|

|

Post by zuolun on Jul 23, 2014 13:31:55 GMT 7

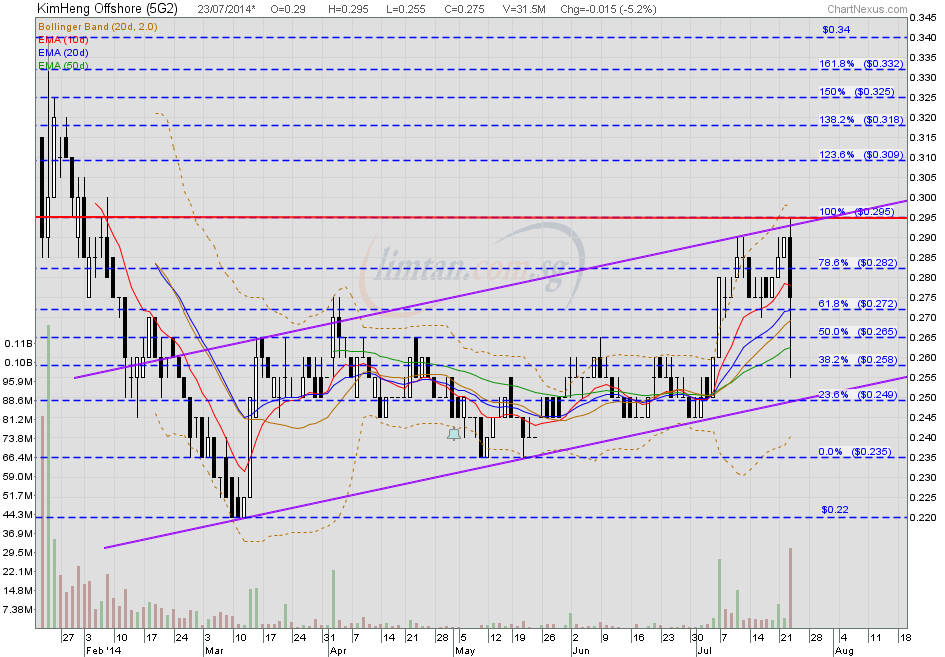

KimHeng — Trading in an upward sloping channelKimHeng had a long-legged hammer @ S$0.275 (-0.015, -5.2%) with 31.5m shares done on 23 July 2014 at 2.40pm. Crucial support @ S$0.27, strong resistance @ S$0.295.

