|

|

HDB

Mar 6, 2014 18:38:56 GMT 7

oldman likes this

Post by zuolun on Mar 6, 2014 18:38:56 GMT 7

|

|

|

|

Post by candy188 on Mar 6, 2014 21:05:01 GMT 7

|

|

|

|

Post by me200 on Mar 7, 2014 7:58:14 GMT 7

It is about time to re-value to property.

It would not surprise that some may sell below valuation. (-COV)

|

|

|

|

HDB

Mar 7, 2014 9:56:54 GMT 7

oldman likes this

Post by candy188 on Mar 7, 2014 9:56:54 GMT 7

Our 2nd flat needed to go through "open auction" system (22k above valuation) before we became the rightful owner in 2007...  If my memory didn't fail, the transacted HDB price was below valuation somewhere in 2009.  Forget COV, welcome to CUV Forget COV, welcome to CUVThe days of COV (cash-over-valuation) are already coming to an end as incidents of CUV – cash-under-valuation transactions – become more common in all sectors of Singapore's property resale market. It is about time to re-value to property. It would not surprise that some may sell below valuation. (-COV)

|

|

|

|

Post by oldman on Mar 10, 2014 18:50:47 GMT 7

What a strange timing to announce this...... I always thought that HDB prices are held up by the valuations determined by HDB. Now, if recent transaction prices determine the valuation, I wonder about the relevance of HDB valuations in the future. HDB prices will then move up and down with private property prices and may not be stabilised by HDB valuations in the future. In other words, in a bearish property market, I think this move will force HDB prices to fall faster and further than before. HDB moves to reduce focus on COV - 10 Mar 2014 |

|

|

|

HDB

Mar 10, 2014 21:33:06 GMT 7

oldman likes this

Post by zuolun on Mar 10, 2014 21:33:06 GMT 7

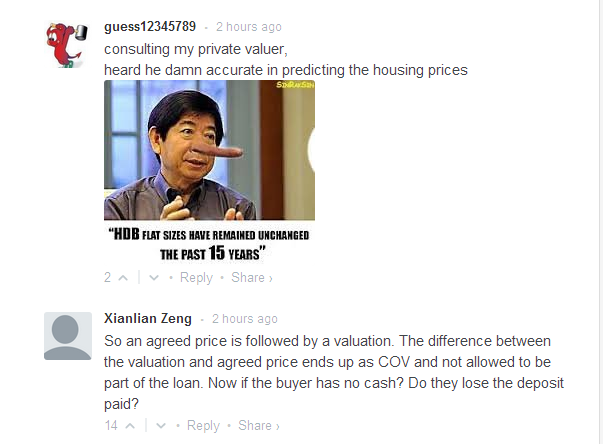

What a strange timing to announce this...... I always thought that HDB prices are held up by the valuations determined by HDB. Now, if recent transaction prices determine the valuation, I wonder about the relevance of HDB valuations in the future. HDB prices will then move up and down with private property prices and may not be stabilised by HDB valuations in the future. In other words, in a bearish property market, I think this move will force HDB prices to fall faster and further than before. HDB moves to reduce focus on COV - 10 Mar 2014 haha...the Pinocchio is the best feedback to the latest HDB news!  Singapore Budget 2014: Agree price, then get valuation for HDB resale deals Singapore Budget 2014: Agree price, then get valuation for HDB resale deals — 10 Mar 2014  |

|

|

|

HDB

Mar 11, 2014 8:11:42 GMT 7

Post by zuolun on Mar 11, 2014 8:11:42 GMT 7

What a strange timing to announce this...... I always thought that HDB prices are held up by the valuations determined by HDB. Now, if recent transaction prices determine the valuation, I wonder about the relevance of HDB valuations in the future. HDB prices will then move up and down with private property prices and may not be stabilised by HDB valuations in the future. In other words, in a bearish property market, I think this move will force HDB prices to fall faster and further than before. HDB moves to reduce focus on COV - 10 Mar 2014 oldman, If one analyses HDB flat as a commodity stock rather than a home, the law of supply and demand should force the HDB resale price to fall according to market forces. The HDB Resale Price Index chart (2005 to 2013) is similar to Blumont's chart, prior to its collapse. A long black marubozu (an early signal) followed by a 12% price decline will confirm a major trend reversal from bullish to bearish. ( Note: The 3 years curb on PRs buying resale flats is also quite similar to brokering firms imposing trading curb on Blumont.)  oldman, There's a Chinese saying: 见好就收 = "Quit while you're ahead." Blumont's EW chart pattern already looked extremely toppish to me in mid-Sep, prior to the collapse on the 3rd of Oct.   |

|

|

|

HDB

Mar 11, 2014 8:25:27 GMT 7

zuolun likes this

Post by oldman on Mar 11, 2014 8:25:27 GMT 7

zuolun, sadly, I feel the same way. The HDB valuations may have artificially supported HDB prices and in a way, supported the lower end condo prices. I thought the old system was good for the Singapore property market as it ensures that there is a floor price for lower end properties. With the new set of rules, I think the floor has been removed. I hope I am wrong though....

