|

|

HDB

Feb 13, 2015 7:09:50 GMT 7

Post by zuolun on Feb 13, 2015 7:09:50 GMT 7

《卖身契》 The Contract Govt repeats: families with S$1,000 income can afford HDB flats Govt repeats: families with S$1,000 income can afford HDB flats ~ 16 Jan 2015 "A family with a monthly income of as low as $1,000 can now purchase a small flat." ~ 11 Dec 2014 774 families have booked flats on incomes of $1,000-$1,200By Janice Heng 23 Jan 2015 SINCE March 2012, more than 700 low-income families have booked new Housing Board flats. Official figures show that at Build-to-Order launches from March 2012 to last July, 744 families with monthly household incomes of $1,000 to $1,200 booked a new two-room or larger flat. At the same time, 655 families in the same income bracket were invited to select a flat but did not proceed to book one, said National Development Minister Khaw Boon Wan on Monday, in a written parliamentary reply to Non-Constituency MP Gerald Giam. Mr Giam had asked for figures from March 2012 onwards. That month was when the idea of buying a flat on a monthly salary of $1,000 made headlines. A comment by Mr Giam in February that year prompted Deputy Prime Minister Tharman Shanmugaratnam to point out that "a family with $1,000 income can now, through our housing subsidies, purchase a small flat". Mr Giam had expressed the worry that many low-income earners would find it hard to afford an HDB flat of their own. Mr Tharman's rebuttal sparked discussions both online and offline, with some wondering whether it was truly possible to afford a flat at that income level. ----------------------------------------------------------------------------------------------------------------------------------------------------- Minister Khaw explains the math of buying a flat on $1,000 salary3 Mar 2012 SINGAPORE - Deputy Prime Minister and Finance Minister Tharman Shanmugeratnam caused a stir on Thursday during the Budget debate, after he commented that 98 per cent of Singaporeans below the age of 35 earn at least $1,000 and are able to buy HDB flats. Mr Tharman was rebutting a claim by Workers' Party NCMP Gerald Giam that many younger Singaporeans from lower-income households will find it difficult to afford a house, reported The Straits Times. On Friday, it was National Development Minister Khaw Boon Wan's turn to explain the maths, admitting that the comment startled many, "precisely because it sounded so incredible". Mr Tharman had told Mr Giam in his speech on Thursday to "catch up" with policies already introduced to help Singaporeans own their own homes. He said: "So I would like to assure Mr Gerald Giam, who might not have caught up with all the developments... that a family with $1,000 income can now, through our housing subsidies, purchase a small flat." According to media sources, his comments sparked intense debate online. Mr Khaw pointed out during Friday's Budget debate that Mr Tharman was referring to a two-room flat, which has a subsidised price of about $100,000, if the applicant is a first-timer. He will also be entitled to housing grants of up to $60,000. "DPM was referring to a two-room HDB flat, which we started building in 2006. The subsidised BTO price for such a unit in a recent launch is about $100,000," said Mr Khaw. "So the net selling price to him is about $40,000, and the monthly mortgage payment of such a HDB loan can be fully covered from his Central Provident Fund contribution." He added that most two-room applicants earn above that income ceiling, highlighting that their median income based on recent BTO (build-to-order) launches is at about $1,400.

|

|

|

|

Post by oldman on Feb 15, 2015 6:25:49 GMT 7

Nice. I too started in a HDB flat.

