|

|

Post by zuolun on Jun 9, 2015 0:17:39 GMT 7

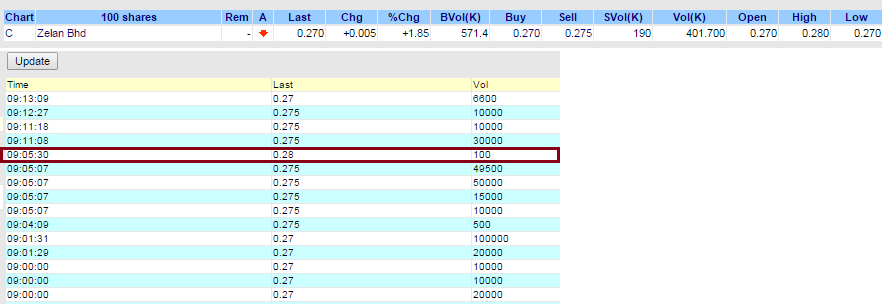

Zelan Bhd ~ Company Official WebsiteZeland Q12015: Current quarter PAZT of RM15.4m ~ 27 May 2015 Zelan eyes more local contracts ~ 15 May 2015 Zelan eyes projects in Pengerang to boost order book ~ 14 May 2015 Zelan to strengthen financials in 2-3 years before paying dividends ~ 14 May 2015 Zelan posts 4QFY14 profit of RM15.27m: Engineering and construction firm Zelan Bhd's net profit for its fourth quarter ended Dec 31, 2014 (4QFY14) fell 33.44% to RM15.27 million, from RM22.94 million a year ago. Revenue meanwhile, stood at RM86.86 million, rising 67.75% from RM51.78 million a year ago. However, it should be noted Zelan sold its shares in IJM Corp Bhd in the three months ended Dec 31, 2013, as part of its restructuring exercise to mend its deteriorating balance sheet. As Zelan had managed to resolve its dispute with Meena Holdings LLC to resume works for Meena Plaza in Abu Dhabi, the engineering firm made a turnaround, recording gross profit of RM9.04 million for 4QFY14. ~ 24 Feb 2015 Zelan: Change In Boardroom ~ 13 Feb 2015 Zelan to receive RM104.7m from MEENA ~ 2 Sep 2014 Zelan gets RM248.5m Petronas job ~ 24 July 2014 Zelan settles dispute with MEENA owner ~ 16 Apr 2014 ZELAN's rights issue ~ 1-for-2 @ RM0.10 per ordinary share with detachable free warrants of 1-for-1 @ RM0.15 per warrant share. ~ 13 Dec 2013  ZELAN ~ Bearish Gartley Bat PatternZELAN closed with an inverted hammer @ RM0.355 (+0.005, +1.4%) with 4.91m shares done on 5 Jun 2015. Immediate support @ RM0.34, immediate resistance @ S$0.36.  Min. 100 shares instead of 1,000 sharesZelan Bhd on 31 Dec 2014 at 9.05am: 1-lotter or min. 100 shares done @ RM0.28, the seller is forced to pay the min. brokerage fee + other charges.

|

|

|

|

Post by zuolun on Jun 9, 2015 5:49:07 GMT 7

sptl123, Harmonic / Gartley pattern is based on Fibonacci ratio and normally used for forex trading without dividend and trading volume. It is applicable to the equity market when the structure of the pattern appears. - Your observations on ZELAN are exactly the same as mine.

- Your ZELAN's chart pattern is technically correct.

- Your ZELAN's chart setting is not dividend adjusted.

- My FOC charting software cannot draw the point D so nice like yours.

ZELAN ~ Trading in an upward sloping channelZELAN closed with a black marubozu @ RM0.345 (-0.01, -2.8%) with 3.04m shares done on 8 Jun 2015. Immediate support @ RM0.33, immediate resistance @ S$0.36.   sptl123, The more you practise drawing your own charts, the better you are!  Your're right! Sino Grandness's Bearish Gartley Bat pattern is still valid. Compare Sino Grandness with ZELAN; the latter is +ve because it's still trading above the 4 MAs as at 5 Jun 2015. Watch the resistance @ RM0.395, the last high; once the share price shoots and sits firmly above it, ZELAN has potential to hit RM0.43 or point D. Thank You very much Bro Zuolun. (A) I practice and redraw the Gartley Pattern. a) Shift point D to a future date since it is a potential/future event. b) With Fibnonacci ratio indicated so beginner like me could read easily. (B) Trading Ideas~ I have long Zelan because: (i) Price above all 4 SMA and MACD cross Signal line. (ii) Chikou-span above kumo and above price. (iii) Price now above kumo and above Tenkan-Sen. I think I will add more if and when Kumo breakout and price above Kijun-Sen. As that mean the price is moving toward D to complete the projected Gartley Pattern. Bro Zuolun, are the above technically correct or incorrect ?

|

|

|

|

Post by zuolun on Jun 16, 2015 14:47:15 GMT 7

sptl123, The kumo cloud has signaled a decisive sell on ZELAN on 15 Jun 2015, which means the dead cat bounce is done. ZELAN ~ Bearish Gartley Bat Pattern BreakoutZELAN closed with a long black marubozu @ RM0.32 (-0.02, -5.9%) with 4.66m shares done on 15 Jun 2015. Immediate support @ RM0.32, immediate resistance @ S$0.345.

|

|