|

|

Post by zuolun on Dec 28, 2014 7:13:18 GMT 7

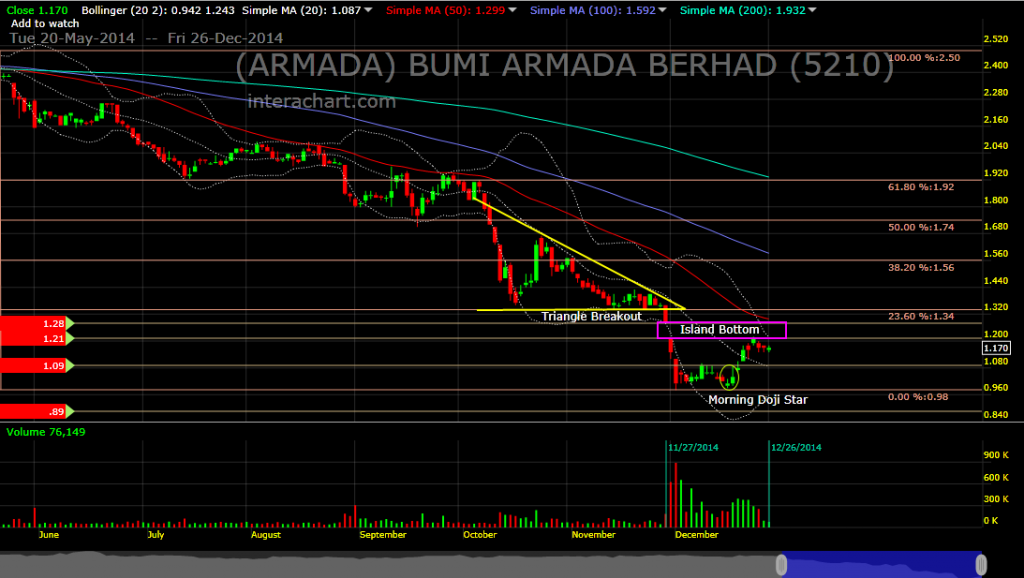

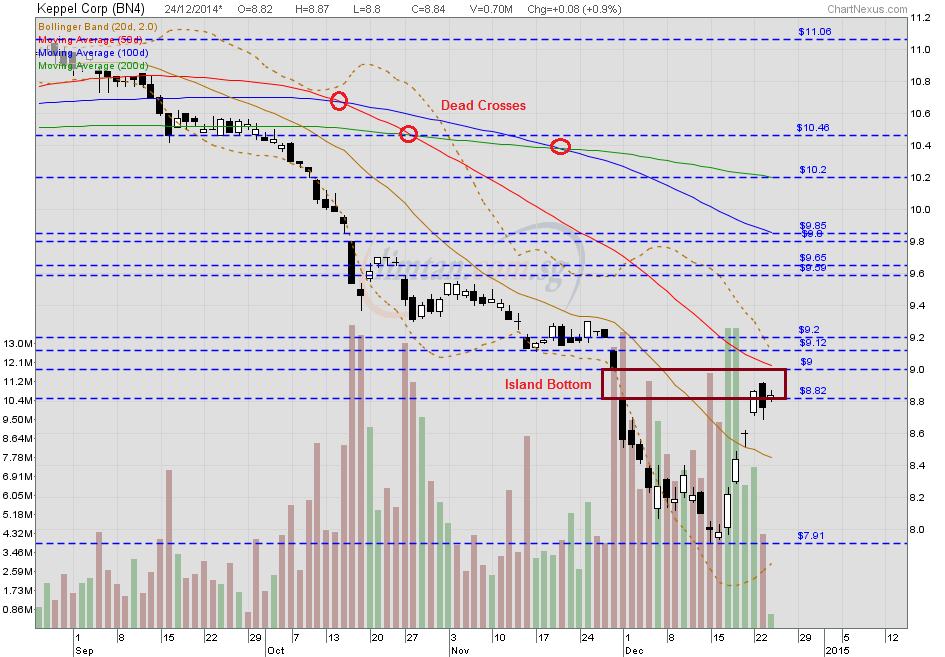

Example 2: CoscoAnother friend loved betting big on Cosco... In Aug 2011, he gambled on a double-bottom reversal and went to long 200 lots Cosco @ S$1.80+ via CFD. Within a couple of days, Cosco collapsed and he was forced to cut loss at > 20% approx. S$80,000 (excluding commission and other charges). This friend used to coach me on TA and he had > 10 years of trading experience in the stock market, then. The W-Shaped on VARD now is similar to the one on Cosco then, it always reminds me of how my friend burned a big hole in his pocket.  — 10 Dec 2014  Bumi Armada Bumi Armada, KepCorp, Vard and Cosco — Double-bottom reversal / W-shaped chart pattern Former minister Lee to chair Keppel: Former minister Lee to chair Keppel: Keppel faced a turning point then. It was involved in businesses ranging from shipyards to telecommunications and banking, and had turned in a loss of $223 million for 1998, its first loss in 13 years, due to the Asian financial crisis. — 25 Apr 2009    [/quote] |

|

|

|

Post by zuolun on Jan 9, 2015 12:26:56 GMT 7

odie, In any stock market, it's all about supply and demand. From a chartist's point of view; buy stocks with good momentum and volume, which can reward you a good profit. Do not buy stocks with low or no volume and sit on them, these stocks are dead and dire cheap for a reason. (Bottom-fishing is the toughest gameplay in the stock market.) Watch