|

|

|

|

Post by zuolun on Mar 19, 2015 6:33:13 GMT 7

|

|

|

|

HDB

Apr 10, 2015 22:43:41 GMT 7

oldman likes this

Post by zuolun on Apr 10, 2015 22:43:41 GMT 7

|

|

|

|

Post by zuolun on Jun 2, 2015 14:54:54 GMT 7

|

|

|

|

Post by zuolun on Jul 15, 2015 14:38:05 GMT 7

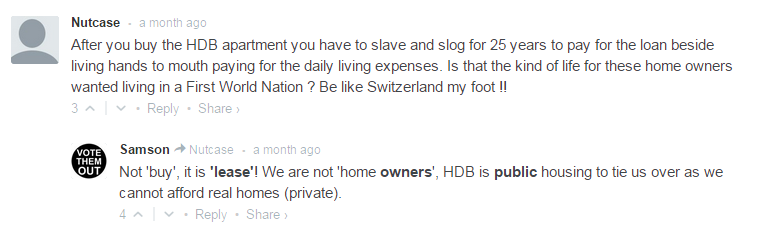

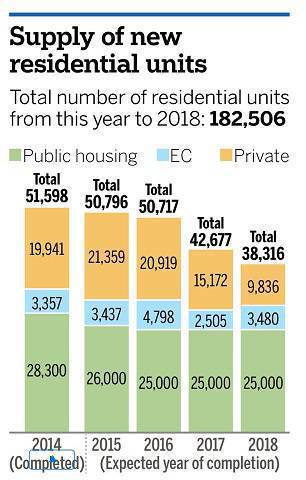

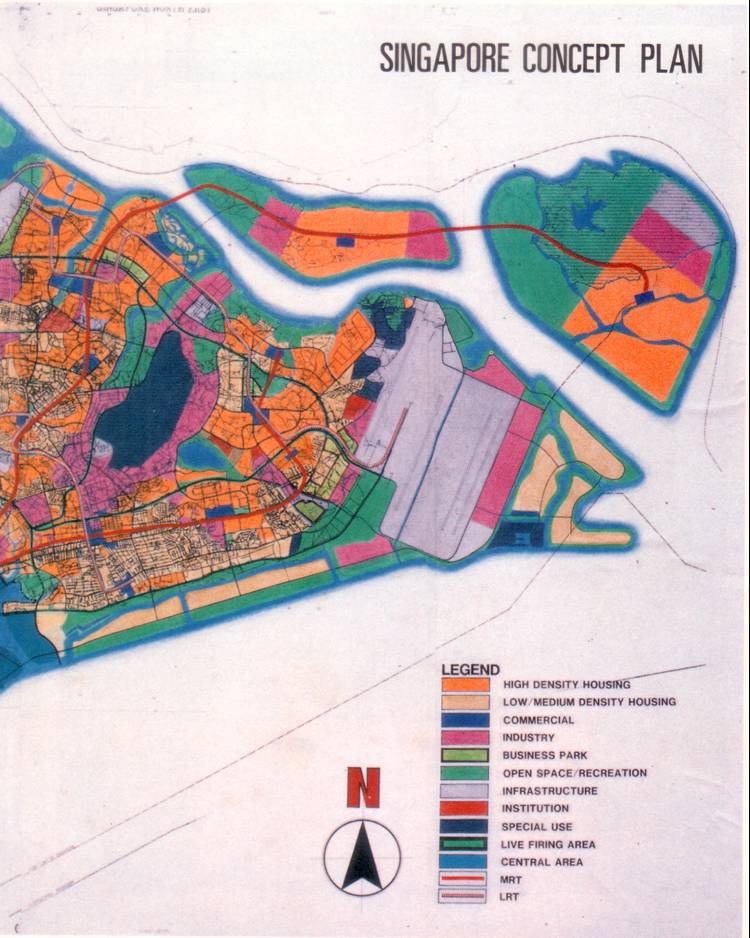

Singapore must plan for 10 million population: Ex-HDB chief ~ 10 July 2015 Is Singapore prepared for a silver tsunami? ~ 29 Jun 2015 Forget 6.9 million, plan for 10 million ~ 23 Oct 2014 Plan for 10 million population: former HDB chief 1 Aug 2014 Look ahead to 10 million people by 2100? ~ 28 Apr 2013 Should we change our immigration policy? ~ 7 Mar 2013 Infrastructure development to keep pace with population growthBy Sharon See 29 January 2013 SINGAPORE: The government is planning to build 700,000 new homes by 2030. That is one of the long-term plans to support the projected increase in population which is expected to hit 6.9 million in about 20 years. Some Singaporeans have observed that population growth in Singapore has outpaced infrastructure development in the last five years. The government is now planning and investing in advance to accommodate a larger population. Beyond just relieving strains on public transport and housing today are long-term plans to ramp up infrastructure developments to support a population of up to six million in 2020 and then a population of up to 6.9 million in 2030. There are already plans to add 800 buses over five years, and by 2030, to double of the rail network to 360 kilometres. This means the addition of three new MRT lines and an extension of two existing lines over the next nine years. Come 2030, there will be another two new lines and three extensions, allowing eight in 10 homes to be within a 10-minute walk from a train station. To further alleviate the strain on public transport, more jobs will be located near residential areas, reducing the need to commute. The White Paper has named Woodlands, Serangoon and Punggol as possible growth areas to create more space for businesses. It also said the Jurong Lake District, Paya Lebar Central and One-North will be expected to mature by then. More healthcare facilities are also in the pipeline with three general hospitals, five community hospitals and two medical centres set to open between 2014 and 2020. On the way too are 200,000 new homes which will be ready by 2016. National Development Minister Khaw Boon Wan said even more land has been set aside to build another 500,000 homes until 2030. Mr Khaw is confident his ministry will be able to resolve the housing shortage and assured Singaporeans that there will be enough homes. For first timers who had difficulty applying for a new flat, Mr Khaw said this problem has been largely resolved. Mr Khaw explained: "There is some mismatch because of our balloting system. If you look at the figure, (there are about 15,000) new family formations every year but I'm building 25,000 new units a year and we have been doing so. This is into the third year now." Possible sites for these new homes include new towns in Bidadari, Tampines North and Tengah but some will also be built in mature estates, allowing children to stay close to their parents. "Wherever there are possible sites for development, we have to do so. And that's why sometimes it is a bit painful for us to have to remove some trees which I know many people are upset about. We are equally upset because I love trees… but sometimes it can't be helped because of larger objectives, larger benefits," he said. Mr Khaw added that good urban planning to achieve a high quality of living is a top priority for the government. There will be more green spaces and parks, and by 2030, at least 85 per cent of Singapore's households will live within 400 metres of a park. The National Development Ministry is expected to release more details on land use plans this week. *************************************************************************************************************************** Pulau Ubin and northern shores in the Draft Master Plan 2013 ~ 21 Nov 2013 Pulau Ubin and the unsettled Singapore psyche ~ 18 Apr 2013 "The Next Lap", Singapore's projected population growth = 7.5 million people ~ 9 Sep 2010 Plan for Pulau Ubin, Chek Jawa and Pulau Tekong Massive reclamation at Pulau Tekong Massive reclamation at Pulau Tekong

