In memory of Dr Michael Leong ~ 13 Feb 2016

RIP Dr Michael Leong and some of his lessons ~ 'When you have enough money, you can either take one of 2 routes. The first is to continue what have made you successful as this frankly, is the easiest option to take. This is your forte and this is what makes you feel good. If you are good at making money, you will surely want to continue doing this as this will give you the feeling of accomplishment and achievement. The second option is to recognise that you have only one life and you do not know when this will be taken from you. When you are aware of this, you will be more aware of the fragility of life and want to do the things that you have always wanted to do in life." ~ 13 Feb 2016

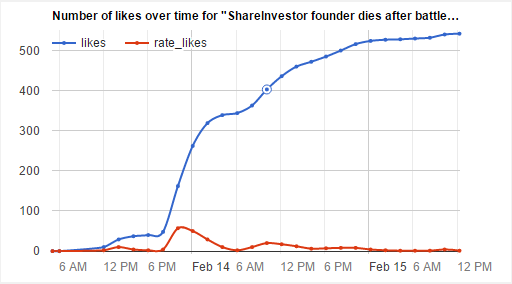

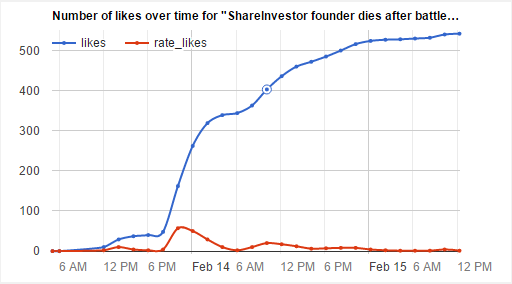

ShareInvestor founder Dr Michael Leong dies after battle with cancer ~ Feb 13, 2016, 5:00 AM SGT

Dr Michael Leong

Dr Michael Leong Doctor's career switch pays off big-time

Doctor's career switch pays off big-timeBy Lorna Tan, Senior Correspondent

Aug 2, 2009

In his second and latest book, medical doctor-turned-entrepreneur and share investor Michael Leong shares his secrets of investing successfully.

The book, Your First Million - Making It In Stocks, is published by Straits Times Press.

His first book was Be An Entrepreneur. It was published in September 2002 by his firm Raditech and has gone into a second edition.

The Malaysian is founder of regional financial Internet media and technology firm ShareInvestor.com and had been actively dabbling in the stock market since his early 20s.

But Dr Leong, 48, started learning about the true mechanics of the stock market only after he set up ShareInvestor in 1999. The platform provides real-time information on shares and other financial instruments and a forum for users.

He became financially independent two years ago, having made most of his wealth through 'fundamental stock investing'.

This means spending more than three months of research time poring over annual reports and searching the Internet for anything to do with a firm, its products, competitors, industry and shareholders.

'This is the amount of information that I need before I even put a single cent into any fundamental investment,' he said.

He sold ShareInvestor to Singapore Press Holdings (SPH) for $12 million late last year, and became a director and consultant.

Having gone through the ups and downs of investing, he wrote his latest book hoping that readers can learn from his mistakes in the past and go straight into fundamental investing instead of speculating in the stock market.

He also gives free talks on investing, and the next one will be at the Invest Fair at Suntec City on Aug 22 and 23.

He graduated from Northern Ireland's Queen's University in 1985 with a bachelor's degree in medicine, surgery and obstetrics. He continued working in the medical sector in Northern Ireland and London till 1991 when he joined IBM Healthcare Singapore as a health-care industry specialist and returned to work here.

In 1997, he left IBM to join Australian health-care IT firm SWi Holdings in Singapore as its chief executive officer till 1999 when he founded ShareInvestor. He is married to housewife Irene, 39, and they have two children, Annabel, 15, and Aaron, 10.

Q: Are you a spender or saver?I am essentially a saver. When I want to buy something, I will save for it and only when I can afford to pay fully for that item in cash, will I buy it.

I don't like taking loans unless there are other benefits in doing so. For example, for my first home, I took a loan since I could use my Central Provident Fund savings to pay for the instalments.

I view cars as luxury items or items that are nice to have but not essential. I would save so that I would be able to pay fully for them. I feel that we should not pay interest to a bank for things that will most certainly depreciate in value.

Q: How much do you charge to your credit cards every month?On average, my wife and I charge about $3,000 every month to our credit cards.

We use one credit card most of the time as we want to chalk up points for that card. We have a lifetime membership for this card and there are no annual fees for it and hence every point that we chalk up can be converted into shopping vouchers.

I usually draw $500 at a time from the ATM and this is often enough cash for the entire family for a week.