the video clip and listen carefully from 1:50 to 1:59... the speaker has revealed an important fact about the stock market gameplay. "In the stock markets today, there are good companies that are overpriced and there are worthless companies that are overpriced. If you are going to be a fool and pay absurd prices because you think that a greater fool will appear in the future, make sure you buy a goat and not a monkey." Do not buy stocks that even worms also won't grow on them!

|

|

|

|

Post by zuolun on Jan 22, 2015 11:46:49 GMT 7

"Insanity is doing the same thing over and over again and expecting different results." ~~ Albert Einstein

对股价12种最愚蠢(最危险)的认识

1) 如果股价已经下跌了这么多,它不可能再跌了

股市是非常不理智的,你不可能预测一个股票可以跌到那一个价位!

所以,林区的建议就是,不要尝试去预测股价会跌到那一个价位,而是反问自己:用这个价格买入这个股票,值得吗?

股价下跌,你就必须看看公司的运作是否依然健全,公司是否仍然在赚大钱;千万不要抱着“股价下跌了这么多,不可能再跌”的心态就买入,因为很有可能你买入的,是一间已经过时,没有赚钱,没有竞争能力的公司。

2) 你总能知道什么时候股市到了底部

林区认为,短期内,你不可能可以预测股价的走势,所以不要去预测!

3) 如果股价已经如此之高了,怎么可能再进一步上升呢?

只要公司的盈利每年增加,股价随着上涨是很合理的一件事情!

所以,不要以为股价上涨了这么多,就不可能再上涨,而赶紧卖掉手中的股票;这样做,你可能就错失了一个可以翻10倍的股票!

4) 每股只有5分钱,我能失去什么?

如果你投资1000股,那么你就能够失去50令吉,再加上一些手续费。

不要用赌博或买万字的心态来买股票:以为买小小,输了就算了;长期下来,你就可能输掉很多钱了!

如果你长期把这些钱投资在优质股上,10年后,你就可以看到你赚了多少!

5) 最终股价会回来的

很多公司股价下跌后,就一直没有丝毫起色,到被除牌的那一天。

所以,不要跟股票谈感情,不要抱着希望;要根据公司的盈利和资产状况来决定是否应该投资,还是卖出。

6) 黎明前的时候总是最黑暗的

不要以为最坏的事情已经过去了,或者最不可能发生的都发生了,还有什么好怕的?前面一定是柳暗花明又一村!

但是,往往在最黑暗之后,还是一段漫长的黑暗!

7) 当股价反弹到了10令吉时,就将其卖出

林区再提醒你一次:短期内,你不可能可以预测股价的走势,所以不要去预测!

还有:不要跟股票谈感情,不要抱着希望;要根据公司的盈利和资产状况来决定是否应该投资,还是卖出。

8) 我有什么可担心的,保守的股票不会波动太大

不要以为买入像大众银行这样的股票就一定稳稳赚,不用去担心!