|

|

|

|

HDB

Aug 29, 2015 7:06:49 GMT 7

Post by zuolun on Aug 29, 2015 7:06:49 GMT 7

|

|

|

|

HDB

Sept 16, 2015 9:30:27 GMT 7

Post by zuolun on Sept 16, 2015 9:30:27 GMT 7

|

|

|

|

HDB

Sept 20, 2015 15:04:37 GMT 7

Post by zuolun on Sept 20, 2015 15:04:37 GMT 7

|

|

|

|

HDB

Oct 16, 2015 8:16:14 GMT 7

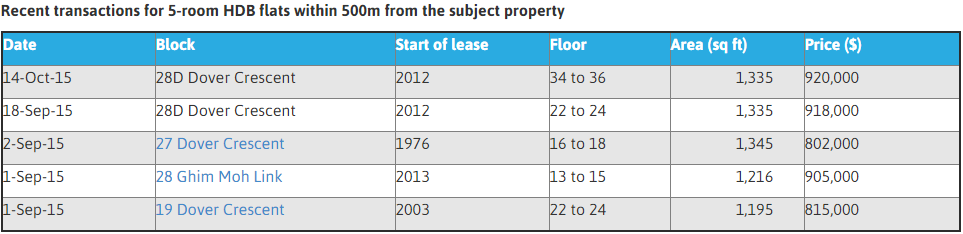

Post by zuolun on Oct 16, 2015 8:16:14 GMT 7

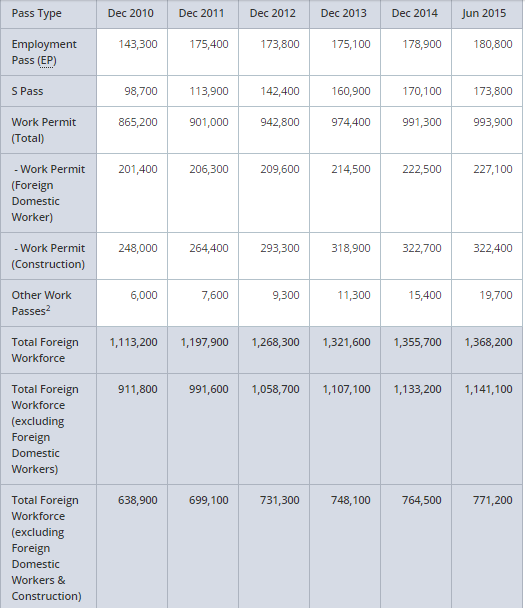

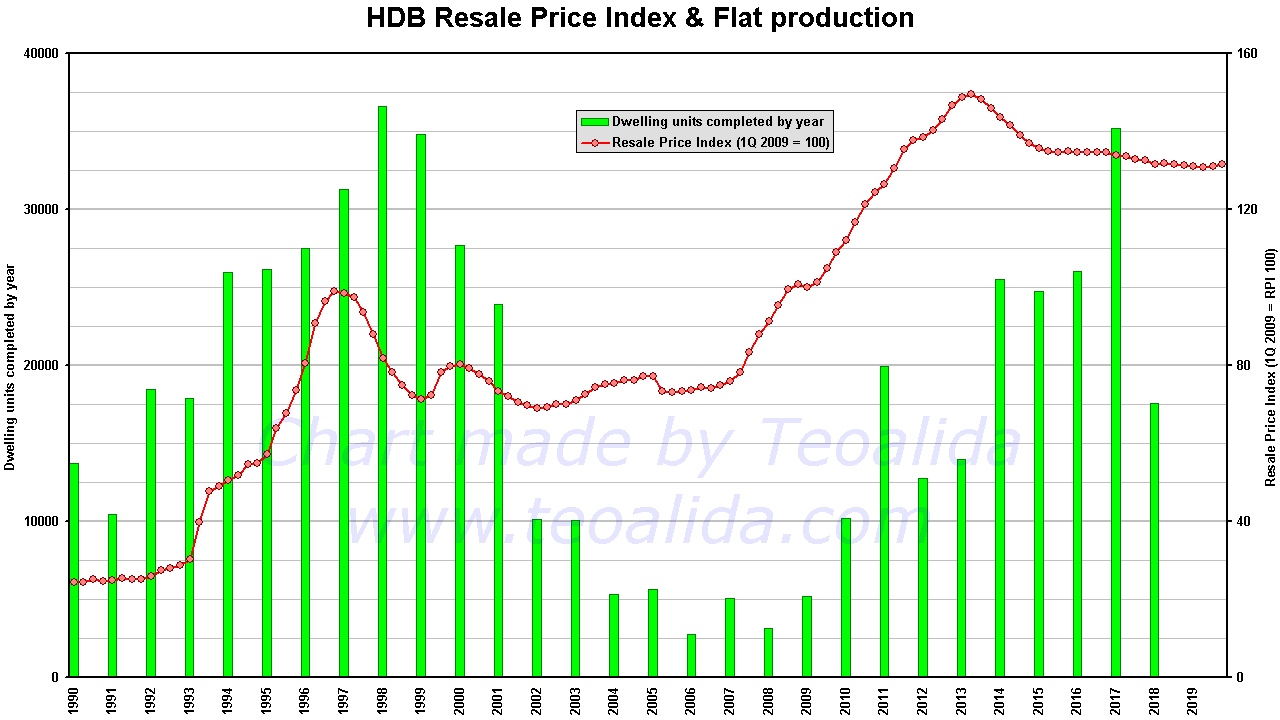

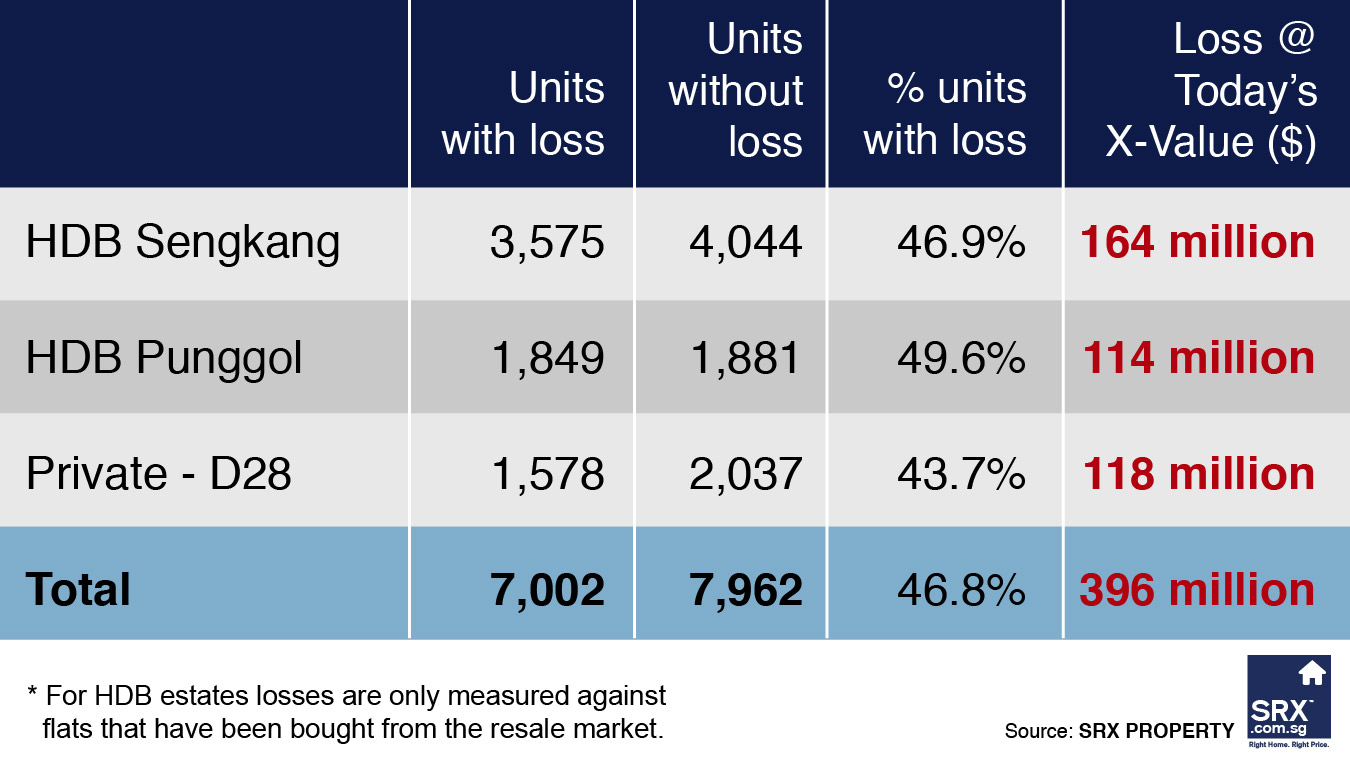

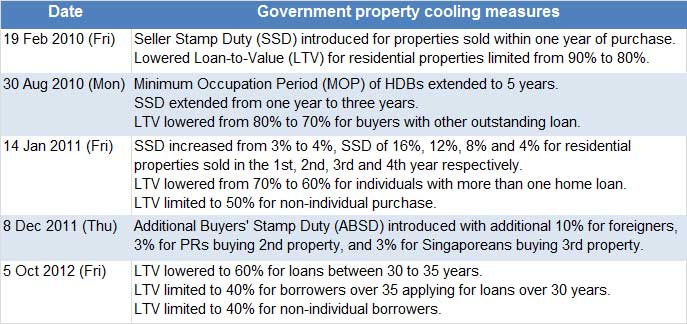

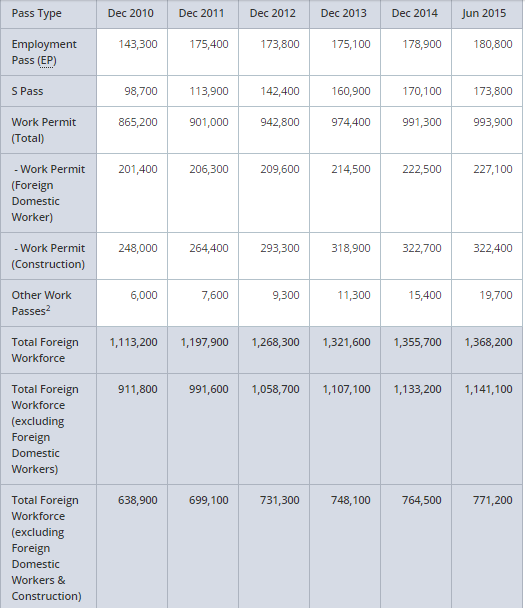

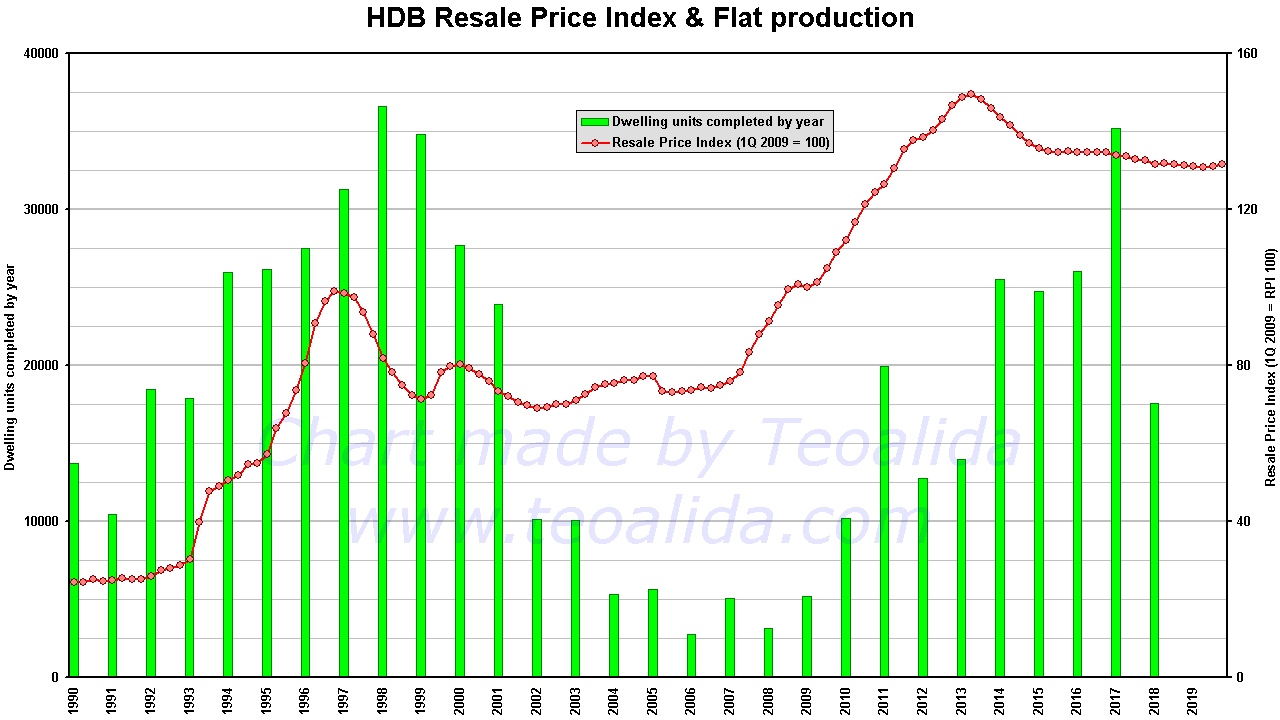

Buyers return as HDB resale prices consolidate ~ 10 Oct 2015 HDB resale prices down 0.4%, transactions up 3.9% in Sep ~ 9 Oct 2015 Does executive condo provide an arbitrage opportunity? ~ 7 Oct 2015 HDB resale prices fall for ninth consecutive quarter ~ 1 Oct 2015 No rush for ECs despite rule changes ~ 30 Sep 2015 A shot in the arm for ECs and HDB resale flats ~ 23 Sep 2015 Foreign workforce growth in first half slowest since 2009 ~ 16 Sep 2015 New trends in property market after GE2015By Ong Kam Seng 2 Oct 2015 The state of the residential property market during the recent General Election and that during the previous one in 2011 are a tale of contrast. In GE2011, housing affordability was a hot-button issue — for new couples who found resale HDB flats increasingly priced out of their reach, as well as upgraders unable to fulfil their aspirations of condominium ownership. By GE2015, cooling measures and loan curbs, especially the Total Debt Servicing Ratio (TDSR) framework introduced in mid-2013, had reined in runaway home prices and led to a market correction. With affordability concerns better addressed, we come to a new chapter in the residential property market. While prospective buyers are relieved at the change of market direction, property owners, especially those who purchased private homes at high prices from 2010 to 2013, are increasingly worried, now that the construction of their properties has been completed or soon will be. With more supply hitting