|

|

HDB

Jun 9, 2014 8:19:46 GMT 7

oldman likes this

Post by zuolun on Jun 9, 2014 8:19:46 GMT 7

|

|

|

|

Post by oldman on Aug 4, 2014 9:00:11 GMT 7

|

|

|

|

HDB

Aug 4, 2014 11:10:06 GMT 7

oldman likes this

Post by zuolun on Aug 4, 2014 11:10:06 GMT 7

|

|

|

|

HDB

Sept 3, 2014 9:18:28 GMT 7

oldman likes this

Post by zuolun on Sept 3, 2014 9:18:28 GMT 7

|

|

|

|

Post by oldman on Oct 1, 2014 13:08:38 GMT 7

|

|

|

|

HDB

Oct 1, 2014 14:47:17 GMT 7

Post by kenjifm on Oct 1, 2014 14:47:17 GMT 7

I was at a talk organised by Mr Lim Wei Xian.

Mr Lim have been hinting that Malaysia will be taking over Singapore place in the future if China 5 years plan with Malaysia works out.

Anyone have any thoughts on that? oldman zuolun

|

|

|

|

Post by pain on Oct 1, 2014 17:39:51 GMT 7

Kenji,

What is the 5 years China | Malaysia plan all about?

|

|

|

|

HDB

Oct 1, 2014 18:32:28 GMT 7

me200 likes this

Post by kenjifm on Oct 1, 2014 18:32:28 GMT 7

China have plans to replace U.S by 2030.

China plans goes by 5 years slot.

Malaysia was chosen by China now and demand will be found in Malaysia compare to SG because we are more expensive.

Disclaimer: This is just hear say. No facts to prove is accurate in anyway.

As much as "hope" were being preached, we must still use logic to understand the real reason why Malaysia or Indonesia might not take over Singapore attractive position even though they have more land space.

This is not the time to enter the property market. The right time might be slightly more expensive but it is still better compare to catching a falling knife in SG or overseas.

|

|

|

|

Post by pain on Oct 1, 2014 20:55:52 GMT 7

China have plans to replace U.S by 2030. China plans goes by 5 years slot. Malaysia was chosen by China now and demand will be found in Malaysia compare to SG because we are more expensive. Disclaimer: This is just hear say. No facts to prove is accurate in anyway. As much as "hope" were being preached, we must still use logic to understand the real reason why Malaysia or Indonesia might not take over Singapore attractive position even though they have more land space. This is not the time to enter the property market. The right time might be slightly more expensive but it is still better compare to catching a falling knife in SG or overseas. Hi Kenji, State-owned Chinese construction firms have been very aggressive for the past few years in Malaysia, US, Singapore, Australia, etc.. Private Chinese developers join in too. A good example of SOC firm will be QingJian. QJ is a state owned Chinese firm set up in Singapore a few years ago. Look at them now. From a pure general builder, they ventured into developer tendering for lands for HDB and private condominiums projects. The other Chinese firm is Qingdao (now in crisis because of copper scandal issues). Recent tenders for the EC project only saw 2 bidders (QingJian & CDL) and QJ won it. Such cases for state-owned Chinese firms are taking place in those countries mentioned. With China's economy booming for past years (>10% in some years), the Chinese have been experiencing capitalist definition of wealth. I remembered working in Yr 2003 in China whereby a 3-rm condominium unit (company provided) in one of the cities cost about S$60,000 (RMB 300,000). There is a Pizza Hut in Shanghai and long queues for the pizzas (cost RMB100 each for large pizza). I did not check the figure but I believe the same unit now will easily costs S$300,000. Bearing in mind, China economy is slowing down to 7%. This figure does not augur well with the party top brass itself. However, if this is the figure for developed countries like US, Japan or even Singapore, the respective state head will pat one another on a good job done in economy. With US$4 trillion of national debt, US has condemned their future generation. Hence, I believe China will take over US one day as the leading economy but in YR2030? My guess is much earlier. Just look at Alibaba Group IPO (Raised US$23 billion). China is the biggest owner of US Treasuries debts. Basically, it 'owns' US so to speak. If you can recall the 80s, Japan was the biggest investor & asset buyer of US skyscrapers, buildings, businesses, shares, etc.. After the property bubble burst, it reverted back to US. In term of land space, Australia stands out as compared to Malaysia. Education wise, Australia provides quality tertiary education with parents sending their kids to Australia Universities. Malaysia ignores English language as teaching language in tertiary studies. Due to Ultra Malay Bumiputra policy, it has also alienated the Chinese population staying in Malaysia (e.g. 2nd rate Chinese citizen, Malay first for university places). The MH370 incident has become a sore point and a low in terms of China / Malaysia relationship leading to a fall in Chinese tourism. China will prefer Australia over Malaysia though China / Aussie relationship has been hot & cold. It is well known that Australia has been chastising China over issues like freedom of speech, human rights, etc.. How about Singapore? No doubt Singapore has insignificant land as compared to Malaysia. However, our infrastructure vested in the various economical pillars especially Finance (Banking, Investment, etc..), IT & Communications, Logistics, Service, etc.. are strong. Since Malaysia is our major trading partner cum neighbour, Singapore has to collaborate for a win-win situation. Hence, big plans for MRT linkage all the way to KL from SG. SG supports the opening up of Iskandar Regions by encouraging SMEs and companies seeking land space to invest there. Now will China abandons Singapore after 5 years and stays with Malaysia because of demand? China has 2 billion population. Malaysia about 22 million (i.e. about the population in Shanghai). If demand is the thing that China is looking for, guess again. China will only go where the money can be made and political influences the country such that they acknowledge them as a world power. But hey, I am just a ordinary person. How will I know what China going to do? Disclaimer: For pleasure reading. No offense / No defence. |