世上没有永远都值得投资的蓝筹股,所以,你还是要非常留意公司的前景,方向,盈利等,这样你才能够保住你的投资。

9) 可能要花长一点时间,有些事情才可能发生

当你花了很大的耐心拥有一个被人忽视而偏偏你喜欢的股票时,你会开始想是不是别人是对的,而你是错的。

但是,林区告诉你,只要公司的基本面是好的,你的耐心一定会得到回报!

林区也许没有告诉你——你需要的耐心,往往一等就是10年,你有这个耐心吗?

所以,有些事情并不是花长一点的时间就会发生,而是花很长的时间才会发生!

10) 看看我已经赔了这么多钱,我不再买股票了!

不要气馁!长期投资股票,一定可以让你有一个舒适的晚年。

11) 我已经错过了一个好股,我一定要抓住下一个

每一间公司都不一样,每一个股票也不一样。

因此,下一个好股跟上一个好股肯定有不一样的地方,所以要抓住下一个好股,并不是“单纯的寻找”上一个好股的特点。

12) 股市上涨,所以我一定是对的;股市下跌,所以我一定是错的

除非你是寻找短期回报的炒家,否则当你买入一个股票后,其价格上下波动只能说明有人愿意付更多或更少的钱去购买同一种商品而已。

|

|

|

|

Post by zuolun on Jan 31, 2015 10:54:58 GMT 7

FA + TA = FATA1. FA tells us why we buy/sell a stock. 2. TA tells us when to buy/sell a stock. 3. A person well-versed in both will be a formidable investor and/or trader. For intraday scalping, the focus is on afew bids of profit. For short-term trend trading, the focus is on "how to calculate the percentage increase" and a profit-take strategy. But for long-term investment, the focus is on "when is the best time to cash out and call it a day". MTQ — An example of using FATA to cash out for good. Chartwise, the best timing was to sell MTQ in July 2014. It is not wrong to take some chips off the table during the journey in investing but it is a cardinal sin to let a profitable longterm investment turning into a loss. There is a story behind every chart.John Templeton: "The time of maximum pessimism is the best time to buy and the time of maximum optimism is the best time to sell."- It makes sense that when most investors are bullish, asset valuations would be high, because everyone has already bought.

- The opposite is also true. When most investors are bearish, asset valuations are low, because everyone has already sold.

“机会总在绝望中诞生,在质疑中成长,在希望中成熟,在疯狂中死亡。” — 邓普顿oldman, Smart money know when to hold 'em and when to fold 'em... Traders just need gut-feel and the right time to profit from the panic.  The Gambler The GamblerOn a warm summer's evenin' on a train bound for nowhere, I met up with the gambler; we were both too tired to sleep. So we took turns a starin' out the window at the darkness 'Til boredom overtook us, and he began to speak. He said, "Son, I've made my life out of readin' people's faces, And knowin' what their cards were by the way they held their eyes. So if you don't mind my sayin', I can see you're out of aces. For a taste of your whiskey I'll give you some advice." So I handed him my bottle and he drank down my last swallow. Then he bummed a cigarette and asked me for a light. And the night got deathly quiet, and his face lost all expression. Said, "If you're gonna play the game, boy, ya gotta learn to play it right. You got to know when to hold 'em, know when to fold 'em, Know when to walk away and know when to run. You never count your money when you're sittin' at the table. There'll be time enough for countin' when the dealin's done. Now Ev'ry gambler knows that the secret to survivin' Is knowin' what to throw away and knowing what to keep. 'Cause ev'ry hand's a winner and ev'ry hand's a loser, And the best that you can hope for is to die in your sleep." So when he'd finished speakin', he turned back towards the window, Crushed out his cigarette and faded off to sleep. And somewhere in the darkness the gambler, he broke even. But in his final words I found an ace that I could keep. You got to know when to hold 'em, know when to fold 'em, Know when to walk away and know when to run. You never count your money when you're sittin' at the table. There'll be time enough for countin' when the dealin's done. Chrousx3

