|

|

Post by zuolun on Mar 12, 2015 9:39:40 GMT 7

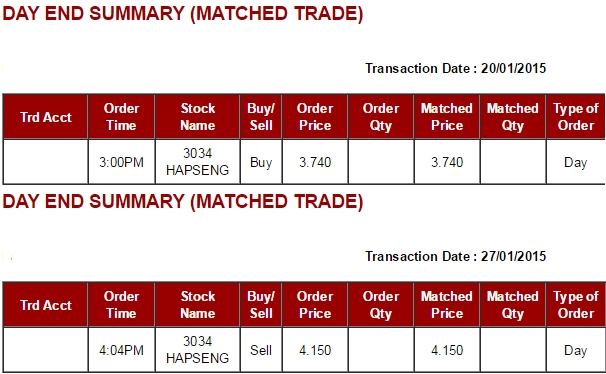

I like this. "A lot of people get it wrong. When the bull market is here, they build debts. Bull market is the time to build cash. Because today’s market turns very quickly. When the market turns, you cannot sell, especially for the property market. You can only sell when things are going up." Dear zuolun, Thank you very much for your many posts. I have benefited a lot! BTW, just curious, are you a full time trader? , I'm a retiree and used to trade quite often in the past but I'm now 90% in cash.  Your question reminds me of Peter Lim: ‘Make sure you stay alive. The market won’t die, so there’s always a next time.’ I am about 85% in cash but I am still buying very selectively when there is a correction. The opportunity cost will be very high if the bull extends for another few years. However, knowing myself, it is far easier for me to handle the emotion of not making big money than sitting on big paper loss or losing big money. Making or losing small money does not bother me. Many high quality investment-grade stocks (M'sia and S'pore) on my radar either have the "fell off the cliff" or the "mushroom of death" chart pattern. I only buy to trade / play the dead cat bounce and/or long stocks for the mid-term; not buying any new stocks for long term investment anymore. Example: Hap Seng (3034) |

|

|

|

Post by sptl123 on Mar 13, 2015 15:38:52 GMT 7

Bro Zuolun, Sometime I wonder, do you really exist in the real world or just “someone” exist in the cyber world?  Just looking at today forum, how you manage to read and know so many things and so fast? It is amazing and beyond comprehensible! From 庄周梦: 我是蝴蝶,还是蝴蝶是我? You are computer or computer is you ?  Do you know your IQ Score? Surely if a criminals has the same level of IQ as you, he could beat NYPD flat  . No offence and always with my highest respect to you Bro Zuolun.  |

|

|

|

Post by zuolun on Mar 13, 2015 16:18:34 GMT 7

sptl123, I used to read and have been closely monitoring certain newsflow which I'm most interested and concerned because stock prices are always news-driven. BTW, I usually sieve thru a long list of the latest news from various sources; read 1st b4 I decide which one to update in the forum, for the record.   Bro Zuolun, Sometime I wonder, do you really exit in the real world or just “someone” exit in the cyber world?  Just looking at today forum, how you manage to read and know so many things and so fast? It is amazing and beyond comprehensible! From 庄周梦: 我是蝴蝶,还是蝴蝶是我? You are computer or computer is you ?  Do you know your IQ Score? Surely if a criminals has the same level of IQ as you, he could beat NYPD flat  . No offence and always with my highest respect to you Bro Zuolun.

|

|

|

|

Post by sptl123 on Mar 28, 2015 15:37:48 GMT 7

My mental picture of Bro Zuolun  :    IQ of 150. Thank you for sharing many interesting, useful and educational information. There is always plenty too learn each day. You are my Hero  ! |

|

|

|

Post by zuolun on Mar 28, 2015 15:57:39 GMT 7

My mental picture of Bro Zuolun  :    IQ of 150. Thank you for sharing many interesting, useful and educational information. There is always plenty too learn each day. You are my Hero  ! |

|

|

|

Post by zuolun on Apr 4, 2015 6:19:51 GMT 7

Bro Zuolun, On your post On Dec 8, 2014 at 7:24pm " Ezra — A "Waterfall Decline", interim TP S$0.45

Ezra closed with a long black marubozu @ S$0.56 (-0.045, -7.4%) with 10.7m shares done on 8 Dec 2014.