|

|

|

|

Post by zuolun on Jul 23, 2014 21:44:59 GMT 7

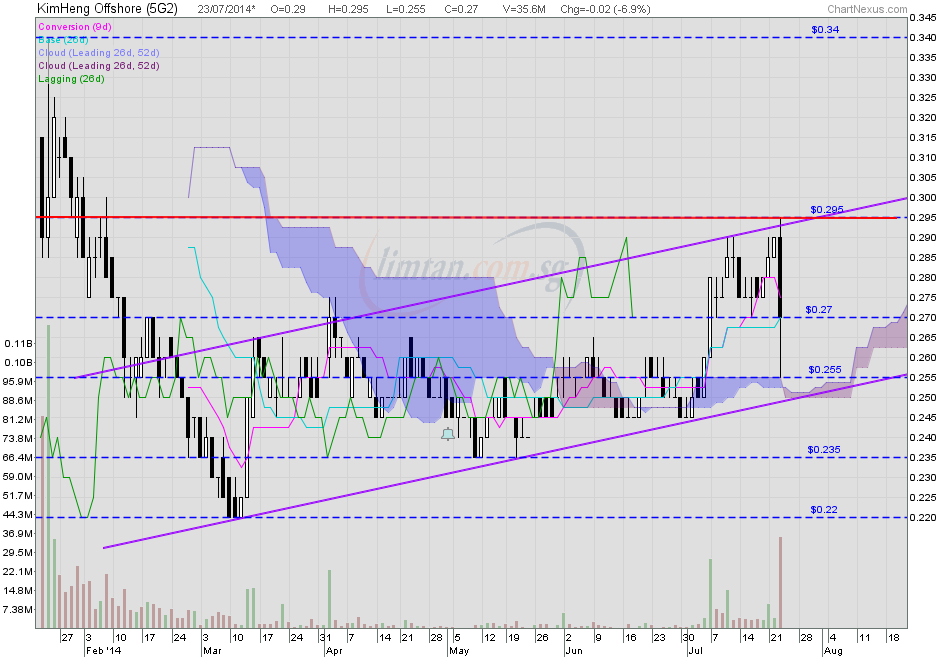

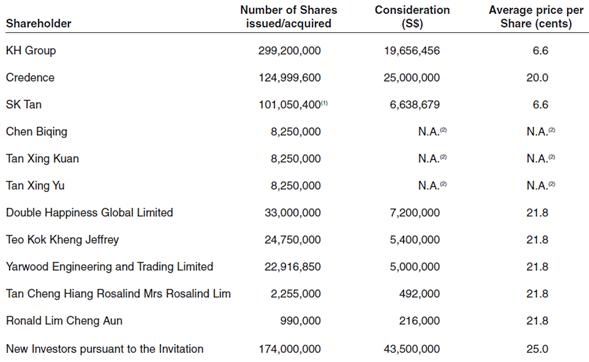

odie, The bayi has taken over the share stabilization job from the stabilizing manager.  Observations: Observations:1. Short-term uptrend is intact; bullish ascending triangle breakout, neckline @ 27c (resistance-turned-support). 2. If the crucial support at 25.5c holds and price is able to consolidate (move sideway and trade above the purple cloud), it would be bullish.  KimHeng IPO: The 6-month and 12-month moratorium KimHeng IPO: The 6-month and 12-month moratorium — 23 July 2014  |

|

|

|

Post by odie on Jul 23, 2014 22:13:36 GMT 7

thanks for the charts, zuolun bro will wait patiently  |

|

|

|

Post by zuolun on Jul 23, 2014 22:20:42 GMT 7

thanks for the charts, zuolun bro will wait patiently  odie, The pump and dump job is because of the 6-month moratorium due yesterday 22 July 2014. |

|

|

|

Post by odie on Jul 24, 2014 5:26:09 GMT 7

thanks for the charts, zuolun bro will wait patiently  odie, The pump and dump job is because of the 6-month moratorium due yesterday 22 July 2014. oic, zuolun bro thanks for advice:) |