|

|

|

|

Post by oldman on Jan 31, 2015 12:56:19 GMT 7

The easiest part is to buy the stock. Hence, FA is usually the easy part. The difficult part is when to sell. If the company is doing badly and the shares fall, it is really not easy to sell at a loss. You will find a hundred and one excuses why FA remains intact. If the company is doing well, it is also difficult to know when to sell as one has a tendency of selling too early. For me, there is a 3rd part which is the volume. Yes, some folks put this under TA but I think there is a lot more to volume than just TA. For me, I keep a close eye on about 50 stocks. I look at their volume traded and if this is significant, I dissect the time and sales and try to tally these with the holdings of the substantial shareholders. Yes, there is a lot of work involved and lots of assumptions have to be made. But volume done is still the best indicator to me that a stock may be on the move.  FA + TA = FATA1. FA tells us why we buy/sell a stock. 2. TA tells us when to buy/sell a stock. 3. A person well-versed in both will be a formidable investor and/or trader. For intraday scalping, the focus is on afew bids of profit. For short-term trend trading, the focus is on "how to calculate the percentage increase" and a profit-take strategy. But for long-term investment, the focus is on "when is the best time to cash out and call it a day". MTQ — An example of using FATA to cash out for good. Chartwise, the best timing was to sell MTQ in July 2014. It is not wrong to take some chips off the table during the journey in investing but it is a cardinal sin to let a profitable longterm investment turning into a loss. There is a story behind every chart.John Templeton: "The time of maximum pessimism is the best time to buy and the time of maximum optimism is the best time to sell."- It makes sense that when most investors are bullish, asset valuations would be high, because everyone has already bought.

- The opposite is also true. When most investors are bearish, asset valuations are low, because everyone has already sold.

“机会总在绝望中诞生,在质疑中成长,在希望中成熟,在疯狂中死亡。” — 邓普顿oldman, Smart money know when to hold 'em and when to fold 'em... Traders just need gut-feel and the right time to profit from the panic.  The Gambler The GamblerOn a warm summer's evenin' on a train bound for nowhere, I met up with the gambler; we were both too tired to sleep. So we took turns a starin' out the window at the darkness 'Til boredom overtook us, and he began to speak. He said, "Son, I've made my life out of readin' people's faces, And knowin' what their cards were by the way they held their eyes. So if you don't mind my sayin', I can see you're out of aces. For a taste of your whiskey I'll give you some advice." So I handed him my bottle and he drank down my last swallow. Then he bummed a cigarette and asked me for a light. And the night got deathly quiet, and his face lost all expression. Said, "If you're gonna play the game, boy, ya gotta learn to play it right. You got to know when to hold 'em, know when to fold 'em, Know when to walk away and know when to run. You never count your money when you're sittin' at the table. There'll be time enough for countin' when the dealin's done. Now Ev'ry gambler knows that the secret to survivin' Is knowin' what to throw away and knowing what to keep. 'Cause ev'ry hand's a winner and ev'ry hand's a loser, And the best that you can hope for is to die in your sleep." So when he'd finished speakin', he turned back towards the window, Crushed out his cigarette and faded off to sleep. And somewhere in the darkness the gambler, he broke even. But in his final words I found an ace that I could keep. You got to know when to hold 'em, know when to fold 'em, Know when to walk away and know when to run. You never count your money when you're sittin' at the table. There'll be time enough for countin' when the dealin's done. Chrousx3 |

|

|

|

Post by roberto on Jan 31, 2015 20:04:55 GMT 7

Am I right to interpret your comment on volume, that it applies to both up trend and down trend movements? Also, while I understand why volume matters, could you kindly expand on why time and sales are important to you? The easiest part is to buy the stock. Hence, FA is usually the easy part. The difficult part is when to sell. If the company is doing badly and the shares fall, it is really not easy to sell at a loss. You will find a hundred and one excuses why FA remains intact. If the company is doing well, it is also difficult to know when to sell as one has a tendency of selling too early. For me, there is a 3rd part which is the volume. Yes, some folks put this under TA but I think there is a lot more to volume than just TA. For me, I keep a close eye on about 50 stocks. I look at their volume traded and if this is significant, I dissect the time and sales and try to tally these with the holdings of the substantial shareholders. Yes, there is a lot of work involved and lots of assumptions have to be made. But volume done is still the best indicator to me that a stock may be on the move.  |