Price now went below your TP. If anyone long the short since, in 4 months the return from gain is about 75% annually  . That is a good example of your: whack a kitty with One Good Trade.  I learned 3 lessons: 1) There are plenty of opportunities in the market. It is so easy to make good money if you have the kung-Fu. 2) There are just enough risk investing in stock market. It can make a poor person very poor. 3) Remind me of The three rules to survive in trading, "Cut loss, cut loss and cut loss". I have many relatives still holding counters such as Jadason, Life Brandz, Advance SCT, and Metech(Aka Centillion) . The value of these stock now is only about 1-3% of their prime-day  , Yes, plenty of opportunities in the stock market but one must be well-equipped with the required skills (both FA+TA) to pick the right stocks at the right time; be very patient and most importantly, have sufficient Capital to make the good money. Actually, this whack a kitty with One Good Trade is similar to oldman's version: "To be successful as an investor, you must learn to overcome this fear of putting sufficient meat into your investments... otherwise, your game of investing will always remain, just a game." From a trader's perspective: "To be successful as a trader, you need to learn and manage your position sizing... otherwise, your game of trading will always remain, just a game."  POSH is one of the best trading stocks my friend got the trend right; he hoot tua tua after the barge sank off Batam, every 10c down = S$10K profit. Last year he whacked JC&C the same way, all the way down, down, down, down, down, down...  Beating the street: 25 golden rules of investing — Peter Lynch “Speculation is a hard and trying business, and a speculator must be on the job all the time or he’ll soon have no job to be on”. — Jesse Livermore I knew someone who shorted Cosco at the peak @ $8 in 2007. He held his long short-position for one year and covered @ $1+ in 2008. I only believed him when he showed me the before-and-after screenshots on Cosco. He purchased 3 pte properties for rental income in 2009 (fully paid with cash, no bank loans) from the nett profit he made from Cosco in 2008. There is a story behind every chart |