the market, rents and prices have fallen upon the completion of some condominiums, even while their mortgage payments are rising in line with higher interest rates. There are also new residential products, such as shoebox condominiums in suburban areas minted in the heady years of 2010 to 2012, leading to new supply and demand patterns, with the units having been completed from around last year. Historical 10-year annual averages or even five-year averages of private residential demand may not be a useful reference for these new residential product types. Developers rolled out a significant number of these small-sized condominiums in suburban areas to achieve higher per-square-foot selling prices, having acquired land at high costs. Small units also helped fill in a market gap then, as many buyers found HDB resale flat prices high even while the units were quite old. A new suburban shoebox condominium, of 400-500sqf, is modern in design and comfortable for a single or for a couple without child, compared with old HDB resale flats. Most HDB flat owners also bought suburban condos in their neighbourhoods so they have easy access — walking across the street or perhaps a short drive — to check on the private property, and use the condo facilities. Down the road, we can also expect more HDB flat owners who bought small condo units nearby to squeeze, say, three or four out of five family members into the brand new but “shrunken” private home, while one member continues to occupy a room in the HDB flat with the spare rooms being sublet. This can optimise the use for the two properties for the HDB upgrader. Having a family member remaining as landlord in the HDB flat is easier to do than subletting the entire unit, and can also lead to better observance of house rules by tenants. However, as such new living patterns become more common, it will be harder to determine the actual use of a property, since owner-occupying and leasing decisions become erratic and fragmented. HDB flat owners who bought larger condo units — those with at least three bedrooms — will generally move into the newly-completed private home and