|

|

Post by zuolun on Nov 19, 2015 8:38:03 GMT 7

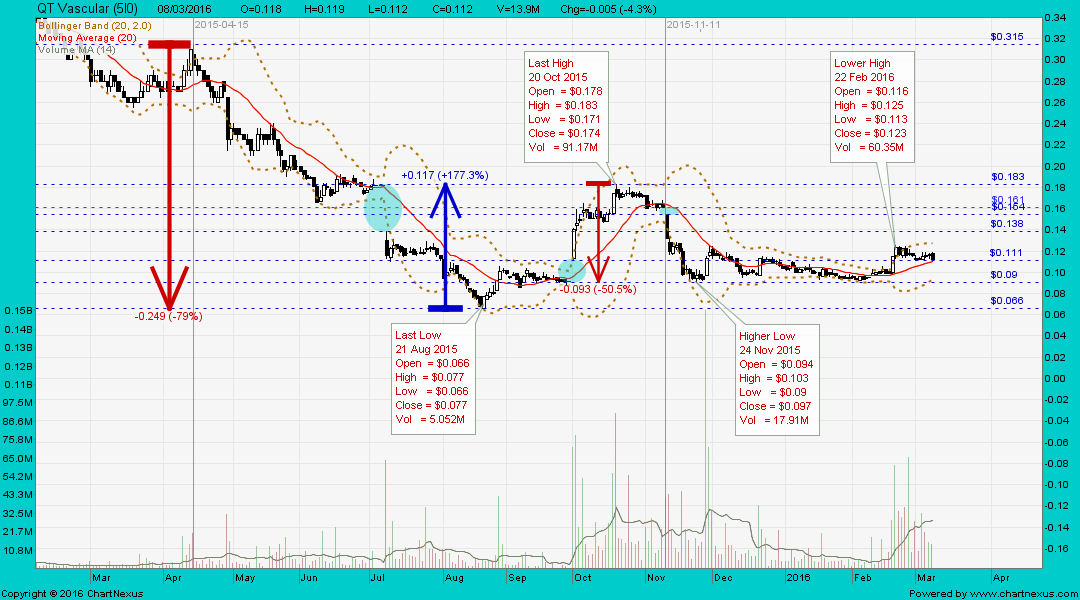

QT's Q3 balance sheet, bottom line in hole after providing for loss of lawsuit QT's Q3 balance sheet, bottom line in hole after providing for loss of lawsuit ~ 9 Nov 2015 QT Vascular ~ Bearish Island Top Reversal, Interim TP $0.066QT Vascular had a hammer and traded @ S$0.102 (+0.004, +4.1%) with 4.59m shares done on 19 Nov 2015 at 0925 hrs. Immediate support @ S$0.097, immediate resistance @ S$0.105.  Chartwise, QT Vascular has a bull trap chart pattern - meaning it's a typical pump and dump set up. In technical analysis, a stock that has made a new low is a decisive signal to short, not long. QT Vascular ~ Bearish Island Top formationQT Vascular closed with a shooting star @ S$0.146 (+0.006, +4.3%) with 78.4m shares done on 2 Oct 2015. Immediate support @ S$0.138, immediate resistance @ S$0.161.  |

|

|

|

Post by odie on Mar 8, 2016 20:15:25 GMT 7

zuolun bro, any updates on this counter? seems like punters here don't quite like QT Vascular  |

|

|

|

Post by zuolun on Mar 9, 2016 4:14:50 GMT 7

zuolun bro, any updates on this counter? seems like punters here don't quite like QT Vascular  The answer is in the -ve news: QT Vascular reported heavier losses. Chartwise, as long as the 20d SMA is well-supported, expect the gap bet. S$0.154 and S$0.161 to be covered, i.e. trap more gullible bulls b4 a retest of the last low @ S$0.066. The set-up is similar to the bull trap dated 2 Oct 2015. QT Vascular's chart structure reminds me of Global Invacom's bull trap X 2 dated 30 Aug 2013. QT Vascular ~ Bull Trap Global Invacom — Bull Trap X 2 Global Invacom — Bull Trap X 2 QT Vascular’s FY15 net loss widens to US$53.1 million on higher expenses QT Vascular’s FY15 net loss widens to US$53.1 million on higher expensesBy PC Lee 29 February 2016 'QT Vascular saw FY15 net loss widen 55.2% to US$53.1 million ($74.7 million), dragged down by higher R&D expenses and other expenses. R&D expenses which contributed to higher net loss, rose from US$6.7 million in FY2014 to US$8.4 million in FY2015. The increase in other expenses by US$23.7 million was mainly due to the recognition of the AngioScore judgement liability provision. The company recognised the entire sum of US$23.4 million, being damages awarded against the company, TriReme US, Quattro, and the company’s CEO, Dr Eitan Konstantino, following the judgement in relation to the State Law Claims. QT Vascular says the final sum to be borne by the group in relation to the State Law Claims, if any, will be determined at the conclusion of the appeal which is ongoing. |

|

|

|

Post by odie on Mar 9, 2016 16:43:08 GMT 7

zuolun bro, any updates on this counter? seems like punters here don't quite like QT Vascular  The answer is in the -ve news: QT Vascular reported heavier losses. Chartwise, as long as the 20d SMA is well-supported, expect the gap bet. S$0.154 and S$0.161 to be covered, i.e. trap more gullible bulls b4 a retest of the last low @ S$0.066. The set-up is similar to the bull trap dated 2 Oct 2015. QT Vascular's chart structure reminds me of Global Invacom's bull trap X 2 dated 30 Aug 2013. QT Vascular ~ Bull Trapthanks zuolun bro for advice the lawsuit and the negative FA is definitely a big overhang:D |

|

|

|

Post by zuolun on Mar 10, 2016 15:50:48 GMT 7

thanks zuolun bro for advice the lawsuit and the negative FA is definitely a big overhang:D Read charts together with the latest related-news to get a better gauge on the market and to predict the probable stock price movement. If you subscribe to 'live' streaming news or have access to any current news source, trade the news (+ve or -ve) and you could have a competitive edge over other retail players who don't have access to them. The best example is the Bullish news on CPO prices.  |

|