|

|

|

Post by zuolun on Apr 7, 2015 16:51:30 GMT 7

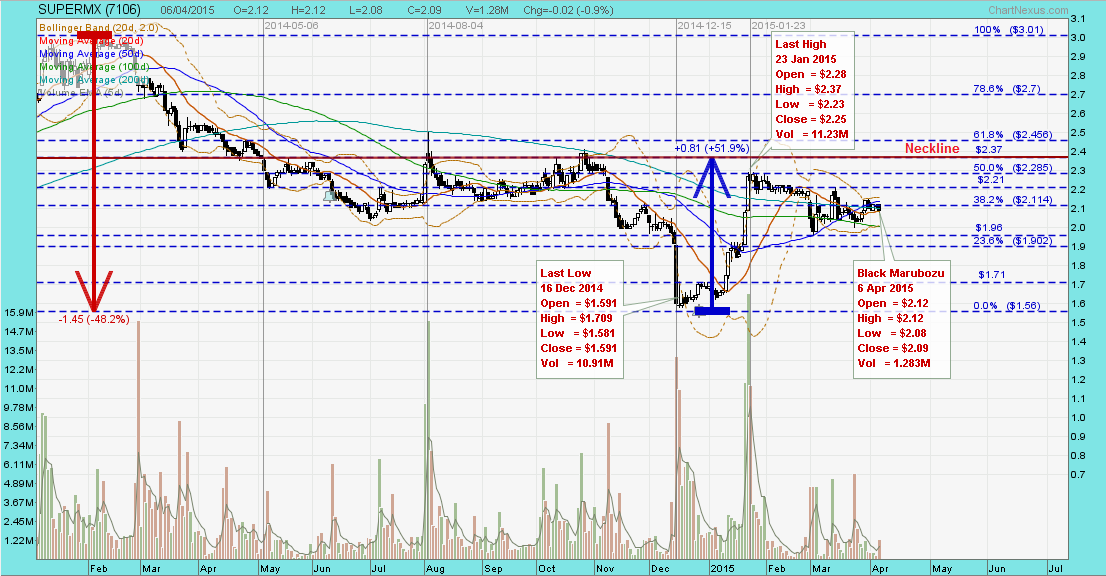

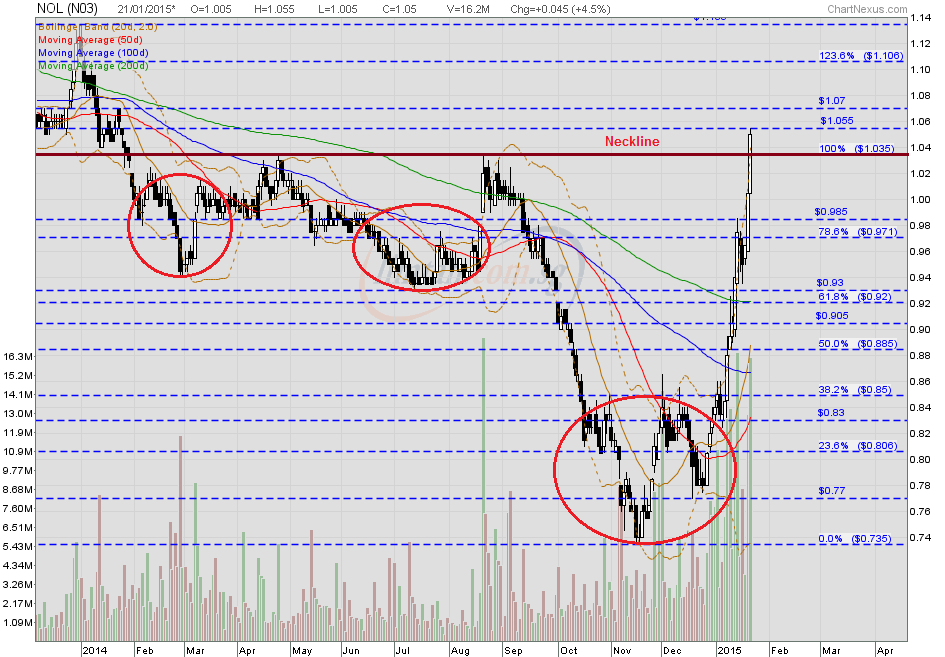

Among the 4 major gameplays in the stock market; the toughest one is no. 4. 1. IPO play 2. Fundamentals & Dividends play 3. M&A play 4. Turnaround/bottom-picking play SUPERMX and NOL are 2 very tough stocks (no.4), where retail players long or short also get killed by the major cheng kay at current price level.   [/quote] |

|

|

|

Post by zuolun on Apr 9, 2015 12:09:54 GMT 7

老人拿了三塊西瓜給年輕人選,年輕人選了最大的,最後卻超後悔!富翁拿了三個大中小的西瓜放在青年面前,說:

「每塊西瓜代表一定程度的利益,你選哪塊?」

青年回答:「最大的。」

富翁把最大的遞給青年,而自己卻吃起最小的...

富翁很快吃完了,

拿起桌上的最後一塊西瓜吃了起來。

青年終於明白:富翁吃的瓜雖都不大,加一起卻比他多!