|

|

|

HDB

Oct 9, 2014 12:10:39 GMT 7

oldman likes this

Post by zuolun on Oct 9, 2014 12:10:39 GMT 7

|

|

|

|

Post by pain on Oct 22, 2014 11:52:36 GMT 7

KBW interview on Channel 8 with English Subtitles - Property Talk Anyone can scan his mind further? Cooling measures will stay for the moment. I believe eventually one by one will be taken out when interest rate is adjusted upwards. BTO and Property News |

|

|

|

HDB

Oct 24, 2014 14:35:35 GMT 7

oldman likes this

Post by zuolun on Oct 24, 2014 14:35:35 GMT 7

|

|

|

|

HDB

Jan 10, 2015 8:08:42 GMT 7

oldman likes this

Post by zuolun on Jan 10, 2015 8:08:42 GMT 7

|

|

|

|

Post by zuolun on Feb 9, 2015 7:10:54 GMT 7

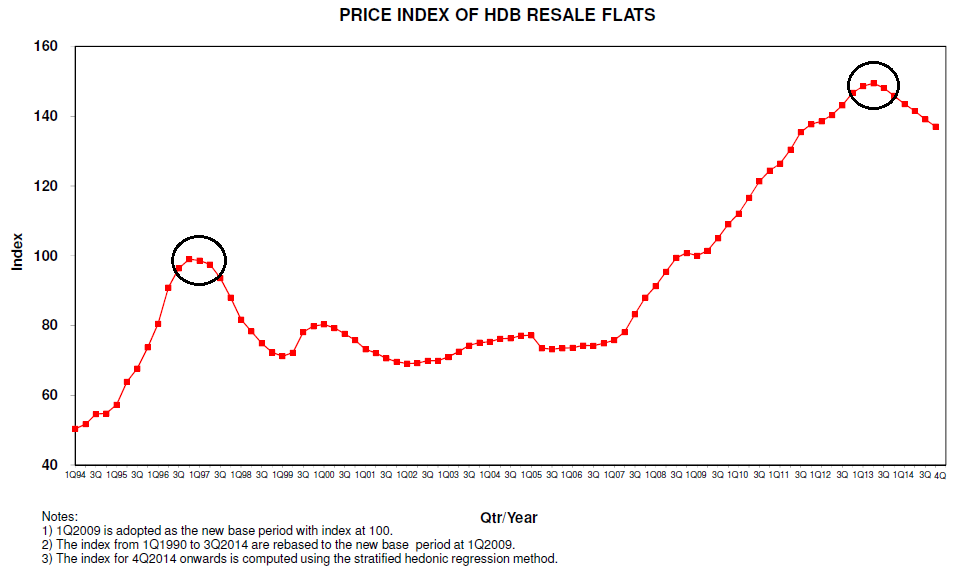

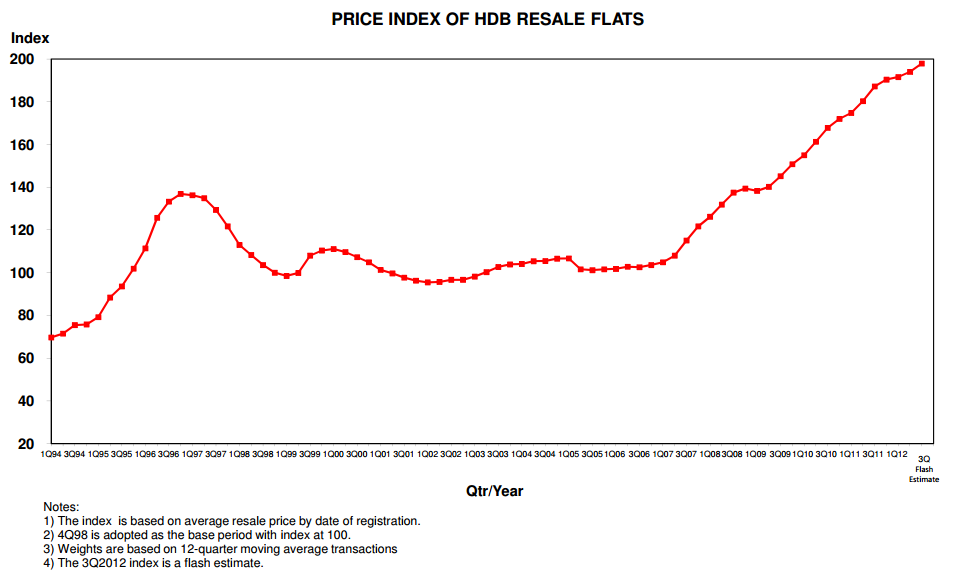

The S$ will crash followed by the SG stock market and the SG property market3-month SIBOR surges 1.3% as MAS adjusts monetary policy ~ 29 Jan 2015 HDB resale prices drop 1.4% in Q4 ~ 2 Jan 2015 HDB RPI as at 3Q2012 Vs HDB RPI as at 4Q2014 ~ The former had already hit 200 in 3Q2012. Notes:1) 1Q2009 is adopted as the new base period with index at 100. 2) The index from 1Q1990 to 3Q2014 are rebased to the new base period at 1Q2009. 3) The index for 4Q2014 onwards is computed using the stratified hedonic regression method. The adjusted RPI as at 4Q2014 appears better looking as compared to the RPI as at 3Q2012...peaked at 200 on the old chart seemed frightening to the eyes!  Resale Price Index from 1st Quarter 1990 to 4th Quarter 2014 Resale Price Index from 1st Quarter 1990 to 4th Quarter 2014 ~ 23 Jan 2015

HDB Resale Price Index(RPI) Q3 2012 oldman, If one analyses HDB flat as a commodity stock rather than a home, the law of supply and demand should force the HDB resale price to fall according to market forces. The HDB Resale Price Index chart (2005 to 2013) is similar to Blumont's chart, prior to its collapse. A long black marubozu (an early signal) followed by a 12% price decline will confirm a major trend reversal from bullish to bearish. ( Note: The 3 years curb on PRs buying resale flats is also quite similar to brokering firms imposing trading curb on Blumont.)  oldman, There's a Chinese saying: 见好就收 = "Quit while you're ahead." Blumont's EW chart pattern already looked extremely toppish to me in mid-Sep, prior to the collapse on the 3rd of Oct.

|

|