Never catch a falling knife ~ oldman

A falling knife in the stock market refers to a stock that experiences a sharp decline and it may collapse > 50% from its breakout/pivotal point, b4 bottoming out.

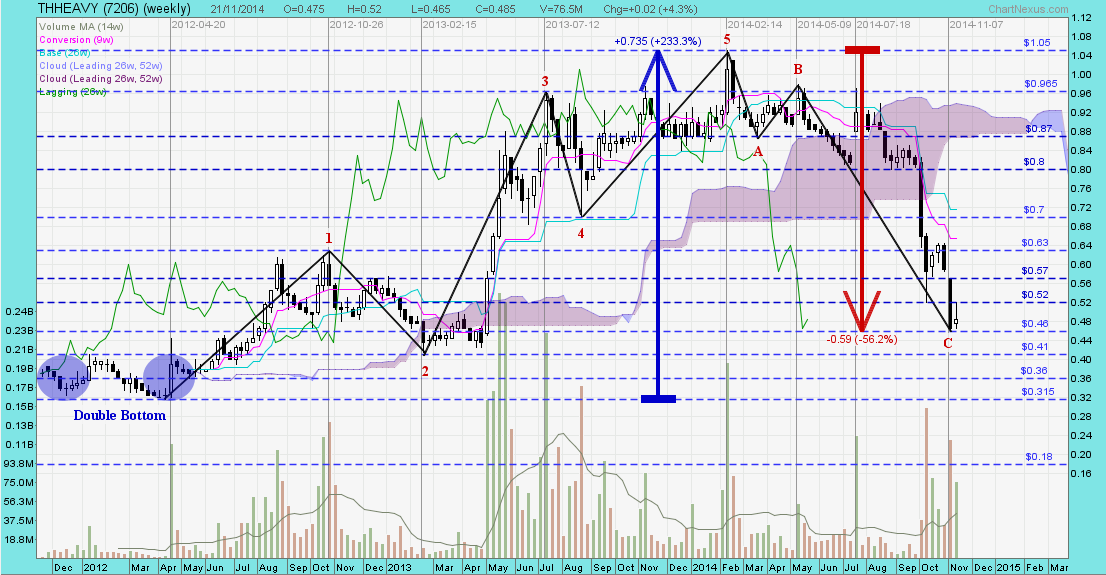

In an uptrend support holds, in a downtrend support breaks. THHEAVY hit record high of RM 1.05 on 20 Feb 2014 and collapsed to a new low of RM 0.13 on 25 Aug 2015.

CIMB ceased coverage on TH HEAVY ~ 16 Feb 2016

Tabung Haji’s (LTH) takes a long-term view ~ 30 Jan 2016

Tabung Haji injects RM275m into TH HEAVY ~ TH Heavy Engineering's Rights issue for ICPS under-subscribed. TH Heavy Engineering’s renounceable rights issue of up to 1.2bn new Islamic ICPS at 25sen each was under-subscribed with only 30.0% taken up. The company said 359.2m of the rights to the irredeemable convertible preference shares on the basis of 16 ICPS for every 15 shares were taken up by the shareholders.“This represents an under subscription of 836,604,824 ICPS-i or approximately 70.0% over the total 1.2bn ICPS-i available for subscription under the rights issue of ICPS-I,” it said. ~ 9 Sep 2015

TH HEAVY CEO Nor Badli resigns ~ 19 Jun 2015

Undemanding valuations; accumulate TH Heavy, says CIMB — 25 Sep 2014

THHEAVY (7206) — A "Waterfall Decline" TP RM 0.07THHEAVY closed with a doji unchanged @ RM 0.15 with 3.33m shares done on 19 Feb 2016.

Immediate support @ RM 0.14, immediate resistance @ RM 0.16.

THHEAVY (weekly) ~ 'Mushroom-of- death' chart pattern, TP RM 0.07Characteristic of 'Mushroom-of-death" chart pattern; the faster you get out, the better you are.

THHEAVY (weekly) as at 21 Nov 2014

THHEAVY (weekly) as at 21 Nov 2014 A lift for O&G firms

A lift for O&G firms12 September 2015

IT seems local institutional funds are still hungry for new shares and bonds by oil and gas companies, as they search for bargains amid the turmoil in the industry caused by a steep decline in the price of crude oil.

These cash rich buyers, including Lembaga Tabung Haji who appear to be taking a long-term view of their investment, even as most investors are shying away from the sector.

Earlier this week, the pilgrim fund bankrolled the entire RM275mil fund-raising exercise by its 30%-owned TH Heavy Engineering Bhd.

This was after other shareholders in TH Heavy declined the offer to subscribe to the rights issue.

Tabung Haji paid 25 sen a piece for the Islamic irredeemable convertible preference (ICPS-i), which came attached with a fixed 20% dividend based on the nominal value of the ICPS-i payable over five years.

The dividend promise provides some element of guaranteed returns for the fund, plus an upside potential if shares in TH Heavy goes up.

Tabung Haji’s decision to pump in more money into TH Heavy came in as much needed financial boost for the loss-making company.

TH Heavy is in the midst of building its first floating, production, storage and offloading vessel, which has already secured a contract and is expected to be ready by the third quarter of 2016.

Meanwhile, an unnamed local institutional fund is also taking a big bet on another oil and gas contractor SapuraKencana Petroleum Bhd.

The fund was said to be the sole subscriber of SapuraKencana’s US$200mil (RM846mil) sukuk that was issued during the week. Proceeds from the exercise will be used to refinance some of its existing debts totalling close to RM17bil.

The 7-year sukuk carries a yield of 4.85% and is unrated. SapuraKencana is one the world’s largest tender rig operator.

It counts the Employees Providence Fund, Retirement Fund Inc (KWAP) and Permodalan Nasional Bhd among its substantial shareholders.

The slump in crude oil prices is taking its toll on producers around the world. For companies like SapuraKencana and TH Heavy, strong backing from local institutional funds is a blessing.

But are these funds exposing themselves too much to volatile oil prices?