啟示:學會放棄眼前利益,才能獲取長遠大利。 Trading is easy but not simpleSeven things every novice traders and investors should know Trading is easy but not simpleSeven things every novice traders and investors should knowAnytime that you make a trade in the stock market, you need to know what you’re up against. Knowing the following seven points will not only help you in your trades, it will put you in the right frame of mind in order to be a successful trader for the long term, which is what we all desire, and what really counts. 1. Don’t Throw Good Money After Bad – If you’ve got a losing stock, don’t make excuses or say things like “now it’s really become a bargain” or “it can only go up from here.” Those are famous last words. If you own an underperforming stock, sell it – today! Don’t wait, and certainly do not add to your shares of that stock. That is a recipe for full-blown disaster. There’s a reason that the stock you own is underperforming. That reason may not be obvious to you now, but eventually the reasons will come out. Your money can be put to much better use buying a stock that is in an uptrend and can make you money right now. 2. Don’t Buy Low and Sell High – We’ve heard this phrase all of our lives: “buy low and sell high.” You can’t go wrong with that advice, right? Actually, that’s wrong, because buying low implies buying a stock that has been on a losing streak, or one that is underperforming. Those are usually the worst kind of stocks to buy. The best stocks to buy are those that have firmly established a definite uptrend. So a more appropriate phrase might be, “buy high and sell higher.” Another piece of advice that goes along with this is as follows: don’t try to pick the bottom. Let someone else try to figure out what the bottom is. It could be that the stock has a few more weeks to go before it completely bottoms out. No use wasting your money guessing on where that point might be. 3. Don’t Swing for the Fences – Everyone wants to hit a home run once in a while, but making that your primary trading aim means you are risking your capital and your sanity. The only way to have long-term success in your trading career is by taking many small gains instead of a few big gains. Home runs are few and far between. They are a nice bonus when they happen, but don’t expect them every time. If a stock has made you some gains, take them. Don’t get greedy or expect a doubling or tripling in price, because you could end up losing what you have already gained, and sometimes a lot more. Take your profits, and move on to the next stock. 4. Know the Best Times of the Day to Trade – The best times of the trading day are the opening and the closing. More specifically, these times are the first hour and a half (9:30 to 11:00 am) and the last hour and a half (3:30 to 5:00 pm) that the stock market is open. That is when there is the most price movement and the highest volume. This is also why the opening and closing price quotes are used in mapping out stock charts. The volume around midday generally dies down quite a bit for one major reason: too many traders, especially the big institutional players (the ones who can noticeably move the market) are out to lunch. Some may take earlier lunches, and some may take later lunches, but there are always big players who have gone to lunch during this time. The people who they have left in charge are usually younger associates with less experience who don’t have much say in decision-making. So it’s best to avoid both buying and selling during this period of the day, as any price movements could be false signals or fake-outs. 5. Do Not queue to Buy or Sell Before the Market Open – Buying or selling a stock before the open (8:30-8:59 am), in what is known as a pre-market trade, is usually not recommended. During the pre-market period, there is a considerable lack of volume. As a result, a few small traders can quickly bid up the price of a stock to a fever pitch. If you try to buy this stock during this time, it will usually come back down after the market opens. Conversely, if you try to sell a stock pre-market, often times you would have sold for a better price if you have waited a minute or two (or five) after the opening bell. Because of the lack of volume, along with a real dearth of institutional investors, it’s best to avoid pre-market trades altogether. 6. Sometimes No Trade is the Best Trade – When markets are falling and volatility is running rampant, staying “on the sidelines” in an all-cash position is often the best policy. Now it’s true that opportunities do arise when market volatility starts going crazy, but this is not the time to be a hero. Wait out the storm. When there is blood in the streets, stay out of the way of the stampeding masses. Once the market sorts itself out, and volatility dies down, it becomes safe to get back in the market. That is also why you should never feel bad about getting your stops hit (getting “stopped out” of a trade). Those stops, which often indicate small losses, save you from much bigger losses later on, bigger losses which can stop you from trading altogether. In fact, what may appear as a small loss at first, may actually be a “gain” in your favor; for example, if you sell a stock for a $0.50 loss, but the stock then continues to lose another $2, you should not consider that trade as a loss. 7. Trading online yourself or calling your stockbroker to execute trades? – If you are not getting the results you hoped for in your trading, should you get professional assistance? Being human beings, we are all susceptible to the ebb and flow of our emotional states. One of the hardest things to do is to disengage your emotions when trading, whether those emotions involve fear (when your stocks are falling) or greed (when your stocks are rising), or just the everyday emotions that stem from your personal life. If you can find a trusted and reliable good stockbroker, you are then able to bypass a lot of your own emotional baggage, and follow the lead of someone who is experienced in the discipline of trading. Find someone who has a good track record, and is willing to back up their claims of success. Anonymous

|

|

|

|

Post by zuolun on Apr 9, 2015 15:51:15 GMT 7

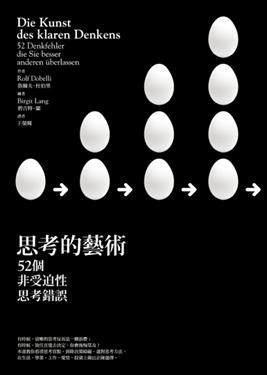

The Art of Thinking Clearly by Rolf Dobelli In engaging prose and with practical examples and anecdotes, an eye-opening look at human reasoning and essential reading for anyone with important decisions to make. Have you ever:- Invested time in something that, with hindsight, just wasn't worth it?

- Overpayed in an Ebay auction?