|

|

|

Post by zuolun on Nov 6, 2014 10:50:04 GMT 7

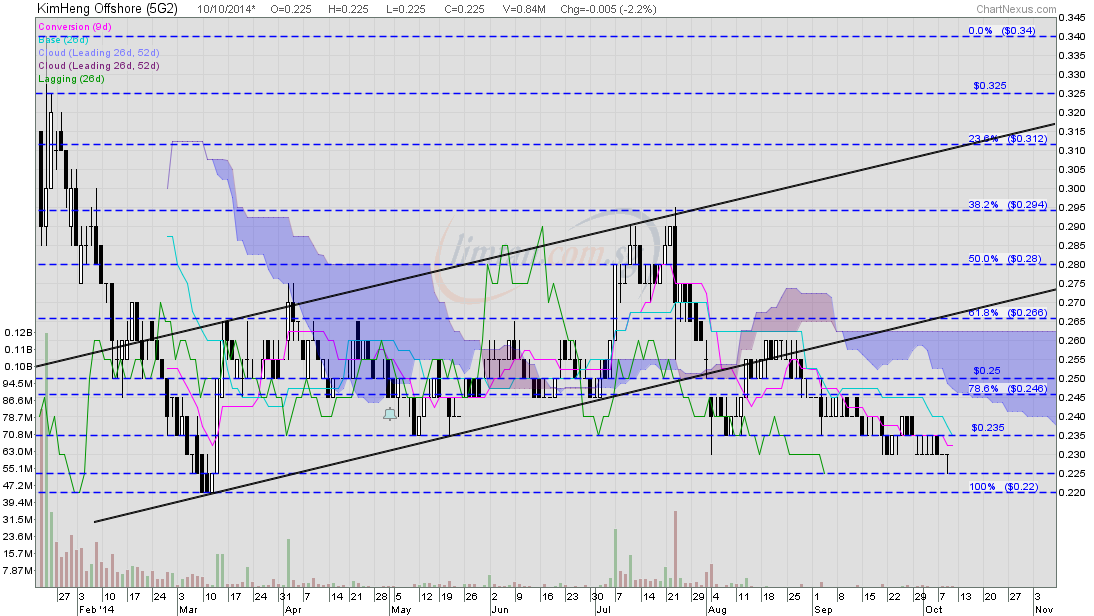

KimHeng Offshore — Bearish Rectangle Breakout, Interim TP S$0.17, Next TP S$0.155KimHeng Offshore gapped down with a spinning top @ S$0.19 (-0.015, -7.3%) with 1.51m shares done on 6 Nov 2014 at 12.30pm. Immediate support @ S$0.181, immediate resistance @ S$0.193.  KimHeng Offshore — Crucial support @ S$0.22 may breakdown to S$0.19 KimHeng Offshore — Crucial support @ S$0.22 may breakdown to S$0.19

|

|

|

|

Post by zuolun on Dec 9, 2014 15:15:08 GMT 7

In technical analysis, a stock that has made a new low is a prime target for short / sell on strength, not long.KimHeng Offshore — Bearish Bollinger Band Breakout, interim TP S$.093KimHeng Offshore gapped down with a long black marubozu @ S$0.137 (-0.013, -8.7%) with 1.02m shares done on 9 Dec 2014 at 4.10pm.

|

|

|

|

Post by odie on May 31, 2015 6:53:38 GMT 7

Kim Heng closed at 13.2cts

Vested

|

|

|

|

Post by hope on May 31, 2015 14:53:10 GMT 7

Bro oldie

I have been trying to sell last week at 0.135 but no taker leh.... This type of share no vol, very difficult to trade.... Sometimes, buyer take very little and I ganna pay minimum comm...I also don't know what to do?

You hv any good news for this counter?

|

|

|

|

Post by zuolun on Jun 2, 2015 7:15:37 GMT 7

I learned 3 lessons: 1) There are plenty of opportunities in the market. It is so easy to make good money if you have the kung-Fu. 2) There are just enough risk investing in stock market. It can make a poor person very poor. 3) Remind me of The three rules to survive in trading, "Cut loss, cut loss and cut loss". I have many relatives still holding counters such as Jadason, Life Brandz, Advance SCT, and Metech(Aka Centillion) . The value of these stock now is only about 1-3% of their prime-day  KimHeng Offshore closed unchanged @ S$0.132 with extremely thin volume done at 120,000 shares on 29 May 2015. Immediate support @ S$0.129, immediate resistance @ S$0.138.  In technical analysis, a stock that has made a new low is a prime target for short / sell on strength, not long.KimHeng Offshore — Bearish Bollinger Band Breakout, interim TP S$.093KimHeng Offshore gapped down with a long black marubozu @ S$0.137 (-0.013, -8.7%) with 1.02m shares done on 9 Dec 2014 at 4.10pm.  |

|

|

|

Post by odie on Jun 2, 2015 21:26:23 GMT 7

Bro oldie I have been trying to sell last week at 0.135 but no taker leh.... This type of share no vol, very difficult to trade.... Sometimes, buyer take very little and I ganna pay minimum comm...I also don't know what to do? You hv any good news for this counter? Hope, I no eye see liao what is your cost price? if cut loss not too painful, maybe better to cut loss bah |

|

|

|

Post by hope on Jun 3, 2015 14:59:04 GMT 7

Hi Oldie

I bought at 0.122 so with dividends of 0.05, still doing ok... but i cant sell ...

|

|

|

|

Post by zuolun on Jun 3, 2015 15:07:09 GMT 7

Hi Oldie I bought at 0.122 so with dividends of 0.05, still doing ok... but i cant sell ... , KimHeng Offshore's last dividend payment was S$0.005, not S$0.05. |

|

|

|

Post by hope on Jun 3, 2015 16:30:20 GMT 7

Hi Oldie I bought at 0.122 so with dividends of 0.05, still doing ok... but i cant sell ... , KimHeng Offshore's last dividend payment was S$0.005, not S$0.05. Yes, you are right, guru zuolun. My fat fingers la.... |

|

|

|

Post by odie on Oct 12, 2015 9:34:16 GMT 7

kimheng still below 200 dma of $0.13

|

|