|

|

|

|

HDB

Mar 11, 2014 9:41:20 GMT 7

oldman likes this

Post by zuolun on Mar 11, 2014 9:41:20 GMT 7

zuolun, sadly, I feel the same way. The HDB valuation artificially supported HDB prices and in its own way, supported the lower end condo prices. I thought the old system was good for the Singapore property market as it ensures that there is a floor price for lower end properties. With the new set of rules, I think the floor has been removed. I hope I am wrong though.... oldman, It depends at what angle you look at HDB flat. Do you consider HDB flat a home, a commodity or both? If one strongly believes that buying a HDB flat is strictly a home to stay for good, then it doesn't matter how the price fluctuates because no matter how high or low it hits, it's Not For Sale. If one believes that a HDB flat is merely a commodity, then one should strictly base on TA to get the best timing and price to trade. However, if HDB flat is a home as well as a commodity, then it's the most tricky game because when the government acts like the brokering firms...imposing more new rules/curbs to move the goal post in a bearish market, the not-so-smart players caught in between may end up camping in the beach or jumping into Bedok reservoir. The +ve result of trading curbs on many penny and micro penny stocks imposed by individual brokering firms to protect investors is yet to be seen but the SGX and most of the stock brokerage firms have already lost their bread-and-butter business past few months due to a sharp decline in trading volume after the BAL saga. The implementation of Circuit Breakers next month may exacerbate market instead of providing protection to investors. Should a steep correction occur and the STI were to hit crucial support at 2775, activation of the Circuit Breakers would be disastrous in a falling market with thin volume. Just imagine when there is a fire and you activate the system to lock everyone inside the building, what will happen to them? |

|

|

|

Post by oldman on Mar 11, 2014 10:04:08 GMT 7

zuolun, I think the cruz of the matter is affordability. I think it will be harder and harder to justify that HDBs are still affordable without these prices coming down significantly. I think most families will not mind a depreciation of their HDB asset as it will make it more affordable for their children to buy their own. Looks like a tight rope between asset enhancement and affordability - our gov may be leaning toward the affordability angle. Don't get me wrong. I think this is the right way to go for the government and the general population.... just that Singapore property investors may have to be more careful....

|

|

|

|

HDB

Mar 11, 2014 10:34:44 GMT 7

oldman likes this

Post by zuolun on Mar 11, 2014 10:34:44 GMT 7

zuolun, I think the cruz of the matter is affordability. I think it will be harder and harder to justify that HDBs are still affordable without these prices coming down significantly. I think most families will not mind a depreciation of their HDB asset as it will make it more affordable for their children to buy their own. Looks like a tight rope between asset enhancement and affordability - our gov may be leaning toward the affordability angle. Don't get me wrong. I think this is the right way to go for the government and the general population.... just that Singapore property investors may have to be more careful.... oldman, An extremely strong uptrend stock which ends with a sudden collapse is normally due to external factors beyond the control of the strong hands or the "cheng kay".  |

|

|

|

HDB

Mar 12, 2014 8:56:06 GMT 7

Post by zuolun on Mar 12, 2014 8:56:06 GMT 7

oldman, An extremely strong uptrend stock which ends with a sudden collapse is normally due to external factors beyond the control of the strong hands or the "cheng kay". oldman, This may be the likely catalyst for the bearish trend reversal on the HDB Resale Price chart, which is beyond the control of the government/HDB and the 3 local banks with massive loan exposure in the HDB flat resale market will get the initial hit. |

|

|

|

HDB

Mar 12, 2014 9:04:38 GMT 7

zuolun likes this

Post by oldman on Mar 12, 2014 9:04:38 GMT 7

Sadly, I tend to agree with you. Now that the HDB property price index is no longer supported by HDB valuations, I think HDB prices will fall much quicker and will drag the rest of the property market with it. For investors, best to go light on property related stocks. Extrapolating further, best to go light on the entire stock market.  oldman, An extremely strong uptrend stock which ends with a sudden collapse is normally due to external factors beyond the control of the strong hands or the "cheng kay". oldman, This may be the likely catalyst for the bearish trend reversal on the HDB Resale Price chart, which is beyond the control of the government/HDB and the 3 local banks with massive loan exposure in the HDB flat resale market will get the initial hit. |

|

|

|

HDB

Mar 12, 2014 9:47:37 GMT 7

oldman likes this

Post by zuolun on Mar 12, 2014 9:47:37 GMT 7

Sadly, I tend to agree with you. Now that the HDB property price index is no longer supported by HDB valuations, I think HDB prices will fall much quicker and will drag the rest of the property market with it. For investors, best to go light on property related stocks. Extrapolating further, best to go light on the entire stock market.  oldman, When I posted the eerie similarities bet. the HDB Resale Price chart and the Blumont chart on fb yesterday, someone argued with me that although the 2 charts look similar but the timeframe is different; 7 years for HDB Vs 2 years for Blumont. I did not respond because he is strictly a FA believer who does not know TA. To understand chart pattern, see how professional chartists read the chart pattern of gold price. "While there are general ideas and components to every chart pattern, there is no chart pattern that will tell you with 100% certainty where a security is headed... patterns can be found over charts of any timeframe...    |

|

|

|

HDB

Mar 12, 2014 20:17:18 GMT 7

oldman likes this

Post by zuolun on Mar 12, 2014 20:17:18 GMT 7

|

|