|

|

HDB

Mar 14, 2014 14:05:13 GMT 7

oldman and om like this

Post by zuolun on Mar 14, 2014 14:05:13 GMT 7

oldman, The worst scenario for the HDB resale flat market is that, in a falling market, in order to stabilize the price and supply in the open market effectively, the government/HDB may shift the goal post further by extending the minimum occupation period, longer ( Example: You must live in your HDB flat for 10 years before you can sell it, regardless of whether you bought directly from the HDB or in the open market. The lock-in is known as the minimum occupation period, 10 years was the original HDB resale rule in the 60's then). And if HDB flat owners (BTO and resale) could not meet the new requirement, exception is granted to sell back to the HDB at the board's stipulated price, not at market price. Should this happen, late-comers (Singaporeans + PRs) who purchase their HDB flats at high prices with CPF funds + cash COV past 3 years will incur huge losses if they've no holding power. COVs: Consigned to history? — 14 Mar 2014 Prices, transactions fall for resale homes — 11 Mar 2014 Steep prices stall resale of DBSS flats — 10 Mar 2014 My First Property Foray - A HDB Flat - Ended In A $100,000 Loss — 31 Aug 2013 100,000 HDB resale buyers hit by price slide — April 28, 2001 |

|

|

|

Post by oldman on Mar 15, 2014 5:55:01 GMT 7

When I was a PR, I bought a 5 room flat and sold it for a profit after 3 years. I then moved over to an exec maisonette in the adjacent block and again sold it after 3 years. Yes, I did benefit financially from being a PR but more importantly, I had first hand experience of living in HDBs and appreciate very much that experience.  |