- Continued doing something you knew was bad for you?

- Sold stocks too late, or too early?

- Taken credit for success, but blamed failure on external circumstances?

- Backed the wrong horse?

《思考的藝術》經過科學證實,股票跌越多,我就越不想賣,原來是有原因的!看懂了...少賠 20萬!這是一本在德國非常暢銷、討論思考偏誤的一本書, 《思考的藝術》經過科學證實,股票跌越多,我就越不想賣,原來是有原因的!看懂了...少賠 20萬!這是一本在德國非常暢銷、討論思考偏誤的一本書,

也許是因為作者本身也有財務背景、加上書中很多股票的例子,

所以也常被歸類為 投資理財書籍。

書名叫做《思考的藝術 - 52種非受迫性思考錯誤》

但是實在太饒口了,

簡單來說,他就是一本:

52種讓你輸個精光,卻渾然不知的思考錯誤!

尤其在投資理財上,非常的實用

我個人認為,這是一本投資新手、老手都值得一看的作品,

大家都熟能詳投資上有所謂的「投資心理學」這種東西,

但是有趣歸有趣,實際上怎麼運用卻一直是個大問題,

而這本因為豐富的例子跟淺顯易懂的敘述,

很適合作為接觸投資心理的第一本入門書。

為什麼 投資大師 講的話,聽聽就好?

存活者偏誤:

沒觀察到其他用 同樣方法 的失敗者,所以高估了成功率

坊間有很多投資大師,他們各個都號稱有傲人績效,

當然跟到唬爛的大師是幾乎會賠錢的,

但是奇妙的是,有時候即使是跟到真的績效很好的大師,投資表現卻還是很差,怎麼回事?

在投資這件事情上,可能大師自己本身的投資方法根本是錯誤的,

他也許是 1萬個使用這個投資方法下唯一一個成功的人,

但是因為其他 9999 個人都失敗了,沒有人會請失敗者上電視的,

所以投資大師雖然自己是萬中唯一的成功者,

卻會誤認為這個方法真的很神,很有效。

後見之明偏誤:

用成功的結果,歸納出錯誤的原因

舉例來說,

有個人只要穿紅內褲出門,

當天他的股票就比較容易上漲。

所以經過了幾次成功以後,

他認為穿紅內褲,就是影響股市漲跌最重要的原因。

人類是一種非常因果導向的動物,

因此硬是東拼西湊因果關係的「後見之明偏誤」

也會加重投資大師亂掰的情況

在投資當下,可能大師自己也是霧煞煞,

但是成功之後,會就會自然幫他的成功找一個合理解釋,

可能是因為投資方法正確、因為認真看財報、因為技術分析熟練等等,

就是會忽略掉自己可能只是碰巧成功的機率。

承認投資失敗,比你想像的還要難

確認偏誤:選擇性的只看喜歡的結果,造成對機率誤判

如果你有在投資,嘗試回答以下問題:

1. 你有沒有一套自己的投資策略呢?

2. 這套策略有效嗎?

光是這兩個簡單的 Yes 或 No 的問句,卻有好多人沒辦法回答得出來。

在投資上,當我們有自己的投資策略時,我們常常會高估這套策略的可行性。

當成功賺錢時,我們把賺錢的歸功於策略奏效,

當失敗時,我們往往忽略或是認為這只是策略的特例。

這件事情聽起來簡單,但是卻實際發生時我們卻可能很難察覺,

例如,不斷找其他可能的數據來佐證自己的投資策略,

因為這個月股市大跌、股票難做所以才會賠錢,你看市場漲的時候還是有賺啊,

因為某某股票大跌我的績效才會這麼差,你看我每一檔都賺只有這個賠耶,

因為今天突然有大戶搶進我放空才會失敗,你看大戶沒有動作的時候都賺啊......等等

我們會不斷強調好的一面,忽略壞的一面,因此造成更多誤判。

想想近幾年來的「廢除死刑」議題,也是一樣的狀況,

每當死刑執行後又發生重大刑案,大家就會以此來主張死刑無用,

但是當久不執行死刑時又發生重大刑案,大家又會說你看死刑還是有必要的。

至於要如何避免這種偏誤呢?

那就是「試錯」-嘗試推翻自己的想法,直到無法推翻為止!

