from us.

I used to work in the UK and we all have to contribute to a superannuation fund. I think this is a collective fund where everyone puts money into a common fund and the fund then pays out the individual pensions (one just has to pray that these funds remain intact when your pensions are due!). But, I cannot touch any of this money until I reach the age of 60. When I reach this age, I will get a certain amount of money every year for the rest of my life. When I turn 60, I am looking forward to going on holiday to the UK every year to collect my pension!

But before that, when I reach the age of 55, I hope to draw some cash out of my CPF account. Also, our CPF system is a lot more flexible as we can use a portion of our CPF to buy properties and shares whenever there is enough money in it. We can also use it to pay certain medical and hospital expenses.

Whether our sovereign funds make more money than the 2.5%, is really their business as they are simply borrowing money from us. We still get our 2.5% a year regardless. Ours is a guaranteed amount, theirs is not. Yes, there is a very minute risk of the sovereign funds losing all their money but really, this is a very very minute risk. Also, given that our sovereign funds are ultimately owned by our government, they can simply print more money.

As regards to the interest rates being lower than the inflation rate, we just have to learn to live with it. To me, there is no point having a higher interest rate than the inflation rate only to see the value of your currency depreciate in value. Take the Malaysian ringgit for example. They have much higher interest rates there and you may feel better off there. But the reality is that the Malaysian ringgit has fallen in value compared to the Singapore dollar and at the end of the day, we are better off here in Singapore.

So, I really don't see any major issues with our CPF system. Just that our government needs to communicate this better and clearly articulate how CPF works with our sovereign funds and the protection that is in place for these funds.

There was some arguments over in one Forum where one Singaporean who has migrated to New Zealand could not agree with some posts about the short comings of Singapore’s CPF system. That die-hard New Zealand Convert (NZC) was convinced that the Singapore’s CPF system is much superior when compare to the New Zealand’s Pension System and we must be thankful to our leaders who has the wisdom. After that, another US guy, who did not identify if he is a migrant, joined in to say that Singaporeans should not grumble about the CPF system as it is far superior system than his US Social Security system where he could only see how much monthly allowances he could draw in the golden years when he received his Social Security statement. Then a Malaysian laughed at the Singapore’s CPF mere returns that would diminish the saving and turn it into just peanuts if Singapore CPF don’t raise the interest rate to match the inflation. Thereafter, a Hong-Ki joined in to give the same remark.

I am very confused as to who and whose system is better but I am convinced that if everyone of us put in effort to improve our CPF system, it will again be the best system in the World once more.

We are only one small step behind. Yes, we have a set back; our sovereignty funds lost a lot of money in the last recession. That may be the very reason why our Singaporeans condemned the CPF system when they knew that the sovereignty funds are mostly from CPF buying up the bonds that might have fueled the sovereignty funds. That might be the very reason giving the perception why the Government has to shift the “goal posts” in CPF and “lock up’ more citizen’s CPF contribution.

The Singaporeans today are unlike those we used to see 10 years ago. They can become very restless when they could not understand why the Government has such CPF policies and why Government die die must import so many foreign talent to take away their jobs. Of course, there may some very good reasons but some Singaporeans are just not listening.

Presently, don’t think we can or want to do much than just to voice our frustrations. Hopefully, our elite groups, the politicians, can pick up the message. One thing for sure, the Singaporeans will always have right to choose who to be the next Government when 2016 comes. That is promised under the present Constitution and hope it will not be taken away from us.