|

|

|

HDB

Mar 15, 2014 9:54:45 GMT 7

oldman likes this

Post by zuolun on Mar 15, 2014 9:54:45 GMT 7

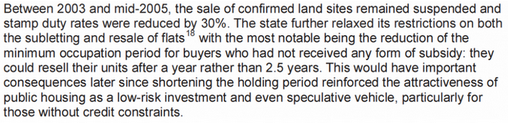

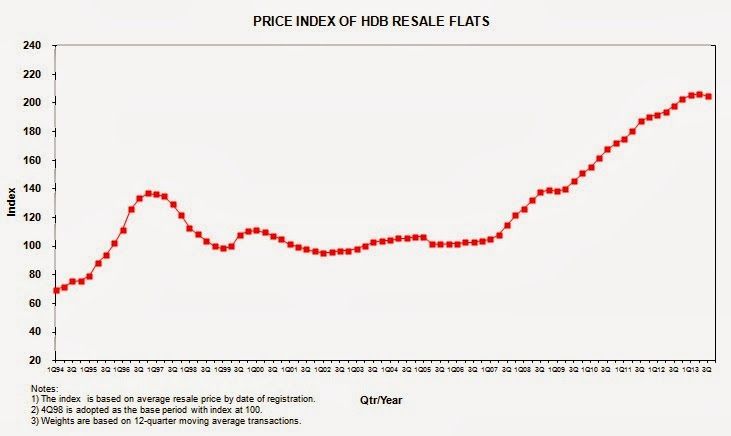

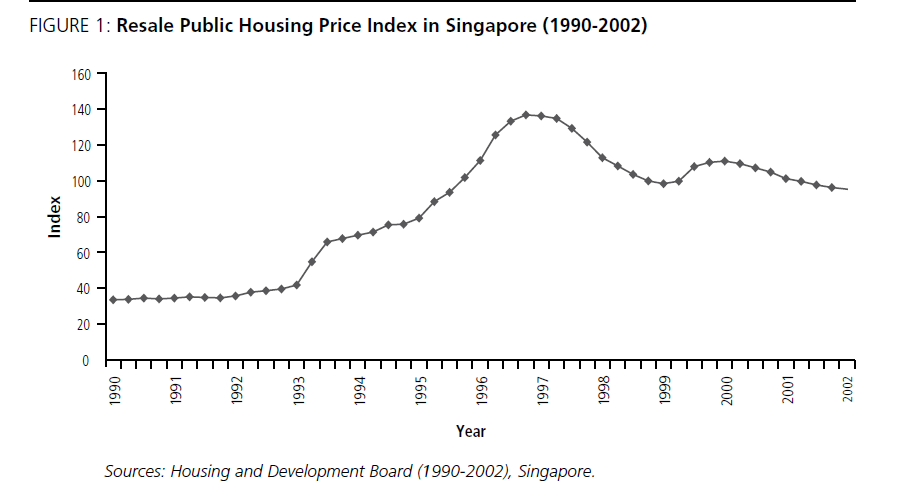

oldman, The worst scenario for the HDB resale flat market is that, in a falling market, in order to stabilize the price and supply in the open market effectively, the government/HDB may shift the goal post further by extending the minimum occupation period, longer ( Example: You must live in your HDB flat for 10 years before you can sell it, regardless of whether you bought directly from the HDB or in the open market. The lock-in is known as the minimum occupation period, 10 years was the original HDB resale rule in the 60's then). And if HDB flat owners (BTO and resale) could not meet the new requirement, exception is granted to sell back to the HDB at the board's stipulated price, not at market price. Should this happen, late-comers (Singaporeans + PRs) who purchase their HDB flats at high prices with CPF funds + cash COV past 3 years will incur huge losses if they've no holding power. When I was a PR, I bought a 5 room flat and sold it for a profit after 3 years. I then moved over to an exec maisonette in the adjacent block and again sold it after 3 years. Yes, I did benefit financially from being a PR but more importantly, I had first hand experience of living in HDBs and appreciate very much that experience.  oldman, Wow...you managed to have the cake and eat it.  I believed you purchased both HDB resale flats at the best timing in the open market with the benefit of an exemption from paying a HDB resale levy then. You were locked-in for 3 years but exceptional ones who purchased between 2003 to 2005 had the shortest Minimum Occupation Period (MOP) of only 1 year. (Majority of HDB buyers are locked-in for 5 years.) BTW, I noticed the government/HDB used to shift the MOP quite frequently to stabilise the HDB resale price and supply in the open market. The mentality is equivalent to the stock brokering firms' trading curbs on designated stocks. "The price paid for the property may or may not have any relation to the value that might be ascribed to the property"...is equivalent to "the market price per share does not equal to the book value per share". The same logic applies to all players in any game: you need to have holding power, if your position is extremely leveraged, it's would be "Game Over" should you receive the last "margin call".  The HDB Resale Price Index — It was < 40 in the 90's as compared to > 200 to date. The HDB Resale Price Index — It was < 40 in the 90's as compared to > 200 to date.   |

|

|

|

HDB

Mar 15, 2014 20:37:07 GMT 7

oldman likes this

Post by zuolun on Mar 15, 2014 20:37:07 GMT 7

Alternative news in 1 day? (part 79) – HDB: No more valuation? — 10 Mar 2014 Ricky Loo: "What happen if one desperate fellow sell his/her flat at way below the last transacted price will the next transaction be base on the average price of all transacted price in the vicinity or base on the last transacted price it definitely will depress the price down further." In the stock market, it is called the "1 lotter".  Yes, I hate "1 lot" gang. Whenever I see my order got 1 lot fulfilled and I have to calm my anger by talking to myself to get big profit next time when selling. i am also looking desperately for cheaper min. commission. will share in case I find one.

|

|

|

|

Post by zuolun on Mar 20, 2014 17:58:06 GMT 7

|

|

|

|

HDB

Mar 20, 2014 18:02:04 GMT 7

oldman likes this

Post by zuolun on Mar 20, 2014 18:02:04 GMT 7

|

|

|

|

Post by zuolun on Apr 1, 2014 11:17:27 GMT 7

|

|

|

|

Post by zuolun on Apr 3, 2014 13:36:22 GMT 7

|

|

|

|

Post by zuolun on Apr 13, 2014 17:11:59 GMT 7

|

|

|

|

HDB

Apr 15, 2014 10:12:25 GMT 7

Post by zuolun on Apr 15, 2014 10:12:25 GMT 7

|

|

|

|

Post by zuolun on May 5, 2014 13:01:01 GMT 7

STProperty Seminar March 2014 - The HDB Market in 2014 & Beyond — 19 Mar 2014

|

|

|

|

Post by zuolun on May 10, 2014 12:06:06 GMT 7

|

|

|

|

Post by zuolun on May 19, 2014 14:39:14 GMT 7

Be fairer to both private property and HDB flat ownersMay 19, 2014 12:01 MR LIEW Eng Leng ("Implications of letting HDB flat owners buy private homes"; last Thursday) has misconstrued my letter ("Continue letting HDB flat owners buy private property"; May 9).The minimum occupation period (MOP) restriction I proposed for private property owners buying an HDB flat applies only to the flat they bought, and not to the private property they already own. It would be unjust if private property owners could buy an HDB flat today and immediately rent out the whole flat the next day. Private property owners buying an HDB unit are depriving the resale market of a flat, skewing demand for flats in the process. The Government needs to decide whether to allow all private property owners to buy flats, or only a select group based on their current home value or income. For example, is it equitable to allow someone who owns a $30 million penthouse in Orchard Road to buy an HDB flat for investment, when he has a wealth of other investment options available? As stated in my earlier letter, we can be fairer to both groups by imposing the same MOP restrictions on both parties, or no restrictions at all (that is, remove MOP for first-time HDB flat buyers). Chiam Tat Ang

|

|

|

|

Post by zuolun on May 19, 2014 22:05:04 GMT 7

|

|

|

|

HDB

May 22, 2014 15:04:53 GMT 7

oldman likes this

Post by zuolun on May 22, 2014 15:04:53 GMT 7

|

|