證明一個邏輯或是策略是不是有效的最佳做法就是 - 反證法,

這有點違反直覺,

我們要不斷拿各種例子去試著推翻我們的想法,

當我們發現無法雖翻的時候,

才能推論「我們的策略是正確的」。

說好的停損線呢?

沉默成本:因為害怕損失,過度重視已經投入但不可回收的成本

老手都會說,股票不能攤平,否則越攤越平,

這句話既然被不斷的重提再提,就代表一定還是有很多人會犯這個毛病。

追根究柢,大約就是沒有設停損線,或設了停損但是捨不得執行。

這用思維偏誤的角度來說也是可行的,這時候控制我們不出場的關鍵偏誤就是「沉默成本謬誤」跟「賭徒謬誤」。

沉默成本是指,人們對「浪費」資源感到擔憂害怕、憎惡損失,

而過分重視已經投入的不可回收成本

也就是說,當你在宏達電(2498)漲到1200的時候進場,而到現在只剩120算是賠90%,

但是你在思考下一步應該繼續持有還是賣出時,不應該考慮過去買進時的1200元,

而是應該要以目前 120元之後的走勢來做考量。

這樣說也許不容易想像,

那我們用個例子,假設你現在看著你的投資紀錄上面寫賠90%

於是你會想說那賠到91%也就算了,都已經跌了1080點,再12點難道會禁不起嗎?

這正是標準的錯誤思維!

如果你不管過去進場的「沉默成本」的話,再跌12點其實是個很大的損失,

因為股價從120跌到108,這代表再跌 10%,理性的投資人應該要趕快賣出,找更好標的。

賭徒謬誤:覺得硬幣正面連續出現太多次了,應該會出現反面

不想賣出還有可能是因為我們心中對於平衡的渴望,這就是「賭徒謬誤」

賭徒謬誤是一種機率謬誤,主張由於某事發生了很多次,因此接下來不太可能發生;

或者由於某事很久沒發生,因此接下來很可能會發生。

去廟裡擲杯,連續3次都是聖杯,下一次你猜還是聖杯嗎?

正確答案是還是有一半機會會是聖杯,因為機率從來沒有變過。

但是往往我們在思考的時候會覺得沒那麼巧,哪有這麼容易矇到連續四次聖杯,

我們會期待一種平衡的力量,一種物極必反的直覺,覺得沒有這麼巧,機率的天秤依該要導正回來,

卻忽略了,其實那是對機率的誤解,機率的天平從來都沒有傾斜過。

換做股票,就會出現所謂的跌深反彈,乖離這種想法,

認為股票漲漲跌跌都常見,所以跌久了就應該要漲,

卻忽略事實上公司的本質才是主導漲跌的真正推手,

即使在市場上大多數人都相信跌深反彈這個想法之下,真的會出現一小段反彈行情,

但是到最後,影響股價的還是公司本身,

反彈頂多是讓你趁別人犯下思考偏誤時,多一個下車的機會罷了。

有些事,是真的沒有道理的

控制錯覺:以為自己多做出一點努力,就能去影響隨機發生的事

在很多時候,在不去細看財務報表、籌碼進出,單就數字來討論的基礎下,

如果真的拿數學、統計工具去做科學檢視,

我們會發現市場走勢真的是隨機的,沒有辦法真實預測漲跌,

但是往往有很多人認為自己可以靠著買賣交易策略,去克服股票的隨機波動,

這大多就是犯了「控制錯覺」,按照目前主流的解釋,控制錯覺是

操作股票的人,喜歡由自己選擇和控制股票交易,所帶來的「權力加強感」,

就好像他們的控制和操作能抵禦「市場帶來的波動」一樣,其實二者之間可能根本毫無關係。

讀後心得:

這本書總共提及了52種偏誤,所以上面這些都還算是九牛一毛,

至於要深入細細探究的話,大概只有買書一途了,

我個人是認為蠻值得買來細讀的,

畢竟有很多偏誤平時真的是非常根深柢固的植在我們的思想中,

如果不常常思考自己的思考盲點,其實很容易久而久之就被盲點牽著走,

尤其是在投資這種失算會賠錢的場合,

投資股票之前還是先好好投資自己吧!