Q: What financial planning have you done for yourself?The bulk of my money is invested in Singapore stocks and shares. I am a very focused investor and have a portfolio of only five to eight stocks, such as semiconductor manufacturing solutions firm Ellipsiz.

I keep a close eye on these stocks, understanding their business models, financials as well as keeping abreast of company and industry developments and all their competitors.

Q: How do you select stocks?I select these stocks very carefully and usually, I buy stocks only when they have no borrowings. The cash held by these companies is also more than the value at which investors price them.

Of course, I must like the business as well and feel that there is potential upside for the business or the company. These factors then give me a high margin of safety as I may want to buy more of these stocks if the share price falls further. I usually buy 3 per cent to 5 per cent of the firm's shares.

I look for shares that multiply a few times in value. I would buy stocks in a recession and hold on tightly to them when they climb up in a bull market and will sell only when I feel that the bull market is near exhaustion.

Yes, I do time the market, but I am interested only in the long-term trends and not the daily, weekly or even monthly trends.

Q: Moneywise, what were your growing-up years like?I am the third child in a middle-class family with four kids. My dad was an eye specialist who worked for the Malaysian government and my mum was a nurse.

We lived in landed properties in various parts of Malaysia, including Penang, Ipoh and Kuantan.

I saw my dad working hard as a professional even as he grew older and he had little time to enjoy himself.

However, if one builds a successful business, one can have many hands working with him and he can then have more time to himself. This is one of the main reasons I hung up my medical coat and went into the business world.

Q: What property do you own?In January this year, I bought a three-storey bungalow in Serangoon. It has 5,000 sq ft of land area.

I used to live in a 1,500 sq ft, three-bedroom apartment in the same area, which I now view as an investment property. I bought it 10 years ago and it is currently not rented out.

Just as I don't believe in investing in stocks for their dividends, I look for capital gains in my property investments, not for their rental incomes.

My first property was in Northern Ireland where I studied and later worked as a medical doctor. I bought a terrace house which I then rented out to friends while living in it.

I sold it when I returned to Singapore at around the same price that I had bought it for.

Q: What's the most extravagant thing you have bought?Probably the BMW 7 series when I sold ShareInvestor to SPH late last year. It was a reminder to myself that if one works hard at something, one can achieve whatever one wants in life.

Q: What's your retirement plan?I think that for business people like me, we will never retire. We will always think of new things to do.

For me, I have moved from running companies to becoming an investor. Most likely, I will be investing as long as I am mentally and medically fit.

As we grow older, I feel that we become better investors. We have first-hand experience of running businesses and know how management and investors think and how they react to events. These experiences are critical in our decision to either hold on to or sell our stocks.

Q: Home is now...The bungalow in Serangoon.

Q: I drive...The grey BMW 7 series. My wife drives a black Peugeot convertible.

WORST AND BEST BETSQ: My worst investment to date...It was in a company called Polly Peck in Britain in 1986. This was a blue-chip counter at that time. After I made my money (about £40) in penny stocks, I thought it was safer to put the winnings in a blue-chip company.

Little did I know that a few months later, the authorities would find irregularities in this company's financials. The company went bankrupt and, with it, all my investments in the company.

I have learnt my lesson that blue-chip counters are not necessarily safer than penny stocks. At the end of the day, investors owe it to themselves to do all the necessary research, whether the company is a penny stock or a blue chip.

Q: My best investment to date...It was in FJ Benjamin. In 2003, I bought its warrants for one cent each. A warrant is a type of traded instrument linked to an underlying asset, such as shares, and it gives the holder the right to buy or sell the asset at a fixed price on or before a certain date.

At that time, the mother share was about 20 cents and the exercise price was around 50 cents. The shares did very well, and I eventually sold the warrants for over 25 cents each about two years later.

怀念 ~ 因为有爱懷念懷念

改編詞:黃偉文 / 編曲:Terence Teo

關起滿室 不足的氧氣 點著煙蒂 回味你的呼吸

搜索腦裡 未完的齟齬 對著空氣 還擊著你的問題

推辭每次 真實的相聚 困著自己 渴望著你的消息

沾沾自喜 拒絕的魅力 不著痕跡 享受著與你的距離

也許喜歡懷念你 多於看見你

我也許喜歡想像你 多於得到你

關起滿室 不足的氧氣 點著煙蒂 回味你的呼吸

散落一地 斷續的謎語 對著空氣 還擊著你的問題

推辭每次 真實的相聚 困著自己 渴望著你的消息

翻來覆去 甜蜜的懷疑 故作神秘 延續著你的好奇

也許喜歡懷念你 多於看見你

我也許喜歡想像你 不需要抱著你

阿……

也許喜歡懷念你 多於看見你

我也許喜歡想像你 受不了真的一起