sublet the entire HDB flat. The negative impact arising from the rising number of large suburban condominium completions will thus be felt more on HDB flat rents. Most HDB upgraders own a four- or five-room HDB flat, so when more large suburban condos are completed, there will be a rise in these HDB flat types put up for subletting. Prospective tenants will be deciding between renting a four- or five-room HDB flat and a small format condo unit in the same locality at similar rents. Owners who have been renting out their HDB flats should expect lower rents upon lease renewal or in a new lease after the current lease expires this year or next. Meanwhile, developer sales have been sluggish in the past two years, except in selected months such as when North Park Residences was launched in April and High Park Residences rolled out in July at attractive prices. It is essential to note that strong buying interest now hinges on two factors: Special selling points and an attractive price. To sell well, a project must offer either of these, or both. Unlike the days of market froth, such buying is more sustainable. As more supply comes to market, developers are moving towards lowering average pricing for executive condominiums and private condos to attract buyers. For ECs, developers have recently cut launch prices from the sticky S$800psf to between S$750 and S$780psf. Developers are also offering attractive prices for some suburban condos at about S$1,000psf. With the property market softening, there has also been much lobbying for the removal of cooling measures for selected groups of buyers, or even the TDSR. There is consensus among many industry players that any easing of these measures will be gradual — given the contrasting needs and concerns among different stakeholders in residential properties. With the most difficult issue of housing affordability successfully tackled after GE2011, the coming few years following GE2015 will see the authorities take into account new property uses and trends in their continual efforts to calibrate the residential property market towards long-term sustainability. ABOUT THE AUTHOR: Ong