|

|

|

|

Post by zuolun on Apr 23, 2015 15:31:11 GMT 7

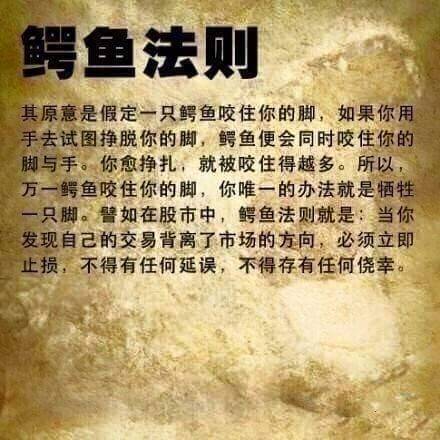

I learned 3 lessons: 1) There are plenty of opportunities in the market. It is so easy to make good money if you have the kung-Fu. 2) There are just enough risk investing in stock market. It can make a poor person very poor. 3) Remind me of The three rules to survive in trading, "Cut loss, cut loss and cut loss". I have many relatives still holding counters such as Jadason, Life Brandz, Advance SCT, and Metech(Aka Centillion) . The value of these stock now is only about 1-3% of their prime-day  , I copy and paste this msg specially for you and myself...why the three rules to survive in trading, "Cut loss, cut loss and cut loss" is so important.  In Cantonese, it's called 斩脚趾,避沙虫。   |

|

|

|

Post by sptl123 on Apr 23, 2015 15:59:46 GMT 7

Thank you very much bro Zuolun for the reminder!

Actually I am still doing badly about cutting loss. I didn't practise it even after my last post on the subject and have suffered recently .

However I will earnestly practise what I preached from now on.

With your guidance, I am improving myself everyday.

我们大家共勉之.

感恩大哥。

|

|

|

|

Post by zuolun on Apr 23, 2015 16:21:56 GMT 7

Thank you very much bro Zuolun for the reminder! Actually I am still doing badly about cutting loss. I didn't practise it even after my last post on the subject and have suffered recently . However I will earnestly practise what I preached from now on. With your guidance, I am improving myself everyday. 我们大家共勉之. 感恩大哥。 , 有感而发。I threw back one stock (swing trade), which I actually could have made 5c profit but I was greedy and went to queue 1-bid higher. In the end, I missed selling it with a profit and had to reluctantly close the trade losing commission on Monday 20 Apr 2015. Today Thursday 23 Apr 2015, I checked the share price, it closed 10c lower than my cost price... If I had hesitated and didn't throw back on time then, the loss would be commission + 10K, at today's closing price. 偷鸡不成蚀把米!  |

|

|

|

Post by zuolun on May 5, 2015 10:30:46 GMT 7

物极必反,否极泰来。An inflection point is a point on a curve at which the sign of the curvature (i.e., the concavity) changes. Find inflection points given graph

|

|

|

|

Post by zuolun on May 6, 2015 16:51:07 GMT 7

近朱者赤,近墨者黑。 Uptrend stocks have higher chances to make a good profit than downtrend stocks.Our life cycle is like the stock cycle, the Elliott Wave pattern. When it's on a downtrend (ABC-wave) and keeps hitting record low, it's very difficult to bounce back to recover fast and sustainable unless you're an aggressive real fighter. A true story of Gerald and Ah Huat. I knew the late Ah Huat when I was a teenager and I always wondered why lady luck didn't continue to be with him. He was an illiterate but had successfully achieved happiness and accumulated great wealth from hard work over time. He was one who never failed to help others when being approached...yet his luck turned south and died after helping the last person, Gerald. I can't stop thinking that Ah Huat could have given his remaining luck to Gerald, in his last stage of his life. Mix with people whose foreheads are shining like the monks, not people whose foreheads are dark with faces looking very haggard = 印堂发黑。 宿命论 宿命论

|

|

|

|

Post by zuolun on May 12, 2015 14:01:06 GMT 7

Thank You Bro Zuolun for the guidance and for shortening my learning curve. I know there are a lot more to learn from you.  Thank you too for giving me so much motivation and inspiration.  , My greatest motivation to learn TA correctly was from someone who had successfully shorted COSCO @ $8 and covered @ $1+   |

|