|

|

Post by zuolun on Apr 2, 2015 11:05:43 GMT 7

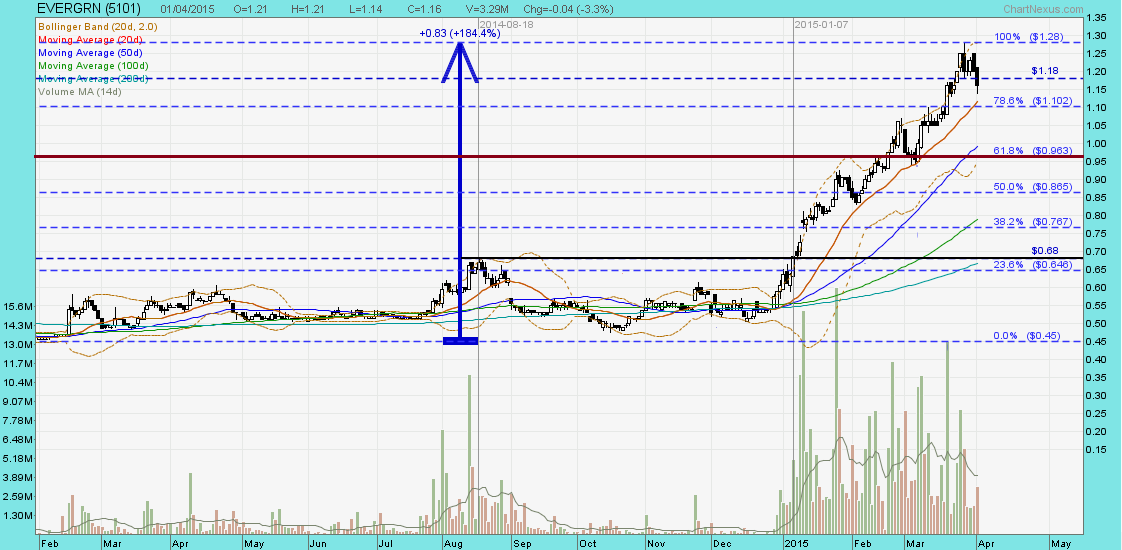

Evergreen — Riding on the impulsive sub-wave-iii of Wave-3, crucial support @ RM0.96, the 61.8% FIBO level Evergreen — Riding on the impulsive sub-wave-iii of Wave-3, crucial support @ RM0.96, the 61.8% FIBO levelEvergreen closed with a hanging man (吊死鬼)@ RM1.16 (-0.04, -3.3%) with 3.29m shares done on 1 Apr 2015.  The trend is your friend, until the end when it bends The trend is your friend, until the end when it bends ~ Evergreen is riding on the impulsive intermediate sub-wave-iii of Wave-3; it will be under selling pressure once the share price pullback and goes down to form a lower high, i.e. riding downward on the intermediate sub-wave-iv of Wave-3. Evergreen (weekly) ~ The Elliott Wave pattern  [/quote] |

|

|

|

Post by sptl123 on Apr 21, 2015 21:27:21 GMT 7

Bro Zuolun, Evergreen Fibreboard Close @ RM 1.14 (-0.01, -0.87%) with high volume of 18,889 lots done - 21st April 2015. From your last post: The trend is your friend, until the end when it bends ~ Evergreen is riding on the impulsive intermediate sub-wave-iii of Wave-3; it will be under selling pressure once the share price pullback and goes down to form a lower high, i.e. riding downward on the intermediate sub-wave-iv of Wave-3.

Is the major trend of Evergreen still an up-trend?

Is it considered to have made a lower high at 8-10 trading days ago? RSI not over sold yet. 5D stochastic at 3.7 and 14D stochastic at 21.11. I am planning to strike the moment stochastic turning up. Is it correct to do so? If support at RM 1.13 do not break, I hope to see formation of a double bottom. What else to look up for if one were to invest in this counter? Peiseh Bro Zuolun for I asking so many questions   s 1.140 -0.010 -0.87 18,889 822 1.140 1.150 699 1.160 1.130 |

|

|

|

Post by zuolun on Apr 21, 2015 23:14:30 GMT 7

Bro Zuolun, Evergreen Fibreboard Close with a Bullish Engulfing candle @ RM 1.14 (-0.01, -0.87%) with high volume of 18,889 lots done - 21st April 2015. From your last post: The trend is your friend, until the end when it bends ~ Evergreen is riding on the impulsive intermediate sub-wave-iii of Wave-3; it will be under selling pressure once the share price pullback and goes down to form a lower high, i.e. riding downward on the intermediate sub-wave-iv of Wave-3.

Is the major trend of Evergreen still an up-trend?

Is it considered to have made a lower high at 8-10 trading days ago? RSI not over sold yet. 5D stochastic at 3.7 and 14D stochastic at 21.11. I am planning to strike the moment stochastic turning up. Is it correct to do so? If support at RM 1.13 do not break, I hope to see formation of a double bottom. What else to look up for if one were to invest in this counter? Peiseh Bro Zuolun for I asking so many questions  , The intermediate sub-wave-iv of Wave-3 on Evergreen (comes in wave-abc down) has just started; current share price may pullback further as it's now trading below the 20d SMA coupled with a negative divergence bet. the OBV and the MFI. Critical support @ RM1.085, strong support @ RM0.965. How to use divergences as leading indicators  |

|

|

|

Post by zuolun on Jun 4, 2015 8:43:37 GMT 7

sptl123I believe you're in-the-money for Evergreen; follow the major cheng kay and run road when your're ahead; it's never wrong to take profit, don't be greedy.  Evergreen — Double Top formation Evergreen — Double Top formationEvergreen closed with a gravestone doji @ RM1.23 (+0.01, +0.8%) with high volume done at 6.24m shares on 3 Jun 2015. Immediate support @ RM1.16, immediate resistance @ RM1.28.

|

|

|

|

Post by sptl123 on Jun 4, 2015 10:05:12 GMT 7

sptl123I believe you're in-the-money for Evergreen; follow the major cheng kay and run road when your're ahead; it's never wrong to take profit, don't be greedy.  Evergreen — Double Top formation Evergreen — Double Top formationEvergreen closed with a gravestone doji @ RM1.23 (+0.01, +0.8%) with high volume done at 6.24m shares on 3 Jun 2015. Immediate support @ RM1.16, immediate resistance @ RM1.28.  Thank you Bro Zuolun, I took profits on the 14th May @ RM 1.15 liao.  |

|

|

|

Post by zuolun on Jun 4, 2015 10:21:53 GMT 7

Thank you Bro Zuolun, I took profits on the 14th May @ RM 1.15 liao.  Evergreen's uptrend is intact, however as the share price closed with a gravestone doji candlestick pattern on 3 Jun 2015, if there's no strong follow-thru buying-support today 4 Jun 2015, then the chart may have an evening doji star candlestick pattern — a strong sell signal.   |

|