Kah Seng is a director at R’ST Research, a real estate research firm in Singapore covering all property sectors, including residential, retail, office, industrial, investment, leisure and hospitality. Singapore needs 900,000 foreign workers on two-year work permits ~ 24 Apr 2011 Government releases new foreign worker growth figuresBy Miklos Bolza 2 Sep 2015 In a recent blog post, the Ministry of Manpower has gone over exactly how the growth rates for foreign workers have slowed down since new tightening measures were introduced in the 2010 budget. While 2010 saw an influx of 79,800 foreign workers (excluding domestic workers), this figure dropped dramatically to 26,000 in 2014. The statistics are even more pronounced when excluding the construction industry, which has one local worker for every seven foreign workers according to Manpower Minister, Lim Swee Say. Ignoring the construction sector, Singapore saw foreign worker growth decrease from 60,200 to 16,400 from 2010 to 2014. When looking at employment share between local and foreign workers in 2014, the government says the total workforce was 67% locals excluding domestic workers. If the construction sector is also removed, this increases with 74% of local Singaporeans making up the total workforce. Although the government has previously announced that it wants a two thirds Singaporean Core, these figures show that the present amount is actually closer to three quarters. The Ministry also put out a summary of all measures it had implemented since 2010 to tighten foreign worker growth in Singapore:- 2010–11: Increased foreign worker levy, tightened EP & S Pass qualifying salary criteria, and cut construction man-year entitlement (MYE).

- 2011–12: Increased foreign worker levy further, cut dependency ratio ceilings (DRCs) for S Pass & manufacturing & services sectors, and cut construction MYE further.

- 2012–13: Increased foreign worker levy further, tightened S Pass qualifying salary criteria further, and cut DRCs for S Pass and services sector further.

- 2013–14: Increased foreign worker levy further and tightened EP qualifying salary criteria further.