|

|

|

Post by oldman on Jan 31, 2015 20:18:41 GMT 7

From the Time and Sales, you get a feel of the type of investors that are buying or selling. Takes really a lifetime of trading and investing to understand volume and how to interprete it. It really is very difficult to explain how to dissect volume..... it is all through experience. Yes, volume is applicable to both up and down trends. Am I right to interpret your comment on volume, that it applies to both up trend and down trend movements? Also, while I understand why volume matters, could you kindly expand on why time and sales are important to you? The easiest part is to buy the stock. Hence, FA is usually the easy part. The difficult part is when to sell. If the company is doing badly and the shares fall, it is really not easy to sell at a loss. You will find a hundred and one excuses why FA remains intact. If the company is doing well, it is also difficult to know when to sell as one has a tendency of selling too early. For me, there is a 3rd part which is the volume. Yes, some folks put this under TA but I think there is a lot more to volume than just TA. For me, I keep a close eye on about 50 stocks. I look at their volume traded and if this is significant, I dissect the time and sales and try to tally these with the holdings of the substantial shareholders. Yes, there is a lot of work involved and lots of assumptions have to be made. But volume done is still the best indicator to me that a stock may be on the move.  |

|

|

|

Post by zuolun on Feb 2, 2015 12:06:07 GMT 7

I can understand your position. One must be able to look after himself first before he can help others. Perhaps some time in the future, you will have more time to be able to share again. Till then, all the best in your trading and thanks for all the sharing. , Appreciate and thank you very much for all the invaluable guidance to me.  Asking questions and giving feedback in pertama forum are the best to learn new things about the stock market.  GRP Limited GRP Limited — An example of a "good FA" stock that "ends up with a stake in an overvalued company" known as Aphrodite Gold. which has a bankruptcy possibility in the next 2 years.In my book, the first chapter is intentionally, Demand & Supply. One must master this to master the stock market. As for FA, we cannot trust this totally. Let's assume that a stock is trading at 30cts and it has cash of $1 with no debt. This will definitely be termed as a "good FA" stock. But, instead of using the cash smartly, management decides to buy grossly overvalued companies with it. As management is usually smart, you have to read in between the lines. Then, instead of having $1 worth of cash, the company ends up with stakes in these overvalued companies and now has a debt of $1 per share. Your 'good FA' stock is now a 'bad FA' stock. At the end of the day, before we can invest based on FA, we have to trust the management. But, how does one assess management in order to know if one can trust them? I don't have the answers to this and hence, I rather invest in top entrepreneurs who are already financially wealthy as I think that their self esteem will be more important to them than just adding a few more millions into their bank accounts. When you are very wealthy, money will mean less and less to you. What is more meaningful is your ability to grow other businesses. These folks will get a high when they successfully build up other businesses. One just have to believe in them and ride the journey with them. Just thinking ...

If the said stock has good FA and the price now is cheaper, don't we accumulate more?

