|

|

IFCA

Apr 14, 2015 14:14:46 GMT 7

Post by oldman on Apr 14, 2015 14:14:46 GMT 7

|

|

|

|

Post by zuolun on Aug 6, 2015 10:24:26 GMT 7

IFCA is a Malaysia-based company engaged in research and development of enterprise-wide integrated business solutions. The Company caters to a range of industries, including contract accounting, property development and management, hotel and club resort, manufacturing and distribution, customized information technology (IT) projects and hardware and networking. Its subsidiaries are Push Technology Sdn Bhd, IFCA Systems (Penang) Sdn Bhd, IFCA Systems (JB) Sdn Bhd, IFCA Consulting (Sarawak Sdn Bhd, IFCA Solutions Sdn Bhd, IFCA Web Sdn Bhd, Network Online Sdn Bhd, IFCA Consulting (Sabah) Sdn Bhd, IFCA (Guangzhou) Technology Co Ltd, Jingyou Information Technology (Shanghai) Co Ltd, IFCA Technologies Limited and IFCA International Limited. CIMB Research retains Add for IFCA ~ 6 Aug 2015 CIMB Research is upbeat on the prospects of IFCA ~ 1 Aug 2015 IFCA falls 4.79% despite analysts bullish on the stock ~ 20 Jun 2015 IFCA fundamentals strong despite steep drop in share price ~ 18 Jun 2015 Bursa queries IFCA over recent sharp fall in price ~ 26 Jun 2015 IFCA's property e-commerce platform to boost revenue ~ 19 Jun 2015 Why the selldown on IFCA? ~ 12 Jun 2015 IFCA slumps after CFO resigns ~ 25 May 2015 The world’s top software stock, IFCA is surging 1300% in KL ~ 13 Apr 2015 IFCA queried over sudden gain in share price, volume ~ 19 Jan 2015 Bursa publicly reprimands IFCA for breach of ACE market listing requirements ~ 9 Sep 2013 暴跌58%後‧IFCA多媒體築底回升 ~ 24 July 2015 IFCA多媒體推電子房產平台 ~ 20 Jun 2015 股价虽暴跌基本面仍佳 创办人续加码IFCA ~ 18 Jun 2015 虽遭不寻常交易质询 竞优国际大热走高 ~ 17 Jun 2015 估值過高‧IFCA賣壓不斷 ~ 16 Jun 2015   IFCA ~ Bearish Gartley Bat formation IFCA ~ Bearish Gartley Bat formationIFCA closed with a spinning top @ RM$0.85 (-0.045, -5%) with 15.8m shares done on 5 Aug 2015. Immediate support @ RM0.78, immediate resistance @ RM0.945.

|

|

|

|

IFCA

Aug 6, 2015 11:41:55 GMT 7

Post by sptl123 on Aug 6, 2015 11:41:55 GMT 7

Bro Zuolun, With reference to the following chart: B is 58.7%(RM 1.42) of XA, is the pattern more Crab or Standard Gartley than Bat? C is 91.2%( RM 0.84) of AB, overshoot 88.6%(RM 0.857). Doe that negate the pattern? ( C touch RM 0.835, 92% of AB) this morning)D is RM 1.7 (84.5% of XA), isn't it more like for D to be 78.6% XA ( RM 1.64 for Standard Gartley) or 161.8% ( RM 2.54 for Crab)?  IFCA ~ Bearish Gartley Bat formation IFCA ~ Bearish Gartley Bat formationIFCA closed with a spinning top @ RM$0.85 (-0.045, -5%) with 15.8m shares done on 5 Aug 2015. Immediate support @ RM0.78, immediate resistance @ RM0.945.  |

|

|

|

Post by zuolun on Aug 15, 2015 11:47:02 GMT 7

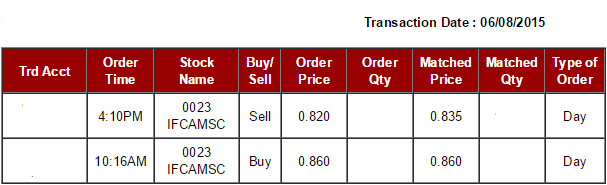

About the statement "should the scenario (Fibonacci retracements ratio) materialise on Silverlake; it is a science (mathematic solution), not an art of technical analysis", am correct to infer that this is a 'if A then B' concept'? In this case what you mean is that if the Fib retracements/conditions are met, the target projections will follow? I have rudimentary knowledge about harmonic patterns and EW, but I find your comments interesting and wish to understand more. For educational purpose, the simplest and easiest way to learn harmonic patterns and EW fast is that, go buy the stock, Silverlake Axis b4 bonus issue, i.e. go against the major trend, try it out with just one lot will do. I used to do it quite often in the past with tight stop-loss in place just to test what I had learned in theory is also valid in practice. Bro Zuolun, With reference to the following chart: B is 58.7%(RM 1.42) of XA, is the pattern more Crab or Standard Gartley than Bat? C is 91.2%( RM 0.84) of AB, overshoot 88.6%(RM 0.857). Doe that negate the pattern? ( C touch RM 0.835, 92% of AB) this morning)D is RM 1.7 (84.5% of XA), isn't it more like for D to be 78.6% XA ( RM 1.64 for Standard Gartley) or 161.8% ( RM 2.54 for Crab)? , When wrong must cut loss fast!I had already cut loss on IFCA intraday @ RM0.835 on 6 Aug 2015; stop loss was placed @ RM0.82 then. Should the last low breakdown convincingly @ RM 0.74 scored on 12 Aug 2015, IFCA will be very ugly, next strong support @ RM 0.46.  IFCA短期可恢復漲勢? IFCA短期可恢復漲勢? ~ 9 Aug 2015 IFCA ~ Bearish Bollinger Band BreakoutIFCA closed with a black marubozu @ RM0.76 (-0.05, -6.2%) with high volume done at 29.4m shares on 14 Aug 2015. Immediate support @ RM0.74, immediate resistance @ RM0.82.  |

|