There have also been additional government measures brought in this year including raising the minimum salary eligibility requirements for work pass holders sponsoring dependents. Figures on whether these initiatives have also reduced foreign worker inflow are expected to be released next year. Foreign Workforce Numbers as at Jun 2015  Why HDB resale flat prices will not fall any time soon: Colin Tan Why HDB resale flat prices will not fall any time soon: Colin Tan ~ 24 Feb 2012

|

|

|

|

HDB

Oct 18, 2015 5:35:20 GMT 7

Post by zuolun on Oct 18, 2015 5:35:20 GMT 7

|

|

|

|

Post by zuolun on Oct 20, 2015 9:29:22 GMT 7

|

|

|

|

HDB

Oct 20, 2015 12:49:08 GMT 7

Post by zuolun on Oct 20, 2015 12:49:08 GMT 7

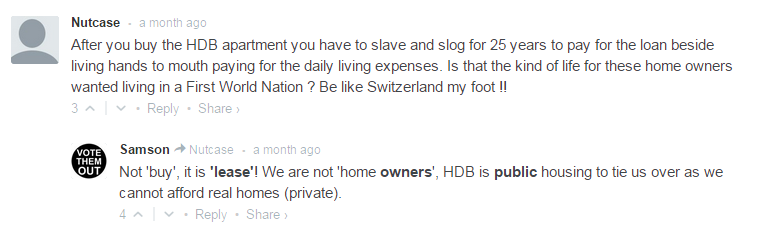

The worst scenario for the HDB resale flat market is that, in a falling market, in order to stabilize the price and supply in the open market effectively, the government/HDB may shift the goal post further by extending the minimum occupation period, longer ( Example: You must live in your HDB flat for 10 years before you can sell it, regardless of whether you bought directly from the HDB or in the open market. The lock-in is known as the minimum occupation period, 10 years was the original HDB resale rule in the 60's then). And if HDB flat owners (BTO and resale) could not meet the new requirement, exception is granted to sell back to the HDB at the board's stipulated price, not at market price. Should this happen, late-comers (Singaporeans + PRs) who purchase their HDB flats at high prices with CPF funds + cash COV past 3 years will incur huge losses if they've no holding power. ~ 16 Oct 2015 HDB may increase new flat supply next year: MND's Lawrence Wong ~ 16 Oct 2015 Residential property market continues to soften ~ 24 Aug 2015 National Development Minister Khaw Boon Wan's doorstop ~ 24 Aug 2015 Raised EC income ceiling hits private resale market ~ 14 Oct 2015 'Bumper crop' of 12,000 flats available at November HDB launch ~ 23 Sep 2015 Should HDB adopt a drastic decline in BTO flat supply? Enough home supply for up to 2030 Enough home supply for up to 2030 ~ 18 Jan 2015  |

|

|

|

HDB

Oct 21, 2015 9:02:01 GMT 7

oldman likes this

Post by zuolun on Oct 21, 2015 9:02:01 GMT 7

"A person's worth is contingent upon who he is, not upon what he does, or how much he has. The worth of a person, or a thing, or an idea, is in being, not in doing, not in having." - Alice Mary Hilton Mark Phooi 14 May 2012 I have a confession to make. Not too long ago, I was financing a money lending operation. It was not my idea to start it but my intention was to help a close friend who was facing a mid career crisis. From an initial investment amount of $200k, the business shot up to 1.1 million within 7 months. The business was brisk and the influx of borrowers was increasing at a furious speed. Despite the exorbitant interest rate of a minimum of 20% per month, there were certainly no shortage of borrowers. In Singapore, most Singaporeans are asset rich by means of owning a subsidized HDB flat. My friend was formerly a property agent and was able to see that an opportunity laid within this group of HDB dwellers. Despite Singapore having the reputation of being a cash rich nation and our Singapore government having more than S$500 billion in assets, most of that belonging to people like you and me, there are still many people out there who are experiencing financial problems. Based on the profile of these borrowers, 97% of them are gamblers. The owners of our city state's 2 casinos have certainly picked the right spot to start their business. Among the Chinese, there is a common saying that gambling lies in the blood of most Chinese people, hence we all like to take risks. From news reports, both casinos are raking in S$500,000 million profit per quarter or almost S$2 billion dollars per year of profit. It is a common truth that the odds are always against the gambler and that is where all the casinos’ profit is derived from. Being a part of the finance or gambling industry, I could see the misery in their eyes and I could understand the pain inflicted in their household. This was something I felt very wrong about. Typically more than 80% of Singapore's population live in HDB flats, with 95% of them owning their own HDB flat. The flat is their only prized asset. Hence, some gamblers choose to dispose their HDB flat as a means to obtain a quick cash out to feed their gambling habit. In a typical scenario, flat sellers have to wait approx. 3 months before they can receive their cash proceeds. A large chunk of this will be returned to the seller's CPF account, while the balance amount (capital gain) will be returned to them in cash. With the processing period of approx. 3 months, obtaining fast cash was the answer to their gambling needs. My initial investment of S$200,000 quickly rose to over $1 million within 6 months and I got back my initial investment amount within 10 months. After slightly over 2 years of operation, it grew to almost a S$20 million revenue business. To understand why there are so many illegal money lenders willing to risk their lives to carry out their business, all you have to do is a simple calculation based on 20% interest per month. Somehow, my conscience overwhelmed me. Making money from the poor did not seem to be a good proposition and I decided to put a stop to my involvement after I recovered my initial capital. This short episode has manifested in many ways to create a positive transformation in my life. I began to realize and appreciate the philosophy of life and money in a different perspective. Largely, it contravened with my philosophy in me venturing into the education business. I have learnt that a person's worth is contingent upon who he is and not how much he has. Building a legacy is better than chasing financial success. After all, our success cannot be measured by our wealth alone but what we do with our experience that benefits the community. This quote aptly describes this: 'If you think you do not have enough, even the rich becomes poor. If you think you have enough, even the poor can be rich'.Living a meaningful and purposeful life has becomes my ethos for the rest of my living years. |