The key operating word is "Good FA". |

|

|

|

Post by zuolun on Feb 14, 2015 8:57:30 GMT 7

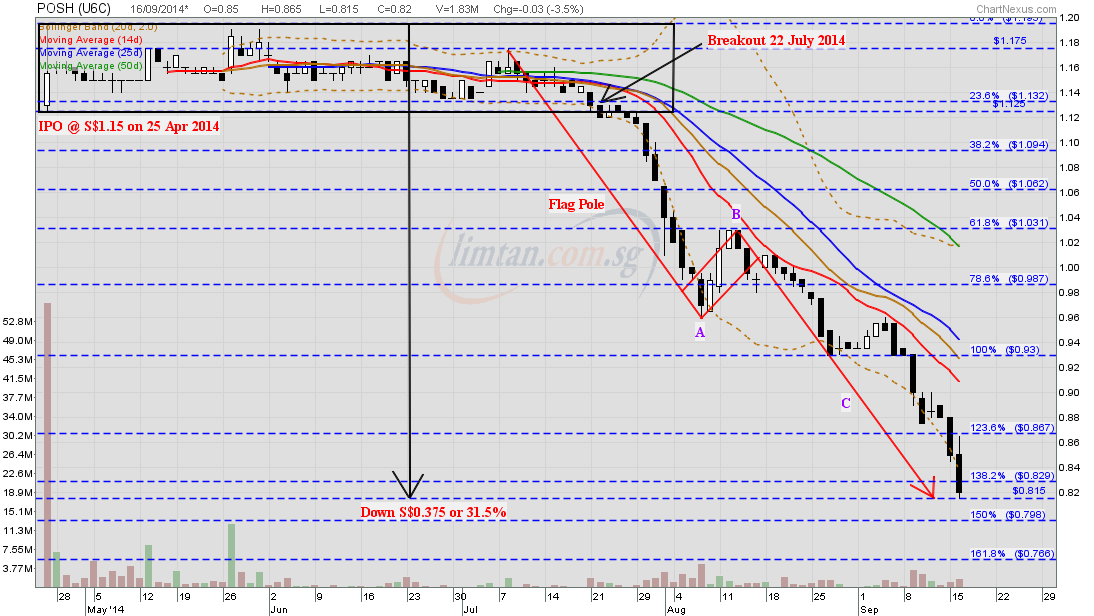

Bro Zunlun, Can this gambler be short still. Read that a stock make new low is an idea candidate for short  It exceed your sell TP last year; good reward if you or someone long the short since . Kim Eng fella buy TP was wrong again, he now can buy Del Monte for less than half the price  KKR seem to be wrong very often; they bought Kodak USA few years ago and loss big big too. I open an CFD account is purely for taking short positions. It is the only plateform I knew which could provide that. Having long for 33 years, I am trying short in 2015  . As getting older, I am limiting myself and be less speculative. " For stock prices, they are relatively slower to go up and faster to come down" . "With FA/ TA and all other things being equal; shorting is not worse off than longing....." The best timing to initiate long-shorting in a confirmed bear market / downtrend stock is after the major key support level has broken down convincingly, i.e. short at the start and/or the mid levels but not so rewarding to short at the tail of the bear market / downtrend. Based on risk/reward ratio, if kena caught big time in a severe short-squeeze, sure die pain pain!            Thanks for your reply. I am intrigued and amused by your confidence and fixation with the said 61c. In the world of investing, anything is possible i suppose. Still, i wonder if the said TP is backed by any fundamentals. If you don't mind me playing the devil's advocate here, perhaps i could suggest that (in your own words) "once the price stabilizing managers had (have) complete the job", perhaps the stock could already have been privatised? Do we know that these "price stabilizing managers" have already "completed the job"? ... afterall, the reported free float is already pretty low now isn't it. I have read Oldman's book (must add here that it's an extremely good book, and i would strongly recommend it to anybody), and he often talks about supply-demand mechanism. Given that, assuming the key shareholders remain and don't sell, surely the "supply" of the stock is drying up ...? I have no vested interest in the stock. I have seen a couple of their projects in China and they seem well-located/well-built and the developer above average ASP seems to suggest they have a rather credible repute. I must qualify though i'm rather perturbed by such TA drawings, which aren't backed by any FA. As said, i could well draw up some equally bullish lines and extrapolations  ... Cheers I raised exactly the same question as you did when someone shorted Cosco at the peak @ $8 based on TA + gut-feel + luck in 2007 then.  POSH is one of the best trading stocks my friend got the trend right; he hoot tua tua after the barge sank off Batam, every 10c down = S$10K profit. Last year he whacked JC&C the same way, all the way down, down, down, down, down, down...  Whack a kitty Whack a kitty with One Good Trade   POSH — Bear Flag Breakout next TP S$0.765 POSH — Bear Flag Breakout next TP S$0.765POSH closed with a long black marubozu @ S$0.82 (-0.03, -3.5%) with 1.83m shares done on 16 Sep 2014. Immediate support @ S$0.795, immediate resistance @ S$0.865. Chart Pattern: - Riding on Corrective A-B-C Wave; it never rains but it pours.

- In technical analysis, a stock that has made a new low is a prime target for short, not long.

|

|

|

|

Post by sptl123 on Feb 14, 2015 9:24:52 GMT 7

Thank you Bro Zuolun. The information is interesting, exciting and inspiational  . Appreciate the time and your advise. It has been well noted and taken too. |

|

|

|

Post by zuolun on Feb 15, 2015 6:45:56 GMT 7

|

|

|

|

Post by zuolun on Feb 16, 2015 15:31:49 GMT 7

GRP Limited ~ Exec. Director Kwan Chee Seng increased its stake in GRP to 28.43% or 188,530,800 shares ~ 16 Feb 2015 GRP Limited, an investment holding company, engages in the design, manufacture, and sale of industrial/marine hoses, fittings, marine safety equipment, and related products for the onshore, offshore, marine, oil, pharmaceutical, and petrochemical markets. The company primarily operates through Hose and Marine, Measuring Instruments/Metrology, and uPVC Pipes and Fittings divisions. The Hose and Marine division supplies and services industrial/marine hoses, fittings, marine safety equipment, onshore/marine loading hoses, industrial/chemical hoses, marine engineering products and services, and hose fittings. This division also offers products for use in the safe applications to protect loading and unloading systems from damage and downtime; and consultation, engineering works, and inspection and testing services. The uPVC Pipes and Fittings division fabricates and trades in plastic moulds and plastic products comprising uPVC pipes; and fittings in the electrical, pressure, DWV, and rubber/sewer sectors under Arrow and STAR brand names. The Measuring Instruments/Metrology division trades and distributes precision measuring instruments and equipment; and dimensional measuring instruments, optics/inspection and measurement, analytical/environmental, electrical/electronics, and torque meter products. In addition, the company is involved in the rental of properties. It operates primarily in Singapore, Malaysia, Indonesia, other Asian countries, the Middle Eastern countries, and the Peoples Republic of China. The company was founded in 1977 and is headquartered in Singapore. I can understand your position. One must be able to look after himself first before he can help others. Perhaps some time in the future, you will have more time to be able to share again. Till then, all the best in your trading and thanks for all the sharing. , Appreciate and thank you very much for all the invaluable guidance to me.  Asking questions and giving feedback in pertama forum are the best to learn new things about the stock market.  GRP Limited GRP Limited — An example of a "good FA" stock that "ends up with a stake in an overvalued company" known as Aphrodite Gold. which has a bankruptcy possibility in the next 2 years.In my book, the first chapter is intentionally, Demand & Supply. One must master this to master the stock market. As for FA, we cannot trust this totally. Let's assume that a stock is trading at 30cts and it has cash of $1 with no debt. This will definitely be termed as a "good FA" stock. But, instead of using the cash smartly, management decides to buy grossly overvalued companies with it. As management is usually smart, you have to read in between the lines. Then, instead of having $1 worth of cash, the company ends up with stakes in these overvalued companies and now has a debt of $1 per share. Your 'good FA' stock is now a 'bad FA' stock. At the end of the day, before we can invest based on FA, we have to trust the management. But, how does one assess management in order to know if one can trust them? I don't have the answers to this and hence, I rather invest in top entrepreneurs who are already financially wealthy as I think that their self esteem will be more important to them than just adding a few more millions into their bank accounts. When you are very wealthy, money will mean less and less to you. What is more meaningful is your ability to grow other businesses. These folks will get a high when they successfully build up other businesses. One just have to believe in them and ride the journey with them.

|

|

|

|

Post by sptl123 on Feb 16, 2015 16:26:18 GMT 7

Bro Zuolun, I could not download the following link which is appended in your last post.: GRP Limited ~ Exec. Director Kwan Chee Seng increased its stake in GRP to 28.43% or 188,530,800 shares ~ 16 Feb 2015

Also check but no SGX announcement on the subject. Not sure if it is something wrong on my PC  |

|

|

|

Post by zuolun on Feb 16, 2015 16:32:55 GMT 7

Bro Zuolun, I could not download the following link which is appended in your last post.: GRP Limited ~ Exec. Director Kwan Chee Seng increased its stake in GRP to 28.43% or 188,530,800 shares ~ 16 Feb 2015

Also check but no SGX announcement on the subject. Not sure if it is something wrong on my PC  , Upgrade the latest adobe reader: Version XI (11.0.10) get.adobe.com/reader/P/S. Under my watchlist, there is one interesting O&G penny stock which the director keeps buying back using his own money, i.e. not company share buyback. The share price is about the same price as GRP around 10c. Under the old ruling, at times, he queued and got 6 lots (6,000 shares) threw down by retailers and it was also reported via the SGX announcement website.  |

|

|

|

Post by zuolun on Feb 17, 2015 7:56:44 GMT 7

Bro Zuolun, the links tell us all things are not well. I better be more careful  , Stick to big-caps and mid-caps rotational play, especially the market mover stocks which are extremely protected = ring-fenced and/or have the BBs' strong support-buy when prices fell to attractive levels. Small-caps, penny and micro penny stocks are extremely speculative in nature (besides S-Chips, many kacang puteh SGX-listed companies remained listed on the SGX todate now become syndicate / casino stocks solely and strictly meant for gambling purposes only) so don't put too much money into them if you're not monitoring the share prices, intraday. |

|