|

|

|

HDB

Nov 5, 2015 10:17:32 GMT 7

Post by zuolun on Nov 5, 2015 10:17:32 GMT 7

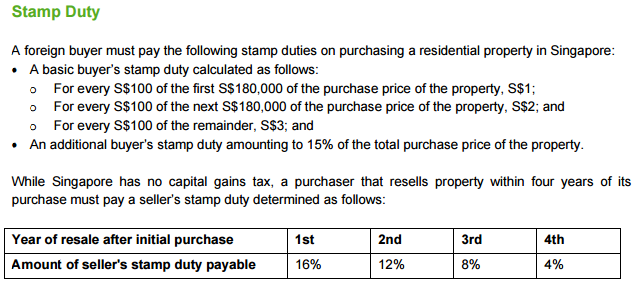

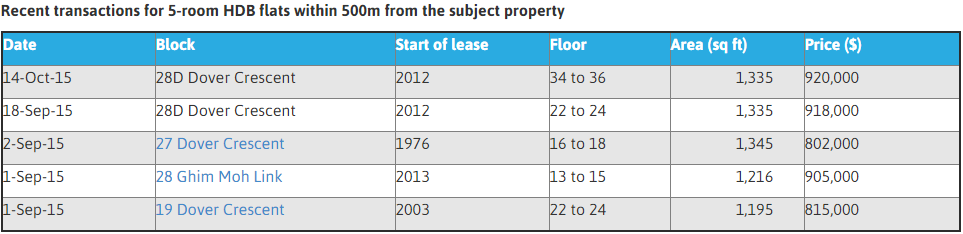

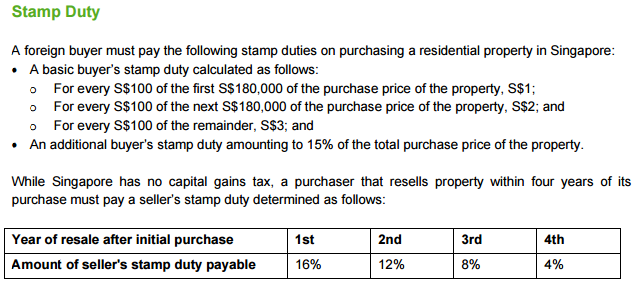

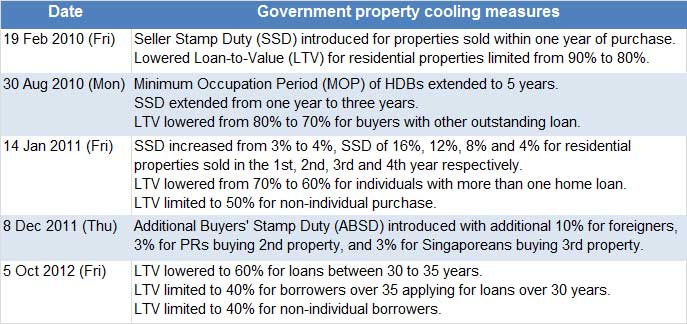

How far can pigs fly? ~ According to URA, by the end of 3rd quarter 2015, there are 72,888 new units in the market. Another 6,296 units are ready by end of 2015. In 2016, another 27,149 will be completed. That is a total of 106,333. Is there an oversupply? Do you own maths. Our census shows that, from 2000 to 2010, the number of households has increased by 230,800 in 10 years’ time. Assuming that the average number of new households is 23,080 per year, even if every new household chooses to buy a private residential unit, we still need 4.6 years to absorb all the supply in the market. ~ 26 Oct 2015 McNair Rd BTO project hits bump as contractor faces financial woes ~ 4 Nov 2015  McNair Towers McNair Towers 4-room flat at Pinnacle@Duxton sold for $990,000 4-room flat at Pinnacle@Duxton sold for $990,000 ~ 3 Nov 2015  Five-room flat 28D Dover Crescent sold at $920,000 Five-room flat 28D Dover Crescent sold at $920,000 ~ 29 Oct 2015  The rates of Seller's Stamp Duty (SSD)The rates of SSD payable on residential property purchased on and after 20 Feb 2010 and sold within certain duration: The rates of Seller's Stamp Duty (SSD)The rates of SSD payable on residential property purchased on and after 20 Feb 2010 and sold within certain duration:

|

|